Summary:

- Johnson & Johnson will post Q223 earnings on Thursday.

- The company is reinventing itself as a pharmaceuticals specialist after spinning out its consumer health division.

- Ironically, consumer health has been performing well – as has MedTech – these divisions will stabilize Q2 earnings.

- Management has promised that its focus on drug development will result in Pharmaceuticals revenues of >$60bn in FY25. I find that hard to believe.

- Litigation remains a problem – witness the $6.9bn write-down in Q123. JNJ is moving against its reputation as a solid blue chip, and I’m expecting further declines in the share price in 2023.

wildpixel

Investment Overview – Why JNJ Has Exited Consumer Healthcare Business

Earlier this year, Johnson & Johnson (NYSE:JNJ) lost its status as the US’ most valuable “big pharma” concern to Indianapolis-based Eli Lilly (LLY).

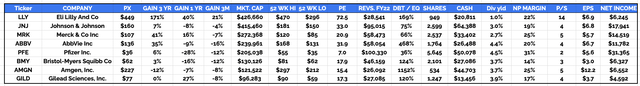

“Big 8” US Pharmas compared (TradingView / Google Finance)

I have often shared the above table comparing what I refer to as the “Big 8” US pharma companies in posts on big pharma companies, and often pointed out the surprising discrepancy between Lilly’s fundamentals and those of the pharmas it is now worth more than.

Consider the fact that Lilly earned just $28.5bn of revenues in FY22, while JNJ earned $95bn. JNJ drove net income of $17.94bn, while Lilly drove just $6.2bn. JNJ’s dividend yields 3%, while Lilly’s yields barely 1%. Across the past three years, however, JNJ stock has grown in value by 7% – Lilly’s by 171%.

There’s clearly a factor in play that’s not covered in the above table and it can be summed up in one word – pipeline. As I wrote in a post on Lilly for Seeking Alpha in June, the prospects for Lilly’s weight loss / diabetes drug tirzepatide – a GLP-1 receptor agonist – are mind-boggling, with $50 – $75bn in peak annual not necessarily an over-exaggeration.

For good measure, Lilly’s Alzheimer’s drug donanemab has just shown in a pivotal Phase 3 study that it slows progression of the disease – opening up another massive market opportunity – $10 – $20bn at least, analysts have speculated.

These new product launches are the reason why Lilly stock has risen by 21% across the past three months, while every other member of the “Big 8” has seen their stock price decline.

Johnson & Johnson is probably best known for its consumer health division – brands such as Johnson’s Baby Shampoo, Tylenol, Nicorette, and Neutrogena – which made a contribution of $14.95bn to the company’s top line in 2022, representing ~16% of all revenues.

The company also has the world’s second largest medical device franchise by revenue – behind only Medtronic (MDT) – which generated $27.4bn of revenues in 2022 – or 29% of total revenues.

The issue is that neither of these divisions drives the kind of dynamic growth the market wants to see – consumer health revenues shrunk by (0.5%) last year, or (4.1%) on a currency adjusted basis, whilst Med Devices grew by 1.4%, or shrunk by (4.8%) on a currency adjusted basis.

The reality of the modern pharmaceutical industry is that – even in spite of bipartisan pressure on drug pricing, and the measures introduced by the Inflation Reduction Act (“IRA”), which powerful pharma lobbies are already pushing back against – drug development is by far the most lucrative element of the industry, thanks to the lengthy periods of market exclusivity granted to new drugs, which more than offset the billions spent on R&D.

Johnson & Johnson’s philosophy is – “if you can’t beat them, join them.” As most people know, the company has spun out its consumer health division into a new entity – named Kenvue (KVUE) – which listed on the New York Stock Exchange (NYSE) in early May, in the largest IPO in the US since 2021, with >172m shares priced at $22 per share, raising ~$2.8bn, and valuing the company at ~$40bn.

What This Means For Johnson & Johnson Investors

JNJ is not the only company to have exited the commercial health industry in order to focus on drug development. Pfizer (PFE) spun out its legacy brands – Viagra, Lyrica, etc – into a new entity, Viatris (VTRS), that merged with generics drugs giant Mylan. Merck (MRK) spun out its legacy brands and Women’s Health division into a new entity, Organon (OGN), and GSK spun out its commercial health segment into new entity Haleon (HLN).

