Summary:

- Visa’s Q1 results are due to come out on the 26th of January.

- We touch upon a few important themes ahead of earnings season.

- We highlight why the Visa stock is a HOLD at this juncture.

David Paul Morris/Getty Images News

Introduction

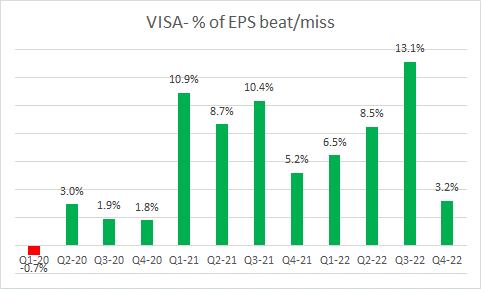

Visa Inc. (NYSE:V) intends to publish its Q1-23 results on the 26th of January, followed by an earnings call, post-market hours. Over the last 12 quarters, Visa has done well to build credibility during earnings season, as the reported EPS has fallen short of consensus figures just once (Q1-20); besides, on average, the earnings beat has been a good 6% higher over the last three years

Seeking Alpha

Here are a few other things to consider ahead of the earnings event.

Q1 Results – What To Look Out For?

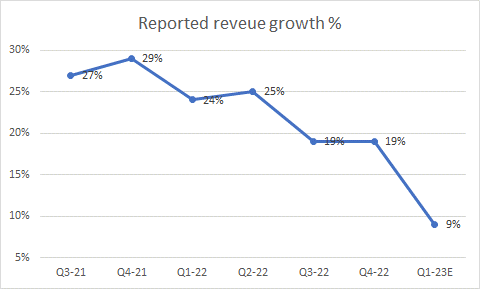

- At the Q4 earnings event, Visa’s management had guided for reported net revenue growth in the high single-digit range. Despite better FX dynamics in recent months, consensus hasn’t moved a great deal from that guidance with a current expected annual growth figure of 9.15% ($7.71bn). Just for some context, management had previously guided for a negative FX impact of 400bps for the whole of FY23, with the impact in Q1 expected to be particularly pronounced at 500bps, before easing off as the year progresses. Given the ~8% correction in the dollar index since the Q4 event, there’s an outside chance that reported growth numbers just about touch the double-digit mark.

- If that does not come through, a 9% revenue growth rate would represent the first single-digit growth quarter after nine straight quarters of double-digit growth. Visa will have its work cut out as the high base effect of double-digit growth will linger all through the year. Might this impact sentiment for growth-hungry investors?

10-Q

- Slowing revenue growth may persist in Q2 as well as V’s decision to exit Russia will likely serve as a lingering headwind till the end of H1-23 with the impact in Q2 expected to be around 500bps (Q1 likely impact: 400bps). The Russian impact has a particularly pronounced impact on Visa’s largest source of revenue – Data processing. For instance, in Q4, reported revenue of this business came in at 10%, with the Russian factor dampening revenue by 500bps.

- Investors should pay particular attention to cross-border travel momentum which has been a useful tailwind for much of last year. However, there are signs that things have begun to flatten out, and considering the tough comps ahead, you do wonder if this narrative will ebb, notwithstanding China’s COVID reopening.

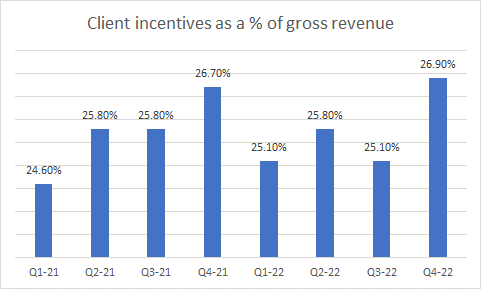

- Visa’s client incentive arrangements have ramped up recently and hit levels of 26.9% as a function of gross revenue. Management implied that this could stay elevated in Q1 as well.

Earnings presentation

- In the last quarter, non-GAAP Opex in nominal dollar terms had grown at 18.4%. This is expected to decline to growth levels of low-teens in Q1, although one shouldn’t also dismiss the impact of the FIFA World Cup on the expense base. The integration of the Currency Cloud and Tink acquisitions too should continue to weigh on expenses through H1.

- On the bottom line front, consensus currently has an EPS figure of $2, which would translate to 11% EPS growth. That would represent quite a slowdown in the run rate, from the 19% bottom-line growth seen in Q4.

Closing Thoughts – Is Visa A Buy, Hold Or Sell?

There are some good, and not-so-ideal reasons to get on board with V at this stage.

Firstly, when you consider forward valuations, a P/E multiple of ~27x in isolation may appear to be pricey to a fair few. But then again, do also note that this multiple is 16% lower than the 5-year average of 32x, and ~38% lower than the peak 5-year multiple of 43x!

