Summary:

- JinkoSolar’s balance sheet shows high debt, but management is actively working on improving it, evidenced by a reduction from $4.38B to $3.66B in total debt.

- The firm’s new N-type panels are expected to drive growth, with efficiency reaching 26.5% by end-2024, but the current negative free cash flow due to high capex is a concern.

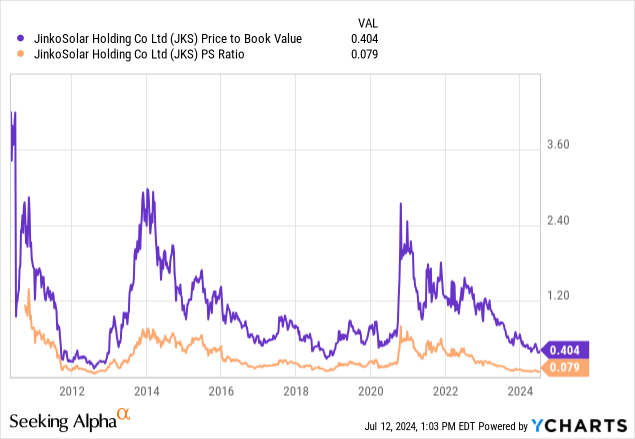

- Valuation is attractive with a price-to-book ratio under 0.5, and if the debt issue is managed, potential for high long-term returns exists; stock price could appreciate 50% by end-2025.

xijian

JinkoSolar (NYSE:JKS) may look unattractive at the moment based on its balance sheet and a lack of enthusiasm for the stock in the market, but I think there is potentially a deep value opportunity here that could make for a highly successful investment over the long term.

Many of its valuation multiples are significantly contracted compared to historical levels, and its price-to-book ratio is currently under 0.5. Furthermore, management has expressed that it is actively working to improve its debt situation, and this has been made evident in the progress reported in the last quarter. That being said, the high level of debt could mean that this company grows slower than one would like, meaning the stock could go down further before it goes up—this concern is further validated by the poor momentum in the stock price over the last two years. Management has been clear that its new N-type panels, which are highly efficient and market-leading, should drive growth. However, I believe the company needs to rework its expense strategy to alleviate concerns with the negative free cash flow currently reported (which, while common in solar companies, is still a weakness, especially considering the high levels of debt the firm has) and must prioritize paying down debt and stabilizing its capital structure. If the firm manages this, the current valuation is incredibly attractive and could lead to high long-term alpha, not just shorter-term deep-value price gains, in my opinion.

Operational Analysis

JinkoSolar is a leading global solar module manufacturer headquartered in China. It manufactures a wide range of solar power products, with core offerings including silicon ingots, silicon wafers, solar photovoltaic cells, and monocrystalline and multicrystalline panels. Notably, JinkoSolar was one of the first companies to offer N-type mono products, which are known for their superior efficiency and performance.

Management is currently planning to enhance its operational efficiency by reducing costs. It wants to leverage the N-type technology and integrated capacity structure, which it has been investing heavily in, to improve profitability, particularly by reducing manufacturing costs. This is vital as the company needs growth in cash flow to help it pay down debt, which I will explain in my financial analysis below. Management has stated that it expects the mass-produced N-type cell efficiency to reach 26.5% by the end of 2024, which is much higher than current, where SunPower can manage an efficiency of 22.8%.

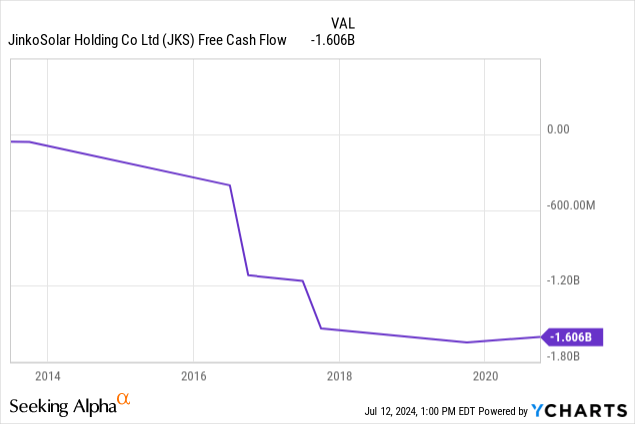

The company currently has a current annual production capacity of 75 GW for mono wafers, 75 GW for solar cells, and 90 GW for solar modules. However, it plans to expand this to 120 GW for mono wafers, 110 GW for solar cells, and 130 GW for solar modules by the end of 2024. Its major expansion projects have included a 56 GW vertically integrated facility in Shanxi, China, and a 4 GW N-type capacity in Vietnam, which is planned. This explains why the company has continued to invest aggressively and has high capex, which has continued to sustain its negative free cash flow yield. JKS arguably has the lead in solar power efficiency, but the concern I have is the expense this has taken on the company’s capital structure.

