Summary:

- Verizon Communications Inc. provides communication and technology services globally.

- Previous analysis showed VZ as an attractive investment for dividend investors. Today we have updated our model with more up-to-date dividend growth assumptions and required rate of returns.

- The updated model estimates the fair value of VZ stock between $46 and $74 per share.

- We reiterate our bullish view.

hapabapa

Verizon Communications Inc. (NYSE:VZ), through its subsidiaries, provides communications, technology, information, and entertainment products and services to consumers, businesses, and governmental entities worldwide.

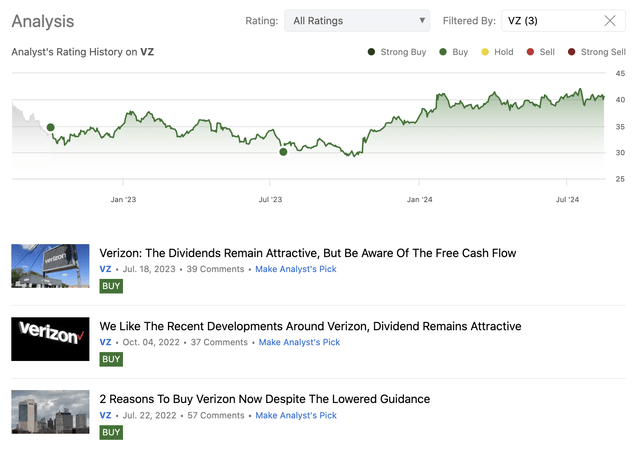

We have been covering Verizon since July 2022, and we have been bullish throughout this entire period. Our latest article has been published already more than a year ago, in which we have discussed in detail why VZ may be an attractive investment for dividend- and dividend growth investors.

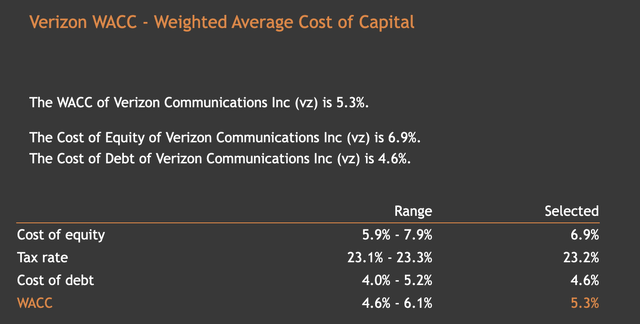

Back then, we have used a dividend discount model – and two scenarios – to come up with a range of fair value estimates for VZ’s stock. In our calculations, we have used a required rate of return of 9.25% – equivalent to the firm’s weighted average cost of capital (WACC) – and growth rate assumptions of 2% in perpetuity. In the first case, our assumptions were that the dividend continues indefinitely from day 1 – yielding a fair value of $39 per share, while the second case assumed that the dividend will be paused for two years, and then both the dividends and the growth are reinstated, yielding a fair value of $33 per share.

The aim of our article today is to revisit our model and give an update on our main input parameters – the required rate of return and the dividend growth rate. We will also validate and justify our results by looking at a set of traditional price multiples, as well as the firm’s latest quarterly earnings results, which have been published in July.

Valuation update

Dividend discount model

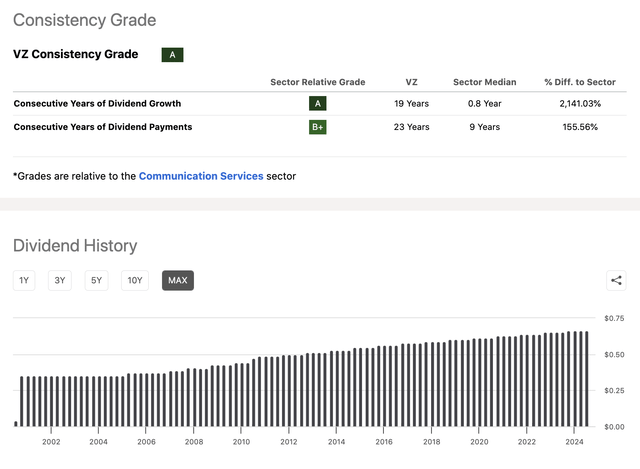

Just like before, we will be once again using a dividend discount model to value VZ’s stock. The firm has remained committed to return value to its shareholders through dividend payments, and these dividend payments also appear to be safe and sustainable because they are well covered by the free cash flow. The current quarterly payment is $0.67. For these reasons, we believe that our approach remains valid.

