Summary:

- Johnson & Johnson beats market estimates for revenue and EPS in Q2 FY24.

- A strong product pipeline includes new drugs for ulcerative colitis and lung cancer.

- JNJ’s acquisition of Shockwave Medical positions the company as a leader in the cardiovascular market, potential revenue synergies from integration.

JHVEPhoto

I initiated a “Buy” rating for Johnson & Johnson (NYSE:JNJ) in January 2024, highlighting its balanced growth between MedTech and medicine business. The company released its Q2 FY24 results on July 17th, beating the market estimates for both the top line and bottom line. I am encouraged by the company’s strong product pipeline, and the recent acquisition of Shockwave Medical. I reiterate a “Buy” rating with a fair value of $190 per share.

Robust Product Pipeline

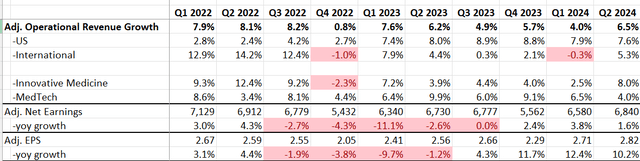

Johnson & Johnson delivered 6.5% operational revenue growth and 10.2% adjusted EPS growth during the quarter, as detailed in the table below. It was a strong growth quarter for the company, especially for its medicine business. As I pointed out in my previous coverage, I favor Johnson & Johnson’s balanced growth between the Medicine and MedTech markets.

Johnson & Johnson Quarterly Earnings

My biggest takeaway is the company’s strong new product pipelines, including TREMFYA IBD, RYBREVANT, and VARIPULSE.

- On May 1st, Johnson & Johnson announced it has submitted applications to the European Medicines Agency (EMA) to seek the approval of TREMFYA, a drug for treating moderately to severely active ulcerative colitis and moderately to severely active Crohn’s disease.

- On March 1st, the company announced that FDA has approved its RYBREVANT in combination with chemotherapy for the first-line treatment of patients with locally advanced or metastatic non-small cell lung cancer.

- Lastly, Johnson & Johnson posted the latest VARIPULSE data on May 17th, showing 75% overall primary effectiveness success. The VARIPULSE product could potentially put Johnson & Johnson competing against Medtronic (MDT) and Boston Scientific (BSX) in the fast-growing pulsed field ablation market.

The solid product pipeline could help Johnson & Johnson generate substantial revenue growth in the near future, in my view.

Acquisition of Shockwave Medical

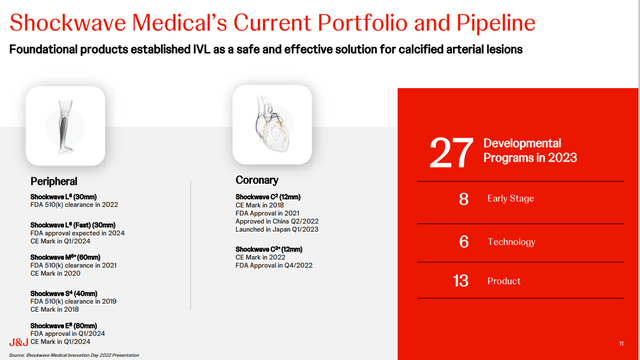

Johnson & Johnson announced to acquire Shockwave Medical for a total enterprise value of $13.1 billion on April 5th, 2024. Shockwave is a leading player of intravascular lithotripsy (IVL) technology for the treatment of calcified coronary artery disease (CAD) and peripheral artery disease (PAD). I favor this transaction for the following reasons:

- With the acquisition, Johnson & Johnson could potentially become a leading player in the high-growth cardiovascular market. Shockwave’s technology could strengthen Johnson & Johnson’s electrophysiology portfolio.

- As disclosed in the announcement, Shockwave possesses a strong product pipeline in the CAD and PAD markets, as presented in the slide below. Additionally, Shockwave could potentially expand its IVL technology into other markets, such as carotid artery disease and structural heart disease.

Johnson & Johnson Investor Presentation

- Johnson & Johnson can fully leverage its global footprint to bring Shockwave’s technology outside the U.S. market. I believe Johnson & Johnson can generate tremendous revenue synergies from the integration of Shockwave’s operations.

