Summary:

- JNJ bulls often praise its dividends – rightfully.

- However, the above-average yield and remarkable dividend record understate the attractiveness.

- Investors should focus on total shareholder returns, which include dividends but also other factors such as EPS growth and buybacks.

- Compounding works on a multiplicative basis, not additively.

- As a result, JNJ’s overall return potential is far greater than the simple sum of these factors.

patpitchaya/iStock via Getty Images

JNJ stock: buy rating reiterated

It was about three months ago that I last analyzed Johnson & Johnson (NYSE:JNJ) stock. As the following screenshot shows, my last article was titled “Johnson & Johnson: Market Will Regret The Overreaction” and rated the stock as a buy. The article argued that recent price corrections were an overreaction to the temporary issues the stock has been facing such as the talc-related bankruptcy filings and the Stelara patent expiration. Quote:

The market certainly has its reasons for the selloff. Similar to its other peers in the sector, the company has no lack of lawsuits and patent expirations. Certainly, the downside risks from patent expirations and legal issues should not be ignored, and their impacts could be considerable. However, I think the Johnson & Johnson positives (such as valuation, strong pipeline with promising new drugs and medical devices, strong financial strength, etc.) far outweigh these negatives.

Since that writing, there have been a few key developments surrounding the company’s operations and finances, which motivated this update. In the remainder of this article, I will explain why this updated analysis also points to a buy rating. My last article concentrated on business specifics such as patent expiration, pipeline development, etc. In this article, I will take a different approach to examine the thesis by concentrating on its finances, with a focus on its capital allocation flexibility in particular.

You will see that the gist of my analysis is to show a doubling compounding mechanism at work for JNJ – the combined effects of healthy profit growth and consistent share repurchases fueled by profit growth. Because compounding works multiplicatively, not additively, this mechanism is far more potent for total shareholder returns than each of them is separately. A typical example of 1+1>2.

JNJ stock: compounding via profit growth

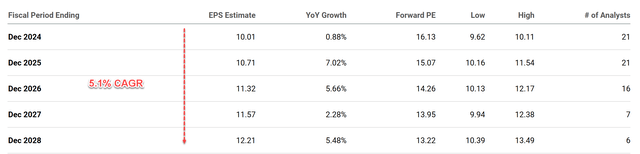

Let me first examine the common compounding mechanism of earnings growth. The chart below shows the consensus EPS estimates for JNJ stock in the next five years. According to the estimates, JNJ’s EPS is expected to grow steadily from $10.01 in FY 2024 to $12.21 in FY 2028, a quite positive trajectory for the company’s earnings in the coming years. The most significant growth is projected to occur between FY 2025 and 2026, with year-over-year growth rates in the upper single digits. Overall, the compound annual growth rate is about 5.1% for this period.

As detailed in my last article, I do expect earnings headwinds from the issues of patent expirations and legal issues. However, I believe JNJ can more than offset these impacts by growth from other areas to achieve the projected growth rates. The leading growth area in my view is its Innovative Medicine segment. I expect this segment to continue to be driven by momentum from key brands and the adoption of new products including those that treat multiple myeloma, plaque psoriasis, prostate cancer, and depression. Its Med-Tech segment is another promising high-growth area. Since my last writing, I have seen good progress on multiple fronts, including advancements in pulsed-field ablation, Abiomed, and surgical robotics. Notably, the latter is up for clinical trials late this year. Besides these organic EPS drivers, I also expect JNJ to benefit from its external acquisitions. In particular, it recently completed its acquisitions of Ambrx to help develop targeted oncology therapeutics and Shockwave Medical to strengthen its cardiovascular business. I expect these acquisitions to help drive EPS growth in the years to come and also expect JNJ to continue being active on the acquisition front.

Next, I will explain why the potency of this first compounding force can be greatly augmented by the second compounding force.

JNJ stock’s second compounding force: Buybacks

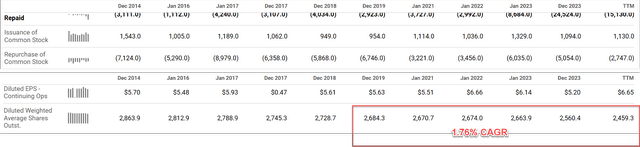

JNJ has been a consistent buyer (and quite a sizable one in my view) of its own common shares in recent years, a good sign for its strong profitability and reasonable valuation. More specifically, the chart below shows its repurchases of common stocks and diluted average shares outstanding, and I want to draw your attention to the data between 2019 and TTM 2024 (those highlighted in the red box).

