Summary:

- Johnson & Johnson reported solid Q3 revenues of $22.5bn, up 5.2% YoY, despite a 34% drop in EPS due to IPRD and litigation impacts.

- The innovative medicines division, led by Darzalex and Tremfya, shows strong growth potential, with management expecting revenues to exceed $57bn in 2025.

- MedTech division saw a 6.4% operational revenue growth, driven by cardiovascular acquisitions, aligning with the company’s focus on high innovation, high-growth markets.

- With a potential resolution to talc litigation and a robust pipeline, JNJ stock is upgraded to “Buy,” offering a 3% dividend yield and substantial long-term growth.

Adam Gault

Investment Overview

Johnson & Johnson (NYSE:JNJ) reported its Q3 earnings on Tuesday, 15th October. It is the world’s third-largest global pharmaceutical company by market cap — and largest, by a distance, in terms of revenues generated. It produced a solid quarter in general, even if profitability was down compared to last year, as a result of the twin impact of in-process research and development [IPRD], and a litigation settlement proposal related to talc. Both of these impacts may be viewed as long-term positives, however, as I’ll explain later in this post.

In terms of the headline figures, revenues across JNJ’s two main divisions, innovative medicines, and medtech, came to $22.5bn, up 5.2% year-on-year. As mentioned, earnings per share [EPS] fell ~34% year-on-year, to $1.11. Adjusted EPS of $2.42 was also reported, down 9% year-on-year, with an IPRD hit also included in this figure.

In terms of guidance for full-year 2024, JNJ upped its revenue forecast to $89.4bn — $89.8bn, which represents annual growth of ~6.6% at the midpoint. Net income forecast was raised from $1.5 — $1.7bn, to $1.9bn — $2.1bn, while adjusted EPS was reduced to $9.86 — $9.96, from $10 — $10.1, with improved performance adding $0.1 to the Q2 forecast, but M&A activities subtracting $(0.24). Operational EPS is forecast to be $9.91, and minus M&A investment, $10.83, which represents a >9% year-on-year uplift.

JNJ Q3 By The Divisions — Innovative Medicine

Innovative Medicines accounted for the lion’s share of Q3 revenues — $14.58bn, up >6% year-on-year. The stand-out performer was multiple myeloma med Darzalex, which achieved >$3bn revenues for the quarter, up >20% year-on-year.

As important, perhaps, was the performance of Tremfya, approved to treat psoriasis, psoriatic arthritis, and in September this year, approved to treat ulcerative colitis as well.

Tremfya is part of JNJ’s immunology division, which accounts for >20% of JNJ’s entire revenues — second only to the oncology division — ~23%. Stelara — JNJ’s best-selling drug of the past few years, earning >$10bn in 2023, is also part of this division, but will lose its patent protection from next year.

Management has suggested this means Stelara revenues will drop in 2024 by ~30% as a result of generic competition in Europe and the US. However, Tremfya, which earned $1bn of revenues in Q3, compared to Stelara’s $2.7bn, is expected to pick up much of Stelara’s lost revenues going forward.

On the Q3 earnings call, Jennifer Taubert, Chairman of the Innovative Medicine division discussed the situation as follows:

we’re really excited about TREMFYA…it really sets what we believe is a new bar in terms of efficacy with the highest rate of endoscopic normalization. And we’ve got rigorous head-to-head data versus STELARA showing superiority in Crohn’s disease. And we think that we’ve got unrivaled flexibility and what will ultimately be a subcu both induction and maintenance dose for TREMFYA. So, TREMFYA was $1 billion in sales for the quarter. And that was really on psoriasis and psoriatic arthritis alone. When we take a look going forward and what we had seen with STELARA in terms of the strength in IBD and the potential, we think that TREMFYA definitely is an asset that is STELARA size or bigger and better. So, a lot of exciting opportunity for us ahead.

In summary then, management believes the immunology division has long-term stability, perhaps even growth potential, despite Stelara’s impending loss of exclusivity [LOE].

