Summary:

- China’s economy and global power will benefit from clean energy and associated technologies, with JinkoSolar as the leader in solar module manufacturing.

- JinkoSolar has presented excellent results, shipping over 78GW of equipment and posting $1 billion in net profit.

- The company’s success is attributed to its forward-looking strategy, operational efficiency, and early adoption of N-type solar panel technology.

Tomas Ragina/iStock via Getty Images

The historical industrial success of the United Kingdom was from coal and the economic success of the United States in the past century was from oil. Turning to the 21st century and beyond, it is not exaggerated to say that China’s economy and global power will benefit from clean energy and associated technologies. Currently, over 80% of equipment are exported from China, and amongst all manufacturers, JinkoSolar (NYSE:JKS) is the leader.

According to the latest earnings of JinkoSolar, the company has presented an excellent results, shipping more than 78GW of equipment and has reclaimed the first solar module manufacturer in the market. It has even posted $1 billion of net profit.

Although the market has entered into a consolidation stage with smaller manufacturers closing down and out-competed by the few leaders, and the price of solar panels has dropped, we are confident that the company will thrive because of the company’s forward-looking strategy and operational efficiency.

While more analysis will be provided below, the company is assigned with a buy rating because the company has a bright prospect in the growing solar industry, especially in China. Moreover, as a leader in the industry, the company is currently under-valued compared with the other players. Therefore, with the improving fundamentals and the higher valuation multiples expected, the target price offers a 10%+ upside for investors.

Solar equipment manufacturers have been through years of difficulties, but not for Jinko

China is the fastest growing market for solar energy project development. It is expected that, with the supports from policies and subsidies, more investors and players will enter the market. In 2023, the national new installations of solar project in China has increased almost 150% compared with the year before. This has shown the cost reduction and technology advancement has been accelerated.

