Summary:

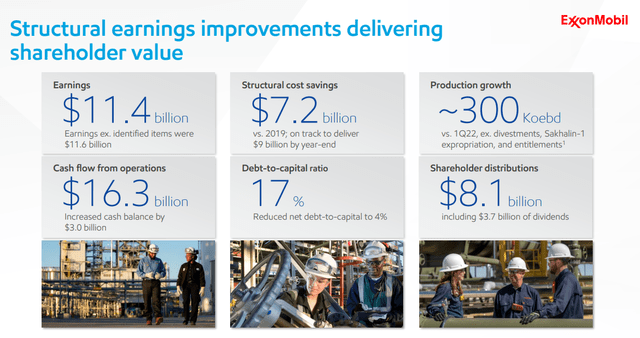

- Exxon had a record first quarter in 2023 after an extraordinarily strong year. It had a staggering net income of $11.4 billion.

- The firm continues to cut costs and show discipline in tailoring its industry-leading upstream portfolio.

- It’s important to remember that Exxon has a massive refining operation, and it will likely continue benefitting from the “Golden Age” in refining.

- This dividend stalwart’s reputation precedes it in the area of returning capital. Sustainability developments strengthen dividends.

- There are some glimmers of hope of sensible regulatory relief. The backdrop of great power competition makes the energy industry strategic.

Joe Raedle/Getty Images News

Exxon Mobil (NYSE:XOM) had another blowout quarter. The rumors of its decline have been greatly exaggerated. It looks more like a company beginning to hit its stride, making itself a more structurally appealing investment through cycles. Exxon is one of the most successful companies in history at delivering for shareholders, and it’s not near done delivering yet.

The company has been driving the performance of the entire sector, given its heft. As the behemoth delivers mouthwatering quarterly returns, it’s important to remember that while valuations have relegated this once dominant firm to lower places on the totem pole of market cap, the company is still prodigious in every way. The firm has over 60,000 employees. Also, many people overlook the fact that the oil industry is responsible for some of the human race’s greatest technological achievements.

