Summary:

- JNJ is a dividend king for having increased their dividend for 50+ consecutive years.

- At the end of the year, JNJ will be spinning off its consumer health segment into a separate public company called Kenvue.

- Talc powder lawsuits have both put pressure on the stock, but also added opportunity for long-term investors.

Justin Sullivan

Johnson & Johnson (NYSE:JNJ) is a healthcare conglomerate that has been a favorite amongst dividend investors for decades. However, returns have not been all that great of late as the company has dealt with political pressures, lawsuits, and is going through a structural change.

Short term investors, it’s probably a tough stock to be in at the moment given the uncertainty. On the flip side, for long-term investors, this could present a great opportunity to invest in a blue-chip dividend king.

Over the past 12 months, JNJ stock has fallen nearly 15%, falling from a market cap above $480 billion to a market cap of nearly $400 billion.

Lawsuits Adding Uncertainty To An Otherwise Stable Company

Rarely do I discuss Johnson & Johnson and mention added risk and uncertainty, but that is currently the case right now with JNJ. Lawsuits hanging over does have both due to its ongoing litigation cases regarding their talc powder.

More than 40,000 plaintiffs have sued the company with some claiming that the company had known about issues regarding its baby powder and other talc-based products having contained traces of asbestos, a carcinogen. Others claimed the talc itself was an irritant that led to ovarian cancer.

After the third circuit court of appeals failed to overturn their decision, JNJ is taking things to the next level by requesting the Supreme Court to review the case, in hopes their subsidiary that filed bankruptcy would take on the liability.

The company could be on the hook for billions, but there is a lot of unknown here at the moment, but at the same time, JNJ is a company that generated over $17.2 billion in free cash flow last year. However, this was a 13% decrease from 2021, largely due to a negative impact of $1.3 billion from inventory related issues.

A New Look Johnson & Johnson On The Horizon

Aside from the talc related lawsuits, JNJ will be spinning off its consumer health segment to a new public company called Kenvue. The consumer health segment is the smallest segment and the slowest growing segment. Consumer health is the segment that holds many household names that consumers have become familiar with over the years. Some of those products include:

- Tylenol

- Motrin

- Zyrtec

- Listerine

- Aveen

- Johnson’s

- Neutrogena

These are just some of the many popular products produced by JNJ’s consumer health segment. This segment is the smallest and slowest growing of the three primary segments of JNJ, which also include pharmaceuticals and MedTech. The spin-off into a new company called Kenvue (KVUE), is expected to take place in Q4 2023. Kenvue will continue paying a dividend, but it is unclear how much yet, so investors will need to stay tuned

