Summary:

- I’ve been bearish on Southwest Airlines stock since 2018 and maintained that stance through the pandemic.

- Historically, Southwest has had a long history as a profitable airline but hasn’t adapted well to the current environment.

- Activist investors should act as a positive catalyst for the stock.

- Even if a full recovery for the business takes 5 years, Southwest’s returns should exceed that of the S&P 500 if they are successful.

EXTREME-PHOTOGRAPHER/E+ via Getty Images

Introduction

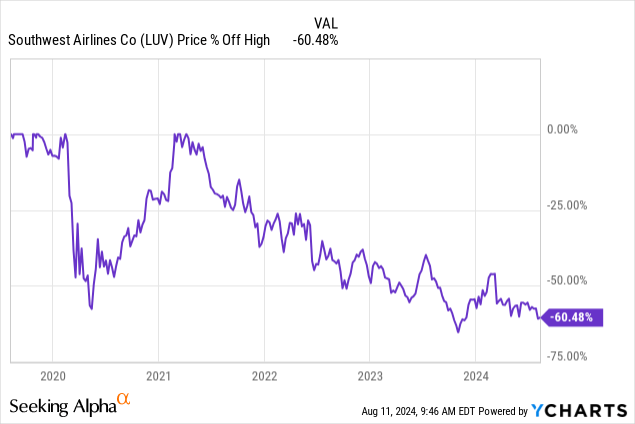

After decades of successful execution, even during challenging environments like those post-9/11 and the Great Recession, the recent pandemic severely damaged Southwest Airlines’ (NYSE:LUV) business. The stock price is now down more than -60% off its highs after initially staging a full recovery in 2021 off the pandemic lows.

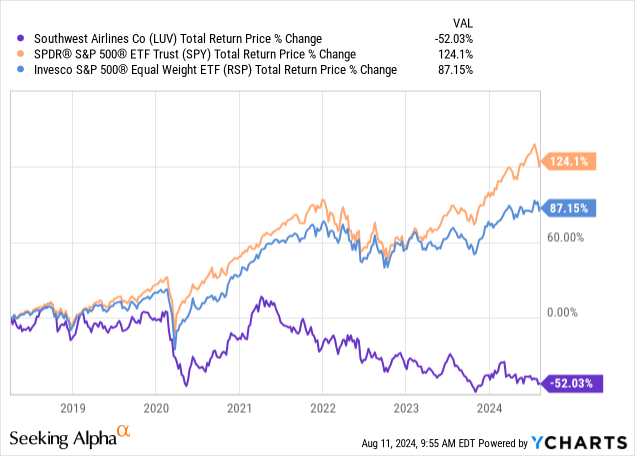

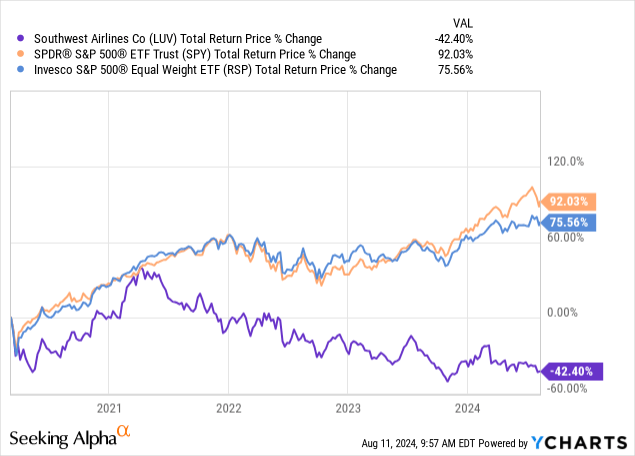

I have been bearish on Southwest Airlines stock since my April 4th, 2018 article “How Far Could Southwest Airlines Fall?” in which I shared the stock’s historical cyclical downside risk even though the business was high quality. Here is how the stock has performed since then:

Even before the pandemic, Southwest stock had been underperforming both the cap-weighted S&P 500 index and the equal-weighted (RSP).

