Summary:

- Johnson & Johnson will announce its Q3 earnings on October 17th, with analysts expecting total revenues of $21bn.

- JNJ recently completed the spinout of its consumer health division, Kenvue, to focus on higher-margin drug development.

- J&J faces challenges in its pharmaceutical division, including the patent expiry of its best-selling asset, Stelara.

- Litigation is another major issue for the company – I would not be surprised to see an earnings miss followed by a selloff.

JHVEPhoto

Investment Overview

Johnson & Johnson (NYSE:JNJ), the New Jersey based Pharma giant, will announce its third quarter earnings next week on Tuesday October 17th. In Q2 2023, JNJ beat analyst’s estimates for revenue, achieving $25.53bn of total revenues, and for normalized EPS, which came in at $2.8, and GAAP EPS, which was $1.96. Ahead of the Q3 announcement, analysts are expecting total revenues of $21bn, normalized EPS of $2.52, and GAAP EPS of $2.17.

Why the sharp fall in revenues? Let’s begin our analysis / preview of JNJ’s Q3, 2023 earnings with a look at the latest developments in relation to the spinout of the consumer health business, Kenvue, which is now complete.

JNJ Ditches Consumer Health Division To Pursue Higher Margin Drug Development

Johnson & Johnson was arguably best known for its consumer health brands, e.g. Tylenol, Listerine, Band Aid etc. but, like several other major Pharmas – Merck & Co. (MRK), Pfizer (PFE), GSK (GSK), for example – the company took the decision to spin out this entire division – which returned revenues of $14bn, $14.9bn, and $15.1bn in 2020, 2021, and 2022 respectively, accounting for ~16% of the company’s total revenues – into a separate entity, known as Kenvue (KVUE).

The explanation for the spinout is straightforward – in a recent fireside chat at the Morgan Stanley (MS) Global Healthcare Conference, JNJ’s Chairman and Chief Executive Officer Joaquin Duato told the audience:

We are very pleased of having completed the Consumer separation. It was a 2.5 year process. And at this point, the Consumer company, Kenvue, is an independent company. And we are enthusiastic about the Johnson & Johnson that has come out of that, exclusively focused on R&D and innovation, on MedTech and Pharmaceuticals. This increased focus is going to help us being more productive, and at the same time, having higher margins and higher growth rates because Consumer had lower margins and lower growth rates compared to MedTech and Pharma.

As I wrote in a previous note on JNJ, covering Q2 2023 earnings:

The reality of the modern pharmaceutical industry is that – even in spite of bipartisan pressure on drug pricing, and the measures introduced by the Inflation Reduction Act (“IRA”), which powerful pharma lobbies are already pushing back against – drug development is by far the most lucrative element of the healthcare industry, thanks to the lengthy periods of market exclusivity granted to new drugs, which more than offset the billions spent on R&D.

Kenvue listed on the New York Stock Exchange in early May, in the largest IPO in the US since 2021, with >172m shares priced at $22 per share, raising ~$2.8bn, and valuing the company at ~$40bn. Last quarter, however, JNJ had continued to own ~90% of Kenvue stock.

In July, JNJ formally announced its intention to “split-off” ~80% of its Kenvue shares through an exchange offer, having received a waiver of its 180-day lockup period. A press release announced:

The exchange offer will permit Johnson & Johnson shareholders to exchange some, all or none of their shares of Johnson & Johnson common stock for shares of Kenvue common stock at a 7% discount, subject to an upper limit of 8.0549 shares of Kenvue common stock per share of Johnson & Johnson common stock tendered and accepted in the exchange offer.

