Summary:

- Ongoing lawsuits have presented the opportunity. It is up to the investor to decide just how much risk this adds to the thesis.

- Post Kenvue spin, the company is deciding to use cash to further diversify their MedTech offerings.

- The great thing about MedTech versus increasing investment in Medicines is that they don’t face the same “patent cliff” issues.

- V-Wave, Shockwave, and Abiomed account for $30.3 Billion of the $40.4 Billion invested in acquisitions since 2020. That’s 75% of the acquisition total in the last 4 years.

Sundry Photography

Digging through dividend ideas

Coming up on an expected FED rate cut, re-emphasis on fixed income proxies like REITs and dividend stocks has been a popular topic lately. Johnson & Johnson (NYSE: JNJ), is a stock I’ve owned for quite a while hoping for a mean reversion to where the stock gets back to providing some alpha through multiple expansion. This dividend King has been growing earnings steadily for a long period of time. They have one of the highest credit ratings in the market due to their dependable cash flows, giving them cheaper access to capital than any other company.

This capital advantage will only increase once rate cuts start to ensue.

Ongoing lawsuits have presented the opportunity. It is up to the investor to decide just how much risk this adds to the thesis. If EBITDA is affected to a great enough extent, this could result in a decrease in the oft-vaunted “AAA” credit rating. I personally believe they can find a way to both maintain the rating and grow, but it will probably sacrifice both dividend growth and share buyback ability for a while in my opinion.

Heat check

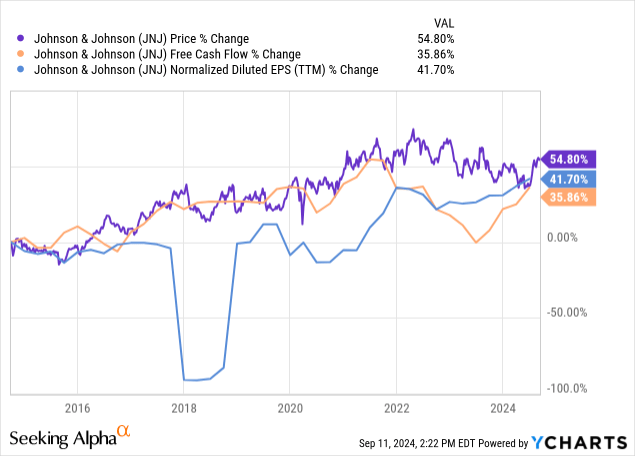

I start every evaluation with a reflexive chart to check in on expectations versus reality. Here we can see that share price has tracked free cash flow pretty consistently over the last decade and has trended well above normalized earnings. While the stock is not as cheap as it was a few months ago, it is still trading well within the realm of reality taking into consideration that I am using normalized EPS numbers on this chart which excludes the one-time profit on the Kenvue sale which would have made GAAP earnings look much larger than this representation.

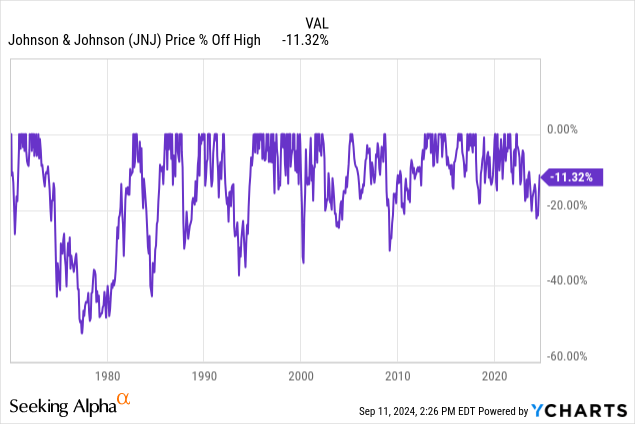

Furthermore we can see the stock is still -11.32% off it’s high and has traded sideways for the majority of the time that the talc case has been going through litigation.

Kenvue spin & current business climate

JNJ Q2 2024 Presentation

Post Kenvue (KVUE) spin, the company is deciding to use cash to further diversify their MedTech offerings, becoming more of a hybrid between an accretive biotech revenue stream and a MedTech device company that may be able to fit into the category of a Medtronic (MDT). Gone is the home care revenue stream with the offloading of Kenvue. The great thing about MedTech versus increasing investment in Medicines is that they don’t face the same “patent cliff” issues.