Since it began trading in November 2020, Viatris (VTRS) shares have fallen in value from ~$17, to ~$10 per share. Since Organon stock began trading in June 2021, the stock has dropped in value from ~$33, to $20. JNJ still holds ~90% of the shares of Kenvue, and there’s a “lock-up” period of 180 days, after which insiders will be permitted to sell their shares on the open market.

Soon, (no date has been provided yet) JNJ will distribute shares of Kenvue to its shareholders, and when that happens, it will be interesting to see what happens. Many JNJ investors may have bought the company’s stock as a defensive play, based on the blend of three different companies in one – consumer health, drug development, and medical devices – offering diversification of risk. These investors may be disappointed to soon be holding two different companies.

If anything, my guess would be that JNJ would have spun out its medical devices business too, if it wouldn’t have represented too radical a move for investors to stomach.

Those shareholders who did value JNJ as a defensive play will soon own a company in Kenvue that, if Viatris and Organon are anything to go by, will experience shrinking revenues, as sales of globally recognized commercial brands are milked, while little attempt is made to innovate new brands or invest heavily in R&D.

They also will own a company in JNJ that’s prepared to take bigger risks than they are comfortable with, as drug development is a “hit and miss” industry. A famous company owner once discussed his advertising budget by stating “I know half of it is wasted, I just don’t know which half!” The same could be said of drug development – half of the R&D budget funds drugs that ultimately fail – but which half?

Q123 Earnings Recap – Litigation Costs Ruin Strong Quarter

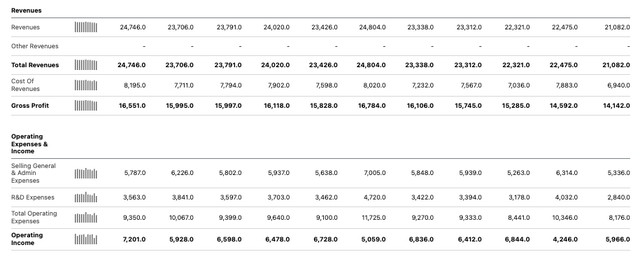

JNJ quarterly income statements (Seeking Alpha)

As we can see above, JNJ had a reasonably strong quarter in Q123, with revenues of $24.75bn its highest figure since Q421, and net income of $7.2bn its highest ever. Unfortunately, the company still reported an overall net loss, thanks primarily to $6.9bn of litigation expenses, and an intangible amortization expense of $1.2bn.

The litigation relates to its body powders – most notably its baby powder – which is subject to thousands of lawsuits as it has been linked to cases of cancer – most notably ovarian cancer and mesothelioma – with researchers suggesting the products were contaminated with asbestos. JNJ faces ~38k lawsuits in total.

The company’s response to this crisis has been to create a subsidiary company – LTL Management – into which it span out all of the pending litigation – as I wrote in my Q123 JNJ earnings preview:

LTL then declared for bankruptcy, effectively shielding itself and JNJ from paying out too much compensation to claimants by virtue of the bankruptcy, in a move known as the “Texas Two Step.”

Initially, LTL attempted to limit its pay-outs to ~$2bn, but this “offer” was dismissed by the courts. This month, however, LTL filed for bankruptcy a second time, this time with $8.9bn earmarked for paying out to claimants over a 25-year period.

The situation is fluid. JNJ says it has “secured commitments from over 60,000 current claimants” who are in favor of the $8.9bn settlements, while it has also moved to sue the researchers who first established links between its products and cases of cancer accusing them of personally profiting from a “false narrative” directed against the company’s products. Meanwhile, other plaintiff groups are seeking as much as $30bn in damages.

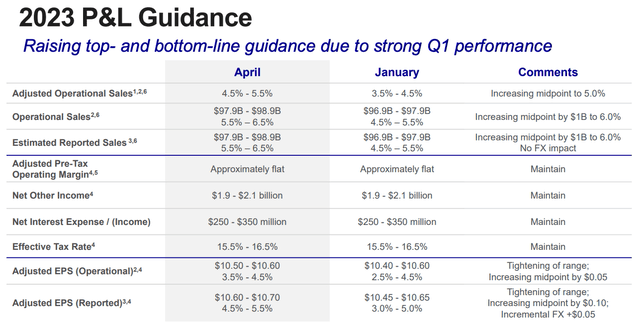

The litigation is another blow any investors who bought JNJ stock believing it was defensive and relatively riskless. But litigation aside, JNJ did post a strong quarter in Q123, beating analysts’ expectations on normalized EPS of $2.68, and on revenues – by >$1bn. Guidance for FY23, as shown below, was also upgraded.

