Summary:

- We forecast Amazon’s stock to drop to $155 within nine months due to a completed long-term Elliott Wave pattern.

- Investor sentiment is overly bullish and at a level that has historically preceding corrections, suggesting a price decline to $155.

- Bollinger Bands indicates intermediate support for AMZN at $155, aligning with our price target.

- Long-term investors should consider selling or holding off on adding to their positions, expecting better opportunities to repurchase at lower prices.

hapabapa

We’re forecasting a price correction to $155 for Amazon.com, Inc. (NASDAQ:AMZN) (NEOE:AMZN:CA) over the next six to nine months. This would be its first major correction after its twenty-two-month price gain of 150%. The forecast is based on two fundamental factors: a very clear-cut, three section WD Gann or R.N. Elliott price pattern, and an exceedingly high level of investor optimism associated with past corrections. Let’s take a look.

The Long-Term Technical Picture of AMZN

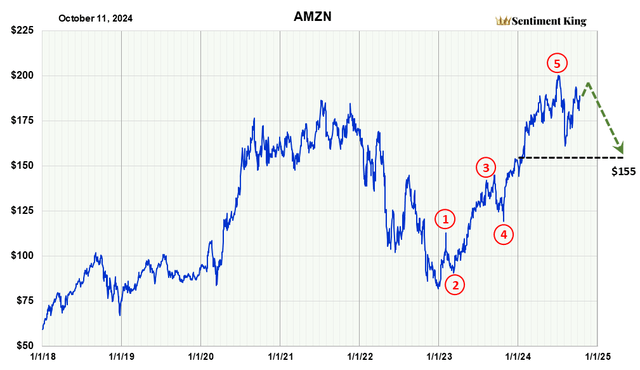

The chart below shows the price of Amazon since 2018. It’s clear from the chart that AMZN has had a powerful advance since 2023 that took place in five waves – three advancing waves and two contracting waves. We marked the end of each wave with a number. The ends of the three advancing waves are marked by the numbers 1,3 and 5 in red. The ends of the correcting waves are marked 2 and 4 in red.

This chart shows a three wave price structure as defined by two great market technicians, WD Gann and R.N. Elliott. (The Sentiment King)

This is a well-known pattern in technical analysis, as it’s the fundamental pattern of the Elliot Wave theory. While it’s called the Elliot Wave, this pattern was observed by market technicians like WD Gann and Charles Dow long before it was named by Elliott. So, it’s been empirically observed for over 125 years. It’s the price pattern associated with a complete bull market.

It is a strong signal that AMZN has finished its main advance and has started into a price correction that could last from nine months to a year. The price target using Elliott’s principle of retrenchment is $155, which is $10 less than the low made in July. We indicated it with a green arrow. That would be an 18% decline from current levels and imply a lot of back and forth price movement, with little forward progress.

Investor Expectations For AMZN Are Too Bullish

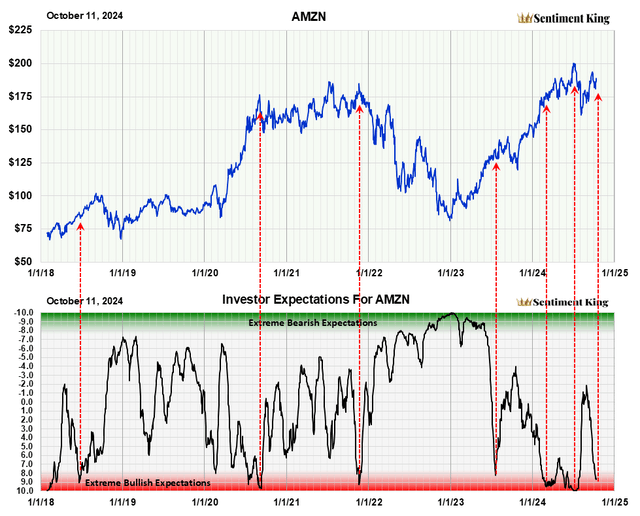

It’s a truism that you want to avoid a stock when “too many” investors believe prices are headed higher, and invest in it when the large majority of investors no longer believe in it. The chart below helps investors do this. It measures investor expectations.

Measuring investor emotion and expectations is the great, unexplored area of stock analysis. It’s the missing ingredient in most technical analysis and is what sets us apart. When “too many” investors have the same expectation, the opposite usually happens. The term “indicators of investor expectations” was coined by Marty Zweig in the 1970s. To discover what investors expect he compared their buying of “put” and “call” option contracts. At the Sentiment King we compare how much “money” is going into ‘directed’ put options versus how much is going into ‘directed’ call options. We only use “directed options,” which are options purchased with a price direction in mind, versus hedging or income option purchases. This is not a short-term indicator. Ratios are calculated over 20 days to obtain long-term expectations. The Green Zone represents extreme bearish expectations while the Red Zone represents extreme bullish expectations. (The Sentiment King)

This indicator shows when “too many” investors expect prices to go higher, or when “too many” think they’re headed lower. The red arrows point to moments since 2018 when investors were overly bullish on Amazon stock. They usually occurred just before some type of correction on Amazon.

