Summary:

- Johnson & Johnson is a healthcare giant, though it will soon shrink in size thanks to the spinout of its consumer healthcare division.

- Litigation around its talc products has progressed, with J&J seemingly likely to make a payout of ~$9bn.

- The Pharmaceuticals division is under threat from the patent expiry of best-selling drug Stelara – although this division is likely management’s priority.

- The medical devices division has recovered from pandemic headwinds but offers incremental growth only – could management offload it?

- The above 4 issues are what I expect to dominate proceedings when Q1 2023 earnings are announced premarket on April 18 – JNJ tends to beat earnings estimates, but I am not sure it will tomorrow, I’d expect a slight correction.

Renphoto

Johnson & Johnson will announce its Q1 2023 earnings tomorrow – in this note, I highlight 4 key issues that I think will be worth looking out for and likely under discussion. While these issues are in play, I am not expecting great things from JNJ share pricewise, although there has been a mini-bear run in play as the talc litigation issues may be on a path to resolution.

Investment Overview

Johnson & Johnson (NYSE:JNJ) is the largest by market cap valuation of what I tend to refer to as the “Big 8” U.S. Pharmas – although perhaps not for much longer.

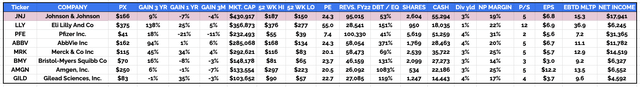

The “Big 8 US Pharmas compared (Data collected from TradingView, Google Finance)

As we can see in the above comparison table the “Big 8” comprises JNJ, Eli Lilly (LLY), Merck & Co. (MRK), AbbVie (ABBV), Pfizer (PFE), Bristol-Myers Squibb (BMY), Amgen (AMGN) and Gilead Sciences (GILD).

Down the years, JNJ has always maintained a healthy lead over the rest of the field by most measure of size – market cap, revenues, net income, and cash, for example. Although Pfizer did deliver a higher revenue number last year, breaking $100bn of revenues, this was mainly due to its twin COVID assets Comirnaty, the vaccine, and Paxlovid, the antiviral, which drove >$50bn revenues between them.

JNJ’s size advantage is derived from the fact that it has 3 major divisions – consumer health, pharmaceutical, and medical devices, whilst the rest of the “Big 8” are primarily involved in pharmaceuticals. In fact, based on pharmaceutical revenues alone, JNJ delivered $52.6bn of revenues in 2022, putting it behind, Pfizer, Merck and AbbVie.

1. What To Expect From JNJ’s Pharmaceutical Division?

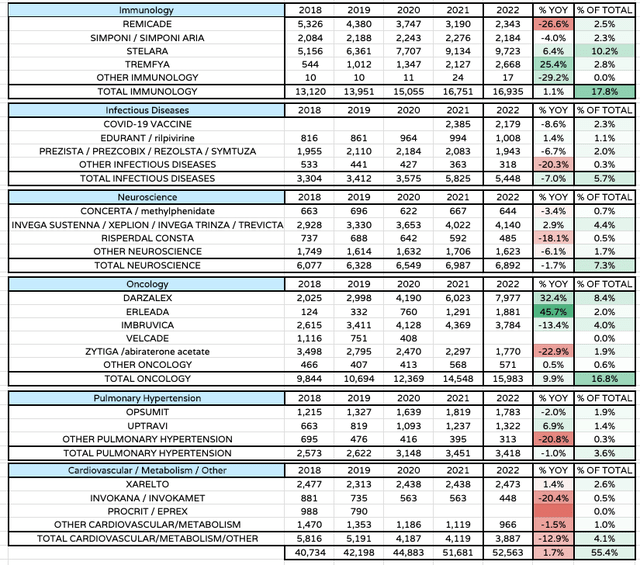

JNJ Pharmaceutical only revenues to FY22 (data taken from JNJ 10K submission)

As we can see above, Pharmaceutical division performance in 2022 was mixed. JNJ markets and sells 16 blockbuster (>$1bn per annum) selling assets, 4 of which come from a strong immunology segment.