Financial & Valuation Analysis

JinkoSolar has an Altman Z-Score of 1.15 which falls in the “distress zone” (below 1.8), which indicates financial difficulties in the longer term if the situation doesn’t improve. Management is aware of the weakness here, and it has decreased the firm’s total debt from $4.38B in Q4 2023 to $3.66B in Q1 2024.

Charlie Cao, CFO of JinkoSolar Company Limited, also reported in the Q1 2024 earnings call that net debt improved from $1.63B in Q4 2023 to $1.22B in Q1 2024, indicating “a continuous improvement in our debt structure.” Pan Li, CFO of JinkoSolar Holding Co., Ltd., stated they are “continuing to improve the efficiency of our working capital, achieving sustainable growth in operating cash flow and enhancing our resilience to risks.”

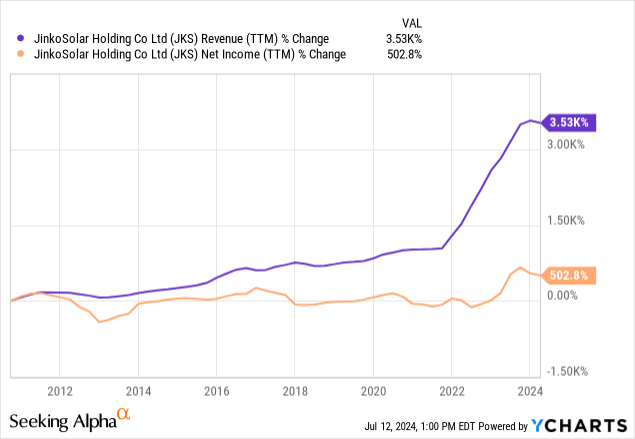

Other than its debt, the company has proven long-term top-line growth, but its profitability is more concerning. Furthermore, its free cash flow growth, as I mentioned in my operational analysis, certainly needs to be addressed. At current, the high levels of capital expenditure are leaving the company with no room for free cash flow at all.

Despite these challenges, the significant value opportunity for JinkoSolar shareholders if buying at the present price is that the company is selling significantly below book value, and also at only a fraction of total sales. If the company can address its capital structure and emphasize profitability more, as well as benefit from long-term trends in solar market adoption across the world, I think this could be a very successful long-term investment indeed.

In my opinion, long-term success all depends on how much growth the company can command in its bottom line, which can be significantly hampered by the inability to finance growth strategies due to debt concerns. Wall Street EPS consensus estimates for fiscal 2024 are -42.77% YoY growth and 74.56% for fiscal 2025. There are only 2 or 3 Wall Street analysts covering JKS, but the consensus at this time is that following 2024, positive EPS growth should resume at +25% levels until the 2027 year-end, which is the limit of forecasts at this stage.

As a result, I do not think it is unlikely that the stock will begin to appreciate in price very soon, especially as 2025 nears and particularly once the company begins to report YoY EPS growth in 2025 again. The normalized PE ratio is currently 2.85, and as the 10Y median is around 9 (although I consider it overvalued for a large proportion of this time), I do not think it is unreasonable for the company’s non-GAAP PE ratio to expand to around 4 by the end of 2025. As a result of this, the stock would be worth $34.32 by 2025-end (based on the consensus normalized EPS estimate of $8.58), indicating a total price return from now until then of around 50%, as the current stock price is $22.90.