The fact that we’ve had three strong Red Zone signals, as AMZN completed a three section advance, is very significant to us. It indicates to us that Amazon has started into a correction that will probably take prices back to $155.

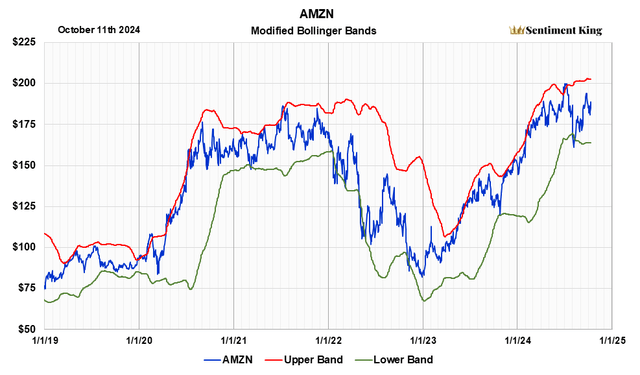

Bollinger Bands Show Intermediate Support For Amazon At $155

Another way to find price excesses is by using Bollinger bands. They show how far prices have advanced above or below the norm.

This Bollinger band chart shows that Amazon stock has been moving sideways since May. You see that by the upper red boundary line moving horizontally at a price of $200. It is our belief that the green line, and the moving average that creates, it will decline by at least 5% over the next nine months, putting the lower green line around $155. It is here where AMZN should receive support.

Bollinger Bands are a popular technical tool used by traders and investors to assess if a stock is overpriced or undervalued. They were created in the 1980s by financial expert John Bollinger. A simple moving average is calculated that represents the trend of interest; in our case we use a 100 day average. Then the standard deviation over the same period is calculated and upper and lower bands are placed above and below this moving average that represent a specific number of standard deviations. In our case we use two. Because the distance of the bands is based on standard deviation over 100 days, they expand and contract with price volatility. This means that, in volatile markets, support and resistance occur at higher or lower levels than in less volatile markets. (The Sentiment King)

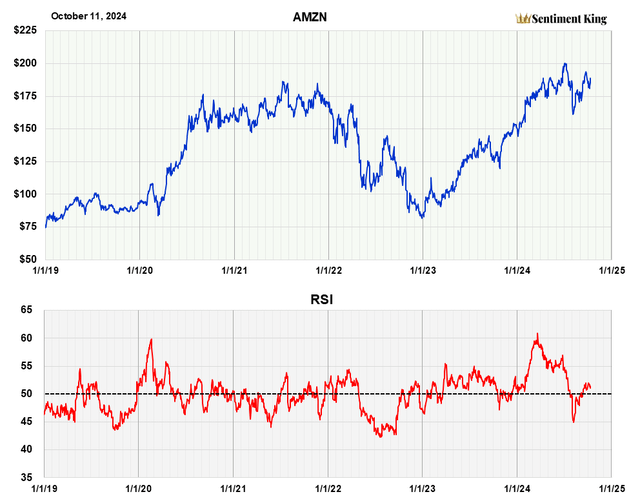

The Relative Strength of AMZN Is Neutral

This last chart shows the long-term RSI (relative strength) of AMZN. We calculate our RSI indicator to measure relative strength over the long term; this is not a short-term view.

The relative strength index (RSI) was developed by J. Welles Wilder Jr. and introduced in his 1978 book, “New Concepts in Technical Trading Systems.” It is probably the most popular momentum indicator used in technical analysis. The RSI measures the speed and magnitude of recent price changes in a stock to evaluate if it’s been oversold or overbought. It has adjustable parameters that allow you to measure these conditions for either the short or long term. We’ve adjusted the RSI parameter in our graph to show the long-term picture. (The Sentiment King)

The relative strength of a stock often provides insight into whether its price is overbought or oversold. It works much better with certain stocks than others. Currently, the relative strength of Amazon (RSI) for the intermediate to long-term, isn’t providing insight to its expected price direction.

Conclusion

It’s our opinion that long-term investors in Amazon should either sell a portion of their current position, or at least not add to their position, for the next six to nine months. We strongly believe they’ll be able to either add to their position or repurchase at a lower price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.