Summary:

- Johnson & Johnson is a defensive pick with a renewed focus on its pharmaceutical and medtech segments.

- The recent selloff in the stock has brought its valuation down to undervalued levels.

- Johnson & Johnson offers a safe 3.0% dividend yield and can provide peace of mind in challenging market conditions.

- This is the ultimate Ultra SWAN for any recession courtesy of its AAA credit rating, recession-resistant business model, 60-year dividend growth streak, and a super low 15% volatility, lower than almost any individual company (and the S&P 500).

- Johnson & Johnson is growing around 5% and yields a very safe 3%, so long-term returns of 8% are reasonable to expect. However, a modest 15% discount means that for the next few years, you could beat the S&P but with lower volatility and almost twice the much safer yield.

Moussa81

This article was co-produced with Kody Kester of Kody’s Dividends.

———————————————————————————

Achieving your financial goals doesn’t require a genius IQ, but you need the emotional stability to stand by said strategy in tough times.

Johnson & Johnson (NYSE:JNJ) is a legendary healthcare company with a renewed focus on its pharmaceutical and medtech segments, making it an excellent defensive pick.

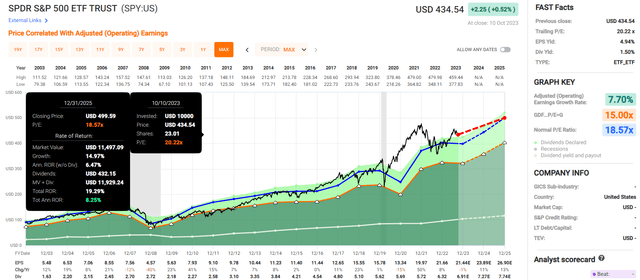

The recent selloff in JNJ has brought its valuation down to firmly undervalued levels, with the stock offering market-matching returns versus the S&P 500.

JNJ’s 3.0% dividend yield is as safe as they come and almost double the S&P’s 1.6% yield.

The healthcare juggernaut isn’t going to make investors rich overnight, but it can provide valuable peace of mind in these challenging times in the market.

One option for dividend investors who are risk-averse and looking to position themselves well for whatever happens next is Johnson & Johnson. Down 13% year to date, as the S&P 500 Index (SP500) has rallied 11%, the stock’s performance has been divorced from reality. For the first time since 2020 here on Seeking Alpha, I will look at what makes J&J a compelling investment.

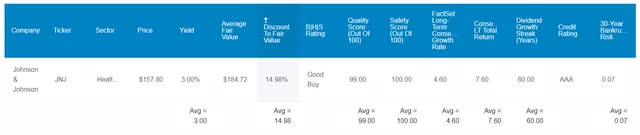

JNJ’s six decades and counting of consecutive dividend growth inherently tells you that its dividend is very safe. This is supported by the company’s adjusted diluted EPS (47%) payout ratio. This payout ratio is well below the 60% that rating agencies consider safe for JNJ’s industry, which bolsters dividend coverage.

Alongside Microsoft (MSFT), the iconic healthcare company is the only other S&P 500 component with a perfect AAA credit rating. For context, that is something no longer even possessed by the U.S. Government itself. This is precisely why the company has just a 0.07% risk of going bankrupt in the next 30 years.

Besides JNJ’s sustainable payout and ironclad balance sheet, the company appears to provide enough of a margin of safety to be a strong buy for income investors.

-

16% discount to fair value vs. 6% S&P premium.

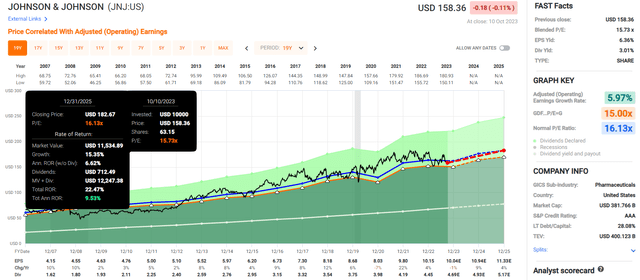

JNJ possesses a solid yield, valuation, and growth trifecta with lower volatility (0.5 5-year beta) that can equal the S&P 500 index in the coming ten years.