Let us discuss now the two input parameters to the model that need to be reviewed: required rate of return and dividend growth rate.

Required rate of return

The following table shows the latest WACC estimate for Verizon.

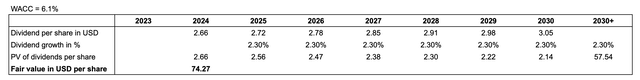

While the average estimate is 5.3%, we believe it is slightly too low. To remain more conservative – or even more realistic – we are going to use the higher end of the range, which is 6.1%.

This value is meaningfully lower than the previous 9.25%. This change in the estimated cost of capital is going to have a meaningful positive impact on the fair value estimate.

Dividend growth rate

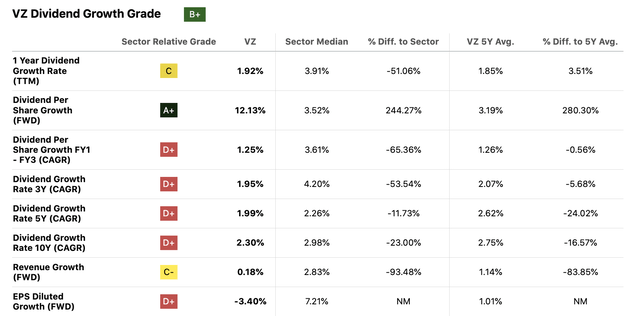

The table below summarizes VZ’s dividend growth over various periods.

Normally, we either like to use the firm’s long-term dividend growth rate as the perpetual growth in our calculations – which in this case is 2.3%- or the overall growth of the economy – which is normally estimated to be roughly 2.5%. But as the revenue growth and EPS growth of the firm is even lower than these figures, we are also going to create a conservative scenario to account for potential downside risks.

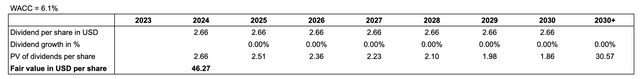

The tables below show the results of our calculations, using a 2.3% dividend growth in perpetuity and using 0% growth, respectively.

2.3% growth (Author) 0% growth (Author)

According to our calculations, the fair value of VZ’s stock is estimated to be between $46 and $74 per share.

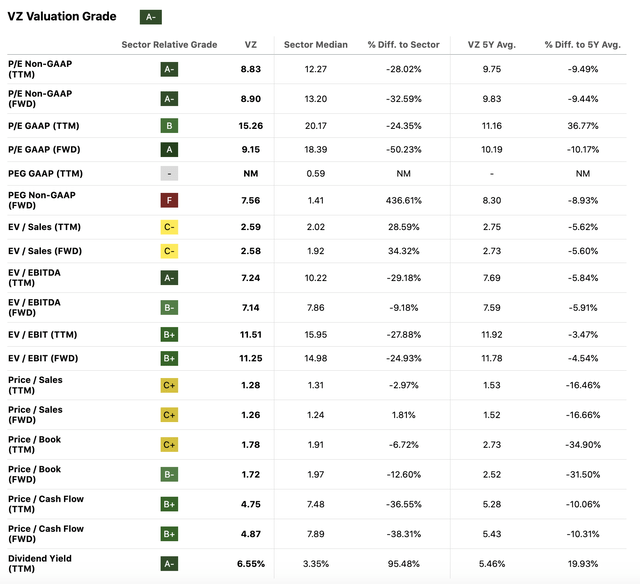

Price multiples

Let us look at the valuation from a different perspective. The following table summarizes a set of traditional price multiples and compares VZ’s metrics with its own historic values and the respective sector median. We can see that according to most metrics, VZ’s stock appears to be also attractively valued. The extent of undervaluation is however not as significant as indicated by our dividend discount model.

