Summary:

- Johnson & Johnson continues to trade in line with historical multiples despite improved financial position and growth prospects following the KVUE spin-off.

- We are relatively bullish on JNJ’s core Pharma and MedTech portfolios, but not enough margin of safety to provide a highly attractive return profile.

- Potential catalysts include indication expansions for key products (Tremfya, Erleada, Spravato), accelerating growth in MedTech, deployment of excess cash-post spin-off, and monetization of the remaining KVUE stake.

poba

Summary

Despite its greatly improved financial position following the spin-off of Kevenue Inc. (KVUE), Johnson & Johnson (NYSE:JNJ) continues to trade in line with its historical trading multiples. With the company set to deliver mid-single-digit organic revenue growth, return ~60% of FCF to shareholders through buybacks and dividends, and potential M&A upside, we felt compelled to take a closer look.

While we are bullish on the performance of JNJ’s core Pharma and MedTech portfolios and R&D pipeline and see several potential positive catalysts on the horizon, we do not see an adequate margin of safety that provides for a highly attractive return profile and compensates for the ongoing Medicare price negotiation risk. We ultimately give the stock a Hold rating for now.

Company Overview

JNJ is a global healthcare company serving ~350MM patients each year. Its activities are concentrated in two primary segments: Pharmaceuticals and MedTech, with a focus on major causes of mortality, including cardiovascular diseases, oncology, respiratory conditions, stroke, and trauma. Following the spin-off of its consumer division, JNJ has redirected its efforts towards innovation and productivity, aiming to enhance its growth prospects and profitability.

The TAM for JNJ’s Pharma operations is ~$1.6Tn, and it has outlined a strategy to reach ~$57Bn in revenue by 2025. This growth is expected to be supported by its strong product pipeline (n.b., includes 5 +$5Bn revenue potential and 12 +$1Bn projects). The pipeline is also set to benefit from >65 filings planned from ’26-’30. The market has been gradually giving JNJ more credit for its pipeline thanks to indication expansions for key products (e.g., Tremfya, Erleada, and Spravato).

In the MedTech segment, JNJ maintains a strong market position with 12 platforms generating +$1Bn in revenue, holding #1 or #2 positions in 11 of the 12 categories. The company’s strategy in MedTech involves shifting its portfolio and concentrating on innovation to engage with faster-growing market segments (e.g., PFA in Electrophysiology, surgical and orthopaedic robotics, and heart failure with Abiomed), with the aim of increasing its weighted average market growth rate (“WAMGR”).

JNJ has expressed a strong appetite for M&A as an avenue for growth, with its CFO, Joe Wolk, indicating a preference for early-stage deals and fast-growing adjacent markets. With almost no net debt following the Kenvue spin-off, JNJ has ample capacity to fund future M&A.

Pharma Segment

During its Investor Day in November 2021, JNJ’s management set forth objectives for the Pharmaceutical segment, targeting sales of ~$60Bn, or ~$57Bn excluding FX impacts, by ’25. The company’s product pipeline is receiving increased recognition, with consensus forecasts now being recently adjusted upwards to anticipate ~$56.2Bn in revenue by ’25. This positive momentum is being driven by several factors:

- JNJ possesses a robust portfolio of existing products, including Darzalex, Erleada, Tremfya, Invega Sustenna, and Opsumit/Uptravi, which have demonstrated a ~6% YoY growth in the first half of ’23.

- The company has greater visibility of its forthcoming products, such as Carvykti, Tecvayli, Talvey, and Spravato, which are expected to significantly contribute to its growth.

- JNJ has also improved visibility into its late-stage pipeline products, which are anticipated to become key contributors in the coming years, including Rybrevant, nipocalimab, JNJ-2113, TARIS, and milvexian.

These factors are driving the market’s increasing confidence in the $57Bn revenue target, notwithstanding the loss of exclusivity for Stelara in various regions and the absence of biosimilar competition until January 1, 2025.

Catalysts

1) Excess Cash & KVUE Monetization

Following the spin-off of its consumer business in Aug-23, JNJ secured ~$13Bn in cash through the debt offering and IPO of Kenvue. Additionally, JNJ undertook an exchange offer, effectively a ~$33Bn share repurchase (n.b., the most substantial repurchase in JNJ’s 137-year history and the largest share repurchase transaction conducted by any company at one time). JNJ retains a ~9.5% ownership in Kenvue, which it could monetize for further buybacks, special dividends, M&A, or drug/tech development.

We expect organic R&D, M&A, dividends, and buybacks, in that order, to the company’s capital allocation priorities for the foreseeable future.

2) Indication Expansions (Tremfya, Erleada, Spravato)

Additionally, there are three notable developments that may not be fully baked into consensus:

- The potential of Tremfya in immunology, specifically for the inflammatory bowel disease (“IBD”) indication, remains underappreciated despite IBD constituting 75% of Stelara’s sales (n.b., Stelara is a similar interleukin inhibitor developed by Janssen used to treat plaque psoriasis and psoriatic arthritis). Upcoming data from studies on ulcerative colitis and Crohn’s disease are potential catalysts for JNJ.

- The expansion of Erleada’s indications in oncology to include localized and high-risk localized prostate cancer, with forthcoming results from the PROTEUS and ATLAS studies as potential catalysts.

- The full potential of Spravato in neuroscience for major depressive disorder (“MDD”), particularly in treatment-resistant cases, has not been fully integrated into projections despite its unique positioning and two FDA breakthrough designations. While the introduction of new antidepressants generally takes longer due to the conservative nature of psychiatry practices, JNJ has observed building momentum and anticipates strong growth within this product line.

