Summary:

- Johnson & Johnson reported solid second quarter results – with MedTech reporting double-digit growth – and raised its full-year guidance for fiscal 2023.

- Kenvue is now a stand-alone company, and investors traded 191 million Johnson & Johnson shares for Kenvue shares.

- While I still remain cautious about Johnson & Johnson, it is a stable and solid business, and the stock could be slightly undervalued.

Mario Tama

When looking at sentiment for different markets (especially stocks) around the world, we see a rather bullish picture right now. And although I did not write so much about it in the last few months, I am still rather bearish and think we are headed for trouble. I am quite aware that we can make several bullish arguments as well as a lot of bearish arguments about the stock market right now, but I am rather bearish.

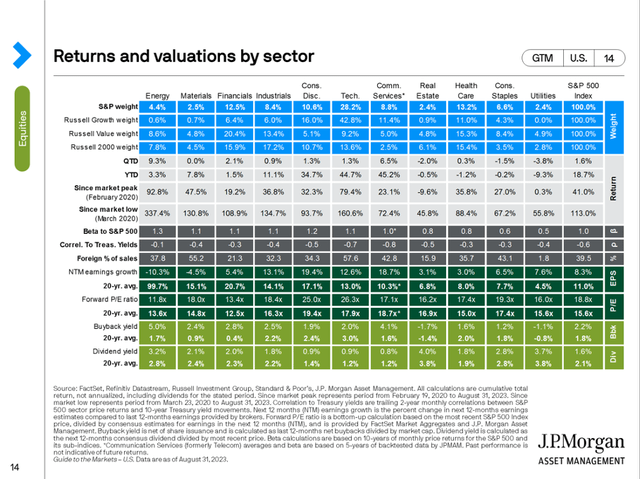

Looking at the last 20 years, the healthcare sector was not the best performing one in the S&P 500, but earnings per share increased with a CAGR of 8.0% (which is certainly solid). For the next twelve months, earnings per share are estimated to grow about 3.0% (and once again we find several other sectors with higher expected growth rates).

Nevertheless, I see the healthcare sector – and especially pharmaceutical and medical technology companies – as a good pick in times of financial distress and recessions. Hence, I am paying close attention to these companies right now – including Johnson & Johnson (NYSE:JNJ). In the last few years, Johnson & Johnson was not the best pick out there, but as it is currently the third biggest pharmaceutical company by market capitalization (behind Eli Lilly (LLY) and Novo Nordisk (NVO)) it deserves a closer look.

Quarterly Results

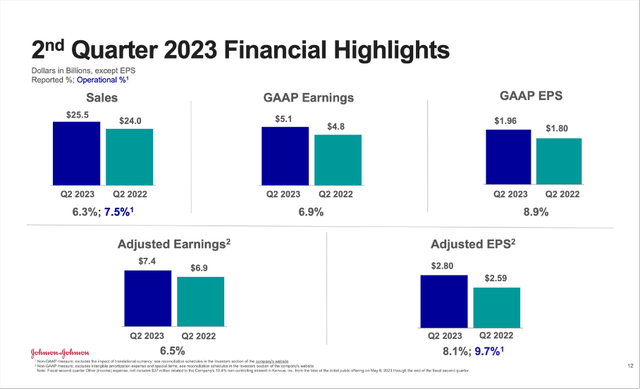

As we often did in the past, we can start by looking at the last quarterly results. And in the second quarter of fiscal 2023, Johnson & Johnson increased its sales from $24,020 million in the same quarter last year to $25,350 million this quarter – resulting in 6.3% year-over-year growth. Earnings before provision for taxes on income increased from $5,840 million in Q2/22 to $6,782 million in Q2/23 – resulting in 16.1% year-over-year growth. Diluted net earnings per share also increased 8.9% year-over-year from $1.80 in the same quarter last year to $1.96 this quarter.

Johnson & Johnson Q2/23 Presentation

We can also look at adjusted diluted earnings per share and see 8.1% year-over-year growth from $2.59 in Q2/22 to $2.80 in Q2/23.

