Summary:

- Large pharma stocks, including Johnson & Johnson, may be experiencing a shift in favor as investors move away from glamour growth stocks as 2024 gets underway.

- Johnson & Johnson is a leading global healthcare company with a below-market valuation and an attractive dividend yield, though its chart has its issues.

- Analysts have mixed opinions on Johnson & Johnson, with some citing concerns about its pipeline and slower growth in MedTech.

- Ahead of earnings due out later this month, I highlight key price levels to monitor.

Sundry Photography

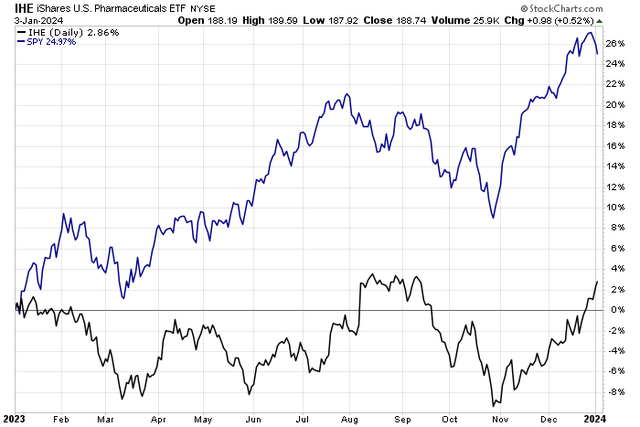

Outside of Eli Lilly (LLY) and Novo Nordisk (NVO), the pharmaceutical space has struggled in the past year. The iShares U.S. Pharmaceuticals ETF (IHE) is up just 3% with dividends included over the past 12 months, sharply underperforming the S&P 500 Trust ETF (SPY). The turn of the calendar has brought about a change, albeit over a short timeframe, in favor of large pharma stocks, though. It has some pundits suggesting a shift from glamour growth stocks to defensive blue chips may be underway.

I have a buy rating on Johnson & Johnson (NYSE:JNJ). I see shares as modestly undervalued ahead of its Q4 earnings report while the technicals are less attractive.

US Large-Cap Pharma’s Underperformance

According to Bank of America Global Research, Johnson & Johnson is a leading global healthcare company that develops, manufactures, and markets a diversified portfolio of products in pharmaceuticals, medical devices, and consumer health.

The New Jersey-based $388 billion market cap Pharmaceuticals industry company within the Healthcare sector trades at a below-market 16.2 forward 12-month non-GAAP price-to-earnings ratio and pays an above-market 3.0% dividend yield as of January 4, 2024. Ahead of earnings due out later this month, shares trade with a low 18% implied volatility percentage, and short interest on the stock is modest at just 0.6%.

Back in October, JNJ reported a generally strong quarter. Q3 non-GAAP EPS verified at $2.66, topping the consensus estimate of $2.52 while revenue of $21.4 billion, up 7% from the same period a year earlier, was $300 million better than expected. The management team issued updated FY 2023 guidance of $83.6 billion to $84 billion in net sales with adjusted EPS seen in the $10.07 to $10.13 range, up slightly from its previous outlook.

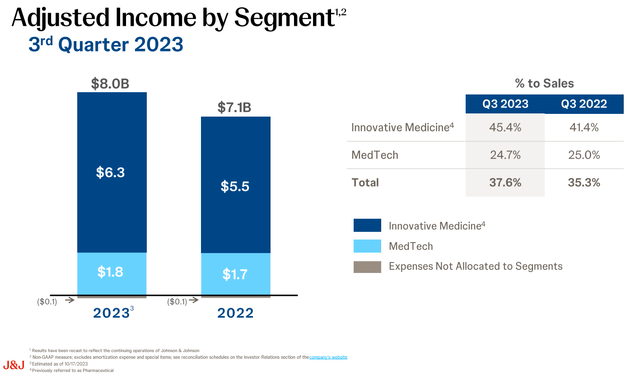

During the quarter, its Pharmaceutical segment was particularly strong, leading to the more sanguine guidance thanks to healthy trends in its Immunology franchise. Weakness in MedTech remains a concern due to a dip in Oncology performance. Then at its Enterprise Business Review Day a month ago, JNJ reaffirmed its guidance while expressing an upbeat outlook of 5% to 7% sales growth from 2025 through 2030.

