Summary:

- Johnson & Johnson has announced plans to acquire Ambrx, a clinical-stage biopharmaceutical company specializing in antibody drug conjugates (ADCs), for ~$2.0 billion.

- ADCs have become a popular investment for big pharma companies, with Pfizer, AbbVie, Merck and others making significant investments into the space.

- Ambrx’s portfolio includes ADCs targeting prostate cancer, breast cancer, and renal cell carcinoma, with its lead candidate, ARX517, showing promising results in prostate cancer patients.

- Johnson & Johnson has targeted $57bn of revenues from its pharmaceuticals division even as >$10bn p.a. asset Stelara loses patent protection.

- This acquisition provides an enhancement to its pre-commercial pipeline – although the success of Ambrx’s product portfolio or technology is not guaranteed.

JHVEPhoto

Investment Overview

Antibody Drug Conjugates (“ADCs”) are the new “must-have” Big Pharma accessory – today, Johnson & Johnson (NYSE:JNJ) became the latest Big Pharma company to make a big money M&A move for an ADC drug developer.

In 2022, Pfizer (PFE) spent $43bn acquiring Seagen and its portfolio of ADCs, including 4 of the 13 drugs with this mechanism of action (“MoA”) approved by the FDA for commercial use.

Last September, AbbVie (ABBV) announced it would buy the ADC specialist ImmunoGen (IMGN) in a $10.1bn deal – ImmunoGen secured approval for its first commercial product – Mirvetuximab Soravtansine, marketed and sold as Elahere – in November 2022, in the indication of FRα positive, platinum-resistant ovarian cancer (“PROC”). Elahere earned $105.2m of revenues in Q3 2023, and $212.1m across the first nine months of 2023

In October, Merck & Co. (MRK) signed a $5.5bn deal with Daiichi Sankyo to co-develop three ADC drug candidates, that could rise to $22bn based on certain milestones being achieved – the two companies have suggested that the program has “multi-billion dollar worldwide commercial revenue potential for each company”. Bristol Myers Squibb (BMY), GSK (GSK), and BioNTech (BNTX) are other companies that have been making M&A deals in the space, albeit on a smaller scale it seems.

Yesterday, Johnson & Johnson threw its hat into the ring by announcing it planned to acquire Ambrx (NASDAQ:AMAM), which it describes as “a clinical-stage biopharmaceutical company with a proprietary synthetic biology technology platform to design and develop next-generation ADCs”, in “an all-cash merger transaction for a total equity value of approximately $2.0 billion, or $1.9 billion net of estimated cash acquired”.

Last year, Johnson & Johnson spun out its consumer health division into a separate company, Kenvue, in order to switch the company’s focus more towards drug development, arguably the most lucrative market for a Pharmaceutical company, with R&D dollars directed towards improving on current standards of care, and often paying off through the approval of new drugs with multi-billion-per-annum (“Blockbuster”) earning potential, and years of patent protection. According to JNJ’s press release:

Ambrx is advancing a focused portfolio of clinical and preclinical programs designed to optimize efficacy and safety of its candidate therapeutics in multiple cancer indications, including ARX517, its proprietary ADC targeting PSMA for metastatic castration-resistant prostate cancer (mCRPC); ARX788, its proprietary ADC targeting human epidermal growth factor receptor 2 (HER2) for metastatic HER2+ breast cancer; and ARX305, its proprietary ADC targeting CD-70 for renal cell carcinoma.

Ambrx Completes Sensational Comeback After Shelving Its Breast Cancer Drug

In a note on Ambrx for Seeking Alpha back in March last year, I discussed the company’s history – from completing its IPO in June 2021, raising ~$126m via the issuance of 7m ADRs, each worth seven ordinary shares, at a price of $18 per ADS, to its decision to halt development of its most advanced clinical stage candidate – ARX788, an anti-HER2 ADC being evaluated in breast, gastric and other solid tumor cancer studies.

The approval of another ADC – Enhertu, developed by pharma giant AstraZeneca (AZN) and partner Daiichi Sankyo – before Ambrx could apply for accelerated approval of its own drug, which showed a confirmed objective response rate (“ORR”) of 57.1% (4/7 patients) and unconfirmed ORR of 71.4% (5/7 patients) in a Phase 2 study, seemingly led to the company’s share price collapse from >$9 per share in December 2021, to $0.5 per share by the beginning of 2023 – a >90% decline in value.

Ambrx opted to pause development of ARX-788, whose pivotal data compared marginally unfavourably to Enhertu, although as I discussed back in March, the company has presented detailed plans to use ARX-788 in breast cancer patients who do not respond to Enhertu, and also indicated it was seeking a partner for this program.