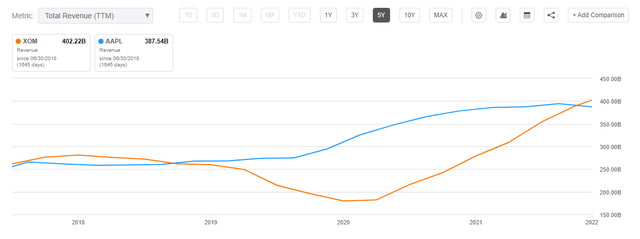

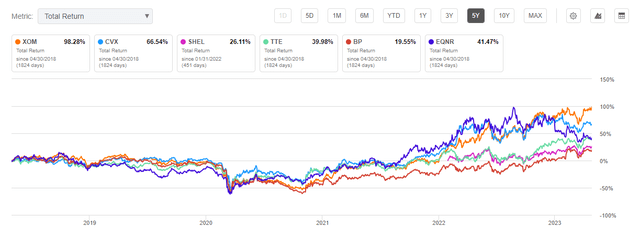

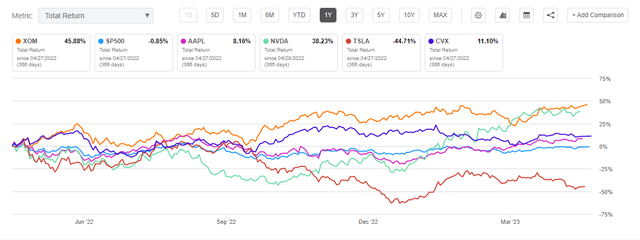

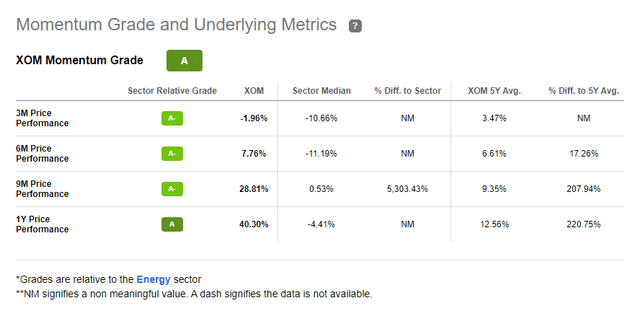

More than that, Exxon just surpassed Apple’s (AAPL) revenue on a TTM basis. Its price performance amongst oil majors started to break away around the beginning of the year, and I suspect it will continue for at least a quarter or two. While there could be some technical factors at play, from my analysis, it seems this breakaway performance is the start of a market realization that Exxon has a superior strategy to deliver shareholder value for the next decade while simultaneously helping in good faith to avert climate catastrophe.

Most Energy firms have been more compliant with government mandates and flatlined production in order to help each net-zero target than Exxon was. It stood recalcitrant and certainly has earned the wrath of climate-focused activists in some respects. Still, activists are activists, and companies at the center of the global economy are what they are too.

While Exxon’s initial approach of shunning efforts to curtail production earned it ire, it has seemingly started solidifying its commercial position in a way that will almost surely benefit shareholders. Exxon’s upstream strategy is one of the major reasons to make this the one oil stock you own if you can only choose or have the financial capacity for one.

Positive Catalysts in Upstream and Downstream

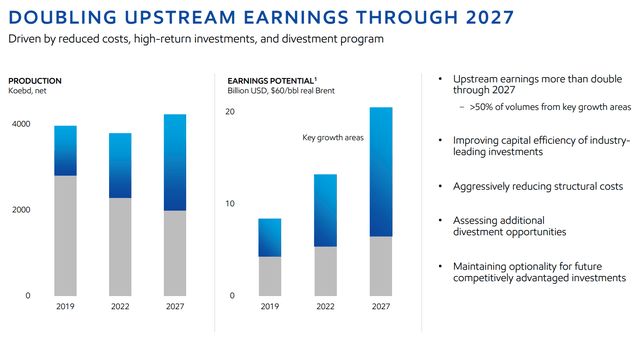

Exxon’s comparably small upstream segment will be a major free cash flow growth driver over the next few years. Its superior production position will bolster the financial advantages of its already primary position in the US industry. Exxon’s master class in vertical integration will be even more powerful when its upstream efforts, which take years to come to fruition, start producing considerable cash flow.

Exxon’s stand-out positions were largely tamed by the successful efforts of pro-climate activists Engine No. 1. The company’s performance since, and some of what Engine No. 1 board members have achieved, suggest Exxon’s new path is more rewarding for shareholders. It will also take some of the heat from Uncle Sam off its back.

So, the fruits of what Exxon achieved while still in a more adversarial position remain intact. Its upstream position is the best in the industry, and the lead is only widening. It has the drop on other major oil producers in terms of Upstream working for shareholders. This also provides more relative capacity for revenue growth.

It is the only oil major that is significantly increasing production and has upstream as one of the primary drivers of cash flow in the next decade. I believe this will continue to benefit the company and only serve to solidify its already-dominant industry position and all the advantages that come with it.

Exxon 2022 Investor Day Presentation

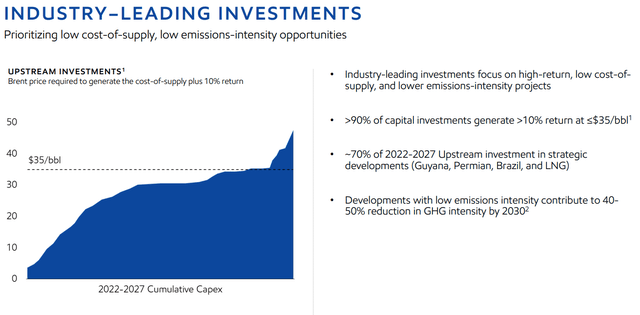

Of course, the cultural mismatch between what Exxon has to do to help the carbon transition and what it has done in the past may be less than many imagine. Exxon has always been world-class at finding efficiencies and cutting costs. And a lot of what it has to do to meet green targets is to be ruthlessly efficient, so I suspect it will be more successful than many detractors might postulate.

