Summary:

- Johnson & Johnson is attractively valued and well-positioned for long-term growth, with a 3.0% dividend yield and a AAA-rated balance sheet.

- The company has faced challenges due to the baby powder controversy, but its stock has shown resilience in the face of bad news.

- Johnson & Johnson’s commitment to R&D, dividend growth, and shareholder-friendly capital allocation make it an appealing investment choice for stability and long-term potential.

Sundry Photography

Introduction

Some stocks have it all. One of these stocks is Johnson & Johnson (NYSE:JNJ).

Despite the baby powder controversy, the company is not only attractively valued but also well-positioned to accelerate long-term growth, provide increasing shareholder returns, including distributing a 3.0% yield, and protect investors from market turmoil with its AAA-rated balance sheet.

Just two companies in the S&P 500 have AAA-rated balance sheets: Microsoft (MSFT) and Johnson & Johnson.

The company offers the perfect mix of growth and value with a stock price that is capable of beating the market with highly favorable volatility.

I’m considering buying this stock for a number of portfolios that I manage – especially for investors with a subdued risk tolerance.

So, let’s dive into the details!

Baby Powder Issues

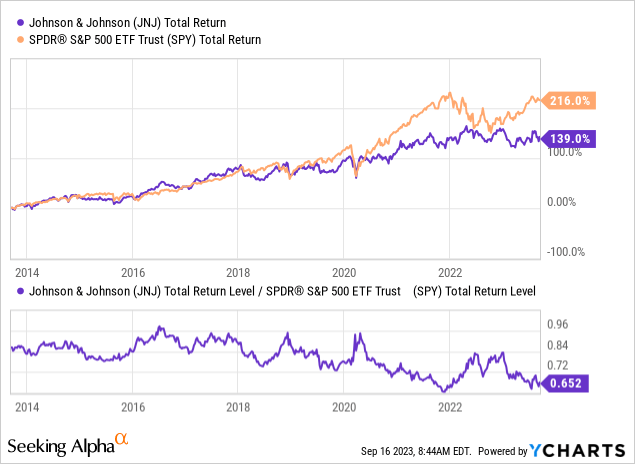

Over the past ten years, JNJ shares have returned 139%, including dividends. This performance lags behind the S&P 500’s 216% return. As the JNJ/SPY ratio in the lower part of the chart below shows, JNJ shares did rather well until 2020. Since then, JNJ shares have underperformed the market.

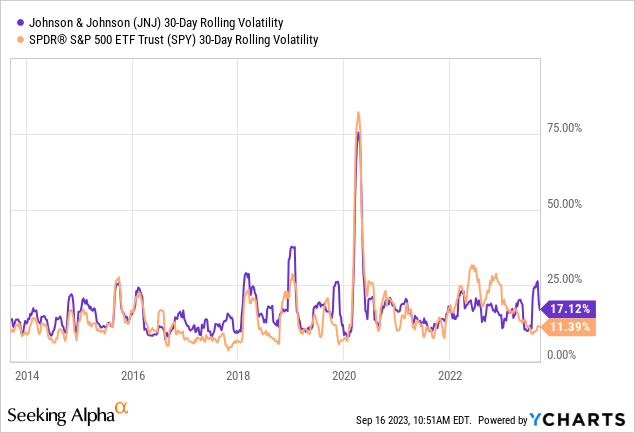

The chart below shows that JNJ has a highly favorable volatility profile. In some periods, the stock has the same volatility as the well-diversified S&P 500.

Having said that, there are a number of reasons for the aforementioned underperformance.

- The S&P 500 is overweight tech. Since the pandemic, tech has done very well, outperforming most value stocks.

- Elevated inflation has caused defensive investments to underperform. This includes JNJ, consumer staples, utilities, real estate, and related investments.

- The company is dealing with uncertainty regarding baby powder lawsuits.

As reported by the New York Times on July 30, JNJ isn’t getting rid of these issues as quickly as it may have expected.

According to the paper, a recent court ruling marks the second setback for Johnson & Johnson this year, as the company tried to utilize bankruptcy proceedings to minimize its liability in light of tens of thousands of lawsuits implicating its talcum powder products in cancer cases.