Also, near the beginning of the pandemic, on March 6th, 2020, when many were downplaying the seriousness of the problem, I wrote the “Sell” article “Re-Evaluating My Bearish Southwest Airlines Thesis“. Here is how the stock has performed since then:

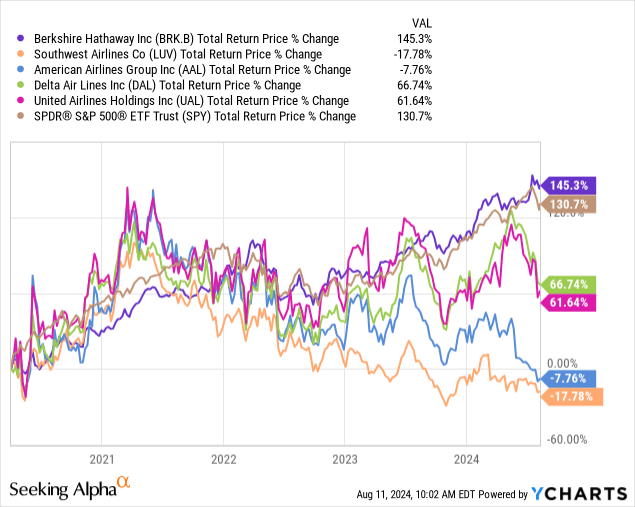

Initially, all airline stocks staged a big rally into the spring of 2021. If you recall, Warren Buffett sold his four US airline stocks toward the end of March 2020, and just a few months later many investors declared him foolish for doing so. Essentially, what Buffett did was take the money from those sales and buy back Berkshire stock, so let’s see how Berkshire has performed since April 2020 versus the airline stocks he sold.

Berkshire Hathaway (BRK.B) has more than doubled the performance of the best airline stocks, performed 5x better than the basket of airline stocks Buffett sold, and also performed better than the S&P 500 (SPY). So, over the medium term (2-5 years), which is the time frame I typically focus on with cyclicals, Buffett’s decision was correct. And the initial bounce off the bottom of the March 2020 lows for airline stocks was irrational.

It’s important to point out, here, that I rarely write articles on stocks that I don’t consider high enough quality for me to consider buying at the right price. So, my bearish articles tend to be on stocks I think could be near cyclical highs, are very overvalued, or that were once high quality, but may be showing signs of having that quality diminish. Southwest has traditionally had the best airline business in the US, that’s why I covered it in the first place. The question has always been one of buying at the right price, without the cloud of a global pandemic hanging over it, rather than business quality. So, back in January of this year, I wrote an article titled “Here’s The Price I’ll Buy Southwest Airlines Stock” where I shared the price I thought Southwest would be a good buy. Here is the conclusion of the article:

Putting all this information together, my buy price for Southwest Airlines stock is $23.45 per share. Sometimes readers misread my “buy prices” as target prices or predictions about where the stock will trade. They are not. My buy prices are the prices at which I think 1) have a reasonable chance of occurring (reasonable being 10% to 20% chance), 2) have a margin safety, and 3) have a high probability of producing the future returns I want (usually a 15% medium-term CAGR or better). In this article, I’ve shown via history why the buy price has a reasonable chance to hit and also recover in a timely manner, thereby producing the level of returns I’m after. I tend to aim for a bigger margin of safety and higher returns than most investors. However, I think investors with different goals can still use the methodology I shared in the article. If I end up buying this one, I’ll write a follow-up article explaining the method in more detail.

Recently, LUV bottomed at $23.58, almost right at my buy price. I thought the recent addition of Elliot Management’s activist stake in the business, might be enough of a catalyst to potentially put a bottom in the stock price, so I have taken a position in LUV and I think now is a reasonable time to buy the stock as a medium-term investment. This article will explain the strategy behind my decision.

History Is A Good Predictor Of The Future

Underpinning my investment strategy for cyclical stocks is an important assumption. That assumption is that if the market was willing to pay a certain price for a stock in the past, then if similar conditions arise again, and not too much has changed with the business, there is about an 80% chance the market will be willing to pay a similar amount again.