With Remicade no longer patent protected, its sales are rapidly declining, but the growth of Stelara – whose sales nearly passed the $10bn mark last year – and Tremfya more than offset these lost revenues. There is a problem, however, because Stelara will lose patent protection later this year. That may not affect Pharmaceutical segment performance in Q1 2023 (earnings out premarket on April 18), or even (much) across the year as a whole, but it will be a significant blow for JNJ going forward – expect to see Stelara revenues fall by a least ~25% per annum from 2024 onwards.

The Infectious Disease division presents a more immediate issue, given demand for JNJ’s COVID vaccine will have almost completely dried up in Q1 2023, wiping >$2bn off the top line. It would not surprise me if management reports <$100m of sales from this source in Q123, amid slight declines in revenues for HIV therapies Edurant and Prezista.

Without patent protection, long-term sales of Schizophrenia therapy Risperdal are in terminal decline, although these losses could be offset by growing sales of depression therapy Spravato (a form of ketamine) – not mentioned above, but name-checked by management on the Q422 earnings call as key to driving “above-market” growth in 2023, alongside blood cancer cell therapy Carvykti, and multiple myeloma (“MM”) therapy Tecvayli, earmarked for peak sales of ~$1bn and $2bn respectively. Look out to see how these assets are performing.

Carvykti and Tecvayli add ballast to an already outperforming oncology division, led by another MM drug, Darzalex, and prostate cancer therapy Erleada, which is another likely blockbuster selling asset. Meanwhile, both the Pulmonary Hypertension and Cardiovascular / Metabolism segments are treading water revenues wise – and I would expect more of the same from these divisions in Q123.

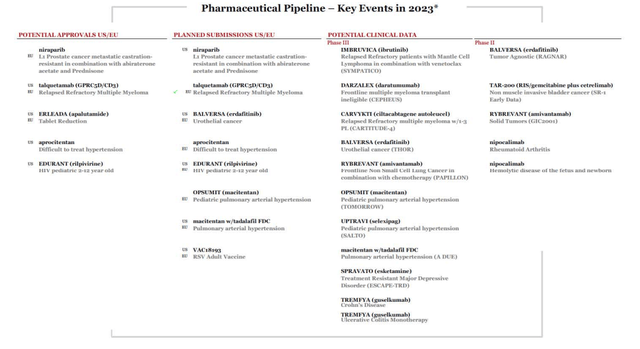

In summary, the Pharmaceuticals divisions’ growth is threatened by the Stelara patent expiration. I would therefore keep a close eye out for any updates on JNJ’s pipeline divulged during tomorrow’s call – and see if you can tick off any of the updates promised when Q422 earnings were released, as per the below slide.

JNJ pharma pipeline promised updates in 2023 (JNJ Q422 earnings presentation)

2. Saying Goodbye To Consumer Health With Kenvue Spinout

When management provided guidance on its Q422 earnings call for 2023 for 4.5% – 5.5% annual growth, or $96.9bn – $97.9bn of revenues, it included a contribution from the Consumer Health division, but as most people will be aware, this division is being spun out into a new company – named Kenvue – sometime around Q323.

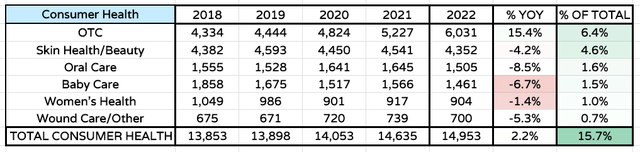

JNJ Consumer Health Top Line Performance (Data taken from JNJ 10K submission)

As we can see above, Consumer Health – despite being what the JNJ brand is arguably most famous for – accounted for only 16% of top line revenues in FY22, and growth is declining across all segments bar Over the Counter (“OTC”), which is thriving.

In January, JNJ made its SEC filing for an Initial Public Offering for Kenvue in which it describes the soon-to-be-launched company as “the world’s largest pure-play consumer health company by revenue” led by brands such as Listerine, Neutrogena, BAND-AID and Tylenol. In early March, Kenvue priced an offering of $7.75bn of senior notes that will be temporarily guaranteed by JNJ.