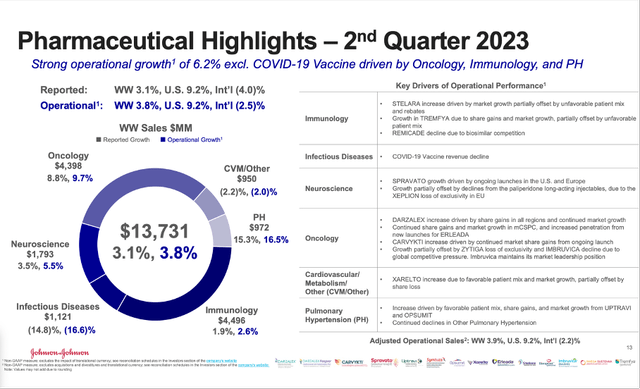

When looking at the three different segments, all three segments contributed to growth. The Pharmaceutical segment, which is responsible for more than 50% of sales, increased sales 3.1% (operational growth was 3.8%) to $13,731 million. And when excluding COVID-19 vaccines, operational growth was 6.2%.

Johnson & Johnson Q2/23 Presentation

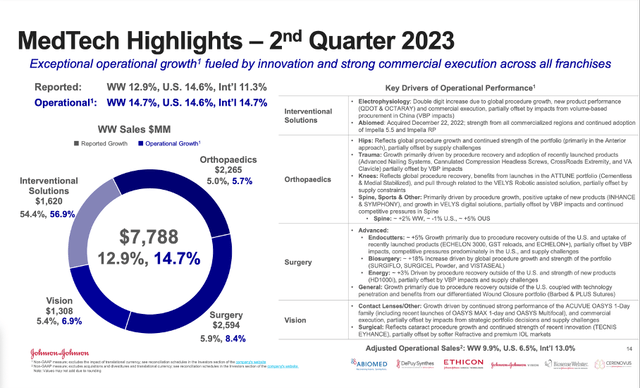

MedTech reported strong growth rates with sales increasing from $6,898 million in Q2/22 to $7,788 million in Q2/23 – resulting in 12.9% year-over-year growth. Operational growth was 14.7% year-over-year and all four sub-segments contributed to growth. Especially “Interventional Solutions”, which reported 54.4% YoY growth – mostly due to the acquisition of Abiomed but also new product performance.

Johnson & Johnson Q2/23 Presentation

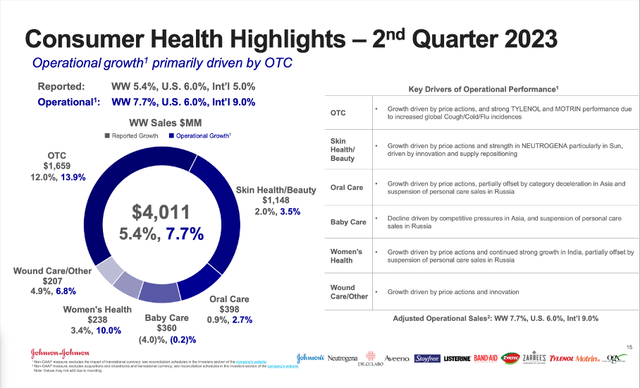

Consumer Health grew sales from $3,805 million in Q2/22 to $4,011 million in Q2/23 – resulting in 5.4% year-over-year growth. Operating growth was 7.7% and aside from Baby Care, which had to report declining sales, all other sub-segments contributed to growth.

Johnson & Johnson Q2/23 Presentation

Updated Full-year Guidance

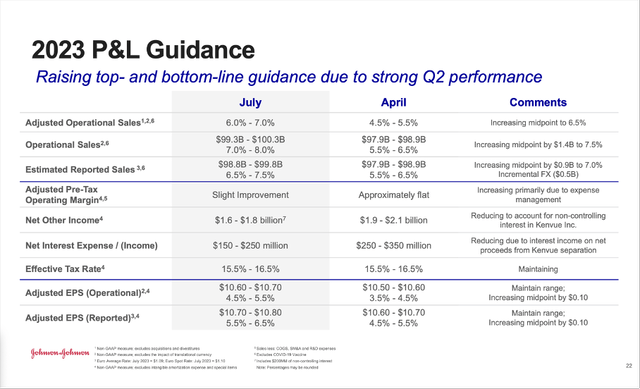

Aside from reporting solid quarterly results, Johnson & Johnson also raised its guidance for the top and bottom line in July 2023 and is now expecting sales to grow between 7% and 8% compared to fiscal 2022. According to this guidance, adjusted earnings per share are now expected to be between $10.70 and $10.80 – resulting in 5.5% to 6.5% YoY growth.