Hopefully, at least in a general sense, readers think this is a reasonable assumption with which to start. And, honestly, it’s the assumption that any mean reversion strategy and most valuation analyses implicitly make with any fundamental analysis, so I don’t think it should be too controversial.

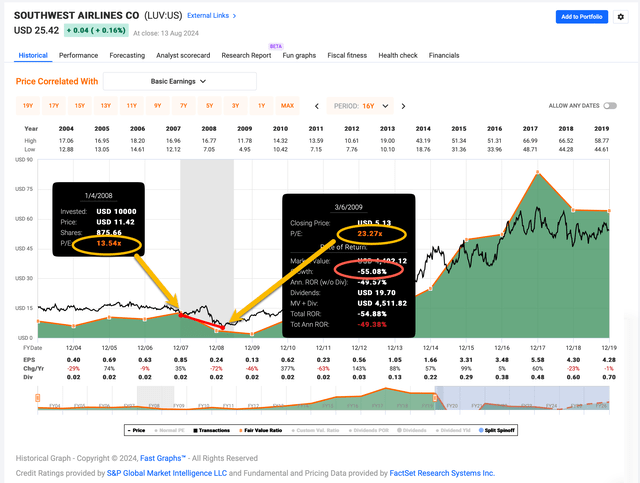

The problem with deeply cyclical businesses like Southwest is that earnings can fluctuate so much, that a traditional earnings-based analysis isn’t very useful for investors. I illustrate this in the FAST Graph below that focuses on the Great Recession period.

I used Basic Earnings instead of adjusted earnings in the FAST Graph above because it better illustrates my point regarding traditional earnings valuations and cyclicality. In January 2008, LUV’s P/E ratio was 13.54 and earnings had been growing at a good pace. That’s traditionally pretty cheap, or at least on the undervalued side using an earnings analysis. Five quarters later, LUV’s P/E ratio was 23.27, which is almost double the P/E five quarters before that. So, on the surface, it looked like LUV was pretty cheap in early 2008 and pretty expensive in March 2009 near the market bottom, even though the stock price had dropped about -55% during that time. The earnings valuation was giving precisely the wrong signal to investors. It signaled a buy just before the stock lost half its value, and it signaled a sell near the market bottom. This is exactly the opposite of what we want to do as investors.

The reason for this problem is that earnings fell a lot during that time. Using basic earnings in the above graph, EPS fell about -85% from 2008 to 2010. When earnings fall, the P/E rises. But what doesn’t get taken into account in this calculation is that earnings of high-quality cyclical businesses recover in a timely manner, so they don’t stay down there. That’s what makes them cyclical.

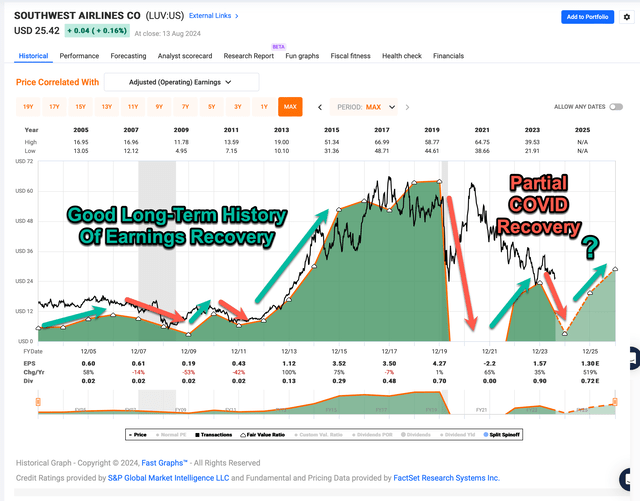

Zooming out the time frame and switching to adjusted EPS, the FAST Graph above shows that LUV’s earnings have experienced 3 significant declines during the past 2 decades, and are currently experiencing a 4th. The stock price recovered during all these declines, and earnings recovered from all of them except COVID, in which it staged a partial recovery before experiencing recent trouble. Any bet on LUV stock here over the medium term assumes there is a good chance, during the next 5 years, LUV can stage an earnings recovery. So, we know that LUV is a cyclical business, and we know they are currently in a deep downcycle that was started during the pandemic, but which they are having difficulty recovering.

