Summary:

- Johnson & Johnson’s underlying business has a stable long-term outlook and the stock has a low volatility profile, which makes it an ideal platform for selling put options.

- The company is trading at a highly attractive valuation, which provides a solid margin of error.

- Selling put options does sacrifice capital appreciation, but with a nearly 10% annualized yield on offer, this opportunity appears to be a win-win to us.

- We’re upgrading JNJ stock to ‘Buy’.

Martin Barraud/OJO Images via Getty Images

We first wrote about Johnson & Johnson (NYSE:JNJ) last June in an article titled: “Johnson & Johnson: Pay Yourself 7% With This Bond-Like Exposure“.

The purpose of the article was twofold – to talk about why JNJ is such a stable long-term investment, and to argue that selling put options on the stock could be a highly profitable way to play the company’s inherently low volatility profile.

Since that article, our advertised trade idea would have outperformed the underlying stock by a bit, getting investors in at a lower price than the market while also paying out a 2.2% cash premium over ~110 days, a payout rate much higher than the dividend over that same span.

While the stock hasn’t ended up appreciating since our ‘hold’ rating, we’re ultimately happy with the performance of our trade idea. Thus, today, we wanted to revisit the stock and pitch a similar move – selling puts in this stable, growing, cash flow machine.

There have been some updates with JNJ over the last year worth noting, and so in this article we’ll touch on JNJ’s new fundamental makeup, estimate Fair Value for the company’s shares, and pitch the aforementioned short put trade idea.

If you’re focused on income, low volatility, or quality as ‘factors’ in your investing, then this might be just what you’re looking for. Let’s dive in.

JNJ’s Financials

As always, let’s start by taking a look at JNJ’s financials.

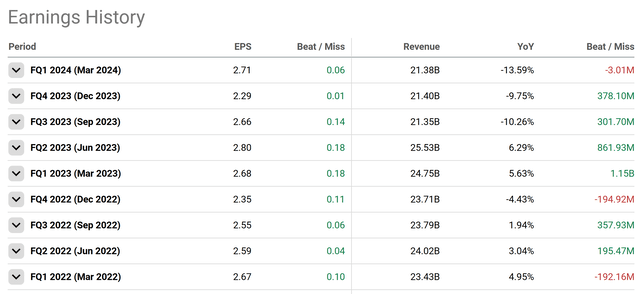

Since our last article, JNJ has posted 4 earnings reports, including Q2, Q3 and Q4 for 2023, and Q1 for 2024. Looking ahead, JNJ is expected to report Q2 2024 earnings in just a few weeks on July 17th.

The reports over the last year have been largely positive, with EPS and revenue both beating analyst estimates, save Q1 of this year’s slight top line miss:

EPS has continued to trend higher vs. 2021 and 2022, while revenue has declined somewhat on the back of the Kenvue (KVUE) consumer staples divestment.

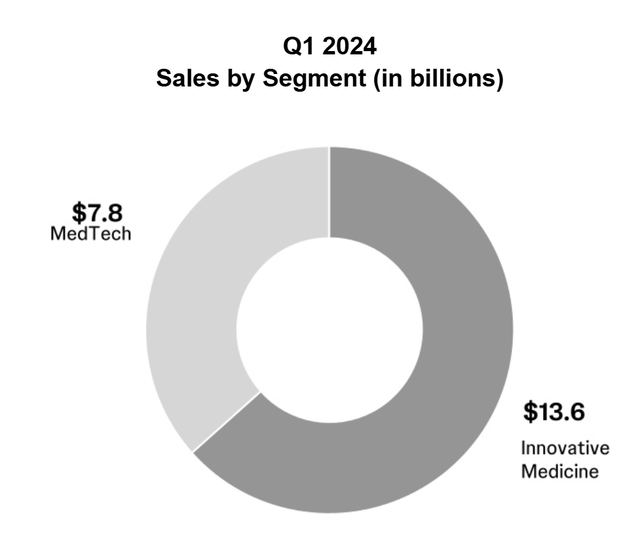

When we wrote about JNJ last year, the company had three main segments – Consumer Care, MedTech, and Pharma. Now, with the Consumer Care division fully split off, JNJ has only retained the MedTech and Pharma segments, as you can see below:

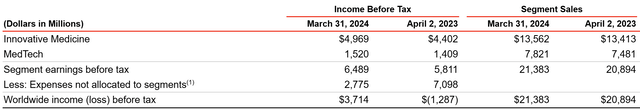

Almost two thirds of JNJ’s revenue comes from its Pharma division, which is also responsible for an even higher percentage of JNJ’s total profit – more than 75% of net income in Q1:

While a cynical investor may argue that JNJ should also jettison the MedTech segment in order to focus on the highly profitable Pharma business (20% MedTech margins vs. 36% for Pharma), we like the diversification that the MedTech segment provides. The business of providing surgery, ortho, and cardio equipment is quite stable over time, and should help to balance out the inevitable swings that come with the business of managing a drug development pipeline.

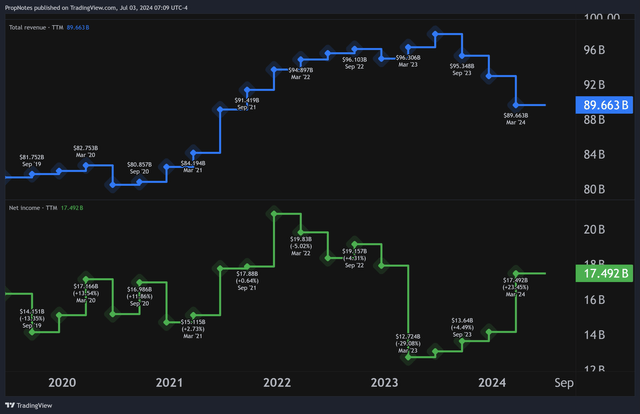

Zooming out, the KVUE spinoff has had a negligible impact on JNJ’s broader financials:

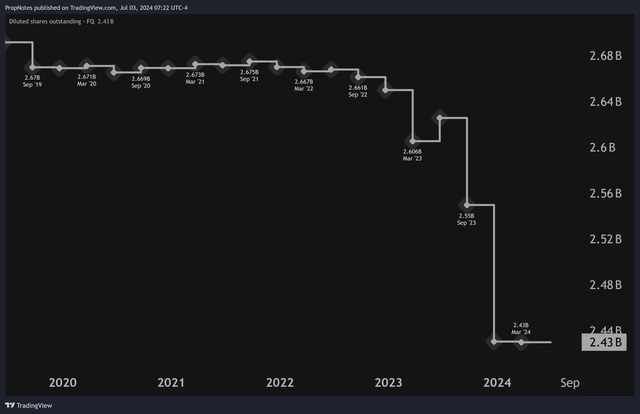

TTM Revenue is still down somewhat a year following the transaction, but TTM Net Income has jumped back up to pre-split levels, which, when combined with the drop in diluted share count, has sent EPS to a record of $2.71 in Q1 of this year:

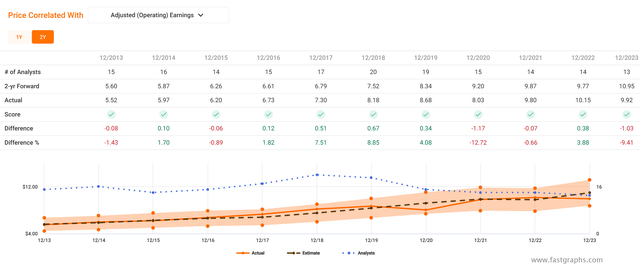

Looking ahead, one unique aspect about JNJ is the company’s high level of predictability on the earnings front.

Analysts have done a broadly good job at predicting earnings multiple years out over the last decade, which gives us confidence as investors that the analyst community, looking forward, should have some insight as to where the company’s fundamental value is headed:

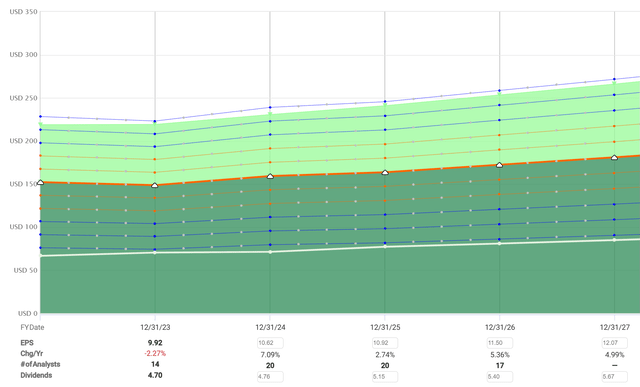

Right now, analysts are expecting JNJ to grow EPS at a muted ~4.8% YoY for the foreseeable future, which is in line with our expectations around both of the company’s mature business segments:

These estimates factor in higher levels of revenue off of the back of inflation and GDP growth, in addition to slight improvements in margins as well as some capital returns to shareholders.