3) Accelerating Growth in MedTech

JNJ maintains a strong core MedTech portfolio, with 12 platforms each generating >$1Bn in revenue, and holding either the first or second leadership position in 11 of the 12 categories. The company has seen an acceleration in its growth rate, from 3-4% during ’16-’19 to ~6% in ”22 and ~8% in ’23. MedTech sales reached ~$30Bn in ’23, the third year of consistent performance, despite the size disparity with the majority of its competitors (n.b., JNJ’s MedTech segment is approximately double the size of close competitors), and the second consecutive year exceeding the industry’s average growth in operating profit.

JNJ’s strategic focus in this segment includes shifting its portfolio towards markets with higher growth potential (n.b., ~50% of the portfolio is in markets expected to grow by >5%, up from ~14% five years ago), and emphasizing focused innovation, with a pipeline estimated at ~$12Bn (n.b., ~$5Bn five years ago). Strategic focus areas include heart failure with Abiomed (n.b., +$35Bn TAM), electrophysiology with Biosense Webster, which is anticipated to experience a significant shift with the introduction of pulsed-field ablation (“PFA”), and advancements in surgical and orthopedic robotics.

Risks

Talc Litigation

JNJ has allocated an ~$9Bn reserve for litigation related to talcum powder. The litigation involves numerous personal injury claims suggesting that talc, particularly in Johnson’s Baby Powder, is carcinogenic. As of the latest update, over 60,000 lawsuits have been filed against JNJ. On April 4, 2023, JNJ announced via an 8-K filing that its subsidiary, LTL Management, committed to increasing its contribution to ~$8.9 billion (n.b., an increase from $2Bn in ’21) to settle the talc claims, with the payment spread over 25 years. This amount has a value of ~$12Bn discounted at ~4.4%. Under the terms of the agreement, JNJ is responsible for all talc-related liabilities for products in the U.S. and Canada, while KVUE is responsible for liabilities in other regions.

On July 28, 2023, Judge Michael Kaplan in Trenton, NJ, dismissed a second bankruptcy filing by LTL Management, stating that the subsidiary was not facing “imminent” or “immediate financial distress.” JNJ has filed an appeal against this decision. While the ongoing talc litigation is a significant factor for JNJ’s stock, it appears to be fully priced in.

Furthermore, JNJ’s financial position, including a cash reserve of ~$22Bn, operational cash flows, the ability to secure external financing, existing credit facilities, and access to commercial paper markets, is likely more than adequate to handle the talc and opioid litigation settlement (n.b., ~$2.2Bn).

Pricing Headwinds

The Inflation Reduction Act (“IRA”) introduces a new dynamic to the pharmaceutical sector, including potential implications for JNJ, by instituting the first-ever instance of Medicare price negotiations. This negotiation process is set to begin with 10 drugs that account for the highest expenditures within Medicare Part D, starting in ’26. Among these, two JNJ medications, Stelara (used for psoriasis and arthritis) and Xarelto (a blood thinner), are included. The negotiation phase was scheduled to commence on February 1, 2024, with the negotiated prices for these initial 10 Part D drugs being announced on September 1, 2024, and coming into effect on January 1, 2026. An additional set of 15 Part D drugs will be targeted for negotiation starting February 1, 2026.

The possibility of further significant JNJ drugs being added to the negotiation list is a factor that warrants close observation. However, the actual application of these negotiations is anticipated to unfold over several years and is expected to affect the broader sector in a similar manner. In parallel, various U.S. states are moving forward with the establishment of prescription drug price review boards and enacting legislation aiming to impose potential price controls on all pharmaceutical transactions within their jurisdictions. Preliminary discussions and analyses suggest that these measures could lead to significant price reductions, though their full implementation may require approximately two years or more.

Valuation

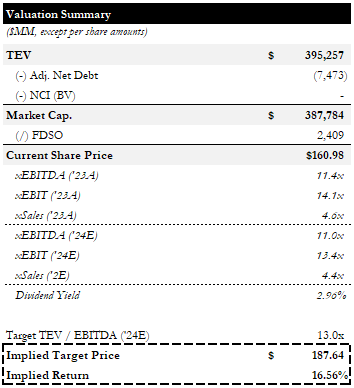

JNJ is currently trading for ~11.8x LTM EBITDA, ~12.8x LTM EBIT, and ~4.3x LTM sales (n.b., ~11.0x NTM EBITDA, ~13.4x EBIT, and ~4.4x Sales).

Valuation Summary (Empyrean; JNJ)

Our price target is based on 13x NTM EBITDA, based on the average daily trading multiple for the past 5 years, and implies ~16% upside.

% Year Rolling TEV/EBITDA (CapIQ)

While we see upside to our target price, we do not view this as an attractive risk-adjusted return given the risks described above and the presence of more appealing alternatives. We are giving JNJ a bullish Hold rating, as we recognize that the stock could have a viable use case in a portfolio (e.g., large-cap, stable, with good growth prospects). However, we are after much higher risk-adjusted returns.

Conclusion

JNJ’s core Pharma and MedTech portfolios are well-positioned to deliver strong growth over the coming years, especially considering the company’s size. A strong R&D pipeline and near-term potential to expand indications for marquee products provide further upside growth potential. Despite our positive outlook for the underlying business, we do not see a sufficient margin of safety that could yield a highly attractive return and compensate for the risks associated with the ongoing Medicare price negotiation. We maintain JNJ as a Hold and will continue to monitor key R&D milestones and the price action for a more attractive entry point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.