Summary:

- Johnson & Johnson had spun off Kenvue, its consumer health division, to boost growth in its more profitable pharmaceutical and medical technology sectors.

- JNJ achieved a steady 3.3% revenue growth over the past decade with a stable 26.6% average operating margin, showing resilience even during market turbulence.

- While analysts predict an annualized EPS growth of 4%, I hold a more optimistic view, expecting JNJ to achieve approximately 5% EPS growth over the next decade.

- Based on my analysis, if the anticipated EPS growth materializes, we could potentially see the stock price reach $219 by the end of 2031, resulting in a total return of nearly 7%, factoring in dividends.

- For JNJ, a company with a AAA credit rating, I recommend a Hold rating for investors seeking to outperform the market and achieve dividend growth exceeding JNJ’s 5-year average of 5.92%.

Sundry Photography

Investment Thesis

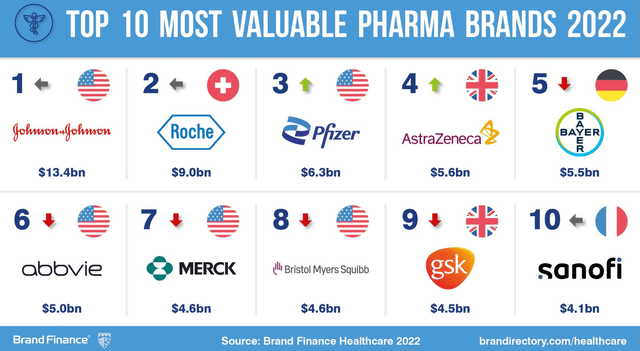

Johnson & Johnson (NYSE:JNJ) is a renowned worldwide healthcare conglomerate celebrated for its extensive array of pharmaceuticals, medical devices, and consumer healthcare merchandise. In 2022, Johnson & Johnson was acknowledged as the most valuable brand in the pharmaceutical sector, with an impressive brand value of $13.4 billion.

Most Valuable Pharma Brands (Brand Finance Healthcare 2022)

The company recently initiated the spinoff of its consumer healthcare products division, now known as Kenvue (KVUE), to unlock value in this more lucrative pharmaceutical business and medical technology. While I view this move as positive sign to potentially deliver slightly better growth that in the past decade, both me and analysts are skeptical that this move will deliver market beating returns of the company over the next decade to come.

That being said, I decided to divest my JNJ investment earlier this year. Initially, the company constituted around 3% of my investment portfolio. However, given the market’s underperformance in recent years and the fact that the company has only achieved a 5.9% dividend growth rate over the past five years, it no longer aligns with my investment criteria. While I still consider JNJ an excellent choice for individuals seeking a defensive addition to their portfolio and a source of safe and stable income from a AAA-rated company.

With that in mind, I give the company a HOLD rating for those who share my criteria of aiming for market-beating returns with at least a 10% annual dividend growth rate. On the other hand, for individuals in pursuit of stability and a secure income source, JNJ remains an excellent choice.

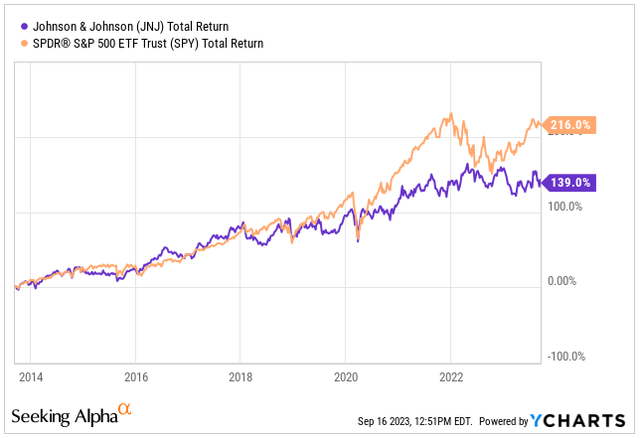

Total Return (Seeking Alpha / YCHARTS)

Business Update & Kenvue Spin-off

Let’s start off the business update by taking a look at JNJ’s historical financials. Over the past decade, the company has been steadily increasing both its revenue and operating profit. It’s worth noting that this growth has been rather slow, with an annualized rate of only 3.3%. However, on the bright side, JNJ has maintained a high level of profitability throughout this period, with an average operating margin of approximately 26.6%. Even during the challenging times of the pandemic, from its peak in 2016 to the lowest point in 2020, the operating margin only saw a modest decrease of less than 5%.