J&J Segment Profits, Weakness in MedTech

Analysts at Wells Fargo are cautious on JNJ, however. Its team lowered its rating on the pharma giant to equal weight due to the loss of market exclusivity for its Stelara drug, which could cast a cloud over long-term earnings strength. JNJ may have to resort to M&A to achieve its EPS growth objectives, the analysts suggest. Key risks for JNJ include slower growth in MedTech as competitive pressures increase along with a slower drug pipeline. Poor execution and integration of M&A could also hurt the brand over the coming years.

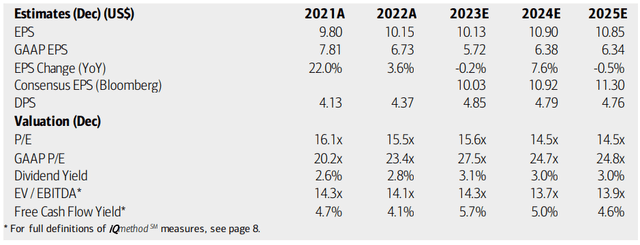

On valuation, analysts at BofA see earnings rising nearly 8% this year following a flat year of operating profit growth. The current consensus outlook, according to Seeking Alpha, reveals an 8% EPS growth rate this year with 4% earnings improvement by 2025. Top-line growth is expected to be in the 2% to 4% range over the next two years. Dividends, meanwhile, are forecast to hold under $5 on an annualized basis over the coming quarters while free cash flow per share hovers near 5%.

J&J: Earnings, Valuation, Dividend Yield, Free Cash Flow Forecasts

If we assume $10.80 of non-GAAP EPS over the coming 12 months and apply the company’s 5-year average operating P/E of 16.7, then shares should be near $180, making it just slightly undervalued today. I assert that a mid-teens multiple is fair for this defensive healthcare stock given the firm’s earnings trajectory as well as a stable dividend yield. Investors can compare JNJ to stocks in the more expensive Consumer Staples sector too, making it a relative value from that perspective.

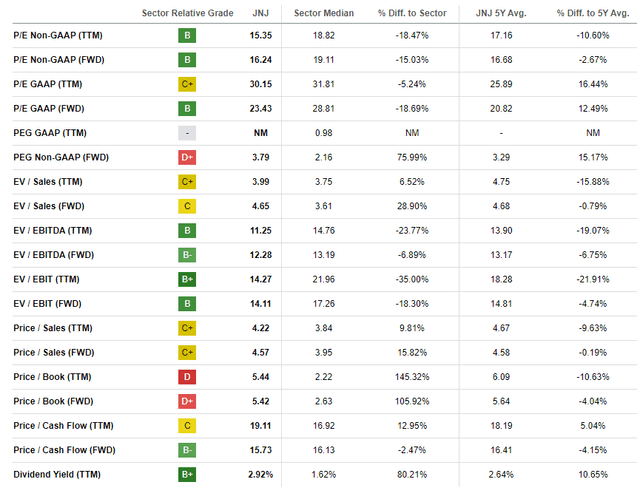

JNJ: Attractive Mid-Teens Forward Multiple, Strong Yield

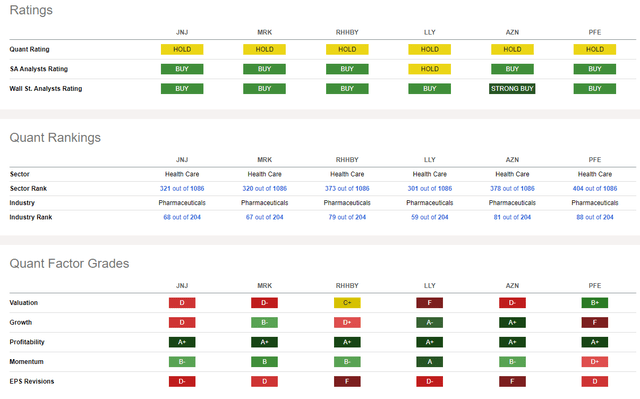

Compared to its peers, JNJ sports a poor valuation grade, but its current earnings multiple is by no means stretched on either an absolute or relative basis. Moreover, with an earnings bounce back this year, I see its growth outlook as improved, though outer-year profit trends are not as robust.