Johnson & Johnson Q2/23 Presentation

And about three weeks ago, management updated its guidance once again due to the Kenvue Inc. (KVUE) spin-off (we will get to this). Johnson & Johnson investors were allowed to exchange JNJ shares for the new company Kenvue, which is listed on the New York Stock Exchange since May 2023. As a result, the number of outstanding JNJ shares was lowered about 191 million (we will also get to this) and this is leading to a $0.28 per share benefit for the adjusted diluted earnings per share in 2023.

Kenvue Spin-Off

Kenvue is the newly formed company that was formerly the Johnson & Johnson consumer healthcare division and now a stand-alone consumer health company. It operates through three segments – Self Care, Skin Health and Beauty, and Essential Health. And on August 23, 2023, the spin-off was completed and Kenvue is now a fully independent company.

Following the IPO in May 2023, only about 9% of shares were free float and Johnson & Johnson was still holding most of the shares (about 90%). But as already mentioned above, investors had the opportunity to exchange Johnson & Johnson shares for Kenvue common stock. In late August, the company announced that Johnson & Johnson accepted about 191 million of JNJ stock in exchange for 1,534 million shares of Kenvue common stock. As a result, Johnson & Johnson now owns only 9.5% of the outstanding shares of Kenvue.

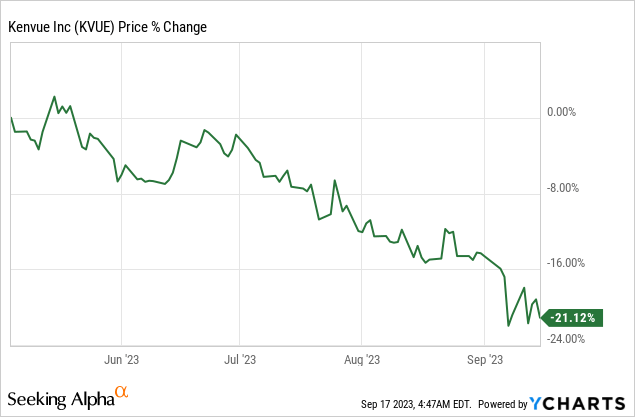

According to Johnson & Johnson, the interest in Kenvue shares was massive and the demand about 4.2 times higher than the shares available. Nevertheless, the stock performance of Kenvue since its IPO was rather a disappointment (but that is only a side note).

Balance Sheet

After the spin-off, we can also look at Johnson & Johnson’s balance sheet. In the past, I claimed in several articles that Johnson & Johnson has a healthy balance sheet. The company still has $11,701 million in short-term debt as well as $33,901 million in long-term debt on its balance sheet. However, when comparing the total debt to $75,149 million in shareholder’s equity we get a debt-equity ratio of 0.61, which is acceptable. And when comparing the total debt to the operating income the company can generate ($27,042 million in the last four quarters), it would take about 1.7 years or 1.7 times the annual operating income to repay the outstanding debt. Not only is this an acceptable metric for the business, but we should also not ignore $21,183 million in cash and cash equivalents on the balance sheet as well as $7,322 million in short-term marketable securities. These rather liquid assets are enough to repay more than 60% of the outstanding debt right away.

Intrinsic Value Calculation

In my last few articles, I always rated Johnson & Johnson as “Hold”. The stock is certainly not a hyped or overpriced company, but considering the rather low growth rates, it was still trading for a premium in my opinion. Johnson & Johnson seems like the typical “bond-like” company that is paying a solid dividend and leads to a stable and predictable return for investors – but most likely only in the single digits.