Current [Q2 2024] revenue exposure

| revenue category [ in millions of USD] | Q2 2024 revenue | percentage |

| Worldwide innovative medicine sales | 14,500 | 64.40% |

| Worldwide MedTech sales | 8,000 | 35.50% |

| total | 22,500 |

As we can see, the company as it currently stands has a revenue mix of about 64% medicine sales versus 35.5% for MedTech. With the newest bolt-on of Shockwave, this should add an additional $1 Billion in revenue to that category in forward years [2025-26].

JNJ Q2 2024 Presentation

The most recent capital allocation strategy shows a re-focused, higher priority on organic business needs. This would indicate that the strategy may be shifting to more in house innovation versus outside acquisition targets.

Most recent acquisitions

tracxn.com

Looking at this excellent timeline of acquisitions since 2020 from tracxn.com, we can see that the biggest growth trajectory target for the company is in MedTech. V-Wave, Shockwave, and Abiomed account for $30.3 Billion of the $40.4 Billion invested in acquisitions since 2020. That’s 75% of the acquisition total in the last 4 years. We are seeing a clear pivot direction for the company.

R&D cycle

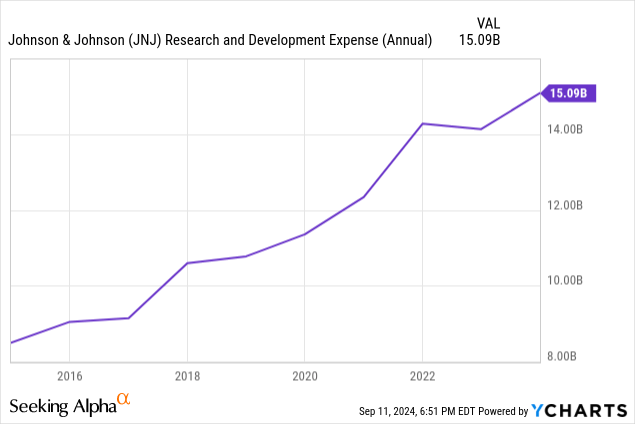

A big part of what Biotech companies do is invest in R&D in order to get the new drug out in time to create incremental revenue sufficient to replace anything that may be lost through patent expiration. Of all the Biotech companies, Johnson & Johnson has one of the smoothest R&D lines that you will see without many peaks or valleys.

Their strong moat and ingrained cash flows allow the company to constantly invest in R&D which for the most part has been going toward acquisitions. Other Biotechs have more jagged peaks and valleys. The company may now be happy with the extent of its MedTech portfolio and wants to focus on organic growth strategies across both revenue platforms.

Shockwave acquisition

Pharmaceutical and medical device company Johnson & Johnson announced it is acquiring cardiovascular device manufacturer Shockwave Medical Inc. for roughly $13.1 billion (net of cash at the target).

The transaction adds a potentially significant growth platform to Johnson & Johnson’s medical device franchise’s cardiovascular portfolio. However, the acquisition utilizes almost all of the company’s financial capacity at the current ‘AAA’ rating.

Given projected hefty cash outflows related to tax and litigation settlements over the next couple of years, adjusted net leverage will remain elevated, near our 1.0x downside trigger.

Still, the company has an excellent business risk profile and we expect management to remain committed to very conservative financial policies

Therefore, we affirmed our ‘AAA’ long-term issuer credit rating and unsecured debt ratings, as well as our ‘A-1+’ short-term commercial paper rating.

The negative outlook reflects very limited debt capacity at the current rating and the potential for further debt-financed mergers and acquisitions (M&A) amid continued uncertainty regarding talc-related liabilities.