Finally, a boost from JNJ’s recent Shockwave Medical (SWAV) acquisition should provide a perfect complement to JNJ’s existing cardio business. SWAV’s high-growth profile should filter down to the bottom line and also boost EPS between now and 2027.

All in all, JNJ’s fundamental nature has changed somewhat since the KVUE split off, but in our view, it has been entirely to the company’s benefit. Record EPS and a tighter focus should keep the company competitive for the foreseeable future.

JNJ’s Valuation

But what is JNJ worth? Just because we still like JNJ’s strong business performance as a ‘platform’ for selling options doesn’t mean that the valuation hasn’t increased the risk of doing so substantially.

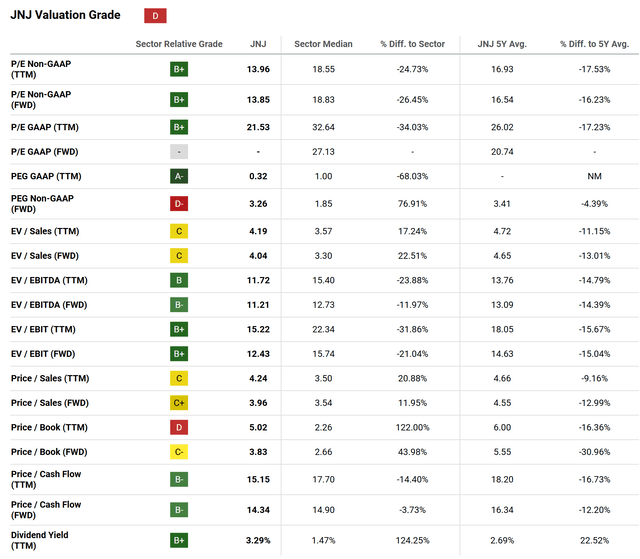

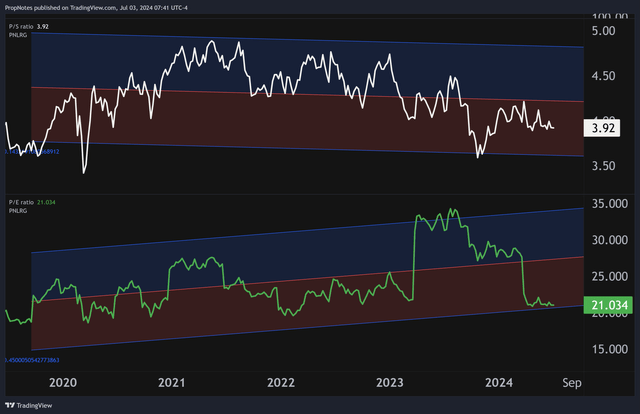

Thankfully, that doesn’t appear to be the case. Right now, JNJ is trading at roughly 4x sales and 21x net income:

Seeking Alpha does rate JNJ a ‘D’ when it comes to the valuation, but that’s only because the quant rating places a high degree of importance on PEG, which skews results a bit.

Looking historically above, you can see that a majority of JNJ’s multiples are trading below their 5-year average by double-digit discounts, which you can also see illustrated in the following chart:

On both the top and bottom line, JNJ is trading towards the bottom of the standard deviation range, which suggests that the valuation, especially on earnings, may revert higher over coming quarters.

From all of these different angles, JNJ appears to be trading at a relatively attractive valuation on backwards looking results.

But what about forward-looking results?