The recent numbers from the Permian suggest Exxon’s unique approach focused on efficiency is paying off: for both shareholders and the environment. Despite boosting production significantly recently, the firm’s carbon footprint there reduced over the same period. But, the spartan strict investments in upstream are going to start providing a ton of cash over the next few years. This is an advantage that international competitors and Chevron (CVX) won’t have.

Exxon 2022 Investor Day Presentation

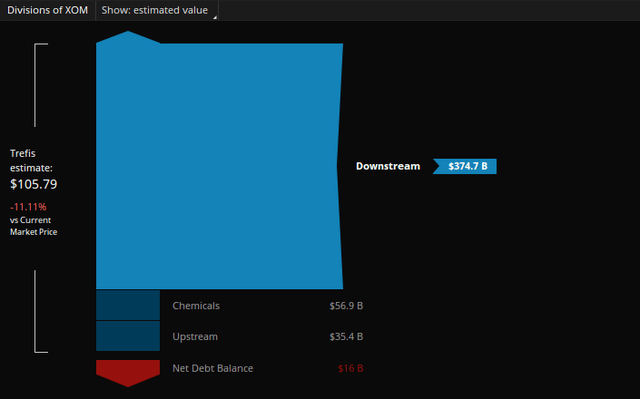

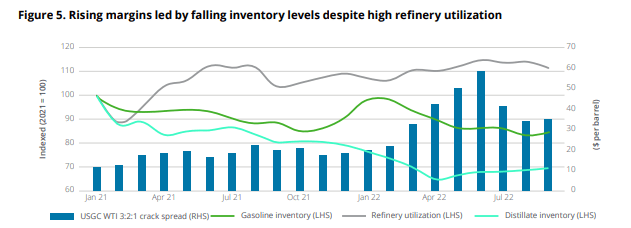

So, Exxon’s strategy here is compelling. However, the bulk of the company’s value is in its downstream segment. This one segment is around 80% of Exxon’s market cap and is nearly a $400 billion business in its own right. It’s sprawling, and there is a major refining capacity. The firm just revamped a massive portion of its US refinery capacity. Refining margins have naturally been under pressure over the last months due to seasonal maintenance. Still, they are due to expand again and appear poised to remain elevated above historical norms.

Deloitte

Bank of America recently said a “Golden Age” for oil refining has begun. Exxon Mobil’s massive downstream segment is poised to be a major beneficiary over the coming quarters as crack spreads are expected to remain well-above 10-year averages. The refining margins and the secular supply dynamics in that industry are one of the key reasons why I see the dividend as more sustainable than some.

A Great First Quarter

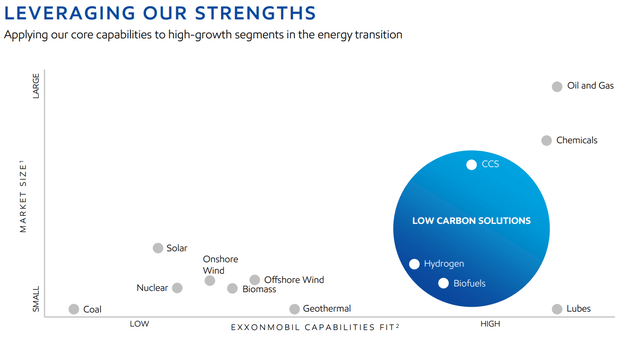

The firm had a fantastic performance in 2022. It has evolved from one of the most recalcitrant resisters to renewables and green energy to a firm that appears poised to be a major player (and good boy) in the energy transition. As Darren Woods, the company’s CEO, has said, “There is an ‘and’ equation.” In other words, the company can both provide energy to the world through fossil fuels and significantly contribute to efforts to reduce carbon emissions and transition to a cleaner energy future.

Exxon Mobil Q1 2023 Earnings Presentation

The natural question would be whether or not such bumper times can continue, particularly as recessionary fears are rising to a fever pitch. This quarter’s performance continued spartan discipline in CAPEX, and the seeming benefits of consolidation make me think that this company has many more years to offer vigorous shareholder returns and technological excellence that builds value. The dividend here also increases your margin of safety.