FY24 Outlook

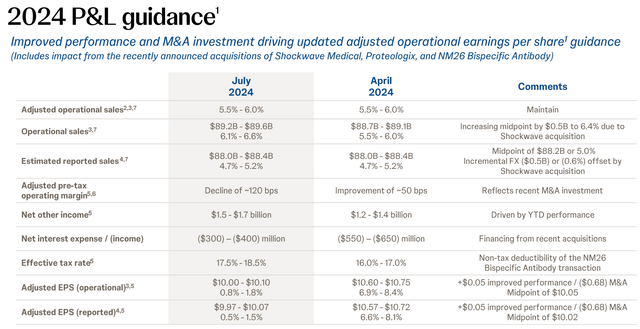

The company maintained its revenue guidance, but lowered its EPS guidance for FY24 due to lower margin and higher tax rate assumptions caused by Shockwave acquisition and non-tax deductibility of the NM26 Bispecific Antibody transactions.

Johnson & Johnson Earning Presentation

I consider the following factors for FY24’s growth:

- For the Medicine business, Johnson & Johnson has accelerated the growth from Q1 to Q2, driven by strong oncology and immunology sales and market share gains. I anticipate Johnson & Johnson will continue to deliver high-single-digit to double-digit revenue growth in its oncology and immunology businesses. Overall, I estimate that the company will deliver 6% organic revenue growth in Medicine Segment for FY24.

- Johnson & Johnson’s growth in MedTech depends on its commercial execution, share gains and the overall procedure growth. I anticipate the company to deliver 5% growth in FY24, in line with the projection for the overall market growth.

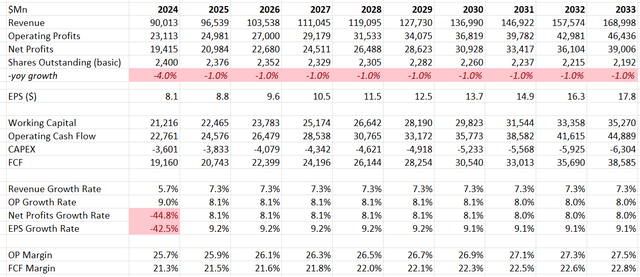

Putting together, the overall revenue growth is projected to be 5.7% in FY24, as per my calculations.

Valuation Update

Johnson & Johnson has accelerated its share repurchase during the quarter, with 7.8% reduction in the total shares outstanding. Based on today’s stock price, I estimate the total shares outstanding will decline by 4% in FY24.

As discussed earlier, I assume Johnson & Johnson will deliver 5.7% revenue growth in FY24. For the normalized revenue growth, I assume Johnson & Johnson can deliver 6% organic revenue growth, presuming the company’s innovative product pipeline could accelerate its Medicine business in the coming years. Additionally, I assume the company will spend 5% of revenue on acquisitions, contributing 130bps to topline growth.

As discussed in my initiation report, I anticipate the company to generate operating leverage from product launches, cost management and operating leverage from R&D. I calculate that the company will grow its operating expenses by 6.9% year-over-year, leading to 20bps annual margin expansion.

Johnson & Johnson DCF – Author’s Calculations

The WACC is calculated to be 7.7% assuming: risk-free rate 4.2% (US 10Y Treasury Yield); beta 0.52 (5-Year average); equity risk premium 7%; debt balance $39 billion; equity $76 billion; tax rate 16%. Discounting all the FCF, the fair value is calculated to be $190 per share, as per my estimates.

Downside Risks

Johnson & Johnson’s Infectious Disease business declined by 12.9% in revenue in Q2 FY24, due to the Covid-19 vaccine revenue decline. The Infectious Disease business represents less than 5% of group revenue. In the near term, I anticipate continued growth challenges for this business due to Covid-19 vaccine demands continue to decline.

Additionally, Johnson & Johnson’s APAC business only grew by 1.9% in the quarter, due to sluggish growth in China. Due to the decline in domestic property and stock market, the Chinese economy is facing strong growth challenges. I expect the domestic healthcare sector in China to continue experiencing weak growth.

Conclusion

The strong new product pipeline is expected to drive business growth gradually for Johnson & Johnson in the near future. The balanced portfolio of medicine and MedTech provides the company with earning stability, in my view. I reiterate my “Buy” rating, with a fair value of $190 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.