I believe many of readers would agree, that one of the key reasons why JNJ has garnered such a large following is its predictability and consistent profitability. This is especially appealing during challenging market periods when other sectors may be much more volatile. JNJ’s beta stands at a modest 0.54, which indicates that if the overall market sees a 10% decline, JNJ is expected to have a more moderate 5% decrease in its stock price, and vice versa.

Historical Financials (Author’s Graph (Data Seeking Alpha))

In Q2, JNJ has successfully executed the spin-off of its consumer health division, Kenvue, as part of its strategy to unlock value within its larger and more lucrative pharmaceutical and medical technology business divisions. This move aligns with the trend observed among major pharmaceutical companies, as many are divesting lower-margin, yet consistently profitable, consumer units to concentrate on the high-stakes arena of developing innovative medicines.

In my opinion, the allure of exclusive new products has grown stronger, especially with the notable success of treatments such as Merck & Co.’s (MRK) Keytruda and weight-loss therapies from companies like Novo Nordisk (NVO) and Eli Lilly and Co. (LLY).

When JNJ initially announced the exchange offer in July, the company held approximately 1.7 billion shares of Kenvue stock, which accounted for roughly 90% ownership in the company. The proposal involved trading up to 1.54 billion of these Kenvue shares in exchange for JNJ shares at a 7% discount, which ultimately led to decrease in JNJ’s shares outstanding of 7.3%.

Through the offering of Kenvue debt and the sale of its shares, JNJ secured $13.2 billion in cash. As a result, it now retains a 9.5% equity stake in the newly spun-off consumer health entity. Additionally, JNJ has affirmed its commitment to maintaining its quarterly dividend of $1.19 per share.

Following the separation of Kenvue, JNJ has adjusted its guidance for 2023 earnings. Excluding certain items, the projected earnings per share will be in the range of $10 to $10.10, omitting the consumer division’s contribution. This marks a shift from the previous earnings forecast of $10.70 to $10.80 per share, as indicated back in July.

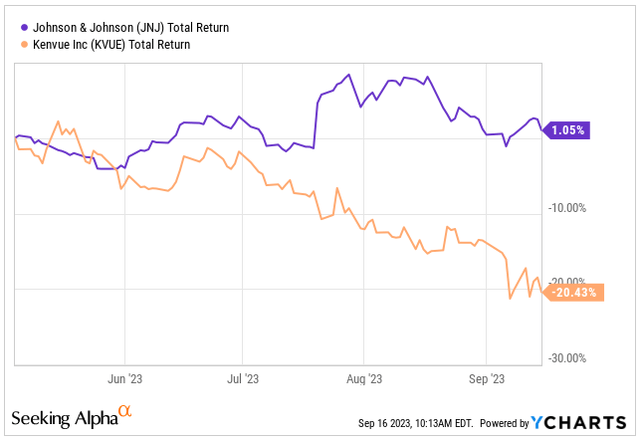

In my perspective, Kenvue might appear as an enticing investment opportunity, thanks to its robust brand portfolio and the promise of newly unlocked growth on the horizon. However, it’s crucial to highlight that the stock hasn’t performed favorably since the spin-off, declining over 20%, while JNJ has remained virtually flat.

