Summary:

- The baby powder controversy has continued to impact Johnson & Johnson’s share price.

- Johnson & Johnson is scrambling to find ways to deal with more than 40,000 lawsuits it’s facing.

- The company has issued a cautious forecast for 2023 in the wake of inflation.

- This article focuses on the fundamentals, the real value versus the current share price, and whether Johnson & Johnson is currently worth investing in.

Justin Sullivan/Getty Images News

Johnson & Johnson (NYSE:JNJ) is one of the oldest players in the healthcare market. However, the company is in a crisis due to its baby powder controversy. It is facing more than 40,000 lawsuits throughout the U.S. for J&J’s talc powder, which is said to create various health problems, especially among women and children. Just in 2021, the company’s request to overturn a Missouri state court ruling that awarded a sum of $2.1 billion to 22 women was rejected by the U.S. Supreme Court.

An avalanche of lawsuits is still pending against the company, which is facing heat for its talcum powder controversy. Although JNJ denies any medical issues that could be caused by its products, it has made a settlement offer of $8.9 billion to settle all the claims. The J&J unit (subsidiary company LTL Management) has even filed for a second bankruptcy to facilitate the deal. However, there are various legal challenges that experts will still face in the company.

When considering these current stories about JNJ, we need to determine which news topics will have a long-term and ongoing effect on the company and its share price. Currently, experts believe that the baby powder controversy could continue to impact the Johnson & Johnson brand name its share prices in the future.

While current news stories, good or bad can sway our opinion about investing in a company, it’s good to analyze the fundamentals of the company and to see where it’s been in the past and in which direction it’s heading.

This article will focus on the long-term fundamentals of Johnson & Johnson, which tend to give us a better picture of the company as a viable investment. I also analyze the value of the company versus the price and help you to determine if JNJ is currently trading at a bargain price. I provide various situations which help estimate the company’s future returns. In closing, I will tell you my personal opinion about whether I’m interested in taking a position in this company and why.

Snapshot of the Company

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. If we look at the overall company rating score, then Johnson & Johnson has managed to score around 84.5 out of 100. In a nutshell, JNJ is certainly considered to be a good company in most categories.

Before jumping to conclusions, we’ll have to look closer into individual categories to see what’s going on.

Fundamentals

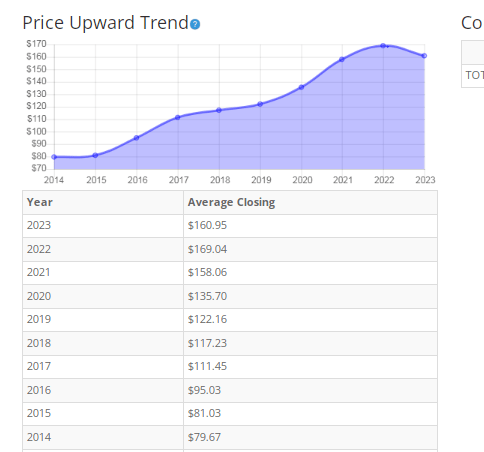

If we look at the share price of Johnson & Johnson closely, we see that the company managed to enjoy continuous growth in its prices from 2014 to 2022. In the recent few months of 2023, the share price has stayed below the $160 mark, but it is still too early to say how the price will play out till the end of this year.

The share price saw a significant increase from 2020 to 2021, when it went up to $158.06 from $135.70. The primary reason for the growth can be attributed to the Covid-19 pandemic since JNJ was one of the biggest vaccine producers. To summarize, the compound annual growth rate (CAGR) for JNJ share is 102%, while the share price doubled in the last ten years.

Share price average has grown by about 102.02% over the past 10 years or a Compound Annual Growth Rate of 8.13%. This is a mediocre return for this time period.

BTMA Stock Analyzer

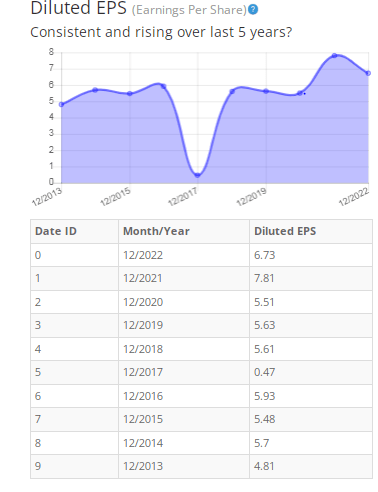

Earnings per Share

On the surface, it appears that there are significant fluctuations in the overall EPS of the company. Especially in 2017, the EPS really took a dive. But when examining this year more, we can determine that tax charges were a major cause of the 2017 EPS dip. Outside of that year, EPS levels have remained stable. The key word is “stable,” as you can see that JNJ is more of a stability investment rather than a high-growth investment.

On the other end of the spectrum, EPS shot up in 2021, but this could be closely tied to the company’s increased earnings due to the COVID vaccine. When dismissing the temporary effects of 2017 and 2021, we can again realize that Johnson and Johnson maintains its earning level with slight growth.

BTMA Stock Analyzer

Since earnings and price per share don’t always give the whole picture, it’s good to look at other factors like the gross margins, return on equity, and return on invested capital.