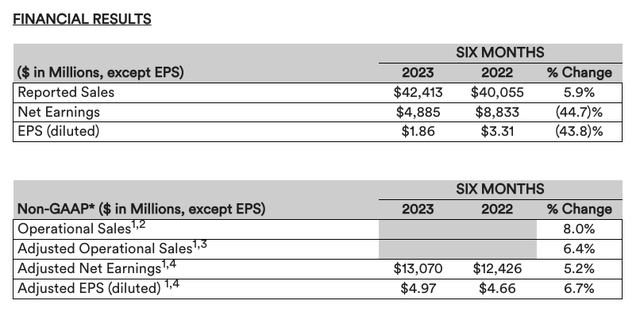

The final exchange ratio was calculated at 8.0324 Kenvue shares for every JNJ share tendered, and on August 23rd the Pharma announced it “has accepted 190,955,436 shares of Johnson & Johnson common stock in exchange for 1,533,830,450 shares of Kenvue common stock. The company confirmed the business separation on August 30th, and updated its financial results for its continuing operations – namely its pharmaceuticals and medical devices divisions – as per the table below:

JNJ updated financials – continuing operations (press release)

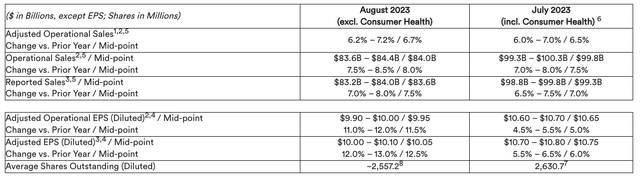

At the same time, JNJ adjusted its FY23 earnings projections as per the table below:

JNJ FY23 guidance – continuing operations (press release)

One aspect of the spinout that is highly attractive to JNJ has been its ability to realize ~$13.2bn in cash proceeds from the Kenvue deal, and according to the company’s Chief Financial Officer, Joe Wolk:

Johnson & Johnson anticipates that it will report a tax-free gain for the separation of the Consumer Health business in the third quarter of 2023, of approximately $20 billion.

To summarize, while Kenvue’s shares have fallen 24% since the company’s IPO, and its market cap valuation dropped to ~$37bn, and while the new company begins life with >$8.5bn of debt, versus ~$1.2bn of cash, JNJ receives a ~$20bn tax free windfall.

Given JNJ’s tender offer for Kenvue stock was apparently oversubscribed, it seems clear that many shareholders opted for the consumer health spinout over the newly slimmed down pharmaceuticals and medical device company.

Given the share price performance of the Pfizer and Merck spinouts Viatris (VTRS) and Organon (OGN) – down 70% and 50% since IPO – the smart move would seem to have been to hold onto JNJ shares, however since mid-August, JNJ shares themselves have been falling. Current traded price is $156 – down >10% since the separation completed.

Johnson & Johnson In Q3 2023 – Can Pharmaceuticals Division Meet Expectations For $57bn Of Revenues By 2025?

As I mentioned in my JNJ Q2 2023 earnings review, the somewhat ironic element of JNJ’s spinout of Kenvue, in search of faster growth and higher margins is that the consumer health divisions’ growth may have been flat, but it was historically no worse than either the pharmaceuticals or medical devices divisions.

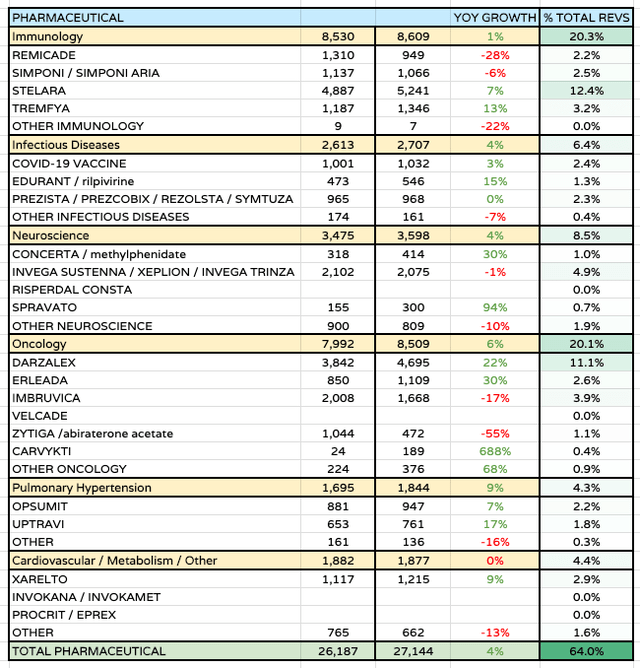

Within pharmaceuticals, there is a major headwind to face in the form of the patent expiry of Stelara – JNJ’s best-selling asset, which earned $10.4bn of revenues in 2022, and $5.24bn across the first 6 months of 2023 >10% of JNJ’s total revenues, or, post Kenvue, ~12.5% of all revenues. Once a drug’s patent protection lapses, and generic versions of the drug are permitted to compete for market share, its revenues typically decline at a rate of >25% per annum.