JNJ FY23 guidance (JNJ presentation)

What To Expect When Q223 Earnings Are Announced

As I have tried to discuss in this post, JNJ – especially for a supposedly blue-chip, rock-solid company, has so headwinds to manage at the present time with the Kenvue spinout, litigation, and re-focus on drug development – that its earnings have almost taken a back seat.

For example, should investors pay attention to Consumer Health division results if they’re planning to sell their Kenvue stock as soon as it’s distributed to them – or vice versa, should those who plan to sell their JNJ stock and hold Kenvue pay attention to the drug development pipeline? Should anybody pay attention to operating profits when JNJ could announce any day that the LDL Management bankruptcy is off, and that it faces tens of billions more in compensation payments?

Nevertheless, the market consensus according to Seeking Alpha is that revenues will come in at ~$24.7bn – more or less the same as last quarter and a slight, $700m increase on Q223 – and that normalized EPS will be $2.62, and GAAP EPS $1.91.

The consumer health division posted 7.4% reported growth in Q123, and 11.3% operational growth. The MedTech division 7.3% reported, and 11 operational growth, and pharmaceutical division 4.2% reported, and 7.2% operational growth.

Price actions were primarily responsible for the growth in Consumer Health, according to JNJ, and a return to BAU after many surgeries were placed on hold during COVID primarily responsible for improved MedTech performance. I would not be surprised to see these trends continue in Q223, although I would be surprised if management raises guidance again.

The real issue lies – ironically – with the Pharmaceutical division. This is the supposed “crown jewel of JNJ’s business and the subject of its new focus and direction. Yet it’s the worst performing division, and things may get worse in Q223.

Stelara is JNJ’s biggest revenue generating asset – driving $9.7bn of revenues in FY22, or >10% of JNJ’s entire revenues. In Q123, it drove $2.44bn of revenues, up from $2.3bn in the prior year period. Stelara is set to lose its patent protection next year, however, meaning its revenues will decline by a likely 25% per annum, as generic competition floods the market.

The patent expiry won’t affect Q223 revenues, but another flagship asset, autoimmune therapy Remicade, also has lost patent protection and saw revenues decline by 27% in Q123. Sales of JNJ’s COVID vaccine were $747m in Q123, up from $457m in the prior year, but the vaccine may not generate any revenues at all in Q223, which will drag down the division’s performance.

Prostate cancer therapy Zytiga is another asset to have lost patent protection, and its revenues fell by >50% year-on-year in Q123 – the comparison could be even worse in Q223.

To summarize, while I would not expect overall Q223 earnings to set too many alarm bells ringing, likely due to the strong performance of MedTech and Consumer Health, they will not set many pulses racing, either. I would expect to see a slight fall in the share price when they’re announced on Thursday, similar to what happened after Q123 earning were announced.

The Bigger Problem JNJ Has – How To Drive Promised $60bn in Pharmaceutical Revenues

It certainly seems ironic that JNJ’s worst performing division is its Pharmaceuticals segment, given that is the focus of management’s future growth strategy, while Consumer Health is discarded and MedTech drifts somewhat. Although JNJ did invest $17bn in acquiring Abiomed and its heart pump portfolio to bolster MedTech, this has not been a hassle-free deal – JNJ was forced to recall 5.5m pumps in June owing to safety concerns.

JNJ management has pledged that the Pharmaceuticals division can deliver $60bn of revenues by 2025. It’s not untypical for big pharmas to set targets for revenue growth – AbbVie (ABBV) and Bristol-Myers Squibb (BMY) for example provide remarkably clear forward revenue estimates product by product, but in JNJ’s case, it’s very hard to see how the company achieves its target number.

