Summary:

- Johnson & Johnson stock has continued to underperform the healthcare sector, worrying JNJ investors.

- JNJ’s potentially massive talc-related legal liabilities will likely affect buying sentiment.

- However, it’s easy to forget that JNJ is a fundamentally strong business with robust free cash flow profitability.

- Investors should be careful about buying JNJ when overvalued, but it’s not.

- Dip-buyers were assessed to have returned with conviction last week, providing JNJ investors another solid buying opportunity.

Wachiwit

Johnson & Johnson (NYSE:JNJ) investors have had to deal with massive downside volatility as JNJ continues underperforming its healthcare sector (XLV) peers. I maintained my bullish thesis on JNJ in my previous article. However, JNJ’s continued underperformance has continued to baffle me, suggesting the market remains concerned over the structural impediments attributed to its potential legal liabilities.

Even though JNJ posted a solid first-quarter earnings scorecard in mid-April, the leading healthcare company’s guidance was below analysts’ estimates. There are concerns about Johnson & Johnson’s growth momentum in the second half as the company navigates the expected entry of European biosimilars of Stelara. However, Johnson & Johnson’s highly robust profitability and well-diversified business should mitigate these risks.

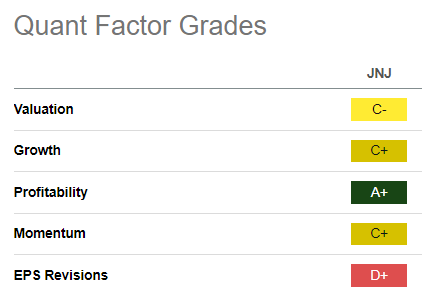

JNJ Quant Grades (Seeking Alpha)

Accordingly, JNJ is assigned an “A+” profitability grade, underscoring its fundamentally strong business model. Over the past five years, Johnson & Johnson has consistently generated free cash flow margins above 20% (except in 2022). With the divestment of its consumer healthcare business, the company has renewed its focus on Innovative Medicine and MedTech business segments.

Both segments delivered robust operational growth in Q1. Accordingly, Innovative Medicine posted 2.5% operational growth, while MedTech delivered 6.3% operational growth. I believe a stronger focus will continue to be placed on JNJ’s Innovative Medicine business, as it accounted for more than 75% of Johnson & Johnson’s corporate EBIT.

Consequently, investors have likely assessed higher execution risks, as JNJ management highlighted concerns attributed to Stelara’s loss of exclusivity. Stelara generated $2.45B in reported sales, accounting for more than 11% of Johnson & Johnson’s reported Q1 revenue base. Therefore, with the impending entry of competitive biosimilars, JNJ could be compelled to introduce more attractive pricing levers to maintain stable volumes.

Despite that, the company anticipates its MedTech segment to maintain its momentum, “with sales growth expected to remain relatively consistent throughout the year.” Therefore, Johnson & Johnson likely wants its investors to focus on the healthcare leaders’ advancements in MedTech to rejuvenate its near-term growth cadence.

As a reminder, Johnson & Johnson leveled up its cardiology platform with the recent $13.1B acquisition of Shockwave. This acquisition, predicated on Shockwave’s intravascular lithotripsy technology, is expected to position the company favorably in the cardiology technology segment. Shockwave’s anticipated 2024 outlook indicates robust growth, even though there could be adjusted EPS dilution over the next two years due to Johnson & Johnson’s financing framework.

Despite that, it underscores Johnson & Johnson’s well-managed, low-leverage balance sheet, bolstered by its solid free cash flow-generating business. With a net debt of just $7.4B in Q1, analysts’ estimates suggest JNJ could regain its net cash position in 2024, bolstering Johnson & Johnson’s ability to make growth-accretive business development investments. Johnson & Johnson management underscored the company’s confidence in its M&A approach. It accentuated that M&A remains a “critical component” of its overall capital allocation strategy, underpinned by “strong cash flow and balance sheet.” As a result, it provides “significant flexibility” to JNJ to execute accretive transactions.

In a potentially higher-for-longer market environment, well-managed businesses like JNJ are well-primed to deliver growth options that bolster the company’s core businesses. Continued progress in the dealmaking space should provide a more constructive framework for Johnson & Johnson to execute well.

Moreover, JNJ recently raised its dividend per share payout by 4.2%, augmenting its appeal to income investors. With JNJ still reasonably valued (“C-” valuation grade), I believe value and income investors will likely find JNJ’s current levels attractive to add more exposure.

Notwithstanding the optimism, Johnson & Johnson’s talc-related liabilities will likely continue to affect a more comprehensive and sustained valuation re-rating in the near term. With JNJ facing ongoing lawsuits, investors will be highly cautious about adding exposure aggressively, given potentially worse-than-expected judgment and payouts that could materially affect JNJ’s FCF and growth drivers. Until the company can execute and deliver a comprehensive settlement through the legal process, JNJ investors must be prepared for potential downside volatility attributed to its talc-related legal woes.

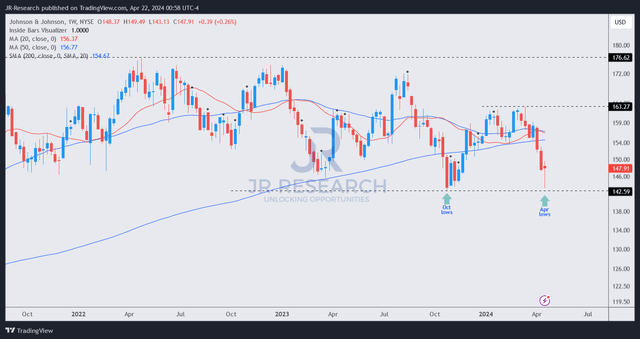

JNJ price chart (weekly, medium-term, adjusted for dividends) (TradingView)

JNJ experienced a steep selloff from its January 2024 highs, down nearly 13% through last week’s lows. As a result, it re-tested its October 2023 lows before bottoming out above the $140 level.

Interestingly, robust buying sentiment returned to undergird JNJ’s bottom last week, suggesting dip-buyers likely helped to defend against further downside volatility.

Therefore, I assessed that near-term pessimism in JNJ is likely reflected, allowing a more attractive risk/reward entry point for long-term JNJ investors to add more exposure.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!