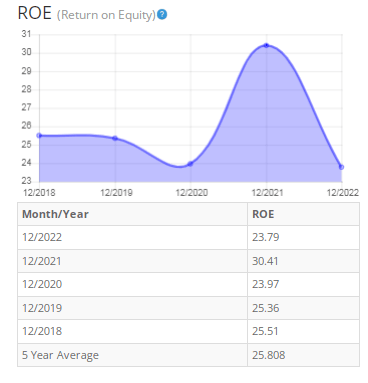

Return on Equity

The return on equity also shows fluctuations like the EPS chart above. But again, this is caused by the temporary surge in earnings from the COVID vaccine. If we dismiss this temporary earnings jump, we can realize that JNJ maintains acceptable ROE levels around 24% to 26%.

For return on equity (ROE), I look for a 5-year average of 16% or more. In the case of JNJ, the 5 year average ROE is around 26%, so it clearly meets my requirements.

Let’s also go over the ROE of JNJ compared to the overall industry. The average ROE for 254 companies in the healthcare industry is around 7.09%.

Therefore, JNJ’s 5-year average of 26% and current ROE of 23.79% is impressive, at more than 3x the industry average.

BTMA Stock Analyzer

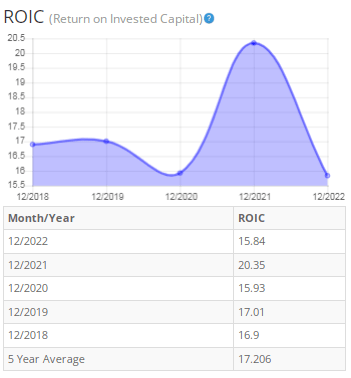

Return on Invested Capital

There have been ups and downs when it comes to the Return on Invested Capital for JNJ. Again, the 2021 number is inflated because of the increased COVID vaccine earnings. The average ROIC for the past 5 years is around 17.2%. For return on invested capital (ROIC), I look for a 5-year average of 16% or more. So, JNJ passes this test as well.

BTMA Stock Analyzer

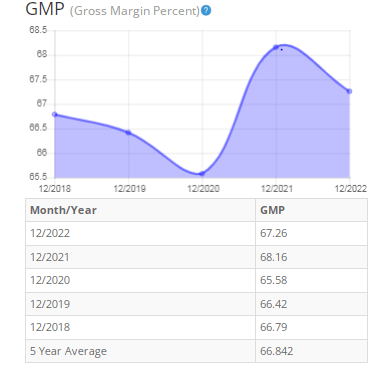

Gross Margin Percent

The gross profit margin hasn’t seen huge movements in the last couple of years. It remained more or less the same from 2018 to 2019 (66.79 and 66.42, respectively) before dropping to 65.58 in 2020. Overall, it has stayed between the range of 65 to 69 for the last 5 years. I typically look for companies with gross margin percent consistently above 30%. As for JNJ, it has a 5-year average of 66.84, which means that it passes this test with flying colors and indicates that JNJ has the ability to maintain great margins and pricing power of its competitors.

BTMA Stock Analyzer

Financial Stability Indicators

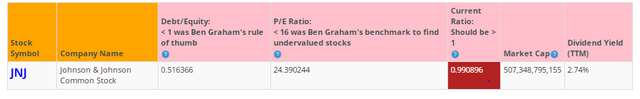

Looking at other fundamentals involving the balance sheet, we can see that the debt-to-equity for JNJ is impressive at less than 1. This means that JNJ owns more than it owes and has long-term financial stability.

On the other hand, the current ratio could use improvement. Ideally, we’d want to see a Current Ratio of more than 1. The lower the number, the more potential risk of a liquidity issue, so JNJ should focus on improving their short term cash-to-liabilities balance.

This analysis wouldn’t be complete without considering the value of the company vs. the share price

Value vs. Price

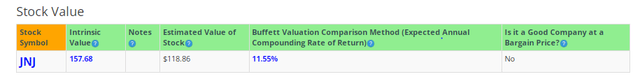

The stock’s estimated value is around $118.86, whereas the current price is $163.70, which indicates that now might not be the right time to buy this stock.

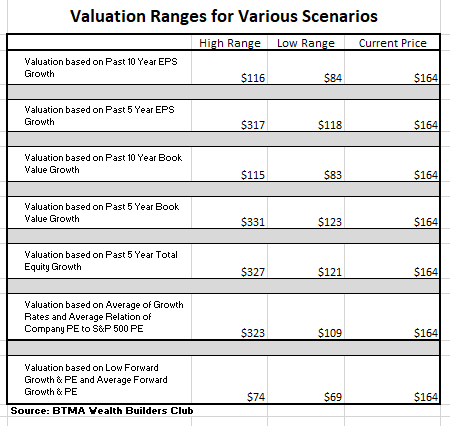

For more detailed valuation purposes, I will use the diluted EPS TTM of 4.77. I’ve used various past averages of growth rates and PE Ratios to calculate different scenarios of valuation ranges from low to average values. The valuations compare growth rates of EPS, Book Value, and Total Equity.

