Summary:

- JinkoSolar shows deep value with a 20% price increase since July, despite an expected Q3 decline; Q4 and FY25 forecast strong growth and a 25%+ 12-month return.

- Q2 saw a 21.6% year-over-year revenue drop and a net loss, but JinkoSolar remains the largest photovoltaic module provider, poised for future stabilization.

- Valuation metrics indicate JinkoSolar is undervalued; growth catalysts include N-type TOPCon technology and international expansion, predicting a $32.45 stock price by late 2025.

- Debt remains a concern, but improving operating efficiency and favorable near-term macroeconomics support a bullish outlook, especially amid rising sentiment for Chinese stocks.

Oleh_Slobodeniuk/E+ via Getty Images

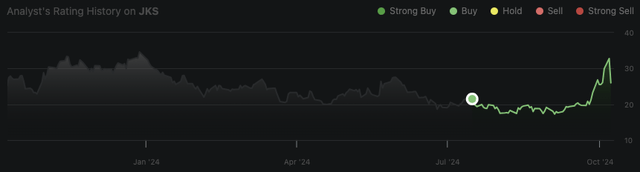

In my last analysis of JinkoSolar (NYSE:JKS) published in July, I outlined a deep value opportunity, which broadly applies to many Chinese stocks at this time. Since that analysis, the stock has increased nearly 20% in price, with a total return of nearly 30%. As Q3 approaches on 10/28, investors should expect another quarter of year-over-year decline. However, this could be an apt time to buy more of the stock if the price falls following the results. Q4 is expected to close the year strongly, with high growth likely in FY25 and a 25%+ 12-month price return possible. The forward dividend yield is also 11.5%.

Oliver Rodzianko’s Performance

Q2 Recap & Q3 Preview

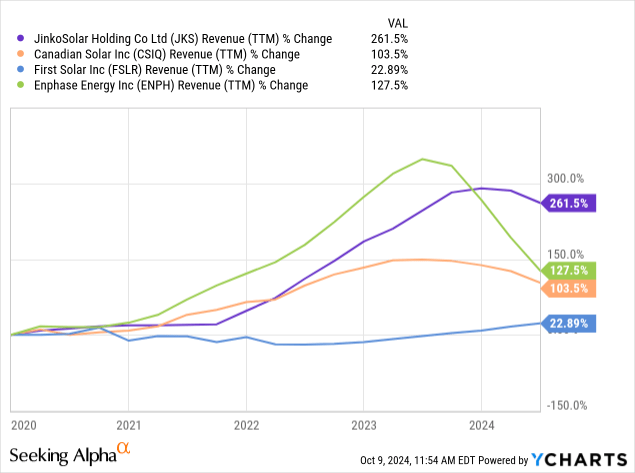

JinkoSolar reported total revenues of $3.31 billion in Q2, coming in $602.88 million below the consensus. While this was a 4.4% increase from the previous quarter, it was a 21.6% decrease year-over-year. The company also saw a net loss of $13.9 million; its normalized EPS declined 21.8% year-over-year. As the solar industry has been facing oversupply and volatile pricing, prices in several segments fell below cash costs. Despite a 34.1% year-over-year growth in module shipments, these cost pressures still meant the company saw a significant year-over-year revenue contraction. That being said, its module shipments in the first half of 2024 were still 43.8 GW, making it the number one provider in terms of size in the photovoltaic industry. Therefore, when prices hopefully stabilize again in the future, JinkoSolar is very well-positioned. That being said, pricing demands require cost reductions, and Gener Miao, JinkoSolar’s Chief Marketing Officer, outlined in the earnings call that these occur almost daily. This allowed the company to maintain its gross margin of 11.1%.

Looking ahead to Q3, management has outlined that it anticipates module shipments to be between 23 GW and 25 GW, aligning with their full-year guidance of 100 GW to 110 GW. The consensus is that Q3 will continue to be hard-hitting for JinkoSolar, with normalized EPS likely to show another contraction year-over-year. That being said, management has mentioned that selling prices should stabilize in Q3, and the quarter will likely set the stage well for strong Q4 and full-year results. Strength in Q4 is especially likely to be driven by seasonal demand and increased shipments before tariffs kick in, especially in key markets like the U.S. These growth catalysts are also supported by demand in Europe, which management expects to increase in Q4. As we recently had a 50 basis point cut in the U.S., I expect this to provide some tailwinds for JinkoSolar for the latter half of Q3. Given these details, I believe we could see a normalized EPS of approximately $0.90, aligning with the recent downtrend seen since the start of FY24. In Q3 2023, the company reported a normalized EPS of $3.31.

In my opinion, any stock price declines following the Q3 report (and following the recent broad growth in Chinese equity prices) open up a significant long-term buying opportunity. As I mentioned, looking more broadly and longer-term, the company is well-positioned. Management plans to leverage its N-type TOPCon technology, which is expected to dominate the market with high penetration rates. These cells offer a higher production efficiency compared to traditional PERC cells, with lower degradation rates. The market share for N-type TOPCon technology is expected to reach over 50% by 2025, according to Solarbe Global. Furthermore, the company continues to expand internationally, particularly in the Middle East, with a new facility in Saudi Arabia, which is likely to begin to be accretive in Q4, according to the Q2 earnings call.

