Summary:

- Johnson & Johnson’s Q3 2024 earnings report will highlight its MedTech division, driven by strategic acquisitions and R&D investments in cardiovascular and orthopedic solutions.

- Despite lagging behind the S&P in price growth, JNJ offers a solid income investment with a 3.09% dividend yield and steady financials.

- Risks include short-term costs from acquisitions, supply chain issues in the Vision division, and external pressures like currency fluctuations and competition.

- JNJ is a ‘Hold’ due to its dependable dividends and strong MedTech growth, but short-term challenges and slight overvaluation suggest caution for new investors.

hapabapa/iStock Editorial via Getty Images

Johnson & Johnson Overview

Johnson & Johnson (NYSE:JNJ), a global healthcare giant with roots going back to 1886, is set to drop its earnings report for the fiscal quarter ending September 2024. The company, known for its wide range of medical devices, pharmaceuticals, and consumer health products, along with breakthroughs in fields like immunology and oncology, plans to release the numbers on October 15, 2024, before the market opens.

MedTech Division in Focus

The upcoming earnings report is likely to put a big spotlight on Johnson & Johnson’s MedTech division. This branch combines biology and tech to deliver cutting-edge, less invasive, and personalized treatments in areas like orthopedics, surgery, interventional solutions, and vision. MedTech has been gaining serious momentum, boosted by smart acquisitions and heavy investment in research and development. In this article, I’ll break down key expectations for JNJ’s Q3 earnings, looking at its strong growth drivers along with a few risks on the horizon.

Long-Term Performance Review

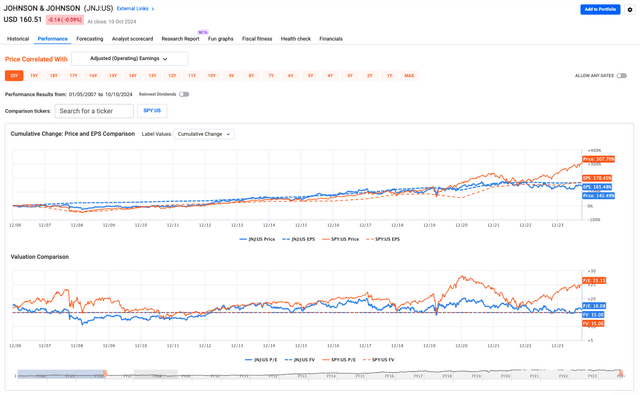

Fast Graphs

Before getting into the specifics, I want to zoom out and review Johnson & Johnson’s performance over the long term. This company has been a big name in healthcare since the 19th century, and I’ve personally held shares for over 20 years, like many other long-term investors.

Fast Graphs

From 2007 to 2024, JNJ’s growth has been decent, but it hasn’t quite kept pace with the broader market. If you leave out dividends, JNJ’s annualized return sits at 5.07%, while the S&P has posted 8.27%. Once you factor in dividends, JNJ’s return bumps up to 6.84%, though it’s still behind the S&P’s 9.01%.

Fast Graphs

A Solid Income Investment

While JNJ hasn’t kept up with the S&P, I still see it as a solid pick for investors looking for income. Its dividends have averaged 7.54% growth over the past 18 years. Though that’s pretty close to the S&P’s 7.14% growth, JNJ’s payouts bring in steady cash flow and boost total returns. During that period, a $10K investment in JNJ would’ve earned $8.28K just from dividends, outperforming the S&P’s $5.32K in dividends. However, JNJ’s price growth has been slower. Compared to the S&P, it’s definitely more conservative. That’s attractive to cautious investors like me, but it won’t deliver the same big gains as faster-growing stocks or sectors.

Q3 Earnings Expectations

Johnson & Johnson’s expectations for Q3 2024 are focused on the strong performance expected from its MedTech division, which is now driving most of the company’s growth. This segment makes up more than half of J&J’s business, due to solid investments and deals that secure its place in key markets. Back in Q2 2024, J&J poured $3.4 billion into R&D, zeroing in on advances in surgery, orthopedics, and cardiovascular care — all expected to play a major role in its future growth.