Essentially, the plaintiffs argue that Johnson & Johnson had knowledge about the risks associated with their talc-based products, including the iconic baby powder, spanning several decades.

In 2021, the company established a subsidiary, LTL Management, as a strategic move to protect itself from the talc litigation. The company proposed an $8.9 billion settlement through this subsidiary, which had filed for bankruptcy.

However, Judge Michael Kaplan recently decreed that LTL’s bankruptcy case should be dismissed. He cited a lack of “imminent or immediate financial distress” caused by the lawsuits.

The good news is that after this news broke, the stock fell just 2%, which shows that a lot of bad news has already been priced in.

Note that the company also changed its logo, which had been in use for more than 130 years, as it tries to rebrand itself after dealing with issues like the baby powder case.

Wall Street Journal

Having said that, the company is very upbeat about its future.

The Future Is Bright

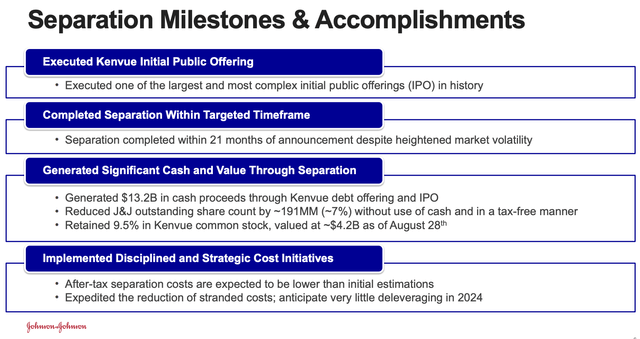

After spinning off its consumer segment through Kenvue (KVUE), the company is now focused on streamlining and improving its future growth opportunities.

Please note that JNJ still has the baby powder liabilities.

During the recent Morgan Stanley Annual Global Healthcare Conference, the company outlined its core goals for the coming decade.

It emphasized two primary objectives: making the MedTech group a top-tier growth leader and ensuring competitive growth in the Pharmaceutical sector.

The company expressed confidence in achieving these goals, citing an 8% growth in MedTech during the first half of this year and plans to sustain growth throughout the decade, even beyond the short-term challenges like patent expirations!

Johnson & Johnson aims to leverage its unique position as the only company with capabilities in both medtech and pharmaceuticals.

It also emphasized the importance of this dual capability in addressing diseases that require a combination of surgical and pharmaceutical treatments.

Hence, JNJ believes that this distinctive position will enable the company to deliver innovative solutions that others cannot.

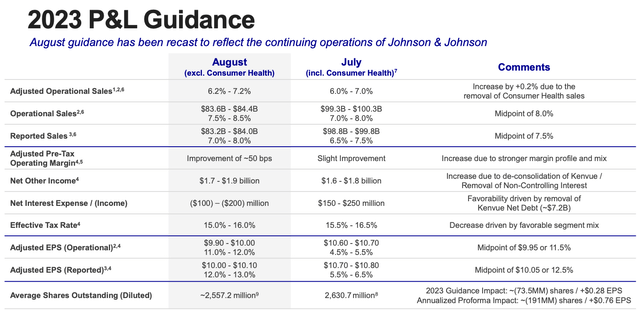

In light of these opportunities, the company also updated its guidance for the full year 2023. It now projects more than 12% adjusted EPS growth, excluding Consumer Health.

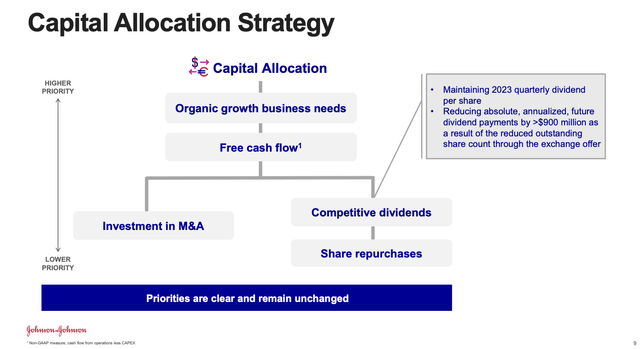

Furthermore, it’s interesting that M&A will NOT play a major role in growing JNJ’s business going forward.