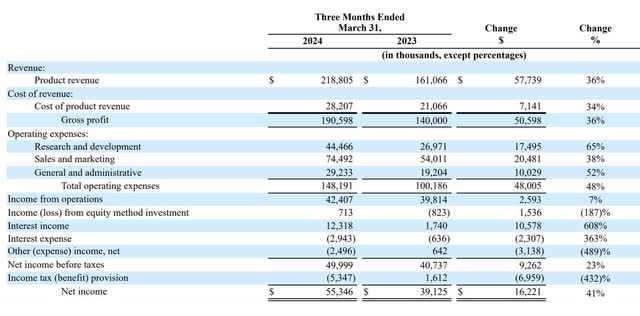

ShockWave MR10Q 2024

Above is the final 10Q filing from Shockwave Medical before being integrated into the business. If the company follows the integrated revenue to EBITDA conversion rates of the parent post-integration then, By my estimates:

- Johnson & Johnson 38% conversion rate revenue to EBITDA.

- Shockwave could add as much as USD 1 Billion per year in bolt-on revenue with the final quarter showing $218,805 million in revenue growing at 36% YOY.

- At a 38% conversion rate, this could add an additional $380 million in EBITDA.

Dividend yield

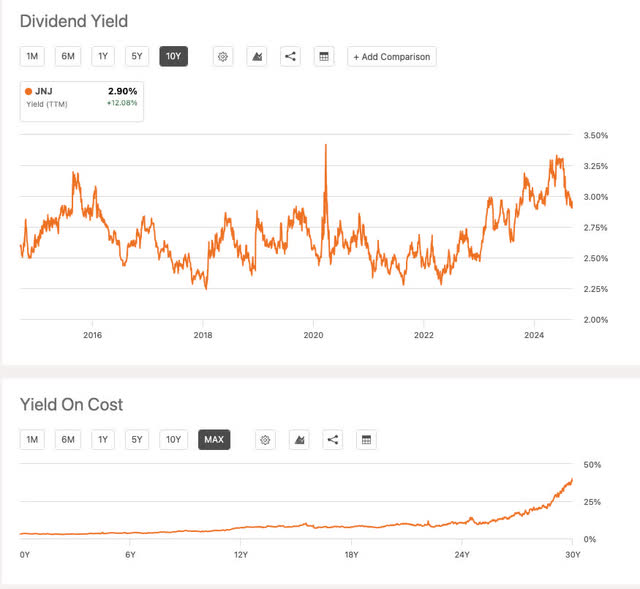

Seeking Alpha

Of prime importance to investors in Johnson and Johnson is the dividend yield. At a 2.96% FWD yield, the dividend yield is well in excess of the most frequently touched yield in the chart of around 2.5%.

Using my best estimate of dividend coverage utilizing the “owner earnings” per share of $7.66 which takes into account the normalized earnings values, the $4.96/ share FWD yield is covered at about 64%. I will discuss later in the article the numbers I utilized in coming up with owner earnings per share. As this is a more stringent measure than free cash flow, the dividend appears well covered here.

The yield on the cost chart for Johnson and Johnson is amazing. Holders that have been in the stock for 30 years currently enjoy a yield on their cost of nearly 40%. If someone put $100,000 in the stock in 1994, they’d be getting $40,000 in dividends every year not including dividends from reinvestment. This puts most rental properties to shame.

Owner earnings valuation

I like to emphasize owner earnings discounts when looking at slow growth Stalwarts versus any typical discounting of future cash flows. I want to look at cash flows now or at maximum one year from now, compare it to the risk-free rate [typically the U.S. 10-year Treasury], and make sure my yield is higher than that with the potential for growth. This is the oft-described Warren Buffett discounting method. It takes into consideration a few important points that standard cash flow analysis might not, it basically excludes stock-based compensation, taxes, and interest payments by using net income versus cash from operations. Only depreciation and amortization are added back and then CAPEX either TTM or predicted forward are subtracted.

In this case, we have the following for Johnson and Johnson:

All numbers in millions USD

- TTM Net income [normalized due to Kenvue spin]:$16,382

- TTM Depreciation and Amortization: $6,886

- TTM CAPEX: $4,809

- Therefore: [$16,382+$6,886]-$4,809=$18,459 “Owner Earnings”

- Discounted at risk free rate [RFR] 4%, $18,459/4%= $461,475 fair market cap.

- Divided by 2,407 million shares outstanding = $461,475/2,407= $191.72 / share fair value.