Positive Outlook and Guidance

Riding this momentum, Johnson & Johnson backed its confidence by raising its full-year EPS guidance by $0.05, aiming for 8.2% growth mid-year compared to last year. Plus, the company upped its sales guidance by $500 million, now expecting growth between 6.1% and 6.6% for 2024.

Strategic Acquisitions

Johnson & Johnson’s positive outlook is lifted by its strategic acquisitions of Abiomed and Shockwave in the cardiovascular space, positioning the company to capitalize on the sector’s projected 8% growth. A good example is Abiomed. J&J spent $16.6 billion on the company in 2022, and this is significant because Abiomed specializes in heart recovery devices, including the world’s smallest heart pump, the Impella. Such pumps are useful for patients suffering from serious heart failure or cardiogenic shock who require immediate heart care during surgery or emergencies. With this acquisition, J&J not only expands into this thriving market but also further extends its MedTech portfolio to support technology like Biosense Webster, a market leader in heart rhythm disorders.

J&J kept building its cardiovascular portfolio with the 2024 purchase of Shockwave Medical for $13.1 billion, following the Abiomed deal. Shockwave leads in intravascular lithotripsy (IVL) tech, which uses sound waves to break up hardened plaque in arteries, treating issues like coronary artery disease (CAD) and peripheral artery disease (PAD). By bringing Shockwave’s IVL platform into its MedTech division, J&J expands its treatment options and strengthens its overall cardiovascular portfolio, adding to its strong positions in heart recovery and electrophysiology.

Helping boost revenue, J&J’s electrophysiology business has been a top performer, with double-digit growth expected in Q3 after gains of 16-19% earlier this year. J&J’s orthopedics division is also expected to keep up its strong performance, with knee and hip segments growing by 9.4% and 7.4% in the first half of 2024. Orthopedic solutions and cardiovascular products are expected to be key drivers of Q3 revenue growth. While the launch of its spine robot in 2025 should be a big development, J&J’s current orthopedics portfolio is expected to boost Q3 results.

Risks and Challenges Ahead

While Johnson & Johnson sounds pretty upbeat for its Q3 2024 report, there’s always going to be a couple of weaknesses that might affect the overall performance. For starters, JNJ has also been buying up companies, pushing its bullish growth forecast, but these come with short-term costs and entail an earnings loss of $0.68 per share in 2024, with another expected decline of $0.33 per share in 2025. While these are necessary investments to grow the business, especially in cardio health, they’re liable to pinch margins in the short term.

Ongoing Vision Division Issues

Another ongoing problem for the company has been its Vision division, which had a rough year thanks to supply chain issues, especially in the contact lens business. There’s hope things will get better in the second half of the year as those supply problems start to clear up, but the Vision segment is still a weak link that could drag down the overall quarterly results.

External Market Pressures

J&J’s got more than internal problems to deal with. The company’s medical technology (MedTech) sales in China are being affected by strict government rules, like policies that force companies to sell products at lower prices (volume-based procurement) and efforts to fight corruption in the healthcare industry. These bureaucratic changes have made it harder for J&J to grow in China, which is a key market for them. These difficulties are expected to continue throughout 2024 and possibly into 2025, making J&J’s international outlook a bit shaky.

Currency Impact and Competition

Currency fluctuations have hit Johnson & Johnson pretty hard this year too, shaving $1.2 billion off their sales. The stronger U.S. dollar, especially against the Japanese yen and Chinese yuan, is to blame. It’s not over yet — these currency shifts are expected to continue to weigh on their revenue growth in the third quarter.

Moreover, competitive pressure is heating up in several of J&J’s key markets. In electrophysiology, Boston Scientific (BSX) and Medtronic (MDT) have made solid gains, challenging J&J’s market share. On top of that, J&J’s OTTAVA robotic surgery platform will go head-to-head with Intuitive Surgical (ISRG), a long-time leader in robotic surgery.