But there is no debate about JNJ’s profitability strength and its capacity to deliver free cash flow while returning value to shareholders. I will lay out later in the article that share-price momentum is lukewarm at best while analyst EPS revisions across the board for the industry have been weak over the last handful of months.

Competitor Analysis

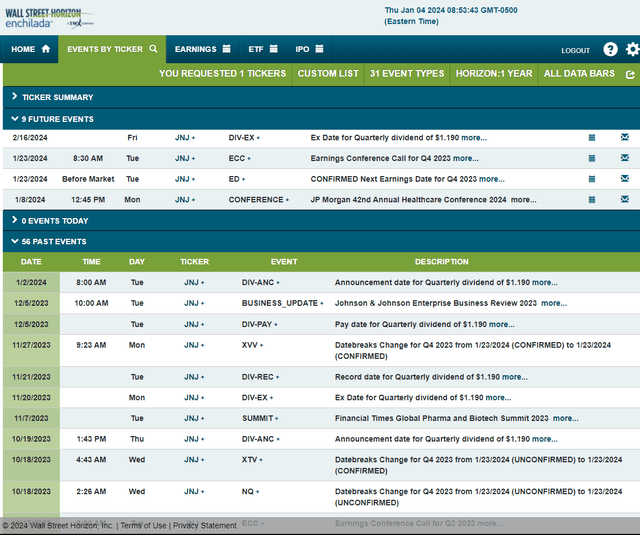

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q4 2023 earnings date of Tuesday, January 23 BMO with a conference call immediately after the numbers are released. You can listen live here. Before the earnings event, JNJ executives are slated to speak at the JPMorgan 42nd Annual Healthcare Conference 2024 from January 8 through 11, often among the most market-moving industry conferences of the year.

Corporate Event Risk Calendar

The Technical Take

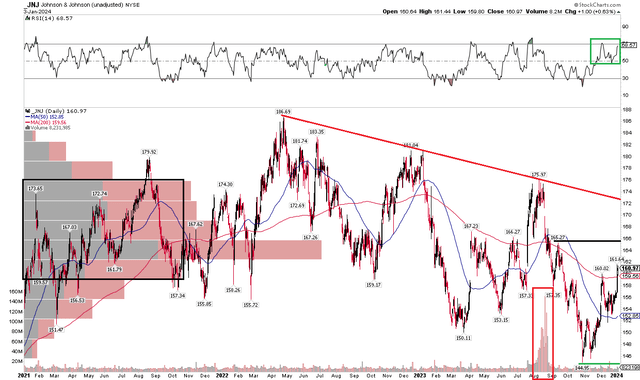

While I see JNJ as modestly undervalued today with a healthy dividend yield, the chart is less impressive. Notice in the graph below that shares remain significantly down from a high notched in April 2022. There is a clear downtrend resistance line off that peak, which currently comes into play around $172, slightly below my intrinsic value target for JNJ.

Also take a look at the long-term 200-day moving average – it’s flat in its slope, suggesting that there is no clear trend. What’s encouraging is that the RSI momentum oscillator at the top of the graph has rebounded into bullish territory, implying that the stock could rally further off its $145 October 2023 cycle low. Still, with a high amount of volume by price all the way up to about $175, it will likely be tough sledding for the bulls to penetrate through all of that bearish overhead supply built up over the past three years. I see near-term resistance at the September bounce-high of $165, but I am particularly concerned about a high-volume decline JNJ experienced in August last year.

Overall, the onus is on the bulls to improve the trend, and the stock has been an underperformer over the past 15 months.

JNJ: No Clear Trend, Downtrend Resistance Line In Play, Improved RSI Momentum

The Bottom Line

I have a buy rating on JNJ. While there are technical concerns, its strong profitability and expected earnings growth, along with a solid dividend yield, make it an attractive defensive stock to own in 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.