Total Return (Seeking Alpha / YCHARTS)

Outlook

As I mentioned earlier regarding the spin-off, JNJ has actually revised down its EPS guidance for 2023 to a range of $10.0 to $10.1, down from the previous guidance of $10.7 to $10.8, marking a decrease of about 7%. With the spin-off, the company essentially traded a revenue-generating powerhouse for cash that they can now allocate to their pharmaceutical and med-tech business divisions to fuel growth. This also implies that the company will report lower revenue next year, likely dropping by around 11% from the previously guided approximately $99.5 billion for 2023 to $89.5 billion for the following year. However, the impact on EPS should be minimal, considering the significant reduction in outstanding shares during the spin-off process.

I want to highlight that the consumer health business will be classified as discontinued operations, resulting in a gain of approximately $20 billion in Q3.

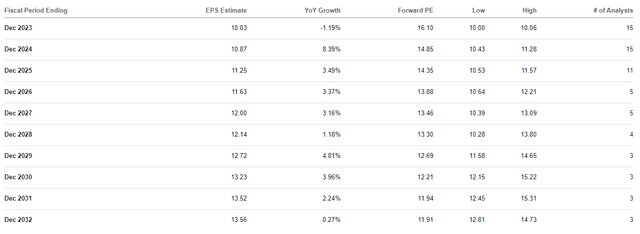

Looking ahead, when it comes to anticipated growth, analysts are forecasting a relatively modest 4% annualized growth rate for the company over the next nine years. In my view, this growth projection appears somewhat conservative, as it doesn’t fully account for the potential benefits stemming from the Kenvue spin-off. Moreover, it doesn’t factor in the newfound value in the weight loss segment, assuming JNJ’s clinical development initiative, currently in Phase 1 for obesity, progresses successfully. It’s important to note that at this stage, there’s an average 59% chance of advancing past this phase. However, if successful, it could open up a substantial market opportunity for JNJ, projected to reach $77 billion by 2030. This roughly translates to an expenditure of $10 per person worldwide.

Financial Forecast (Seeking Alpha)

The analysts’ assumptions seem rather cautious, especially when we take into account the projected growth of the pharmaceutical industry as a whole, which is set to achieve at least a CAGR of 5.80% until 2030. While the oncology market currently holds the top position in terms of total value and is expected to maintain its prominence, it’s worth noting that the weight-loss segment is poised for the most rapid growth.

Given these factors and considering JNJ’s already substantial size, I anticipate that the company has the potential to deliver annual growth closer to the range of 5.0% to 5.5% in both its top and bottom lines over the coming decade. This would also mark an increase from the historical annual growth of 3.3%.

Valuation

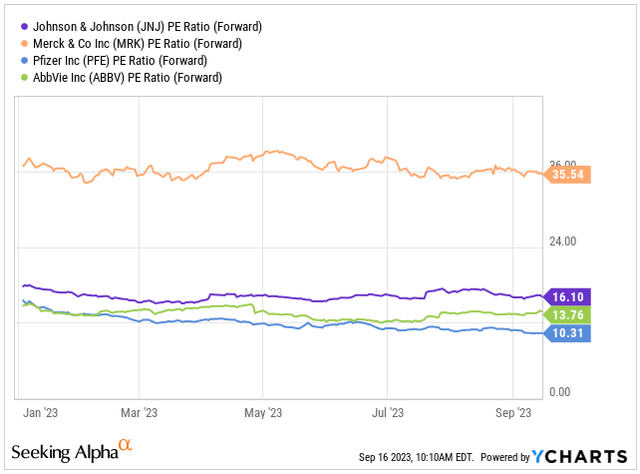

Now, turning to the valuation, let’s start with the Forward PE ratio in comparison to JNJ’s peers. Presently, the company is trading at a Forward PE ratio of 16.10x for FY24 earnings, which is slightly lower than its 5-year average Forward PE ratio of 16.78x. When we assess JNJ against its peers, it positions itself right in the middle. On one side of the spectrum, we find Merck, which, in my opinion, is relatively expensive, having experienced a strong stock price performance in late 2022 and currently trading at 35.54x. On the other side of the scale, there’s AbbVie (ABBV), with a ratio of 13.76x, and Pfizer (PFE), trading at 10.31x.