Market Valuation Insights

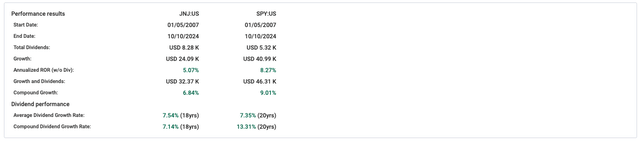

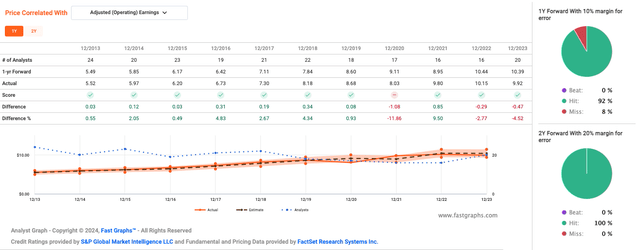

Fast Graphs

With so much competition out there, let’s check in on how JNJ is valued in the market: its blended P/E ratio comes in at 16.08x, slightly above the fair value benchmark of 15x. This means the stock might be slightly overpriced compared to where it’s traded before. But it’s currently below its usual 17.29x P/E ratio, so if market or investor sentiment shifts, the stock could climb.

J&J’s earnings growth rate sits at 5.5%. It’s steady, but not exactly thrilling. Other pharmaceutical companies are growing faster, so if you’re after rapid growth, J&J might not top your list. That said, J&J brings a lot of stability to the table, which appeals to a different kind of investor.

A big plus for J&J is its 3.09% dividend yield, perfect for investors wanting steady income since the company has a strong business and a long track record of reliable dividend payments. On top of that, with a reasonable payout ratio, solid credit rating, and manageable long-term debt at around 28%, there’s little risk of them cutting the dividend anytime soon. In fact, there’s a good chance they might even bump it up in the future.

Final Takeaway

All in all, J&J is solid. At this entry point, It’s not the kind of stock that’ll wow you with big, shiny returns. But, it is dependable. You’ll get a decent dividend, and their financials are rock-steady and if you’re the type who plays it safe and wants something reliable, J&J is a good move.

Even with some small valuation worries, JNJ’s updated outlook for 2024 shows it’s still running strong. The company expects growth in both sales and adjusted earnings, backed by solid free cash flow of $7.5 billion this year so far, up from $5.5 billion last year. This cash gives JNJ room to reinvest, especially in its growing MedTech division.

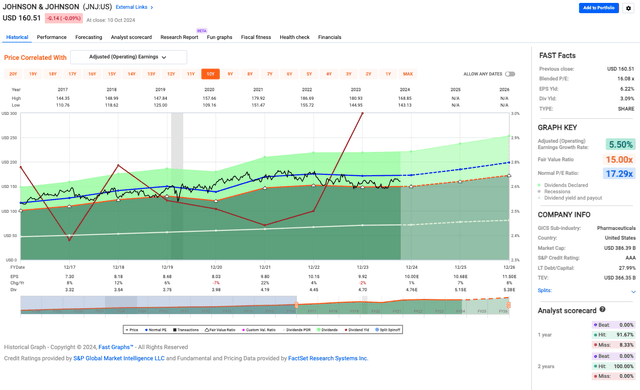

Fast Graphs

And when it comes to earnings, J&J has a strong track record, meeting forecasts 91% of the time over the past 10 years (see above). Over the past two years, they nailed every forecast. But there were a few misses, like the 11.86% drop in 2020 and 4.52% in 2023, but these misses don’t worry me — they were just part of the pandemic chaos, especially in 2020.

I’d say JNJ is a ‘Hold’. Their MedTech division and smart buys position them for long-term growth, especially in cardiovascular care, but the stock hasn’t exactly kept pace with the market. The P/E ratio shows it might be a little overpriced. The steady dividend and strong financials still make it a solid choice for those looking for steady income. But with some short-term problems like dilution from recent deals and international hurdles, if I were new to this, I’d hold off for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.