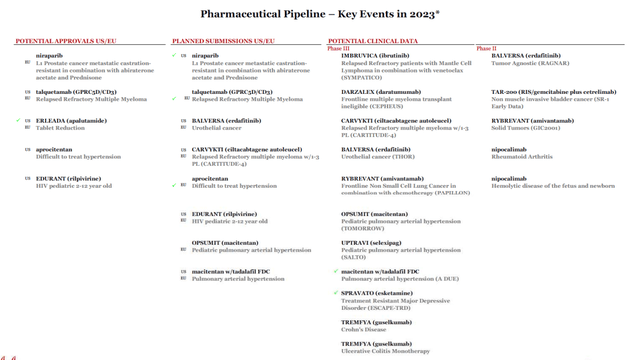

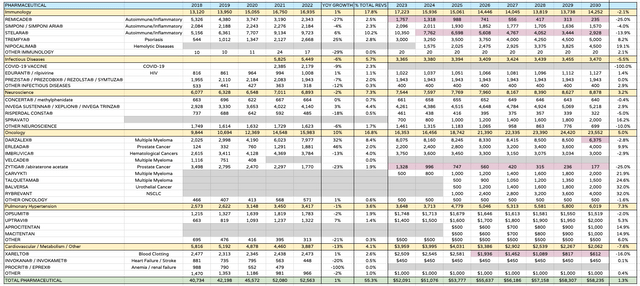

Let’s take a look at the company’s pharmaceuticals product pipeline for 2023, as shared in the Q123 earnings presentation.

JNJ pipeline (earnings presentation)

Most of the products featured already have been approved in one or more indications, and are targeting label expansions – blood cancer cell therapy Carvykti, multiple myeloma therapy Darzalex, etc. There’s precious little here, however, to compare with e.g. Lilly’s tirzepatide or donanemab, or AbbVie’s twin autoimmune therapies Skyrizi and Rinvoq, forecast for ~$25bn combined sales or even BMY’s new product portfolio, designed to add $25bn to the top line.

Using analysts’ forecasts, my own research, and JNJ’s guidance, I have put together some detailed product by product revenue forecasts for JNJ’s current products, and assumed all its pipeline products shown above – cancer therapies Balversa, Rybrevant, and Talquetamab, Pulmonary Hypertension drugs Aprocitentan and Macitentan, depression drug Spravato, Nipocalimab, indicated for hemolytic disease – are all approved and make blockbuster (>$1bn per annum) revenue contributions. I have shared these in the table below.

JNJ drug product revenue forecasts (my table)

Naturally these are ballpark figures only, but this table underscores, in my view, how difficult it will be for JNJ to meet its $60bn revenues target by 2025, Being as generous as I reasonably could be, I could not get within $5bn of management’s target by 2025. The patent expiries of Zytiga, Stelara et al offset the growth in other areas.

Concluding Thoughts – Q223 Earnings Will Be Problematic In Several Ways – But Bigger Threats Are Lurking

JNJ’s share price has experienced a rough 2023 to date. In January the stock price was $180, and it has sunk as low as $152, although it trades at $161 at the time of writing.

JNJ has lost its status as the US’ biggest pharma by market cap, and it’s set to shrink further once Kenvue fully decouples from the other two divisions. JNJ has clearly identified pharmaceuticals as its key focus going forward, but my suspicion is that will displease its investor base who likely bought the stock as a blue chip paying a healthy dividend with a risk averse business model.

By targeting $60bn of Pharmaceuticals revenues by 2025, the company has set its stall out to become another Eli Lilly, or at least another AbbVie, Bristol Myers Squibb, or Merck, all in on drug development, driving growing profit margins thanks to new pipeline products with years of patent protection ahead of them.

The irony is, its pipeline looks thin and its existing products are gradually losing their patent protection, and that’s bad news for JNJ’s shareholders – at least in the short term. When you add together the Kenvue spinout, the litigation issues, the sky high expectations for Pharmaceuticals, and the patent woes, my conclusion is that JNJ stock may face a period of downward adjustment.

My preliminary discounted cash flow calculations – which I plan to share in a future post – suggest that the stock could sink as low as $125 per share, although ever the optimist where pharma stocks are concerned, and because I believe that JNJ can become a drug development powerhouse in time, I would be tempted to buy if the stock price does dip <$135, as I suspect it might before the end of the year. JNJ has the right idea, it is simply behind the 8-ball.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, BMY, GILD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.