Of course, this dividend aristocrat has an enviable record. I think recent financial developments suggest that the treasured cash flow for so many families is safer than ever, which I’ll discuss in detail below.

The Giant Is Awake and Ready for the 2020s

Exxon has a massive amount of premier physical assets, oil reserves, and many intangible assets. When a company’s around for well a century and a half, it’s bound to make some important relationships. Exxon has an army of engineers and experts to run one of the planet’s most physically and logistically intensive operations. You might also be surprised that over the past year, Exxon has dramatically outperformed some of the market’s favorite stocks.

The company made $30 billion in shareholder distributions last year and has raised its dividend for an imperial length of 40 years through multiple crises and existential threats. The company has seen its share of crises and successfully weathered them, having been founded in the early 1880s.

However, the unique combination of COVID, negative prices, and the regulatory threat from increased awareness of climate change have hardened the company into a resilient moat for shareholder value. The company knows how to keep shareholders around and make it worth their while if you’re keen enough to listen to what they’re offering.

Exxon is one of my favored ways to play the concept of ‘rhetorical arbitrage‘ that I introduced in my article on the Energy sector a couple of months ago. While Energy firms are increasingly cast as villains in public debate, they are also increasingly seen as a necessary part of humanity’s transition from fossil fuels.

Exxon 2022 Investor Day Presentation

So, I think this is a major factor. The 2010s were marked by the victorious and inexorable march of Technology against the backdrop of a declining Energy industry. The institutional allocations to the sector reached the point where investors essentially proclaimed the sector dead. There is definitely a lot of uncertainty in the sector pertaining to its future, but if you have to be in one place that you can count on being around in a decade or two and still paying dividends, it’s Fortress Exxon.

Valuation and Benefits of Owning Exxon

Exxon enjoys a premium above most of its foreign peers as a fully integrated oil major. However, the current levels of valuation may be elevated relative to peers, but historically it is still depressed. Of course, the share price will likely drop if there is a major recession or financial crisis. Even if this does happen, though, we discuss above how the firm is able to maintain double-digit returns on many projects at $35 dollar oil.

This was not the case in recent down cycles, so I’d argue the downside is more protected than in the event of past recessions. But many folks have been talking about a minor recession or a soft-landing. If this is what ends up happening, I think the multiple could obviously increase as goodwill spreads through the market.

Oil and Gas is a mature business where assets and how you wield them are of preeminent importance. This is even more the case in our modern times, where the very ability of Energy firms to survive can depend on their ability to be attractive enough to shareholders in terms of capital return. So, the narrow path to consistent financial success is even narrower in a business that is already capital-intensive and has little room for error on projects.

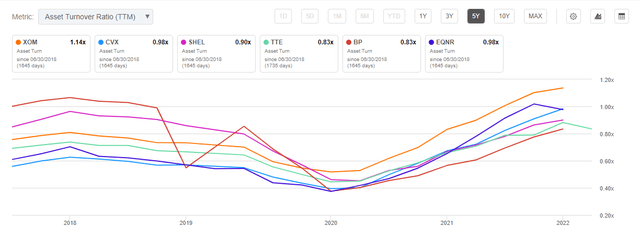

This is why I think it is quite significant that Exxon is the only major with an Asset turnover ratio over 1. The significant lead in this area over peers says to me that there’s some more room for favorable developments on the valuation relative to peers. Exxon’s rumored appetite for large acquisitions could serve to only further bolster its increasingly supreme position among the Western oil majors.

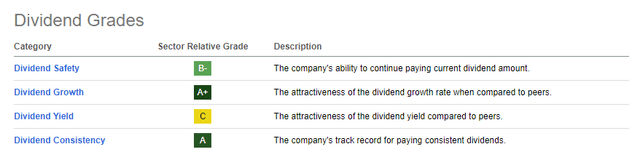

But, of course, one of the most appealing things about Exxon as an investment is its supreme record as a dividend aristocrat. This proven compounder has shown that it considers the dividend and rewarding shareholders sacrosanct. Based on my analysis and the continued strides the company is making, I think that the dividend safety grade of B- is a little low, particularly given the firm’s stellar record.