The important things to look out in Q123 earnings will be that the OTC division remains strong, that the remaining divisions are not falling too far behind the revenue curve, and that exchange rate headwinds are not buffeting the division too badly.

Spinouts are all the rage amongst Big Pharma currently. Pfizer spun out its established (i.e., no longer patent protected) brands division, Upjohn, into a new company that merged with generics giant and became Viatris (VTRS) – see my recent note on Viatris here – whilst Merck span-out its Women’s Health, Biosimilars and Established Brands division into a new entity, Organon (OGN), which began trading in 2021. GSK (GSK) and French Pharma Sanofi (SNY) have also spun out their consumer health and drug ingredients businesses respectively in recent years.

When Organon span-out, Merck realized a tax-free windfall of ~$8bn, whilst Pfizer raised ~$12.5bn of debt by spinning out Upjohn. Look for any updates that JNJ is planning anything similar. Spinouts tend to benefit the parent company more than one spun out, and are arguably completed for slightly cynical reasons.

Kenvue, for example, will assume responsibility for handling all litigation claims around JNJ’s talc products outside of the US and Canada, which brings us neatly to our next area of focus.

3. The TALC Litigation – And The Original Company Spinout

In its 2022 10K submission, JNJ reveals:

A significant number of personal injury claims alleging that talc causes cancer were made against Johnson & Johnson Consumer Inc. and the Company arising out of the use of body powders containing talc, primarily JOHNSON’S Baby Powder. The number of these personal injury lawsuits, filed in state and federal courts in the United States as well as outside of the United States, continued to increase.

Baby powder is one of JNJ’s most famous – and now, sadly, infamous products. The company apparently faces ~70k lawsuits related to the fact its Baby Powder products may have caused cancer in users, notably ovarian cancer. Although JNJ has denied the allegations, the company lost cases in court that led to a deluge of new claims.

In response, JNJ set up a company, LTL Management, in October 2021 into which it “span-out” all of the pending litigation. LTL then declared for bankruptcy, effectively shielding itself and JNJ from paying out too much compensation to claimants by virtue of the bankruptcy, in a move known as the “Texas Two Step.”

Initially, LTL attempted to limit its pay-outs to ~$2bn, but this “offer” was dismissed by the courts. This month, however, LTL filed for bankruptcy a second time, this time with $8.9bn earmarked for paying out to claimants over a 25-year period, which seems to have been more warmly received by plaintiff’s lawyers.

The outcome of this latest process may be the biggest single influence on JNJ’s share price when Q123 earnings come out tomorrow, and management joins a call with analysts shortly after, although expect them to be tight-lipped wherever possible. In early April, when the $8.9bn bankruptcy settlement was first reported, JNJ stock leapt from ~$158, to $163, a gain of 3%. In early March, JNJ stock had hit a two-and-a-half year low of ~$151.

For anyone surprised that an $8.9bn payout can be viewed as a positive, the consensus is that JNJ could have been liable for a great deal more – think >$20bn – and the company is generally considered to have got off lightly – all matters are far from resolved. As mentioned above, Kenvue is on the hook for all ex-U.S. litigation – the spinout looks to have completed just in time from JNJ’s perspective.

4. How To Revive A Stagnant Medical Devices Division

JNJ’s third pillar – its medical device division – is something of a mixed bag.

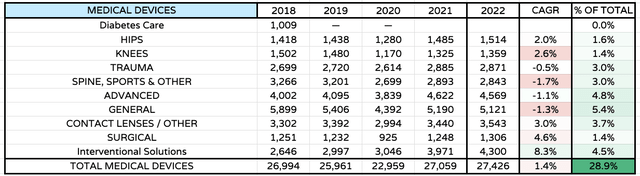

JNJ Medical Device division performance (JNJ 10K Submission)

As we can see above, medical device revenues were badly impacted by the pandemic (and the cancellation of elective surgeries) in 2020, but despite an impressive comeback in 2021, the division grew revenues by just 1.4% in 2022. This division accounted for nearly 30% of JNJ’s revenues in FY22, and it will account for an even greater percentage of revenues after Kenvue is spun out.