The pause was also related to the company’s precarious cash position, with management announcing a strategic reprioritisation in October to extend its cash runway into 2025, which involved cutting its workforce by 15%

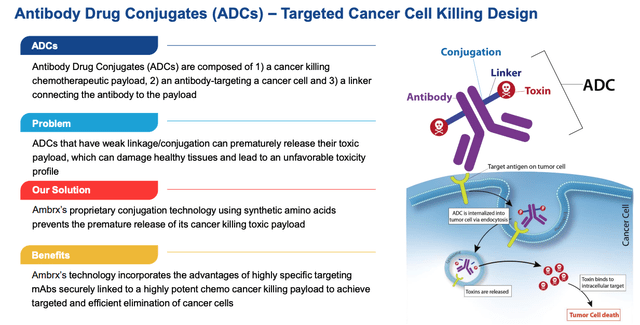

In February last year, however, Ambrx stock began soaring thanks to data from another of its pipeline candidates – ARX-517. At this point, we should define exactly what an antibody drug conjugate is and what it can do. An ADC is defined as follows by ADCreview.com:

Antibody-drug conjugates or ADCs are a new class of highly potent biopharmaceutical drug composed of an antibody linked, via a chemical linker, to a biologically active drug or cytotoxic compound.

These targeted agents combine the unique and very sensitive targeting capabilities of antibodies allowing sensitive discrimination between healthy and cancer tissues with the cell-killing ability of cytotoxic drugs.

As per the below slide from a recent Ambrx investor presentation, Ambrx believes that its “proprietary conjugation technology using synthetic amino acids prevents the premature release of its cancer killing toxic payload”.

Ambrx proprietary drug development technology explained (Ambrx investor presentation)

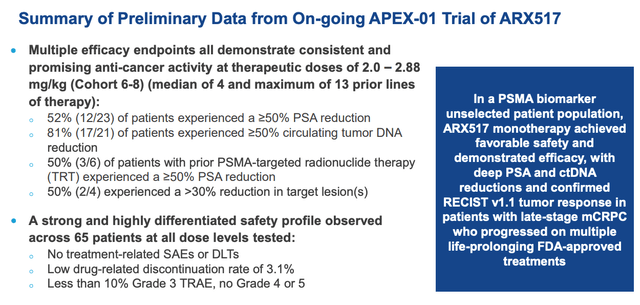

ARX-517 – Outstanding Prostate Data Put Ambrx In Shop Window

In its recent investor presentation Ambrx highlights the unique properties of ARX-517 as follows:

- Fully humanized anti-PSMA monoclonal antibody (“MAB”) produced in CHO cells with site-specific incorporation of SAA for conjugation

- Contains two (2) drug-linkers (AS269, a tubulin polymerization inhibitor) per mAb, a DAR2 ADC

- Highly stable linkage – site-specific conjugation via oxime chemistry

The results that generated such excitement amongst investors – sending shares rising from $1.5 in early February, to $16.5 by mid-June, for a gain of ~1,000% – are summarised in the slide below:

Ambrx prostate data (Ambrx presentation)

The company notes that PSMA is a “clinically validated target and an established market” for prostate cancer patients, thanks to the approval of Novartis’ Pluvicto, a radiopharmaceutical drug – radiopharmaceuticals developers, like ADC developers, are hot property in the biotech at present, after BMY announced in December that it would acquire newly IPO’d RayzeBio (RYZB) in a deal worth $62.5 per share, or ~$4.1bn.

Still, doubts persist about the safety profile of radiopharmaceuticals therefore they may be an opportunity for ARX517 to build market share in this later line indication – analysts have suggested Pluvicto could earn ~$2bn in peak annual revenues, based on a label expansion into earlier line therapy. Could ARX517 deal in similar numbers?