JNJ Pharmaceuticals division performance 1H23 (data taken from JNJ Q223 10Q submission)

Nevertheless, the pharmaceuticals division performance across 1H23 was in fact reasonably impressive, with the Immunology division growing 1% year-on-year, Infectious Diseases 4%, Neuroscience 4%, Oncology 6%, Pulmonary Hypertension 9%, and Cardiovascular / Metabolism remaining flat year-on-year.

The entire division now accounts for ~64% of JNJ’s slimmed down business, with medical devices accounting for 36%. Oncology – $8.5bn of revenues, 20% of total revenues – and immunology – $8.6bn of revenues, also 20% of total revenues, are the key segments.

With Remicade revenues falling 28% year-on-year, and Stelara revenues likely to do similar from next year, it’s clear JNJ needs to offset these losses within immunology, if it wants to achieve its ambitious goal of driving $57bn of revenues from its pharmaceuticals division by 2025.

Although there is money available for an M&A spree, CEO Duato told the audience during his recent fireside chat that he did not expect to alter the current capital allocation priorities, which are directed more towards internal R&D than external M&A:

If I tell you the numbers, in the last 5 years, we invested $64 billion in R&D in the last 5 years. We used $60 billion for dividends and share repurchases, so about 60% of our free cash flow and $33 billion for M&A. So that gives you a picture of what are our capital allocation priorities. And this is something that we don’t plan to change. We want to maintain our robust financial position…

The majority of the growth of Johnson & Johnson, the overwhelming majority of the growth is going to come from our existing R&D and our existing portfolio

In my JNJ Q2 earnings review I shared detailed product by product forward revenue projections to illustrate how tricky JNJ may find it to hit that number given current growth rates, plus the impact of the Stelara loss of exclusivity (“LOE”), but Duato has insisted the figure can be reached, listing IL-23 inhibitor TREMFYA, prostate cancer therapy ERLEADA, anti-psychotic INVEGA-SUSTENNA, and multiple myeloma therapy DARZALEX as key revenue drivers. These assets currently account for ~21% of JNJ’s total revenues and their revenues figures will be a key area of focus when Q3 2023 earnings are released.

Additionally, Duato has listed the hematological cancer cell therapy Carvykti, TECVAYLI, a bispecific cancer drug approved in October last year to treat multiple myeloma (“MM”), a second bispecific, TALVEY, also recently approved in MM, and antidepressant Spravato as key revenue driving assets. These 4 drugs all have peak revenue expectations set by the market of ~$2bn, and in an optimistic scenario, could drive double-digit revenues for the company – although not by 2025. Again, I would advise investors to study these drug’s revenue numbers closely when earnings are released.

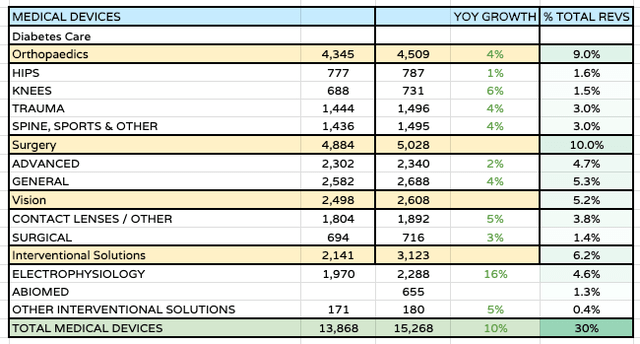

When it comes to the medical devices division, despite the reasonably successful bedding in of Abiomed’s cardiovascular / electrophysiology business, acquired in December 2022 for ~$16.6bn, Duato has stressed that this division will be expected to grow organically, rather than through aggressive M&A.