Again, the steep drop off in the 10 year yield in anticipation of rate cuts on the short end of the curve is greatly assisting discounting models for these slow growers. If we upped the risk-free rate to 4.5% [ closer to short-term rates], we get about a $170/share valuation. However, comparing these owner yields to shorter-term rates includes reinvestment risk as the bonds mature and rates drop. I would personally expect Johnson and Johnson to continue having growth in owner earnings yield for the next decade if history tells an accurate story.

With that in mind, the stock is trading at 21.82 X current owner earnings or a yield of 4.58%.

With 2025 earnings growth expected to be roughly 7.1%, the stock would be yielding 4.9% in owner earnings by 2025 if owner earnings track with GAAP earnings growth.

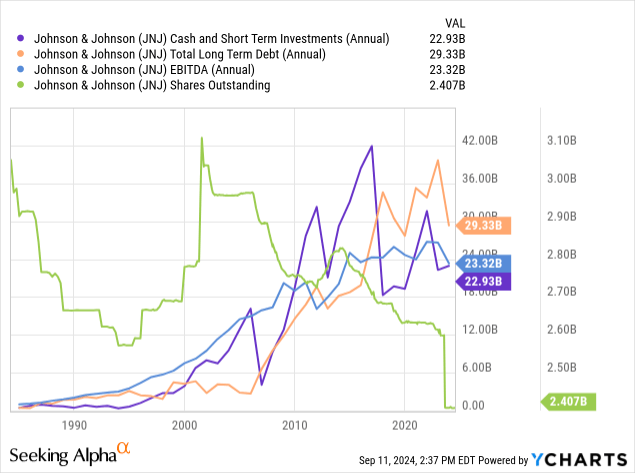

Balance sheet

In my opinion, the most important items on the balance sheet are :

- Cash and short term investments

- Total long term debt

- Shares outstanding

Johnson and Johnson has a very strong balance sheet which is the reason they have the S&P Global AAA rating. At $29.33 Billion in long-term debt and $23.32 Billion in EBITDA, total long-term debt is only 1.25 X EBITDA. Typically Johnson and Johnson keeps this number around 1 X to maintain their credit rating. Here is commentary from S&P Global:

Following the 2022 acquisition of Abiomed and considering sizable expected tax and talc-related payments, the acquisition utilizes almost all of the company’s debt capacity at the current ‘AAA’ rating level. Adjusted net leverage following the transaction will be roughly 1.2x, above our 1x downside trigger. However, we expect the company to quickly reduce leverage to below 1x due to EBITDA growth, strong free cash flows, and a continued commitment to very conservative financial policies.

Shares outstanding have been in a consistent down and to the right pattern since the early 2000s, further rewarding shareholders. Time will tell if recent acquisitions can increase EBITDA enough to offset any future litigation payouts. We can expect Johnson and Johnson to do whatever it takes to preserve the credit rating which is probably the most important moniker they have. Paying down debt instead of increasing dividend payouts at a faster-than-average clip and or decreasing share buyback rates should be expected now that we know S&P Global’s expectations.

Growth catalysts

Developing MedTech segments to become an eventual 50% revenue generator would make this an attractive pivot story. Observing Shockwave’s last income statement before acquisition reveals fast year-over-year revenue growth. Johnson and Johnson believea lot of what these companies bring to the table regarding cardiovascular procedures is especially promising.

Risks and summary

Much of the risk in Johnson and Johnson is in the ongoing talc litigation. No one knows when this will end and maneuvers to get out of payments just seem to stall the process further. It’s getting so contentious that we now have intra-lawsuits between plaintiff law firms regarding the settlement.

With the most up-to-date numbers looking like $8 Billionover a period of 25 years, which has now been re-negotiated to a possible $6.5 Billion amount. Whatever the final number, it looks like somewhere between a $260 million to $320 million hit to cash flow annually is in store. Credit rating agencies would expect Johnson and Johnson to make adjustments to debt if the LT debt to EBITDA ratios get below a certain threshold. This is the biggest risk as it may create temporary stagnation in dividend increases and share buybacks which are now at the very bottom of their priority list as per the most recent presentation. They will need to grow their way out of this stagnation.

Regardless, this company is fairly priced has a competitive dividend yield to the 10-year Treasury, and growing. Well primed post a rate cut and a nice pivot strategy into MedTech. Buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ, MDT, KVUE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.