-

3.0% yield + 4.9% growth + 1.4% annual valuation upside = 9.3% CAGR annual 10-year total return potential vs. 10.1% S&P 500.

Contrary to popular belief, achieving your financial goals as an investor doesn’t have to be complicated. Is it easy? Nothing in life that is easy to accomplish is worth having anyway.

According to Warren Buffett, you don’t need to be a genius or smarter than everyone else to do well as an investor and attain your financial dreams. So, what’s the secret?

Buffett says, “We don’t have to be smarter than the rest; we have to be more disciplined than the rest.”

Dividend-focused investors like myself should especially like companies with robust balance sheets. This is because decades-high interest rates won’t burn companies not saddled with significant debt. The Federal Funds rate is between 5.25% and 5.5%, with most analysts thinking rates will top 25 basis points higher than the current range.

But JPMorgan Chase CEO Jamie Dimon has taken a contrarian view, believing that the Federal Reserve could hike rates another 150 basis points to a staggering 7%. Whether or not this prediction materializes, it’s not a bad idea for investors to prepare for such a scenario.

J&J Is Old Reliable

When you think of the bluest of blue chips, JNJ is probably one of the first names that comes to mind. After all, it has consistently grown through recessions, depressions, pandemics, and wars.

JNJ finalized the spinoff of the slower-growth consumer health spinoff Kenvue (KVUE) in August. Now owning just a 9.5% stake in the latter, JNJ comprises strictly two segments: Pharmaceutical and MedTech (e.g., medical devices).

JNJ Fact Sheet

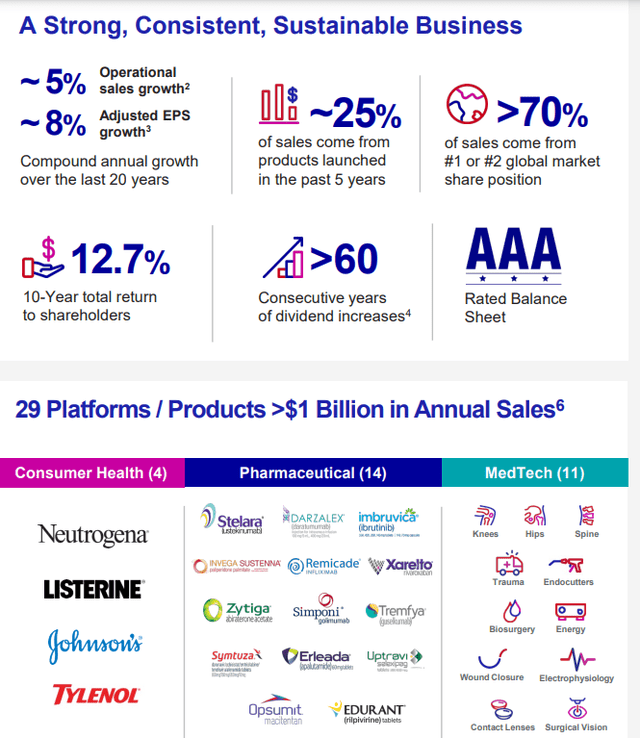

Owning 14 pharmaceutical brands that were blockbusters in 2022 and 11 billion-dollar Medtech brands, JNJ enjoys a wide moat. This explains how the company generated 5% annual operational sales growth and 8% annual adjusted diluted EPS growth over the past 20 years for shareholders.

That’s all well and good. But whether JNJ can continue to produce similarly solid results matters in the future. The good news is that based on an analysis of fundamentals, I believe the answer is a resounding yes. JNJ hasn’t forgotten what has made it a financial success: the company has consistently allocated around 15% of its sales to research and development. This continued through the first six months of 2023, with JNJ dedicating $7.4 billion to research and development – – ~15% of its $50.3 billion in year-to-date sales. These resources will help develop the nearly 100 recent and future indications in its pipeline. It’s by no coincidence that this commitment to innovation has allowed the company to generate approximately a quarter of its sales from products launched in the last five years alone.