PV Magazine

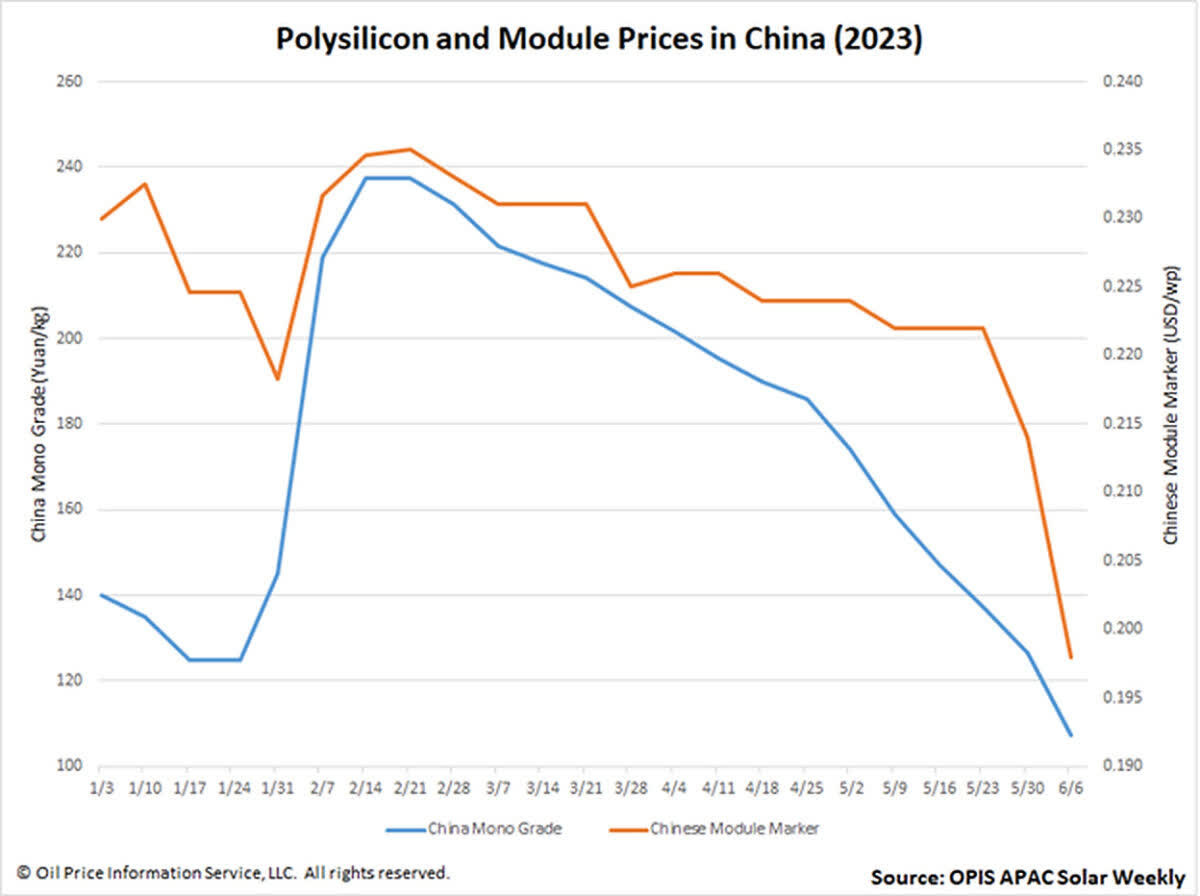

But in fact, cost reduction for solar project is not always good for solar equipment manufacturers, since this indicates these companies are racing for the bottom. The plunge in price last year was largely due to the over-capacity in China, when there are more than thousands of suppliers in the market. According to the management of Jinko, this has always been the situation of the industry since the first day, and there are approximately twice of the supply than the demand. This has also concerned the US, when Treasury Secretary Janet Yellen visited China, she has specifically warned the Chinese authority regarding dumping these supplies overseas.

Image created by author with data online

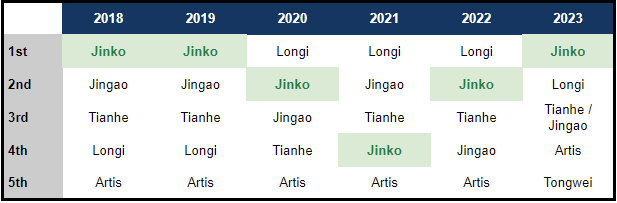

But for Jinko, the company has maintained the top positions in the industry for many years and has reclaimed the first in 2023, as indicated in the above table. One of the reasons being that, one of the factors that drove down the price of solar panel is the drop in silicon’s costs, which actually drove down the cost of production. Taking advantage of this, Jinko, with 78GW of product shipped, has made a record-high profit last year. This has shown how solid the business is when it comes to market competition. But why?

