Summary:

- I’m initiating Tesla with a buy for near-term investors ahead of the highly anticipated Robotaxi Day and 3Q24 earnings.

- .I think Tesla will benefit from its longer-term secular tailwinds, including global EV adoption, a more friendly interest rate environment, and U.S. government backing.

- Tesla should be able to better navigate the harsher Chinese EV competition on these secular tailwinds.

- I also expect GAAP gross margins to pick up next quarter due to an easier year-over-year comparison from 3Q23, when they started declining.

- I hereon share my positive sentiment on Tesla and why I see more upside into FY25.

ithinksky/E+ via Getty Images

Investment thesis:

I am initiating Tesla (NASDAQ:TSLA) with a buy ahead of its upcoming Robotaxi Day on October 10 and Q3 earnings scheduled for the end of the month. The company released its 3Q24 deliveries and production report earlier this week. The stock was down ~5% after deliveries missed analyst estimates. I’m writing on Tesla with two things in mind that make Tesla a mid-term outperform, in my opinion. The first is the company’s longer-term secular tailwinds involving global EV adoption and a better rate environment materializing for 2025. The second is more of a regulatory factor, which involves the U.S. government backing American EVs over Chinese ones.

Rivals on the Chinese front

Tesla isn’t like any other company in my tech coverage because it dabbles on both sides of being a tech and auto company. Let’s unpack this multi-faceted company. Here’s what I’m looking at:

Chinese EV competition:

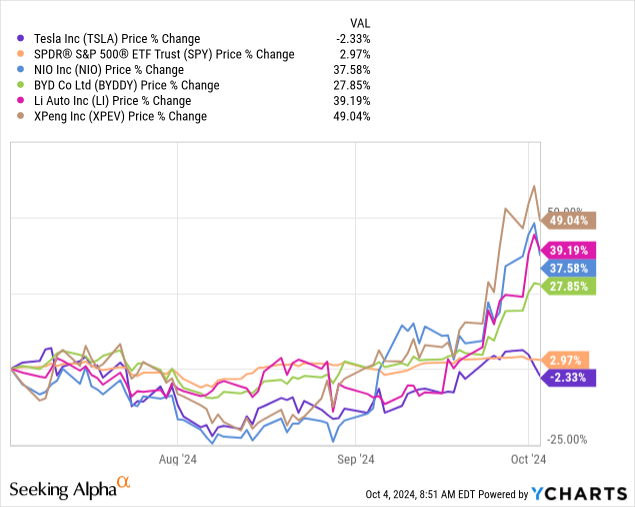

Tesla’s stock is down 2.3% on the 3-month chart, slightly lower than the S&P500, up ~3%, and also lower than the Chinese EV peer group, with Li Auto (LI) up 39%, XPeng Inc (XPEV) up 49%, Nio (NIO) up 37.5%, and BYD Co Ltd (BYD), up 27.8%, as seen below.

YChart

With increased competition from Chinese rivals, the pressure on Musk is rising. Tesla delivered 462,890 electric vehicles in 3Q24, with a 6.4% increase from a year ago and a 4.2% increase from last quarter, and it missed expectations of a 470,000 or 8% year-over-year increase. This quarter’s deliveries and production numbers caused the stock to drop over 6% during the trading day but pick up into the close, closing only 3.5% lower for the day. The initial disappointment of the results caused investors to press sell now and ask questions later until many realized that while missing estimates, the results marked the return of growth after two-quarter declines, the highest third quarter in deliveries for Tesla, and the third-largest in the company’s history.

Part of investors’ disappointment comes from the fact that Tesla’s Chinese rivals had a pretty bright month in September. Nio reported a new quarterly record for deliveries with an 11.6% year-over-year increase, and XPeng’s sales were up 39%, reaching 21,352. Li Auto also announced deliveries of 53,709 vehicles for last month. As for the leading Chinese EV brand, BYD, which focuses mainly on cheaper and hybrid models, it hit its fourth consecutive quarter in monthly sales growth since March, at 419,426 NEVs in September.

One thing to be expected from such a competitive space is share pressure. Obviously, Tesla is not immune to share loss as more players work for a slice of the pie, which is the EV market. Tesla saw its share of the market shrink from a high 70s percent range of the market to dropping below 50 percent earlier this year. The company is specifically facing share loss in China; Tesla’s total deliveries in China in the period of January-August witnessed a 0.57% decline from a year ago, according to CNevpost. BYD continues to dominate the market share with 37%, above Geely at 7.2%, and Tesla is placing third with a 6.2% share, an increase still from 5.27% in the month before.

I’m not too worried because although Tesla’s share of the market is under pressure, the market itself is expanding as consumer adoption of EV balloons is in the bigger picture. I don’t think investors should get too caught up with woes over Tesla’s share loss without tracking how much the market itself is expanding as well as the spend flowing into it.

According to Fortune Business Insights estimates, the EV industry is expected to see a CAGR of 13.8% from $671.5 billion in 2024 to $1.9 trillion by 2032. In the near term, Tesla may have some competition to fight off before the macro picture in North America rebalances, which I suspect will happen in early 2025.

On the U.S. front: a glimpse of light

Risks

Tesla got stained with slower deliveries and margin pressure for the greater part of the post-pandemic period. Last quarter, 2Q24, was accompanied by a 7% year-over-year decline in sales following an 8.5% year-over-year decline in 1Q24. Adjusted EBITDA margins have been specifically feeling the heat; the adjusted EBITDA margins show a company’s ability to generate cash and its operating performance regardless of accounting adjustments and capital structure.

Tesla’s adjusted EBITDA margins remain a risk, coming in at 14.4% in 2Q24 compared to 18.7% in the year-ago quarter, with the full quarterly performance shown below.