Consistent Dividend Growth At A Low Valuation

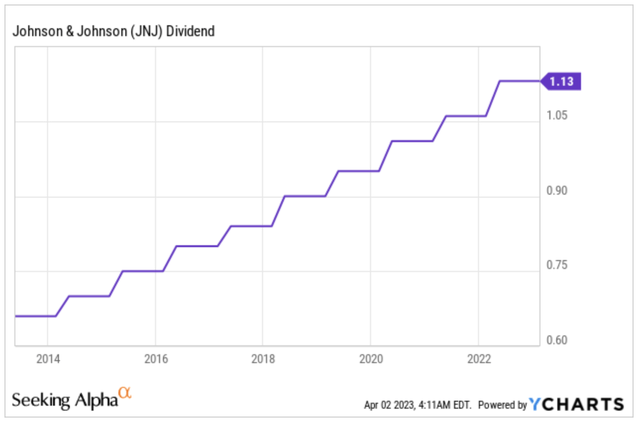

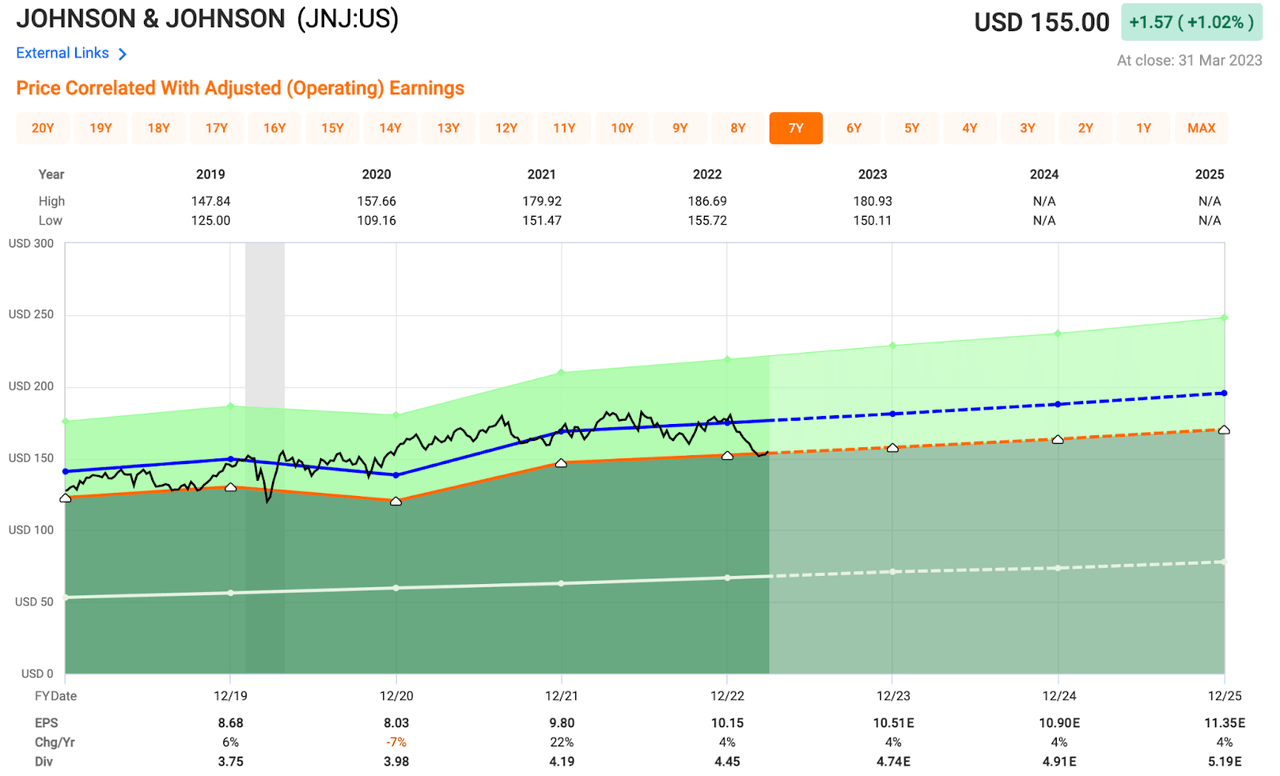

Let’s begin by taking a look at the dividend. JNJ has paid a growing dividend for 60 years now, which makes them a dividend king. The company currently yields a 2.9% dividend with a five-year dividend growth rate of 6%. The payout ratio is low at 44%, meaning there is plenty of room to continue growing the dividend moving forward. However, dividend growth may be slow due in large part to the uncertainty around the lawsuits.

In terms of performance, JNJ shares have been under pressure, down more than 12% on the year due in large part to the lawsuits I just discussed. This has created an opportunity for long-term investors that do not mind adding a little risk and uncertainty for a long-term blue-chip company like Johnson & Johnson.

The company currently trades at a P/E multiple of 14.7x which is well below their five year average of 17.2x. This is the lowest valuation we have seen since March 2020.

Investor Takeaway

Johnson & Johnson has long been known for its safety, consistency, and dividend growth. However, the talc related issues have thrown a wrench in that of late, which has put pressure on the stock.

The lawsuits could cost the company billions, but the company is a money printing machine with strong cash flows, making any large settlement something the company can handle. It will certainly have an impact on the business and will likely impact the dividend. I fully expect the company to continue growing their dividend to maintain their Dividend King status, but the growth I expect to be minute, at least until there is more clarity for management.

In terms of earnings impact, the settlement amounts are still unknown and will be for a while, but I do not expect this to disrupt the regular business activities and strategy moving forward. The uncertainty is what has led to the undervalued stock.

However, the low valuation is what you get for taking on that risk and uncertainty as the company goes through the appeals and potential settlement process.

Being a long-term investor, the risk is definitely worth the potential reward to invest in a AAA rated company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

no marketing to add