During this period, JNJ repurchased on average ~$5 billion worth of its common stock. In the most recent two years, the repurchases have both exceeded $5 billion, far exceeding the issuance of common shares as seen. As a result, its buyback program has led to a substantial decrease in diluted average shares outstanding from 2,684.3 million in 2019 to the current 2,459.3 million (as of TTM 2024). This decrease translated into an annual reduction rate of 1.76% CAGR in its shares outstanding.

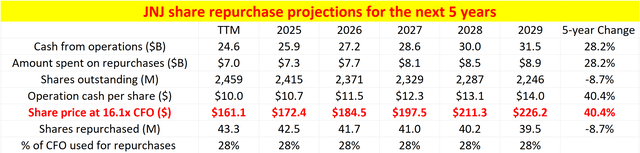

Given the profit growth analyzed in the previous section, I consider it reasonable to assume that such repurchases will continue in the next few years. Under this assumption, the table projects the combined impacts of its earnings growth and share count reduction – the double-compounding mechanisms mentioned upfront. To recap, the assumptions used in this projection are:

- First, this projection assumed JNJ’s cash from operations to grow at the same CAGR as its EPS projected by consensus (i.e., 5.1% CAGR for the next five years).

- Second, this projection assumed JNJ to continue buying back 1.76% of its outstanding shares each year.

- The projection also assumed that the future repurchased prices to be 16.1x of its CFO, which is the current multiple.

You can, of course, massage these numbers to make your forecast. However, I think these numbers are reasonable enough and sufficient to illustrate the essence of the potency of the double compounding mechanisms.

As a particular note, the above assumptions together also imply that JNJ will be allocating a fixed percentage of its CFO on share repurchases. The percentage turned out to be 28% as seen in the table. It’s a very reasonable level and, in turn, serves as a validation of the assumptions made above.

Under these assumptions, JNJ’s CFO will grow by about 28.2% in five years to $31.5 B in 2029. But on a per-share basis, the CFO growth would be far greater: A whopping 40.4% as seen. It’s larger than the simple sum of the CFO growth (28.2%) and the percentage of shares repurchased (8.7%), a numerical illustration of the multiplicative nature of compounding as aforementioned. Under the current valuation multiple of 16.1x CFO (which is undervalued as argued in my previous article), the projected price appreciation would be over 40%.

Other risks and final thoughts

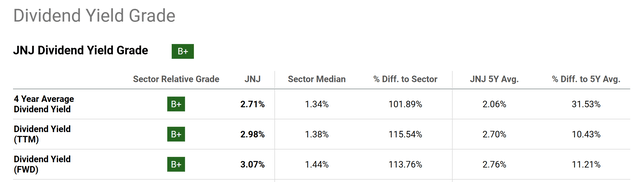

As an additional upside risk, I feel any analysis on JNJ, a quintessential dividend king, would not be complete without a mention of its dividends. The chart below shows the dividend grades of JNJ stock, and you can indeed how attractive it is. Its four-year average dividend yield is 2.71%, which is more than double the sector median of 1.34%, and provides a sizable stream of income. The forward yield is even higher at 3.07%, noticeably above its four-year average and indicating undervaluation. Finally, I also urge investors to look beyond the cash dividends and focus on total shareholder yield. As mentioned above, the company has bought back about 1.76% of its commons shares per year in recent years. Thus, the total shareholder yield is more than 4.4% (1.76% buyback plus 2.71% average cash yield).

In terms of downside risks, the talc-related bankruptcy filings and the Stelara patent expiration are the key risks in the immediate term (the focus of my last article. In addition, there are some secondary risks worth mentioning. Investors should interpret JNJ’s financials with the sales of COVID-19 vaccines excluded. Such sales have helped the company’s numbers in recent years. However, ultimately, I consider these sales to be temporary and expect the boost to fade over time. Its recent financials also show an uptrend in selling costs, marketing costs, and higher R&D investments. These increases might be positive for the long term but can create margin pressure in the short term.

All told, my verdict is that the downside risks are largely temporary, but the positive forces are structural. Thus, I consider the reward/risk profile to be very favorable for JNJ shares under current conditions. This article focused on one of the key forces: The force of double compounding via earnings growth and share repurchases. I expect this mechanism to continue and create outsized total returns in the years to come.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.