During the aforementioned conference, the company noted that the majority of its growth will come from its existing R&D and portfolio. It emphasized its preference for early-stage deals, which can be licensing deals, partnerships, or acquisitions, allowing the company to leverage its scale in development, manufacturing, and commercialization.

[…] we are enthusiastic about the Johnson & Johnson that has come out of that (the Kenvue spin-off), exclusively focused on R&D and innovation, on MedTech and Pharmaceuticals. This increased focus is going to help us being more productive, and at the same time, having higher margins and higher growth rates because Consumer had lower margins and lower growth rates compared to MedTech and Pharma.

[…] leverage our scale in development, in manufacturing, in commercialization, and to capture the most value we can. So clearly, if we could, it would be all these type of deals. And we have a great track record in Pharma in being able to do that. You mentioned some of them. And we also have a good track record in MedTech to do that. It does take longer to maturate these deals in MedTech, that’s clear. – JNJ

The company is guiding for $57 billion in Pharma revenue for 2025. In 2022, that number was $52.6 billion.

Having said that, the company will use M&A to some extent, as it aims to build a best-in-class MedTech business. The company has a keen interest in ophthalmology and cardiovascular segments, with a focus on strategic M&A.

Historically, 90% of their deals are under $1 billion, aiming to strengthen their portfolio and drive innovation.

Procedure volumes in the MedTech industry have been strong, driven by recovery from COVID-19 disruptions. Johnson & Johnson anticipates a return to normal seasonality by 2024, with a 5-7% growth rate this year and a shift back to a 4-6% growth range in 2024.

Johnson & Johnson considers China a crucial market for its growth, and the country is showing signs of recovery from the pandemic. The company is focusing on expanding its medical technology presence in Tier 2 and Tier 3 cities. During this year’s Wells Fargo Securities Healthcare Conference, Johnson & Johnson emphasized its commitment to providing top-tier healthcare services across different levels of cities in China.

During the Wells Fargo (not to be confused with the Morgan Stanley conference) conference, the company also commented on the new trend in weight loss drugs (so-called GLP-1s). After all, these drugs have done a number on the stock prices of various healthcare stocks.

The company is optimistic about the advancements in patient care related to GLP-1s, particularly in addressing obesity, which is considered a disease.

It emphasized that the GLP-1s will complement both medicines and surgeries, creating a broader patient funnel. While there may be a short-term impact on surgical procedures, in the long term, this advancement is seen as beneficial for patients and the total addressable market by broadening treatment options.

I have seen these comments from a wide number of healthcare providers and believe that it’s bullish for JNJ in the long run.

Shareholder Distributions

Like most S&P 500 companies, JNJ has a very clear capital allocation strategy.

As we just discussed, the company’s first target is to provide capital for organic growth. Once that has been taken care of, the company focuses on M&A and growing its dividend. After that, excess cash is used for buybacks.

Next year, the company is expected to end up with $3.4 billion in net cash, which means it is expected to have more cash than gross debt.

Also, as mentioned in the introduction, the company has an AAA-rated balance sheet.

Hence, there’s no need to prioritize debtholders over shareholders, which has resulted in very satisfying dividend growth.

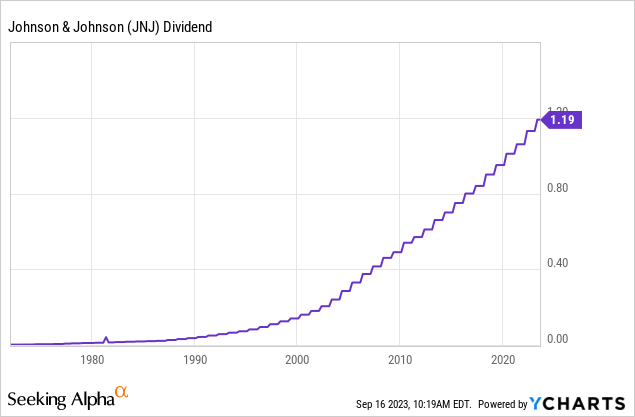

Having said that, the company currently pays a $1.19 per share per quarter dividend. This translates to $4.76 per year, or a 3.0% yield.