Jinko is the first mover on a new technology

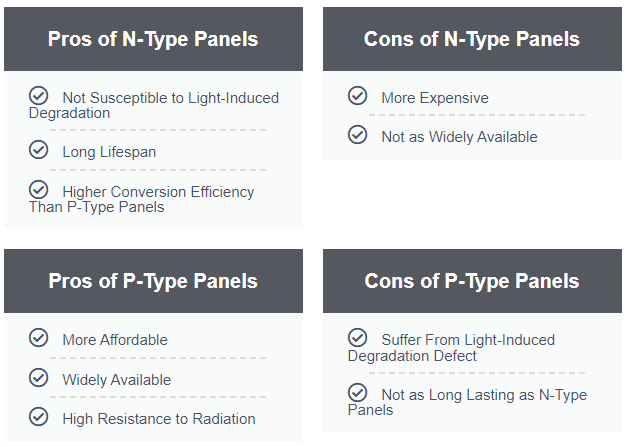

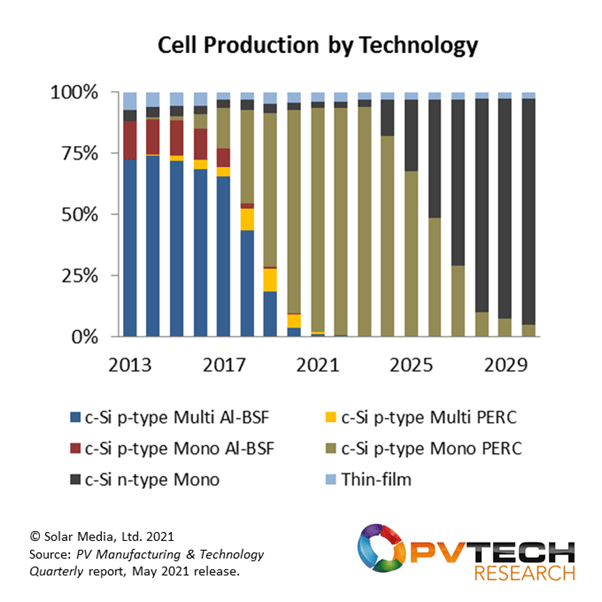

As technology advanced, new types of solar panel technology are replacing the old version. This is referring to the competition between P-type (positively charged) PV cell, which is what the industry has always been using, and N-type (negatively charged) PV cell, which is the emerging technologies that industry players start to use. According to data, N-type (TOPCon) battery has a maximum efficiency at 38.7%, higher than the 24.5% of P-type PV cell. As such, a report by PV Tech suggests that N-type technology which is the more efficient and advanced one, has already exceeded P-type in terms of spending.

CHINT

And Jinko is one of the earliest firm believers in N-type technology. The company recognizes its efficient, low-cost and more adaptable nature, and has established a manufacturing line as early as 2019, when most of the other manufacturers do not believe in the company. Benefitting from this, Jinko’s product sales in terms of N-type battery account to 40% of the market share. And do not forget, this is a rapidly growing market and N-type is set to dominate all PV panels. The company will enjoy the first-mover advantage.

PV Tech

2023 Performance: Revenue and profitability are growing at a fast pace

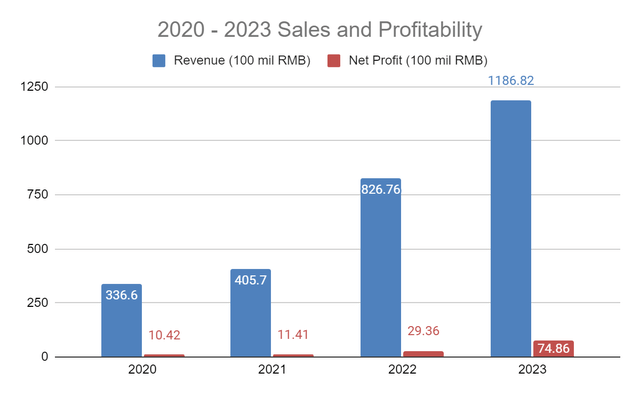

JKS’s revenue climbed from $33.6 billion to $118.7 billion from 2020 to 2023, which is an increase of 253% in four years. During the same period, net profit has increased even for 618%. This impressive growth in terms of sales and the higher profit margin can be attributed to the foresight of the company in developing the N-type market. The higher market demands and lower cost in N-type products have enhanced the company’s gross margin from 10.6% in 2022 to 14.4% in 2023.

Imaged created by the author with data from JKS

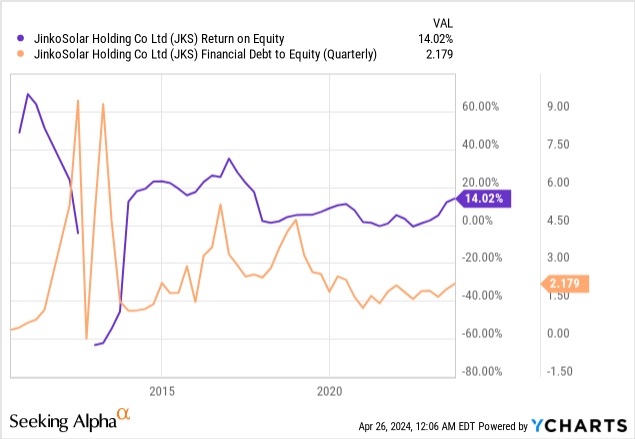

While the company is growing rapidly, the company’s liquidity and debt ratio is a topic of concern, which the management also acknowledges it and has publicly claimed that this is “the most important battle” in the short term. The company has a negative cash flow of $700million while having a 2.6x debt-to-equity ratio. This is because of the establishment of a 56GW capacity plant in China for its energy storage business, which is deemed extremely important for its future.