Quarterly earnings – key highlights

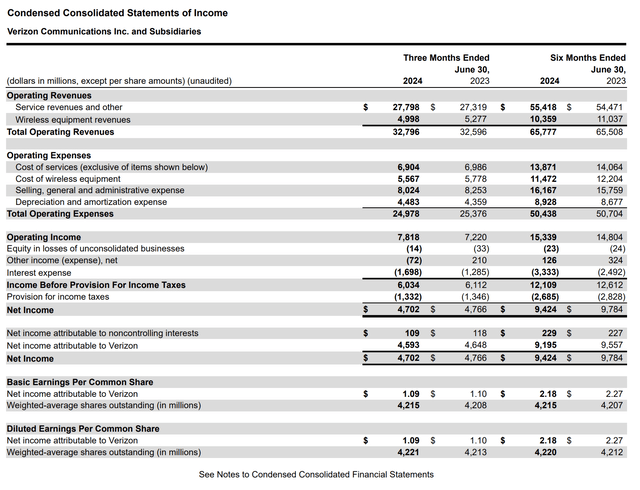

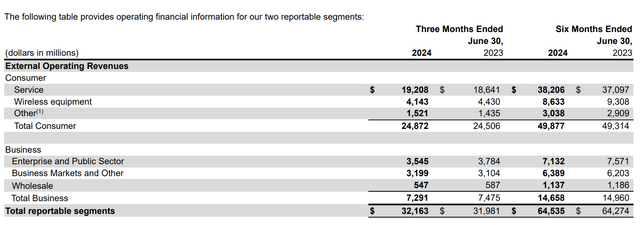

Verizon’s quarterly revenue of $32.8 billion missed analyst estimates by $240 million, although increasing by 0.6% compared to the prior year. Adjusted EPS, on the other hand, came in at $1.15, in-line with analyst expectations.

The increase in service revenue has been the primary driver of growth in the past quarter, partially offset by the weakness in the wireline equipment revenues.

Looking forward, the firm expects the total wireless service revenue grow in the range of 2% to 3.5% in the full year. Adjusted EBITDA is also anticipated to increase by roughly 1% to 3%, while adjusted EPS is anticipated to be between $4.50 to $4.70.

While the results are not extraordinary in our view, we believe that they are good enough for the dividend- and dividend growth to be sustainable. It is a robust company with a robust business model. It is clear that we are not recommending the stock for its outstanding growth figures, but for its commitment to return to shareholders, which, we believe, is likely to continue based on the quarterly results.

Before concluding our article, we have to point out one important risk factor that all investors need to keep in mind, before making a final investment decision. And this is debt.

VZ’s balance sheet is debt heavy. This is not uncommon in this industry that the firms have significant amount of debt in their capital structure. Normally, debt capital is much cheaper than equity capital. Today, however, the interest rate environment is relatively challenging and pretty uncertain. When VZ needs to refinance its maturing debts in the coming quarters, the cost of debt is likely going to be much higher as the Fed has still not cut interest rates. When, and by how much the Fed will cut the rates, is still uncertain.

Higher cost of debt can lead to higher interest expenses, leading to shrinking margins and the deterioration of profitability. As a result, VZ’s bottomline results, its cost of capital and its ability to pay dividends are also impacted. Therefore, it is crucial to always keep debt and refinancing costs in mind.

Conclusions

Using a dividend discount model, with a required rate of return of 6.1% and dividend growth rates of 0% and 2% in perpetuity, yields a fair value of $46 and $74, respectively, for VZ’s stock.

A set of traditional price multiples also indicate that at the current price point, VZ’s stock is attractively valued.

As Verizon’s capital structure is debt heavy, investors need to keep in mind the potential changes in the interest rate environment in the near future, before making a final investment decision.

We reiterate our bullish view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.