However, I am more concerned with total GAAP gross margins, which will help me better understand Tesla’s core business performance and better reflect general profitability related to production costs. And while total GAAP gross margins also declined year over year for the past four quarters, GAAP gross margin was up sequentially last quarter. I think next quarter’s gross margins will beat year over year due to the easier year-over-year comparison from 2H23 as gross margin started declining in 3Q23. Below is a chart showing Tesla’s total deliveries, total productions, and total GAAP gross margin for the last five quarters.

|

2Q23 |

3Q23 |

4Q23 |

1Q24 |

2Q24 |

|

|

Total deliveries |

466,140 |

435,059 |

484,507 |

386,810 |

443,956 |

|

Total productions |

479,700 |

430,488 |

494,989 |

433,371 |

410,831 |

|

Total GAAP gross margin |

18.2% |

17.9% |

17.6% |

17.4% |

18.0% |

Rewards:

Part of why I think Tesla remains favorable despite these risks of margin contraction and high competition is because it has economics of scale (which can be defined as a commensurable saving in costs gained by a higher level of production) and U.S. government backing. Tesla is not for the faint-hearted and not for those who want to make quick money and cash out – it’s a longer-term play, in my opinion. Recent September 0.5% percentage rate cuts should help boost consumer spending power, and I expect this to reflect onto Tesla’s deliveries by early FY25.

Tesla has also been losing market share in the United States, with a market share between April and June down to 49% from 59.3% a year ago. But during the 2Q24, the top two selling EVs in the U.S. were: 1. Tesla Model Y (30% market share), 2. Tesla Model 3 (12.9%). Ford (F) has around 7.2% of the U.S. market share.

In May, President Biden increased tariffs on Chinese EVs from 25% to 100% to protect Tesla’s market share in the U.S. This follows the 2022 Inflation Reduction Act, which aims to reduce emissions by 40% by 2030, according to the White House. I expect we’ll continue to see positive support for American EV and auto manufacturers from the U.S. administration this decade as the U.S. works to hit its now target “for EVs to make up 30% to 56% of light vehicle sales from 2030-2032 model years.”

Valuation:

There are different ways to approach Tesla’s valuation, considering it dabbles on tech and auto fronts. In my opinion, it makes the most sense to value Tesla against the large market cap peer group, particularly made up of industry leaders. The large-cap peer group average that I use as a benchmark to measure the attractiveness of Tesla’s valuation includes tech companies that match Tesla’s market position in their respective industries and which can more accurately speak to Tesla’s valuation being attractive or not. According to data from Refinitiv, Tesla’s EV/Sales ratio for C2024 is 7.5, which is in line with the peer group average of 7.6. I think this indicates that Tesla is fairly valued compared to other tech companies with a large market cap; this is important for investors looking to jump into a U.S. tech company with a dominant market position at a relatively fair price. With rate cuts now underway, I think the macro headwinds should also ease into 2025, and consumer spending on luxury should rebound.

The Price/Earnings ratio is 106, significantly higher than the peer group average at 33.1. This is to be expected as Tesla is more diversified than the large-cap U.S. companies and has several legs of growth. I think the numbers reflect the market sentiment of Tesla and investor confidence in future growth prospects. According to data from Refinitv, around 15% of Street Analysts give the stock a strong buy, and over 26% give it a buy. Around 36% of Street Analysts give the stock a hold, reflecting uncertainty ahead of the Robotaxi event due to the previous August delay.

I think the next few weeks will be pivotal for the stock. Around 15% of Street Analysts give the stock a sell, and 7.5% give it a strong sell. I think Tesla’s market sentiment perfectly reflects the stock movement over the last few months, too. The PT median for early July was $184.98 and surged to $217.5 in August. It kept an upward trend through September at $220.5. The PT median now stands at $222.5. As for the PT mean, it maintained the same upward trajectory and was at $194.8 in July; it went up to $206.2 in August and was slightly up in September and currently, at $208.9 and $209.4, respectively.

I believe some of the positives haven’t been priced in, like the anticipated Robotaxi event and 3Q24 earnings towards the end of the month. I believe the stock has more upside ahead. While a high P/E ratio could indicate that the company is currently priced at a premium, I think the case for Tesla is different, and the company at current levels is dirt cheap compared to other large-cap companies.

With all said, I think Tesla remains undervalued as an auto company and has pricing power over its Chinese competitors. I believe the company is somewhat protected in the U.S., and Europe is soon to join with the European Union, which has voted to impose tariffs on Chinese EVs.

What’s next:

I think Tesla’s early investments in AI position it at the forefront of the EVs and technology sectors. Good things take time, and it can’t be argued that Elon Musk has been taking his time. I think next week’s event will reveal some interesting innovations along with the expected demonstrations of the 12.5 version of FSD (full self-driving) and the fully autonomous cyber-cab. Fears of the event not living up to expectations are weighing on some investors, including Morgan Stanley’s analyst Adam Jonas, who believes the company’s future valuation is “highly dependent on its ability to develop, manufacture and commercialize autonomous technologies, ranging from transportation to humanoid.”

I think Robotaxi stands to maybe be a more immediate catalyst, potentially bringing with it some upside surprise after the stock deflated on the deliveries miss this week. On the bright side, Nvidia (NVDA) CEO Jensen Huang believes the future is robotic and that we’ll get to a point where even factories will be autonomous. I think this could very well be the case, and I believe Musk has a big role to play in that future.

I am watching closely to see how the innovation introduced in the event will work out in terms of permits and test site details. I think these will be very important for Tesla’s transition from promises to execution. In the mid-term, I’m also watching the promised FSD regulatory approval in both Europe and China. I think Tesla has multiple things working in its favor and would advise investors not to get caught up with the rear-view mirror perspective on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.