Med Device performance 1H23 (JNJ data )

In fairness to the CEO, the division has thrived in 1H23, as we can see above, driving 10% growth, with almost every segment performing well. This may be attributable to a return to business-as-usual medical practices post COVID, with patients opting for non-elective surgeries that were unavailable during COVID. My slight concern would be that that momentum may have slowed in the third quarter, although I would expect performance in the second half of the year to closely mirror the first half, with management pulling out all the stops to show that growth in med devices can be just as impressive as pharmaceuticals in the post-Consumer health Era.

Litigation – “I See Smoke, But No Fire”

In my last note I discussed the 38,000 lawsuits that Johnson & Johnson was facing in relation to its body powders, and their apparent contamination with asbestos, allegedly leading to cases of cancer. The Pharma has attempted to limit the amounts it may pay out by creating a separate entity, LTL Management – into which it spun out all of the pending litigation, with LTL subsequently attempting to declare for bankruptcy, and its assets used to pay claimants.

This maneuver – known in legal circles as the “Texas-two-step” – has so far been unsuccessful, with a judge ruling against JNJ at the end of August, arguing that LTL does not (yet) show significant enough signs of financial distress. The judge’s precise words were “this Court smells smoke, but does not see the fire”.

JNJ has proposed an $8.9bn settlement, which could be released if bankruptcy is eventually granted, and it seems the company’s strategy is simply to wait for a while, then file for bankruptcy again, once LTL’s financial distress is clearer to see. The bankruptcy judge in the case, Michael Kaplan, has not ruled out siding with the company in the future, commenting “I just don’t have a crystal ball”.

In late September, JNJ was hit with a further 11,000 lawsuits, although this is not necessarily surprising given suits were not permitted to be filed while the bankruptcy court case was being heard. JNJ has pledged to withdraw all of its talc products from the market by the end of this year, but of course, any lost revenues will no longer be an issue for JNJ, so much as it is an issue for Kenvue, and LTL.

Concluding Thoughts – What To Expect From Johnson & Johnson’s Q3 2023 Earnings? I’m Somewhat Bearish

To summarize all of the above strengths, weaknesses, opportunities and threats in as succinct a fashion as possible, and what it might mean for JNJ’s share price as earnings are released next Tuesday:

First of all, although JNJ has a habit of outperforming analyst’s estimates, I would not be surprised to see a narrow miss next week, given the complexity surrounding a major corporate event, i.e. the Kenvue spinout. In my view, the market is unlikely to grant JNJ any leeway around revenues or profitability around such a major change, and given the company’s forecast for revenues of $84bn across the full year, and $42.4bn earned in 1H23 I don’t see the company achieving much more than the $21bn of revenues forecast by the market, particularly given Q3 is not a traditionally strong quarter for JNJ relative to the others. Based on the same logic I would not expect to see a significant earnings beat either, with a narrow miss a possibility.

Nevertheless, I expect an upbeat assessment of progress from management, who have waited 2.5 years to complete the Kenvue spinout, from which the company can clearly take a lot of positives – a $20bn tax free windfall, a renewed focus on the pharmaceuticals and medical device business, growing profit margins, the opportunity to continue the significant momentum generated in 1H23, with most business segments outperforming.

In my last note covering JNJ’s Q2 2023 earnings, I gave the company a “sell” recommendation, and despite some clear progress, and JNJ stock only falling by ~2% since that note was published, I am not going to change my stance ahead of the next earnings. JNJ’s stock spiked briefly after (positive) Q2 earnings were announced, and I expect management will be desperate to wow the market with an excellent quarterly performance, but problems persist at the company – the Stelara LOE, the overly ambitious growth targets, and the litigation – that have not been sufficiently addressed, even if the Kenvue spinout has been successfully completed.

The fact that the tender for Kenvue’s shares was oversubscribed, even when other, similar spinouts have underperformed, suggests to me that shareholders are still not happy with JNJ’s performance, or leadership, and Duato’s reluctance to embrace an aggressive M&A strategy – perhaps owing to fears around litigation costs – will likely displease them further in my view.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OGN, VTRS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.