A single quarter is unlikely to have ushered in much change so I would not expect there to be anything especially untoward in the Medical Device division results for Q123, although JNJ’s Chief Financial Officer Joe Wolk did promise growth of 4% – 6% growth, commenting:

we anticipate that there will be a little bit of, I’ll call it, carryover from some of the COVID surges that we saw in the Asia Pacific region in the fourth quarter. But, other than that, a normal cadence of steady procedure recovery.

Something that I believe may be worth considering – and listening out for when Q123 earnings are announced – is any hint that JNJ may be considering spinning out its Medical Device division as well. After all, today’s Big Pharma industry is laser focused on drug discovery because it offers the greatest financial rewards, and biggest margins, thanks to lengthy periods of exclusivity during which Pharma’s can charge higher prices and claim reimbursement from health insurers.

Such a move on management’s part would be extremely bold but it could certainly be justified – should it occur, JNJ would become a Pharma with similar revenue generation to Merck and AbbVie, who are primarily drug development focused, and a quick glance at the share price performance of these 2 companies – +45% and +94% over the past 3 years – compared to JNJ – +9% over the past 3 years – tells its own story.

Conclusion – Drug Development, Spinouts, Litigation and What To Do With Medical Devices – My 4 Priorities Ahead of Q123 Earnings

JNJ is not quite the world’s largest healthcare concern – that honor falls to UnitedHealth (UNH) – my note on that company’s Q123 performance can be found here – but it is a behemoth all the same, and frankly, within the healthcare industry, behemoths are a little out of fashion.

JNJ’s dividend pays $1.13 per quarter and its yield is a healthy 3%, although that is more attributable to a stagnant share price than any particular generosity on JNJ’s part.

JNJ’s overall credentials are hard to doubt – price to sales ratio of ~5x, price to earnings of ~24x, debt to equity ~53%, and EBITDA multiple of ~15x. That more or less guarantees that investor will not lose money hand over fist by investing in JNJ and holding shares long term.

With that said, however, JNJ is a company in flux to a certain extent, mostly for the 4 reasons I outline above. Its focus and priority is likely on its Pharmaceuticals division, where it hopes to turn $52.5bn of revenues into $60bn per annum one day, even while its best-selling asset Stelara goes off patent this year.

I would keep a close eye on Pharmaceutical Division progress – it’s this division more than any other than can now unlock upside in JNJ’s share price – although this division is more likely to shrink, owing to COVID and Stelara revenues falling – than grow in the short term.

I would listen carefully to the latest updates on Kenvue – and especially carefully to any discussion of ex-US talc litigation. I would also be keen to understand what Kenvue shares JNJ shareholders will own post-spin out, and what controlling interest JNJ will have in Kenvue post spin-out – I have seen a figure of >80% discussed.

Spinouts can be convenient dumping grounds for assets and issues large Pharma’s would rather be shot off as opposed to strong investment opportunities, although in some cases – e.g., Viatris – they begin life with share prices that are wildly discounted to intrinsic value.

I would pay attention to Medical Device division revenues (are they still being boosted by post-pandemic tailwinds?) and look out for any signs management has unusual plans for this division.

Finally, the talc litigation may well overshadow most other matters at JNJ presently, although I would not necessarily expect management to be overly forthcoming on the topic – which was hardly mentioned on the last earnings call.

In summary, my conclusion would be that although JNJ is a fundamentally investable company, being a dividend paying healthcare blue chip, the current turbulence is a little troubling, and unless Q123 results are unexpectedly positive – consensus analyst opinion is for EPS of $2.34 – $2.59, with the average being $2.51, which I don’t think the company will beat – I’d be more comfortable sitting on the sidelines.

My own discounted cash flow analysis, which I hope to share in a future post, suggests that Johnson & Johnson stock ought to trade ~$160 per share, and I would expect a slight downturn tomorrow, after the recent bull run.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BMY, ABBV, GILD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.