Southwest’s earnings history fits the profile of a deeply cyclical business. Because of this dynamic, I don’t use earnings to guide when I buy cyclical businesses, I use historical stock price patterns, under the assumption that they will probably repeat in a similar fashion as they have done in the past.

Southwest Airlines’ Historical Stock Cyclicality

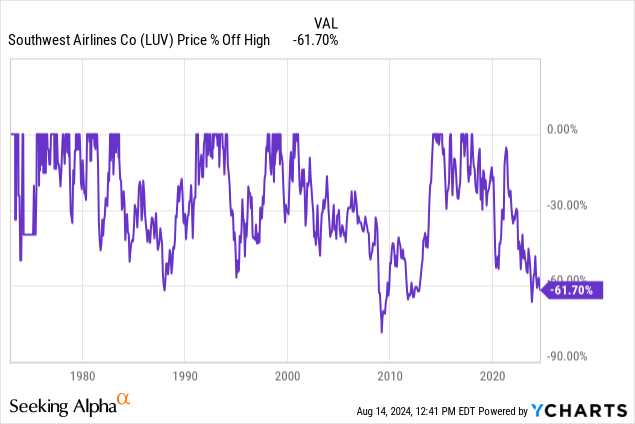

Because I’ve written on Southwest stock several times in the past, I have shared some of this data before. I’ve updated the portions where new information is available. First, let’s examine LUV’s long-term historical price patterns with a very long-term drawdown chart:

The big picture view, going all the way back to the 1970s, we can see Southwest stock had 4 or 5 very significant drawdowns, and they have recovered from all of those in a timely manner. These are the sorts of cyclical stocks I like to invest in when they are well off their highs.

Some of the key factors current LUV shareholders might want to consider are the speed at which the stock price could fall, how deep the plunge could be, and how long they might expect the stock to stay below the price at which it is today. Over the past 50 years, LUV has had ten sell-offs of 35% or more as depicted in the table below:

| ~Year | ~Time Until Bottom | ~Duration | ~Depth |

| 1973 | 4 months | 6 months | -50% |

| 1974 | 6 months | 18 months | -60% |

| 1978 | 4 months | 8 months | -37% |

| 1981 | 4 months | 15 months | -49% |

| 1984 | 6 months | 18 months | -46% |

| 1985 | 2.5 years | 6 years | -59% |

| 1994 | 1 year | 4 years | -60% |

| 1999 | 6 months | 18 months | -38% |

| 2001 | 8 years | 14 years | -78% |

| 2018 | 5+ years | ? | -61% at this time |

Typically, with deep cyclical investments, I plan to buy a stock when it is a certain percentage off its highs, and then sell it when it recovers that old high. What I want to know is what sort of returns I might expect if I buy LUV at certain levels off its high price. Usually, I only want to buy it if I think the returns will be superior to the market. I’ve shared this data and calculations in previous articles, but here they are again:

Given what we know from Southwest’s past cycles, I’m going to backtest entry points after -35% and -60% declines. Investing after a -35% decline would have gotten us into all 9 of Southwest’s previous major declines. Embedded in that entry point is the secular bull story that airlines have now consolidated, fuel prices stay lower for longer, more people want to fly, etc. Investing after a -60% decline would have gotten us into 3 out of the 9 major downturns.