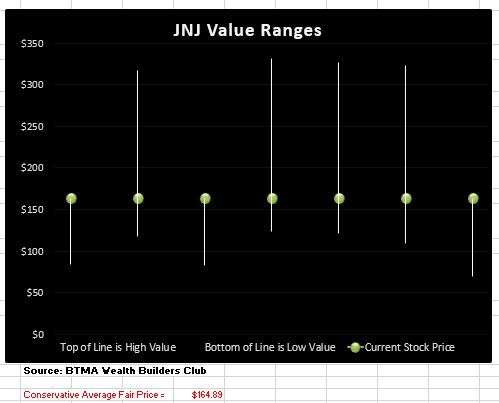

In the table below, you can see the different scenarios, and in the chart, you will see vertical valuation lines that correspond to the table valuation ranges. The dots on the lines represent the current stock price. If the dot is towards the bottom of the valuation range, this would indicate that the stock is undervalued. If the dot is near the top of the valuation line, this will show an overvalued stock.

BTMA Wealth Builders Club BTMA Wealth Builders Club

This analysis shows an average valuation of around $164 per share versus its current price of about $164, this would indicate that JNJ stock is fairly priced.

Summarizing the Fundamentals

Fundamentally, Johnson & Johnson is a rock-solid company. All of its fundamentals are stable and at acceptable levels, including EPS, ROE, ROI, and Gross Margin.

Financially the company is sound with more equity than debt. One area needing slight improvement could be the short-term liquidity situation as noted by its current ratio of less than 1. This can be especially concerning since the company currently faces lawsuits for its baby powder controversies.

These lawsuits could also sway investors from investing or re-investing in JNJ. It may even discourage customers from purchasing its products (especially its baby powder). In turn, this would negatively affect earnings and share price.

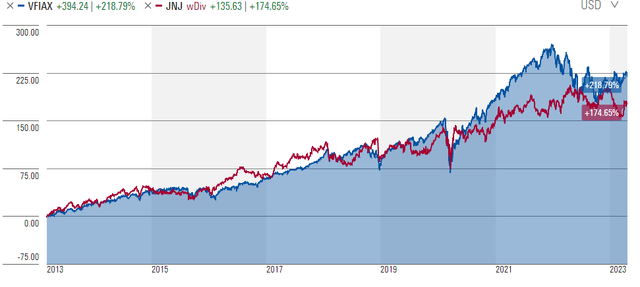

JNJ Vs. The S&P 500

Let’s look at how JNJ has performed in line against the S&P 500 (SP500) in the last 10 years. We can see that JNJ has mostly mimicked the return of the market benchmark. However, in recent years, JNJ has noticeably underperformed against the S&P 500. This chart helps me to realize that it might not be worth investing in JNJ if it performs in a similar or worse fashion than the S&P 500. This realization is further amplified when considering that JNJ is much less diversified than the S&P 500. JNJ seems more risky, with less return potential than an S&P 500 index fund.

The only situation that I could see it being advantageous to invest in JNJ is if I could buy it at a significant discount, so that the potential gain would reduce the risk.

Forward-Looking Conclusion

Over the next five years, the analysts following this company expect it to grow earnings at an average annual rate of 4.34%.

In addition, this stock’s average one-year price target is $179.35, which is about a 9.5% increase in a year.

Does JNJ Pass My Checklist?

- Company Rating 70+ out of 100? YES (84.75)

- Share Price Compound Annual Growth Rate > 12%? NO (8.13%)

- Earnings history mostly increasing? YES

- ROE (5-year average 16% or greater)? YES (25.88%)

- ROIC (5-year average 16% or greater)? YES (17.02%)

- Gross Margin % (5-year average > 30%)? YES (66.84%)

- Debt-to-Equity (less than 1)? YES

- Current Ratio (greater than 1)? NO (0.99)

- Outperformed S&P 500 during most of the past 10 years? NO

- Do I think this company will continue successfully selling the same main product/service for the next 10 years? YES

JNJ scored 7/10 or 70%. It seems worth considering as a potential investment.

Is JNJ currently selling at a bargain price?

- Price Earnings less than 16? NO (24.39)

- Estimated Value greater than Current Stock Price? NO (Estimated Value $118.86 > $163.70 Stock Price) and my detailed valuation indicates that the stock is fairly priced.

Valuation metrics suggest that JNJ is selling at a price that’s fair to overpriced.

Fundamentals show a long-time solid company that can command a higher selling price. But the company’s brand name and reputation has been tarnished recently with a plethora of lawsuits.

Loss of trust in the company’s management and products could sour customers and investors from continuing to invest in the stock. As this happens, and if more negative news is revealed in relation to the lawsuits, the share price could fall further.

I see this as a chance to own a solid business that could later be selling at an even better bargain price. I have Johnson & Johnson on my watchlist and I’ll be waiting to take a position if the price falls to new lows, which would make it too attractive to pass up.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to find good companies at bargain prices that will provide you with long-term returns and dividends in any investing climate, then my Seeking Alpha Marketplace service (Good Stocks@Bargain Prices) is a good match for you.