Risk Analysis

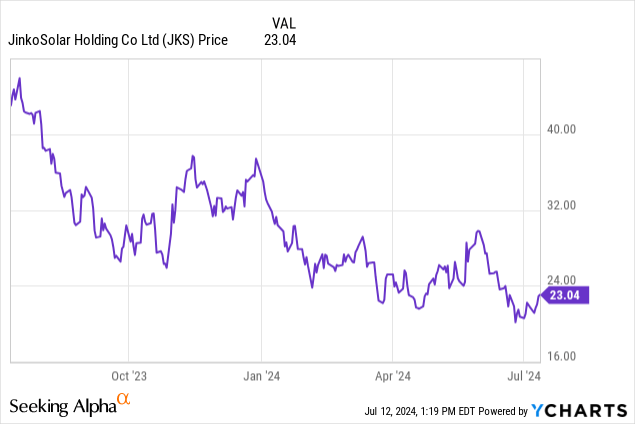

It’s possible that the market does not pick the opportunity up, although I see this unlikely, as when 2025 earnings growth starts to be reported, I think it will generate interest. That being said, the stock has a 1Y price performance of -46.82% and a 3M performance of -4.46%.

I think this risk has to be taken seriously, and I think it might be worth waiting to invest when some upward momentum has already been gained to avoid the company falling further. I think the reason the market has been so pessimistic about the company during this time of earnings contraction is that its balance sheet is so weak, and also its free cash flow is still a notable problem. I think this significantly reduces the attractiveness of JinkoSolar in the market, but I think management has expressed that it is aware of this and so is taking the necessary steps to address the problem in due course. Still, I think growth expectations over the long term should be moderated because its expansion is likely somewhat inhibited by the current high levels of debt.

Management has clearly been doing this to keep the company competitive, and the vertical integration of its business model means that JinkoSolar has cost control, quality assurance, and supply chain stability. However, it takes high capital requirements, which is made evident by the high capex affecting free cash flow, but it also reduces flexibility and can affect profitability by making the company less agile and exposing it to risks with certain elements of its model becoming redundant as technological capabilities and manufacturing processes change. As a result, I think its vertical integration is a double-edged sword, and I believe JKS shareholders need to keep growth prospects moderate against other industry competitors, primarily because the level of debt the company has taken on to fund expansion is too high right now, in my opinion.

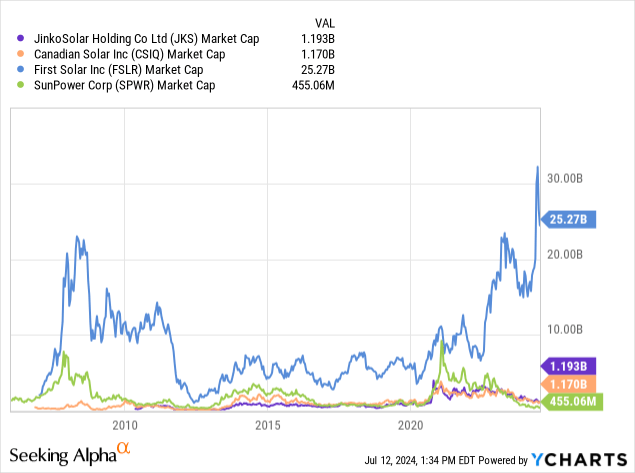

On the note of competition, the company’s main direct competitors are Canadian Solar (CSIQ), Trina Solar, First Solar (FSLR), and SunPower (SPWR).

Of these, First Solar stands out as being much larger than its smaller direct competitors, and as such, I think it has the capability to continue to consolidate its moat, particularly in the United States, which is its core market (96% of revenue) compared to JKS, which is more globally diversified. As a result, I think more pressure could be placed on Chinese imports of Solar, especially under Trump, which could diminish the growth opportunity in the United States, which is one of the leading adopters of solar energy.

Most notably, the highest threat is arguably from Trina Solar, which has technology leadership with its 210mm product and N-type i-TOPCon technology, which is in direct competition with JinkoSolar’s N-type panels. It has multiple world records in efficiency and power output, and is similarly geographically diversified to JinkoSolar. It has a market cap of $962.5M.

In my opinion, JinkoSolar has proven it is committed to remaining competitive through its own N-type offering, and I don’t doubt management’s capability in the field, which is made notable through its strong revenue growth. However, I stress again that while I do consider this a deep-value opportunity at the moment, in a few years’ time, when the company is more fairly valued, the capital structure and growth in profitability will be paramount to monitor to address whether the stock is worth holding once it is more fairly valued.

Conclusion

In my opinion, this is a deep-value investment that should play out well over the next 1 to 2 years. However, I think there is some concern with negative momentum at the moment in the stock, so investors may want to wait until it is clearer that the upside has begun before initiating a position. That being said, from here toward a more fair value, the potential 1 to 2-year price growth seems substantial to me. In addition, to help weather any downside from the current momentum before my forecasted appreciation, the stock also has a dividend yield of 6.5%.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.