In the last two years, the stock was trading rather in a sideway range and in the last 5 years the stock gained only 15% in value (not including dividends). Hence, the stock is trading for a similar price as in my last few articles and an updated rating could only stem from higher growth rates or higher expected free cash flow in the years to come.

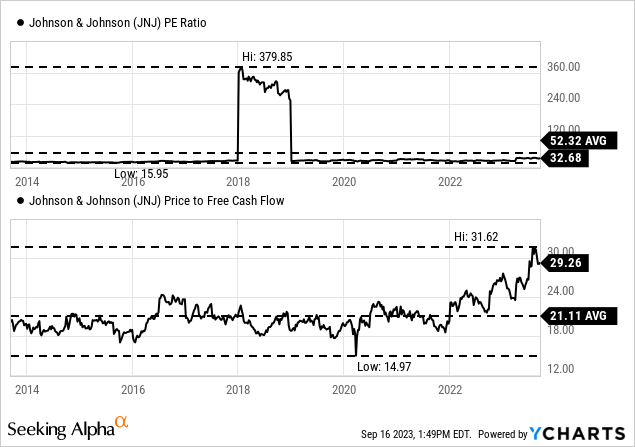

When looking at simple valuation metrics it seems difficult to call the stock a bargain at this point. Johnson & Johnson is trading for 33.3 times earnings and 29.8 times free cash flow. And as I have mentioned several times in the past, a valuation multiple of 30 or higher is only justified for companies growing with a high pace (stable double-digit growth rates). It also doesn’t matter that Johnson & Johnson is trading below its 10-year average P/E ratio (which was 52.32).

But we must take into account that earnings per share as well as free cash flow declined rather steep in the last few quarters. And a declining denominator (in this case earnings per share or free cash flow) leads to higher valuation multiples. Free cash flow is actually back to the levels of the years 2014 till 2016 and we have to ask the question if the current free cash flow is representative of the current business and if we should calculate with the trailing twelve months amount.

At this point, the simple valuation metrics are once again showing its limitations and a discounted cash flow calculation to determine an intrinsic value is the better choice in my opinion as we can include different numbers for free cash flow in each year. And for our discount cash flow calculation we must make some assumptions. We could take the free cash flow of the last four quarters as basis (which was $14.55 billion) but as already mentioned above, the amount is rather low. The average free cash flow of the last five years was already $17.35 billion. And free cash flow peaked at $22.56 billion recently.

I would argue we should use at least $17.35 billion as realistic assumption. In my opinion, we can also calculate with 6% growth from now till perpetuity. The last number of reported shares outstanding was 2,625.7 million and as mentioned above, we must subtract 191 million shares leading to 2,434 million outstanding shares right now. When calculating with these assumptions we get an intrinsic value of $178.20, and the stock would be slightly undervalued at this point.

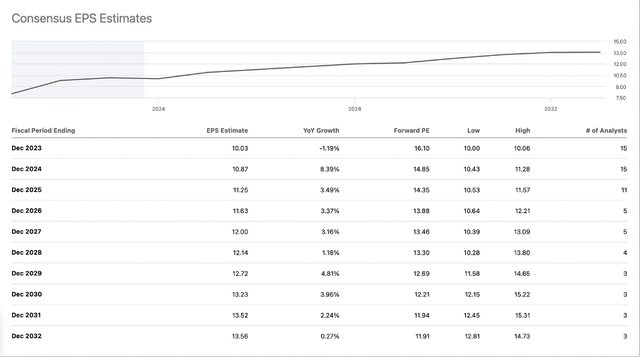

However, when looking at analysts’ estimates for the next few years, Johnson & Johnson is expected to grow its earnings per share only with a CAGR of 3% from fiscal 2022 to fiscal 2032.

Johnson & Johnson Consensus EPS Estimates (Seeking Alpha)

Instead of 6% growth till perpetuity, we can – according to these estimates – assume only 3% growth till perpetuity for Johnson & Johnson. This would lead to an intrinsic value of $101.83 for Johnson & Johnson and the stock would be extremely overvalued at this point and probably not a good investment.