Therefore, I am not worried about the debt ratio and cash burn in the short term, since this should be considered as investment, considering the company has an increasing ROE of 14%.

Valuation:

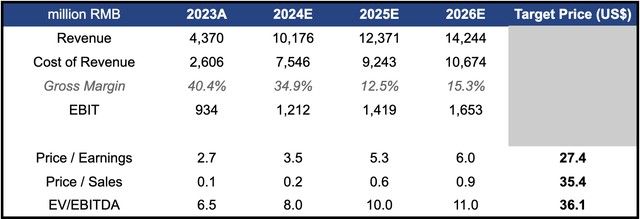

Image created by the author with data from the company

After a few years of rapid growth, JKS is expected to grow at a slower pace given the solar projects in China have been mostly halted because of grid capacity. This is also coupled with the narrowing margin of the company because of the drop in solar panel market price. However, as discussed, the company will continue to improve its profitability.

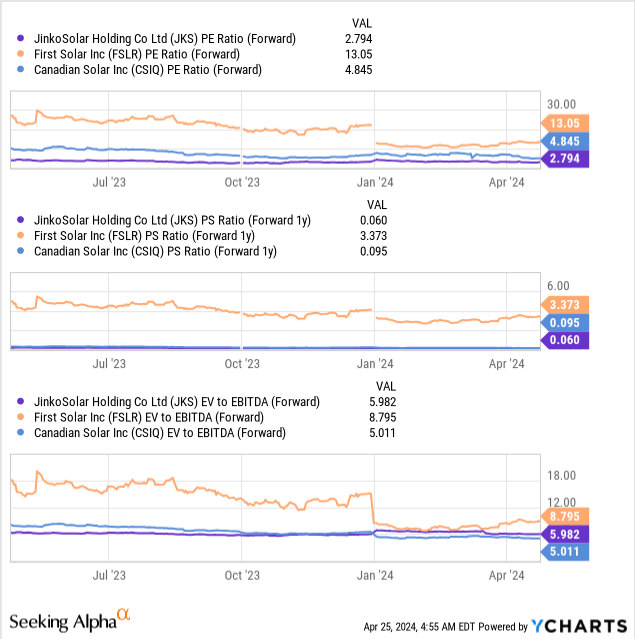

When we look at the company’s valuation premium compared with other peers, being the first in the industry globally has strangely given no premium than its peers like First Solar (FSLR) and Canadian Solar (CSIQ). But I expect this will reverse, since China has gained a more and more important role in the global solar industry. As such, even though the fundamental growth rate and profitability of the company will slow down, the change in share price valuation towards this Chinese leader will continue to bring up the company’s valuation.

Hence, our target price based on different valuation metrics ranges from $27 to $36.

Investment risks

- Concentration risks: A huge proportion of revenue of Jinko is generated in China domestic market, which is highly competitive and affected by the macro market risks in China. Therefore, this concentration of business creates a concentration risks for investors. Investment in the company is, to some extent, investing in the overall solar energy growth in China.

- Policy risks: In the past several years until now, China’s solar energy market is subsidized and supported by policies that boost the growth of projects. While these policies are expected to reduce and affect the number of projects, the company’s prospect is affected by the changing policies.

- Political risks: While Jinko is trying to expand its overseas market, the US and Europe are seeing a potential policy to block import of solar panels and related technologies from China. This will create a huge impact as to Jinko’s international business diversification efforts.

Conclusion

Our target price based on different valuation metrics, such as P/S, P/E, and EV/EBITDA, ranges from $27 to $36. Even though the company may grow slower than it used to be, the company, being in China which is the fastest growing market of solar projects and being a leader in technical and business front, I expect that it will be re-valuated by investors with a higher premium. Therefore, it is a buy to me

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.