You’re also getting pretty solid earnings growth through FY25 at that multiple, even if it may not quite hit the highs of recent periods; just for some context, in FY23, you’ll get double-digit growth of 10.3%. If you thought a high base effect would limit earnings growth, note that the consensus figures for FY24 and FY25 point to an even better earnings profile, with improving earnings growth over the next three fiscals. In effect, this is a business that’s providing you with medium-term earnings CAGR of 14%; that’s a figure you’d typically associate with mid-caps who are still relatively early in their life cycle, not mega-caps who usually churn on single-digit figures!

The V stock may not provide you with the most compelling dividend yield, but there are other commendable facets (particularly its fidelity to growing its dividends at an impressive pace every year) to the overall dividend narrative that make it one of the best dividend stocks in the Dow.

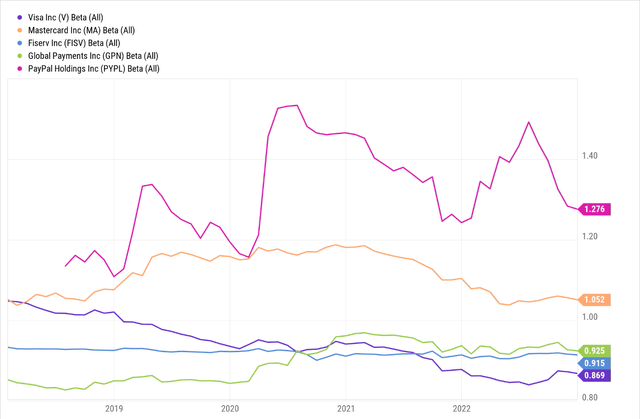

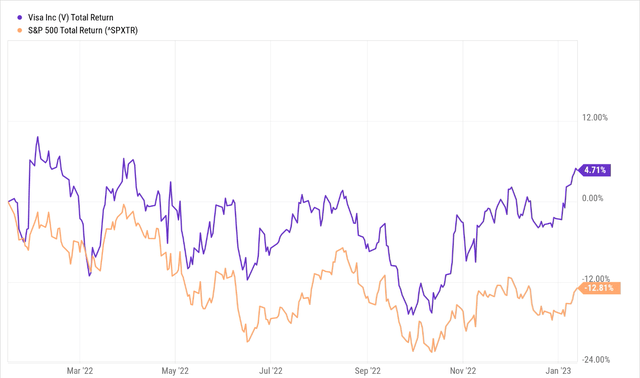

Investors may also consider their positioning with Visa based on what they think the benchmark index could do. It’s fair to say that in recent periods there’s been a reasonable degree of decoupling with the S&P500. As noted in the image below, relative to other major options in the payments space, the V stock’s sensitivity to the benchmark has reduced over time and it may prove to be a decent hedge going forward.

We’ve already seen some evidence of that last year when the V stock ended up delivering steady positive returns of mid-single-digits, even as the broader markets had fallen by 13%. Some of the alpha could be a function of the pricing power that Visa has, in a heightened inflation era.

Finally, we touch upon the technicals, and whilst there are some encouraging developments for momentum investors, I don’t believe the risk-reward is too ideal for a long position

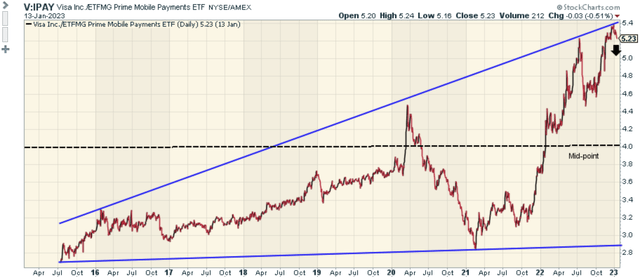

The image below highlights how the V stock is positioned relative to other options from the mobile and electronic payments industry.

We can see that this ratio currently looks enormously overextended to the upside, not only trading at levels of ~30% over its mid-point, but it’s also very close to the upward-sloping boundary of its range. If prospective investors were looking for suitable mean-reversion opportunities in the digital payments space, it’s hard to see V topping their list.

On the weekly chart, we can see that the V stock’s long-term price imprints have been in the shape of an ascending broadening triangle pattern. Since July 2021, we’ve seen a pullback in the shape of a descending channel, with the price taking support at the lower boundary of the triangle. I feel that would have been an ideal terrain to consider the V stock. In recent weeks, momentum traders will no doubt be enthused by the stock’s breakout from this descending channel but given the sub-optimal risk-reward at this juncture, I would prefer to sit on the fence.

All things considered a HOLD rating feels fitting at this juncture.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.