Valuation Analysis

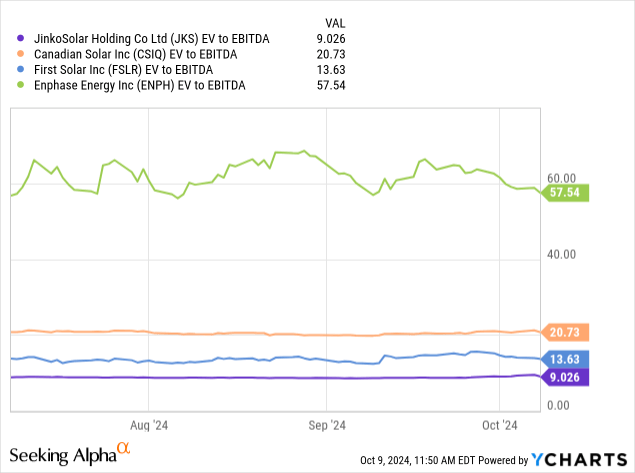

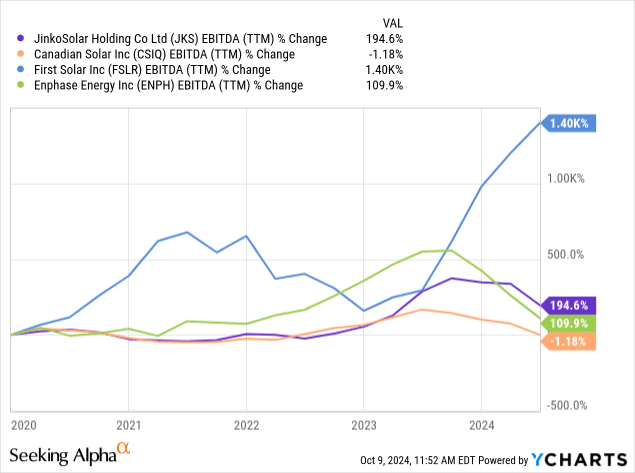

This valuation analysis acts as an investment-allocation peer analysis rather than an operational and competitive analysis. The four companies that I am analyzing are JinkoSolar, Canadian Solar (CSIQ), First Solar (FSLR), and Enphase Energy (ENPH).

Of these companies, JinkoSolar is most appealing on a pure valuation front. However, its growth rates are somewhat lackluster compared to my favorite solar investment at the moment, First Solar. That being said, it is still performing very well, especially given the deep value in the stock price.

Looking directly at JinkoSolar, its forward EV-to-EBITDA ratio is currently a 51.3% contraction from its five-year average, yet its forward EBITDA growth is only a 9.5% contraction from its five-year average. However, its forward EV-to-sales ratio is currently a 55.4% contraction from its five-year average, and its forward revenue growth rate is also a 53.6% contraction from its five-year average. Therefore, while there is an indication that the stock is undervalued, the high-return thesis depends on the company achieving stronger growth in FY25 and beyond, which, based on my analysis, it will do.

In terms of a 12-month price target, I think FY25 is going to be a strong year for JinkoSolar with a lower interest rate macroeconomic environment and growth catalysts, including its N-type TOPCon technology and international expansion with expanded capacity at the end of 2024. As the global demand for solar panels is likely to stay strong, with a particularly good environment in 2025, I estimate that the company could generate a normalized EPS of $5.90. I expect a stabilization in pricing in 2025 as demand increases due to more favorable macroeconomics. In addition, given its TTM P/E non-GAAP ratio is currently slightly lower than its 10-year median of approximately 7, I expect this to expand. In late 2025, I estimate the P/E non-GAAP ratio will be approximately 5.5. This is higher than my estimate of over 4 in my last analysis of the company (the P/E non-GAAP ratio was 2.85 at the time) primarily due to increasing market sentiment for Chinese stocks and the fact that JinkoSolar is already now trading at a P/E non-GAAP ratio of 4.7. If these forecasts come to be, the stock price will be $32.45, indicating a 12-month upside potential of over 25% from the present stock price of $25.70.

Debt Update & Risk Analysis

In my last coverage of JinkoSolar, I mentioned its debt was somewhat of a problem for investors. Management did mention in the Q2 earnings call that they are focused on improving operating efficiency, which should then help it optimize its asset-liability structure to manage its debt levels. That said, with a net debt of $1.95 billion as of the last report and TTM revenues of $15.38 billion, this is arguably manageable. That being addressed, its equity-to-asset ratio of 0.16 is still low, and management may struggle to continue expanding at the rate that it intends without overburdening itself with liabilities. This is especially true as JinkoSolar is a reliably free cash flow negative business due to the high capital intensity of its vertically integrated business model.

Furthermore, JinkoSolar’s reliance on its N-type TOPCon technology means it is vulnerable to risks associated with this. For example, there are concerns about the durability of its glass-back sheet models under certain environmental factors, like damp heat conditions. This could impact customer acceptance and market share over time if not addressed by management properly.

In addition, while we have seen rising sentiment for Chinese stocks recently-largely driven by the Chinese government implementing policies to support economic growth and stabilize markets-this sentiment could fade if geopolitical tensions escalate or if economic data from China disappoints. That being said, I am bullish on many Chinese stocks right now because they offer deep value, and I do expect the Chinese economy to grow well in the coming years. While socialist policies from the CCP could prove inhibitory, the valuations are worth an allocation, even given the broader macroeconomic risks.

Conclusion

JinkoSolar is likely to have a weak Q3, but Q4 should be stronger, and I am expecting a robust FY25. Given the lower interest rate environment on the horizon and increasing sentiment for Chinese stocks right now, JinkoSolar has many positive catalysts working for it in the near term. With valuation multiples signifying deep value, investors may want to consider JinkoSolar as a strategic international value investment alongside the high-growth U.S. operator First Solar.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FSLR, ENPH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.