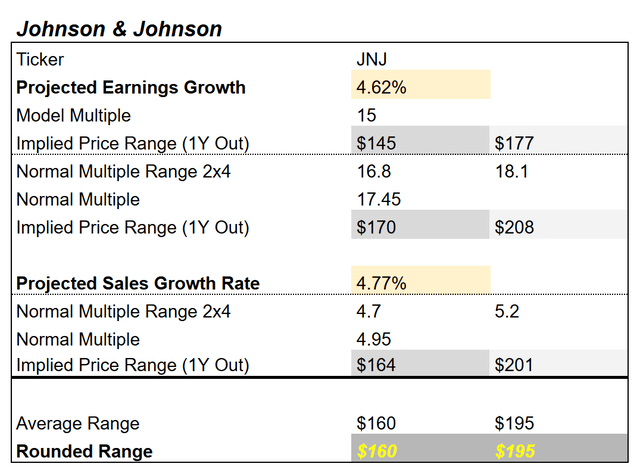

We estimate JNJ’s Fair Value range to be somewhere between $160 and $195:

This calculation factors in three separate ranges and then averages them together to get a reasonable estimate of the company’s ‘Fair Value’. These ranges include a model multiple, as well as two historical earnings and sales multiples, which are then combined with the company’s projected growth rate.

JNJ recently closed yesterday at $146 per share, which shows that an entry into the stock now should come with a pretty considerable margin of safety against too much further downside.

The Trade

While we like the margin of safety and JNJ’s overall business profile, as discussed in this article as well as previously, JNJ definitely isn’t one of those companies that’s going to earn you unbelievable capital appreciation over time.

Internal organic EPS and sales growth rates are low, and the company operates in a saturated market that isn’t about to change substantially in the coming years. Thus – our trade idea: selling put options on JNJ.

Selling put options on a stock sacrifices potential capital appreciation over time for an immediate cash payout. Given everything we’ve discussed, this appears to be an optimal setup for JNJ.

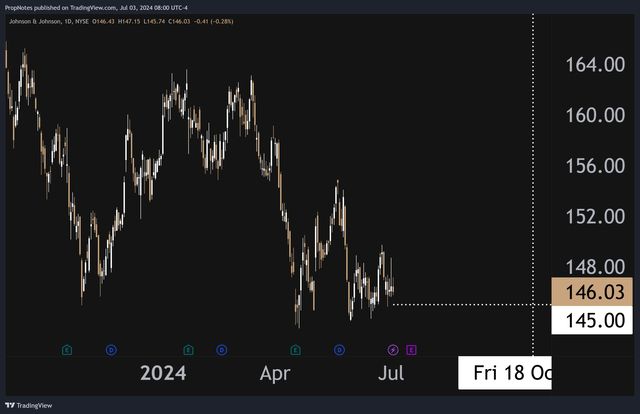

We like the idea of selling the $145 strike October 18th options, which are currently paying $4.10 per contract:

At $4.10 per share, or $410 per contract, these options should require $14,090 in buying power to sell. This cash payout calculates to a 2.8% cash yield, which, over 107 days, annualizes to a healthy 9.8% annualized yield.

If JNJ increases in price between now and October, you get to keep the cash free and clear. If JNJ dips below $145 between now and option expiry, then you’d be obligated to purchase the stock at $145, but you’d still get to keep the $410 in cash, giving you a cost basis neat $141.

In this way, whether you’re earning the cash yield on your buying power or an eventual stock position, the 9.8% annualized capital return is substantially above the yield you can find elsewhere for buying investment grade fixed income products or keeping money in a bank account. Plus, while the position is open, your brokerage account will also pay you interest on your reserved buying power, which should boost the return of this trade even further.

Risks

That said, there are some risks to selling puts on JNJ. Here are three key ones to know.

First off, selling puts could force you to purchase JNJ at a serious premium if the stock takes a huge dive, which would obviously be suboptimal. This isn’t a different risk profile than simply buying shares at present, but it’s something to know. If litigation woes around Talc get worse, for example, this may be something to consider.

Additionally, there are two earnings reports scheduled for between now and option expiry. If the market reacts poorly to these, then the short put trade could suffer material losses, similar to how holding the stock may produce losses in an adverse scenario.

Finally, there’s potential opportunity cost associated with selling put options on JNJ. If the stock does very well, then you’ve capped your upside at the cash payout, which may be far smaller in percentage value than a rally might produce.

Summary

Overall, though, while there are some risks to selling put options in JNJ, we like the company’s stable profile, attractive multiple, and EPS growth prospects. Selling options to capture immediate cash yield while sacrificing upside appears to be a win-win, especially if it leads to a purchase in the stock at an even better price.

We’re also upgrading JNJ to a ‘Buy’ rating.

Good luck out there!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in JNJ over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.