For these reasons, FactSet Research believes that JNJ can generate 5% annual earnings growth over the long term. This is not the most blistering growth in the stock market, but it’s not bad, either. That’s especially true considering that J&J’s 30-year bankruptcy probability is merely 1 in 1,429 under its AAA credit rating. The company is one of the best investment candidates for capital preservation.

Solid But Not Flashy Dividend Growth Lies Ahead

JNJ’s 3.1% dividend yield isn’t exceptionally enticing against the 10-year (US10Y) risk-free U.S. treasury rate of 4.6%. But as one of the surest stocks on Wall Street, the company offers one thing that treasuries do not: the potential for inflation-beating dividend growth in most environments. JNJ has generated 6% annual dividend growth over the past five years.

Similar dividend growth is primed to continue in the years ahead: JNJ posted $10.15 in adjusted diluted EPS in 2022. Against the $4.45 in dividends per share paid during that year, this is an adjusted diluted EPS payout ratio of just 43.8%.

JNJ’s dividend was also reasonably covered by free cash flow (“FCF”). The company recorded $17.2 billion in free cash flow last year. Compared to the $11.7 billion in dividends paid, this is an FCF payout ratio of 68% (page 50 of 151 of JNJ’s 10-K filing). Considering these factors, JNJ boasts the maximum possible 5/5 dividend/balance sheet safety rating according to the DK Research Terminal.

Risks To Consider

As a stock, JNJ falls just short of offering the safety and security that treasuries do. All businesses face risks that investors need to know before putting their hard-earned capital to work.

In recent years, JNJ shareholders have become painfully aware of the legal liabilities companies can face for right or wrong. Earlier this year, in April, JNJ reached a deal to pay out $8.9 billion to tens of thousands of North American plaintiffs in its talc-based baby powder lawsuits to be spread out over 25 years. Pending the company’s appeal of this settlement based on an alleged lack of scientific merit, this legal headache could be put to rest soon. However, it is worth remembering for the future that massive companies with vast resources make targets ripe for litigation.

Investors must also be comfortable with the general risk of operating in the pharmaceutical and medtech industries. These are highly competitive industries constantly evolving, so JNJ needs to keep launching revolutionary products to remain competitive. If the company can’t do so, its sales and earnings could stagnate as patents on key products like Stelara eventually expire (more risks can be found in the Risk Factors section of JNJ’s 10-K on pages 14-21 of 151).

Summary: A World-Class Business That Can Compete With The S&P

Dividend Kings Zen Research Terminal

Due to its stable operating fundamentals, fortress-like balance sheet, and manageable payout ratios, JNJ scores a flawless 13/13 Ultra-Swan rating from the DK Research Terminal.

DK’s numerous valuation metrics averaged out have an assigned fair value of $185 a share for the stock. JNJ’s current $155 share price implies it is undervalued by 15%, making it a strong buy for more conservative income investors.

FAST Graphs, FactSet FAST Graphs, FactSet

JNJ’s 3.0% dividend yield and 5% annual consensus earnings growth deliver decent total returns to investors from the current valuation. An eventual 1.4% annual valuation multiple expansion could chip in the total returns necessary to rival the 10% annual total return consensus of the S&P 500.

All from one of the only single stocks less volatile than the S&P 500, courtesy of its recession-resistant business model, AAA-balance sheet, and the income dependability that only comes from a 60-year dividend growth streak.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own JNJ via ETFs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—————————————————————————————-

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and more.

Membership also includes

-

Access to our 13 model portfolios (all of which are beating the market in this correction)

-

my family’s $2.5 million charity hedge fund

-

50% discount to iREIT (our REIT-focused sister service)

-

real-time chatroom support

-

real-time email notifications of all my retirement portfolio buys

-

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.