The table below shows the results one would have had they invested after a -35% decline in price during Southwest’s previous downturns. The returns in the table do not include dividends. I annualized the returns and then compared them to the S&P 500 if bought and sold on the same dates, annualized. The goal is to see if historically buying after a -35% decline would be an alpha-producing strategy, so the last column is the alpha produced by the investment annualized relative to the S&P 500. All the percentages should be treated as estimates and are based on the approximate months held. If one buys after a ~35% decline and sells after the stock makes a full recovery, it produces a ~55% simple return, so that is the simple return for each of the investments in the table below. I have excluded the years from the 1970s because the stock was so thinly traded during those years, but they would have produced solid alpha.

| Year the Decline Began | Purchase Date | Sell Date | Months Held | Annualized Gains | S&P 500 Annualized Gains | Annualized Alpha to the S&P 500 |

| 1981 | 7/29/81 | 9/1/82 | 14 | 47.14% | -7.24% | 54.38% |

| 1984 | 7/16/84 | 7/8/85 | 12 | 55.00% | 26.60% | 28.40% |

| 1985 | 5/1/86 | 1/18/91 | 56 | 11.79% | 8.85% | 2.94% |

| 1994 | 5/16/94 | 1/20/98 | 44 | 15.00% | 32.78% | -17.78% |

| 1999 | 9/22/99 | 7/24/00 | 10 | 66.00% | 14.08% | 51.92% |

| 2001 | 7/10/02 | 2/24/14 | 139 | 4.75% | 8.69% | -3.94% |

From 1980 onward, Southwest has been a mixed bag in terms of producing alpha if one invested after a -35% decline off the highs. In 1994 it would have significantly underperformed the S&P 500, and in 2001 it took over a decade to recover its previous highs and also underperformed the S&P 500 during that time period. As a general rule, I want cyclical investments to recover within 5 years, so the 2001 downturn is a major issue for me.

Next, let’s see what sort of effect making an investment after a -60% drawdown in 1994, and 2001 would have had.

| Year the Decline Began | Purchase Date | Sell Date | Months Held | Annualized Gain | S&P 500 Annualized Gain | Annualized Alpha to S&P 500 |

| 1994 | 12/20/94 | 1/20/98 | 37 | 48.65% | 37.00% | 11.65% |

| 2001 | 11/19/08 | 2/24/14 | 63 | 28.57% | 25.69% | 3.98% |

Alright, the good news is that buying LUV after -60% would have produced great returns and produced alpha during the 1994 and 2001 downturns. Additionally, the 63 months held during the decline that began in 2001, is pretty close to my 60-month preferred time horizon because even though the downturn started in 2001, we wouldn’t have bought until 2008. One can see from the data above why I’ve always been slow to buy LUV. When buying -60% off its highs, the stock still would have outperformed the S&P 500, but only if one didn’t make an earlier purchase.

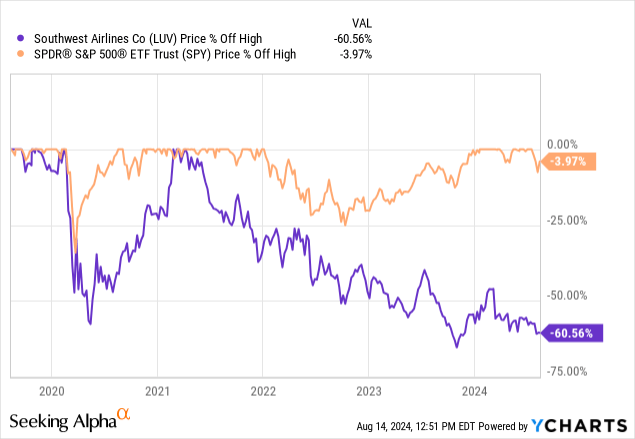

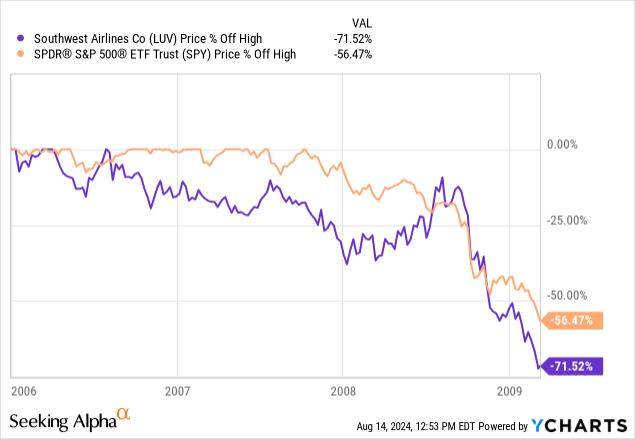

In my last LUV article, I decided I would aim to buy after a -65% decline off the high instead of -60%. I’ve since changed my mind and decided it’s reasonable to go ahead and buy after the -60% decline. There are three reasons for this. The first is that SPY hasn’t followed LUV down this cycle.