The dividend is protected by a 44% payout ratio and 60 years of annual consecutive hikes. Using next year’s free cash flow estimates (see the overview in the valuation part of this article), the cash payout ratio is also 44%.

The five-year dividend CAGR is 5.9%.

On April 18, the company hiked by 5.3%.

While dividend growth isn’t very high, dividend growth is consistent, and its yield is currently 3.0%, which is decent.

This brings me to the valuation.

Valuation

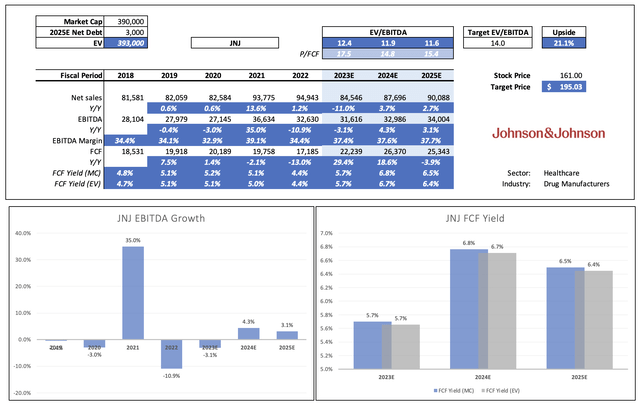

The company is expected to grow its revenues in the low-single-digit range over the next few years. Free cash flow is expected to grow faster – on average – reaching a free cash flow yield of roughly 6.5% in 2025.

Leo Nelissen (Based on analyst estimates)

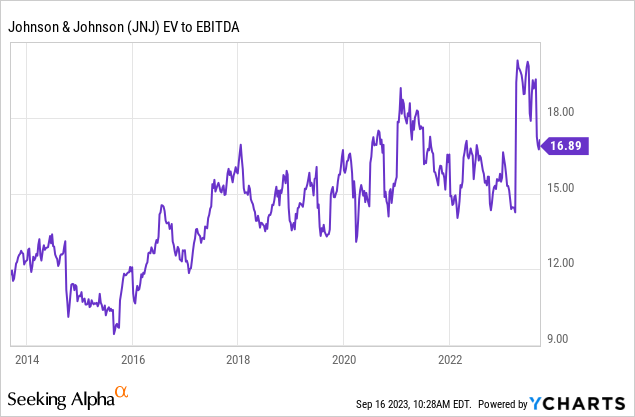

During the past five years, JNJ has traded close to 15-16x EBITDA. The company is trading at 12.4x 2023E EBITDA. That number drops to 11.6x using 2025E analyst estimates.

When applying a 14x multiple, the company is trading roughly 20% below what could be its fair value at $195 per share.

I decided not to use a higher multiple to account for somewhat weak (temporary) revenue growth and ongoing risks related to lawsuits – although I expect these headwinds to fade without major consequences for the company’s shareholders.

The current consensus price target is $181.

Going forward, I will figure out how JNJ fits into my portfolio and some of the portfolios that I manage/advise. I really like the low-risk dividend growth profile of this stock and its fortress balance sheet.

As I also have other healthcare companies on my watchlist, I will spend the next few days and weeks figuring out how to structure future investments.

Takeaway

Despite recent challenges, Johnson & Johnson remains an appealing investment opportunity.

With a 3.0% dividend yield, AAA-rated balance sheet, and a focus on both MedTech and Pharmaceuticals, JNJ offers a balanced mix of growth and value.

While the baby powder controversy has weighed on its performance, the stock’s resilience in the face of bad news is promising.

The company’s commitment to R&D, dividend growth, and shareholder-friendly capital allocation make it an attractive choice for investors seeking stability and long-term potential.

With a current valuation that may be below its fair value, JNJ presents an opportunity worth considering, especially for those with a lower risk tolerance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.