Johnson & Johnson doubtless studied Ambrx’ ARX-517 data closely before making a decision to bid for the company – the deal value of $28 per share represents a 100% premium to the last traded price on 5th Jan of $14, so clearly, management believes in Ambrx’ approach. Yusri Elsayed, M.D., M.H.Sc., Ph.D., Global Therapeutic Area Head, Oncology, Johnson & Johnson Innovative Medicine, commented in a press release:

The results seen to date with ARX517 in mCRPC are promising and represent a potential first- and best-in-class targeted therapy for the treatment of this aggressive disease. In addition, Ambrx’s pipeline and ADC platform present exciting future opportunities to deliver enhanced, precision biologics as we look to transform the treatment of cancer and improve patients’ lives

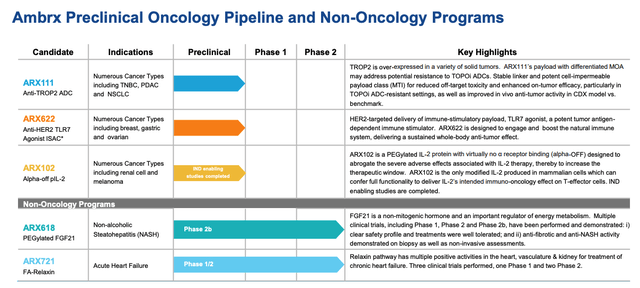

It may well be the case that JNJ values Ambrx’ technology platform – and perhaps its patent IP – as highly as it values the ARX-517 candidate, or indeed ARX-788, or a third candidate, ARX-305, an anti-CD70 ADC indicated for renal and other cancers, whose investigational new drug (“IND”) application, to allow in-human studies to begin, has been cleared by the FDA.

Ambrx preclinical pipeline / non-oncology (Ambrx presentation)

As we can see below, Ambrx also boasts a diverse preclinical oncology pipeline, plus two non-oncology programs, targeting the large and lucrative nonalcoholic steatohepatitis (“NASH”) and heart failure markets.

What Does Johnson & Johnson Get From Ambrx Deal – Breaking Down The Opportunity

As mentioned in my intro, Pharmas have been queueing up to gain access to ADC drug development technology, and by the standards of the deals made by Pfizer, AbbVie, and Merck, for example, arguably, Johnson & Johnson may be getting good value for money from this deal.

Of course, Seagen boasts 3 approved ADCs, and Pfizer believes it can find an initial $3bn of revenues from the portfolio and pipeline, rising to >$10bn over time. AbbVie, also, gained access to an already approved asset – Elahere -generating >$100m per quarter in revenues, whereas Ambrx’s lead assets are both likely 1-2 years from a full approval.

Nevertheless, Johnson & Johnson – the world’s second largest Pharma company by market cap – will be able to throw substantial resources at Ambrx programs, and my feeling is the company will look to develop new candidates besides ARX-788 and ARX-517 and move them into clinical studies as rapidly as possible, leveraging what it hopes will prove to be “best in class” ADC technology.

The size of JNJ’s deal for Ambrx is not large enough to materially affect JNJ’s share price, which currently trades at $161, valuing JNJ’s business at $388bn. As I wrote in a note on JNJ for Seeking Alpha back in October last year:

the pharmaceuticals division performance across 1H23 was in fact reasonably impressive, with the Immunology division growing 1% year-on-year, Infectious Diseases 4%, Neuroscience 4%, Oncology 6%, Pulmonary Hypertension 9%, and Cardiovascular / Metabolism remaining flat year-on-year.

The looming patent expiry of JNJ’s best-selling drug, the autoimmune therapy Stelara, which racked up revenues of >$5bn across the first two quarters of last year, presents a significant problem for the company as it tries to become a fully fledged prescription drugmaker. Management has targeted driving $57bn of revenues from its pharmaceuticals division by 2025 by 2025 – the figure in 2023 is likely to be ~$52bn, the same as in 2022.

JNJ will certainly feel as though the Ambrx deal was the best the company could make in terms of upgrading its research into ADC technology – although other companies JNJ might have considered include the likes of Mersana Therapeutics (MRSN), or ADC Therapeutics (ADCT), or MacroGenics (MGNX), which are all involved in developing ADC technology.

The best case scenario JNJ is likely considering is an approval – and blockbuster revenue opportunity – for one of ARX-517 or ARX-788, or both, and success using Ambrx’ technology to help create a promising late-stage product pipeline with best-in-class potential in the exciting field of ADC technology.

If such a scenario were likely, JNJ might have been expected to pay a similar fee to the $43bn paid by Pfizer for the significantly more derisked Seagen. Nevertheless, Ambrx shareholders will likely be delighted by recent developments, as the future of the entire ADC platform looked in serious doubt only 15 months ago, and JNJ shareholders ought to feel some enthusiasm for the deal also, as the ADC space is rapidly evolving, and there is a slim chance that Ambrx’ package is a winning one.

Only time will tell, but readers can certainly expect to hear a lot more about ADC technology in the coming years – arguably, these drugs could have as big an impact on the way certain cancers are treated since the rise of the immune checkpoint inhibitor class, which produced Merck’s >$20bn per annum selling Keytruda.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.