Considering this analysis, it appears that JNJ is trading relatively close to what could be considered its fair value. However, it’s important to note that this assessment doesn’t factor in the growth potential beyond FY24. So, let’s now shift our focus to the future.

Forward PE Ratio (Seeking Alpha / YCHARTS)

As I mentioned earlier, it’s important to anticipate a decline in revenue in 2024 due to the spin-off and the sale of Kenvue shares. Regarding other assumptions for this analysis, I anticipate the company’s revenue to grow at an annualized rate of 5%, with EPS following a similar growth trajectory. If this scenario materializes, JNJ is on track to achieve approximately $121 billion in sales by 2031, marking a substantial 40% increase from the expected revenue at the end of 2023. Simultaneously, I project that EPS will reach $14.6, representing a slightly higher increase of 46% from the 2023 figures. Assuming a 5-year average Forward PE ratio of 16.7x for its earnings in the next year, I expect the company to continue trading within a similar range moving forward.

|

Fiscal Year |

2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 |

| Revenue (b$) | 89.5 | 94.0 | 98.7 | 103.6 | 108.3 | 112.6 | 117.1 | 121.2 |

| Rev. Growth | -11% | 5.0% | 5.0% | 5.0% | 4.5% | 4.0% | 4.0% | 3.5% |

| EPS ($) | 10.9 | 11.4 | 12.0 | 12.6 | 13.1 | 13.7 | 14.2 | 14.6 |

| EPS Growth | 8.4% | 5.0% | 5.0% | 5.0% | 4.5% | 4.0% |

4.0% |

3.0% |

| Forward PE | 17 | 16 | 16 | 16 | 15 | 15 | 15 | 15 |

| Stock Price ($) | 185 | 183 | 191 | 201 | 197 | 205 | 213 | 219 |

Considering these factors, I anticipate that the company’s stock could reach approximately $219 by the end of 2031. This would represent a solid 36% increase from its current trading level of $161.5. In practical terms, this translates to an estimated 4% annualized growth in the stock price. When factoring in the company’s current dividend yield of 2.87%, investors might expect a total return of just under 7% on an annual basis. While this falls slightly short of the historical total returns of the S&P 500, which have averaged around 10.2%, it’s worth highlighting that JNJ boasts a AAA credit rating and has a Beta of only 0.54. This makes it an appealing choice for those seeking stability and a dependable income source, particularly as a defensive holding during periods of market turbulence.

However, if I consider my investment criteria, which prioritize achieving returns that beat the market, along with a commitment to superior dividend growth of at least 10%, JNJ doesn’t quite meet these standards. The company has only managed to achieve an annualized dividend growth rate of 5.92% over the past 5 years.

With these considerations in mind, I would rate the company as a buy for individuals looking for stability and a safe dividend income. On the other hand, for those who are actively seeking investments that can outperform the market while delivering robust dividend growth, I would recommend exploring alternative options.

Conclusion

Over the past decade, JNJ has been a beacon of stability in terms of its financial performance. The company has managed to maintain a consistent top-line growth rate of 3.3% annually. While it may not be setting records for the fastest growth, what’s really notable is JNJ’s impressive profitability, with an average operating margin of 26.6%. Even during tough times, the company remains highly profitable.

Now, with the recent spin-off of its consumer health division, JNJ is strategically focusing on its larger and more lucrative pharmaceutical and medical technology divisions. This strategic shift is a positive development. However, analysts are forecasting relatively modest EPS growth of around 4%. While I’m a bit more optimistic, believing JNJ could achieve at least 5% growth over the next decade, it’s important to manage expectations. We’re unlikely to see returns that surpass the broader market.

In summary, JNJ appears to be a solid choice for investors seeking a dependable income source, especially if you value stability and safety. However, if your goal is to outperform the market, it might be prudent to either HOLD your existing positions or explore alternative investment opportunities elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.