Stable Investment

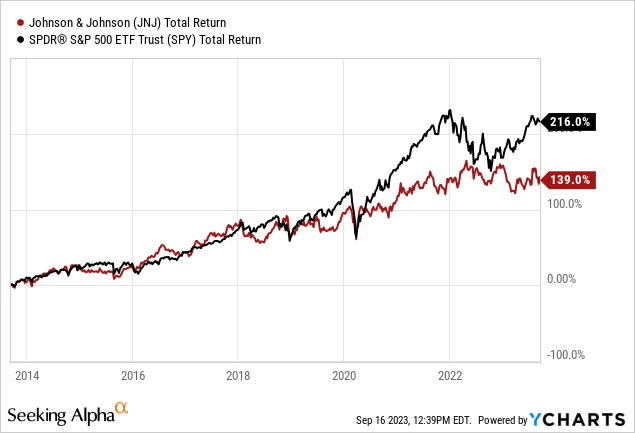

When asking the question if Johnson & Johnson is only a solid or a great investment, we can also look at the performance in the past. And when looking at the last ten years (total return), Johnson & Johnson was able to keep up with the S&P 500 performance till about 2020, but since then the S&P 500 clearly outperformed. Of course, we can discuss if the performance of the S&P 500 in the last few years was reasonable and sustainable. And we can also discuss if the underperformance of Johnson & Johnson (and other pharmaceutical companies) is only a temporary trend and if we might see a reversion to the mean in the next few years. But I have difficulties arguing that Johnson & Johnson is a great investment.

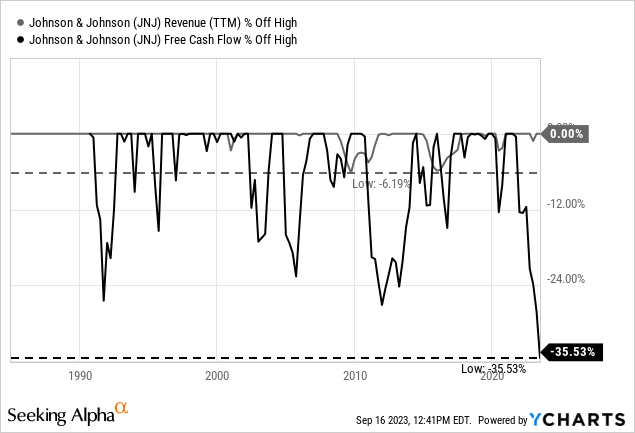

On the other hand, Johnson & Johnson seems like a great pick during recessions. When looking at the performance since the 1980s, revenue hardly declined for the company – even during recessions. Revenue never declined more than 6% in the past 40 years – and we can make the argument that Johnson & Johnson is rather a recession-resistant company. When looking at free cash flow we see steeper declines but the current drawdown with about 35.5% is the steepest in its history. In the past, free cash flow never declined more than 25% – also an impressive performance for any business over such a long timeframe.

And as it seems likely for the business to head towards another recession, Johnson & Johnson might not be the worst pick at this point.

Conclusion

I don’t want to bash Johnson & Johnson here, but in my opinion the company is not the best long-term investment and probably not a stock that will lead to long-term double-digit returns. However, Johnson & Johnson is the perfect investment for anyone who is not searching for high double-digit returns (that always go hand in hand with higher risks) but looking for stability and predictability, stable returns and a reliable (and growing) dividend as well as a limited downside risk. In my last article I identified a strong support level around $150 for Johnson & Johnson and the stock is once again trading close to that support level.

And while I don’t think Johnson & Johnson is the best long-term investment in the market, it could actually be a great investment in the next few years. I already mentioned above that pharmaceutical companies are solid investments during a recession (and I think we are headed for another recession).

And therefore, I would actually rate the stock as a very cautious “Buy” at this point – knowing very well there are better investments out there. But Johnson & Johnson has the potential to return 10% annually in the next few years to come and that makes it a “Buy”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.