The S&P 500 is near all-time highs while LUV is down about -60%.

Now let’s compare the drawdowns to 2008:

Near the bottom of the Great Recession, SPY had actually fallen nearly as deeply as LUV off its high. This made it more difficult for LUV to outperform coming out of the recession. This dynamic has changed this time around. The odds of LUV producing significant alpha if it recovers are much higher.

The second I think it’s reasonable to buy now is that it looks like the Fed is poised to start lowering interest rates, and there is some chance (though not my base case) that we might get a soft landing in the US. My portfolio, which holds roughly 1/3rd cash right now, is positioned particularly well for a true soft landing, so I think it’s reasonable to add a few stocks that could outperform under those conditions.

And the third reason is we now have an activist investor, Elliot Management, pushing for needed changes at Southwest.

Activist Investors

Many times in the past I’ve had activist investors come in when stocks are slightly above my buy prices, and once it became publicly known the activists had taken a stake, it effectively put bottoms under the stocks before I could buy them. Some of the time, activist investors are just looking for a quick turnaround in the stock price and don’t bring anything of substance to the table (I’m not mentioning names). These instances tend to annoy me the most because they can prevent me from getting the prices I want when a stock is down. There are one or two activists, however, who bring some positive ideas to the table and genuinely aim for a medium-term turnaround in the business. Generally speaking, I think of Elliot as one that often legitimately has something to offer. So, we have a case here, where not only might I not get my lower buy price, but we might actually have a positive catalyst for the business over the medium term.

As I wrap up the writing of this article, it was announced today that Elliot is planning to nominate 10 new directors to LUV’s board. My view is that Southwest’s management has made mistakes. At the very least, they have been incredibly reluctant to adapt to the times as we saw with their scheduling fiasco in December 2022 when 60% of flights were canceled. It’s clearly a company in need of change, and they are continuing to stubbornly fight it.

Conclusion

Southwest is likely to have persistent headwinds over the next year. The economy is slowing, the main supplier of their aircraft, Boeing (BA) is in shambles, and management is under pressure to change things that have traditionally worked for Southwest, but which have been exposed to have serious issues. However, one of Southwest’s problems relative to peers is that post-pandemic, many travelers chose to travel internationally the past two years instead of domestically. It’s likely this international travel boom shifts back more toward domestic travel, and this should help Southwest’s value proposition for domestic flights. Additionally, lower interest rates might be able to cushion a slowing economy enough to avoid a 2008-like recession, which Southwest stock is close to being priced for right now. So, we might have a slowdown rather than a recession. And finally, most other stocks are still pretty expensive, so if the economy does find a way to muddle through over the next 5 years, the potential gains in a stock like Southwest dwarf the average S&P 500 stock. I think aiming for a 100% return in Southwest stock is reasonable within 5 years. It’s doubtful there is any condition the S&P 500 comes close to that level of return.

All that said, cyclical stocks are volatile and risky if there is a bad recession. Most other airlines have gone bankrupt at some point in the past 20 years. For that reason, I limit individual position weighting for deep cyclical stocks to 1% weighted positions and choose to spread that risk around a little bit rather than concentrate on a single cyclical stock. That’s the weighting I recently took with my Southwest stock purchase. Now it’s time to wait for a medium-term recovery.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you have found my strategies interesting, useful, or profitable, consider supporting my continued research by joining the Cyclical Investor’s Club. It’s only $40/month, and it’s where I share my latest research and exclusive small-and-midcap ideas. Two-week trials are free.