As far as the yield grade, not all yields are equal. Some of the highest yields are some of the surest not to be there in a few years. Of course, Exxon’s dividend likely isn’t going anywhere anytime soon. The mix of appreciation potential for the stock itself with a solid and sustainable dividend yield is what I like about this company.

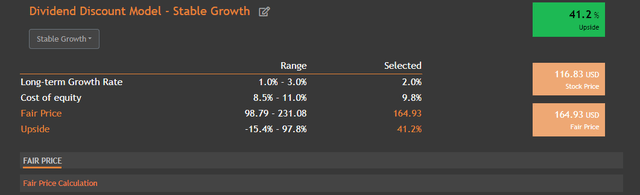

Even with a yield that is not quite as high as some in the Energy sector, Exxon is still undervalued with the Dividend Discount Model, as you can see above. It can also be considered undervalued with reasonable assumptions in a Discounted Cashflow, although the upside on the DCF is not as substantial as with the DDM.

Still, to me, the stock seems a bargain even with the recent runup in performance. Of course, if you want to buy Exxon, please do yourself the favor of not trading it. Own it, preferably directly, and enroll in the dividend reinvestment program. Don’t touch it for five years. I am very optimistic you’ll be happy with the result. If you have reservations about climate change, owning the stock directly will also give you an opportunity to vote as a registered shareholder.

Risks And Where I Could Be Wrong

The financial risks to the company are muted right now as it undergoes a cash bonanza and has structurally lowered the cost basis of crucial elements of the business. Still, I will monitor my financial condition for any material adverse developments that would cause me to change my buy rating. The stock has had a nice run-up, so there’s probably some tactical price risk. The momentum has been exceptionally strong.

The Energy business is a tough one. Obviously, it’s not easy drilling holes in the ground and turning crude oil into jet fuel. It’s particularly not easy on the scale that Exxon does it. So, with such a vast physical business, any number of risks can derail your investment.

These can include major accidents, oil spills, and more stringent government regulations that hamper profitability. Reputational and political risk have outsized importance for an oil major. Exxon has always been a favorite target of Energy industry critics.

One bright sign in this area is that the primary House GOP legislative initiative of 2023 appears to be an Energy bill that includes significant regulatory relief. I’m not qualified to parse the exact effects of this bill on the industry, and I’d like to keep past my days of reading multi-thousand-page bills behind me if possible.

However, a ‘back-of-the-envelope’ analysis of this plan makes me concerned that eroding entry barriers for smaller participants could somewhat erode Exxon’s competitive position. However, I don’t think the passage of this bill is currently considered likely. Exxon’s clean Energy efforts could always become a liability if not found to be genuine, but I don’t think this is the case at all after careful analysis.

As far as flack from the left, I am of the opinion it will mostly be rhetorical. Yes, the industry is a favored whipping boy. Still, in the Second Cold War that we are now living through, it is also a vital national asset that provides an advantage in confronting our adversaries and helping our allies. Even so, supply dynamics are tight, and a major spike in price could always draw the potential for legislative or regulatory action that hurts shareholder interests.

Conclusion

Exxon is a bit of a paradox. It is controversial and even considered recalcitrant by some, but it has consistently delivered to shareholders for over a century and a half. Of course, the firm does face a number of challenges and threats. However, I firmly believe that the discussion around a business is less important than the business itself for most investors. Ultimately, the strategy Exxon is embracing to reward shareholders is compelling.

The firm continues to deliver profits, drive efficiency and is making strides to be a major contributor to the Energy transition in a positive way. Exxon’s refining margins and coming FCF bonanza from increasingly disciplined upstream projects make me think the dividend is safe for the foreseeable future. Earnings-based and dividend-based valuation methods both suggest the stock trades lower than fair value. If you don’t own this one already, buy some and hold onto it.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.