Infectious diseases — $836m, Neuroscience — $1.8bn, Oncology — $5.4bn, and Pulmonary Hypertension — $1.1bn, and Cardiovascular / Metabolism — $887m — were the remaining contributors to revenues, alongside immunology — $4.6bn.

Going forward, after announcing it would be shuttering its cardiovascular / metabolic unit, and winding down infectious disease activities relating to COVID-19, the company wants to focus exclusively on immunology, oncology, and neuroscience. There are plenty of exciting pipeline prospects across each of these divisions, and few other patent expiry issues besides Stelara.

For example, within the next couple of years, JNJ expects to secure approval for immunology candidate nipocalimab in generalized myasthenia gravis and rheumatoid arthritis. It also has candidate JNJ-2113 in psoriasis and ulcerative colitis [UC], twin neuroscience drugs seltorexant and aticaprant, in major depressive disorder [MDD], and MDD with Alzheimer’s — all of these drugs are expected to achieve peak revenues in the multi-billions.

Within oncology, to complement the main revenue drivers Darzalex and prostate cancer drug Erleada — $780m of sales in Q3 — Talvey and Tecvayli will be added to the Multiple Myeloma franchise, and Balversa has been approved to treat bladder cancer. All of these are potential blockbusters (>$1bn revenues per annum), while Rybrevant, approved last quarter for EGFR-mutated advanced lung cancer, is being tipped by management for peak revenues of >$5bn per annum.

In summary, then, the outlook for the innovative medicines division is broadly positive. Management says it hopes the division will exceed $57bn in revenues in 2025, and that figure looks likely to rise at a good clip — perhaps mid-single digit percentages, until 2030, by which time it could be a >$70bn per annum revenue division.

JNJ Q3 By The Divisions — MedTech

MedTech may be the lesser known of JNJ’s two main divisions, but after the spinout last year of its best known division, consumer healthcare, into a new entity, named Kenvue (KVUE) (which will report Q3 earnings on 24th October), its importance to the company increases significantly.

Fortunately for JNJ, performance in Q3 was impressive, with revenues growing 6.4% on an operational basis, to $7.89bn, the four major contributing segments being Cardiovascular — $1.97bn, Orthopedics, $2.2bn, Vision, $1.3bn, and Surgery — $2.4bn.

Cardiovascular revenues surged by 26%, thanks to the impact of two recent acquisitions, Shockwave and Abiomed, the former being acquired in May, and adding an intravascular lithotripsy [IVL] platform for coronary artery disease [CAD] and peripheral artery disease [PAD] to JNJ’s armoury.

Surgery revenues fell slightly, but the further ~$1.7bn acquisition of V-Wave Ltd., a privately held company focused on developing innovative treatment options for patients with heart failure, announced on October 9th (and accounting for the lion’s share of this year’s IPRD charges) further bolsters the cardio division. This is a specific target for management thanks to its “portfolio shift to high innovation, high-growth markets,” and sets the business up for long-term innovation and growth.

In fact, JNJ’s Chief Financial Officer advised on Tuesday’s earnings call:

For MedTech, we continue to expect to deliver on our long-term objective identified at last year’s Enterprise Business Review of growing operational sales in the upper end of the 2022 through 2027 weighted average market growth rate of 5% to 7%.

JNJ Taking Steps To Ease Litigation Woes

JNJ has few issues with debt, reporting $20bn of cash and marketable securities, against $36bn of debt, for net debt of just $16bn. This is a very healthy figure by Big Pharma standards — JNJ’s debt to equity ratio of ~58% compares very favorably with the likes of Amgen (AMGN) and AbbVie – >1,000%, or Bristol Myers Squibb – >300%, for example.

The one major headwind JNJ faces that arguably weighs heavily on its share price is litigation related to historic use of its talc product potentially causing cases of ovarian cancer.

The company is still trying to resolve ~60k separate claims relating to this issue. It has attempted to settle all cases once and for all by spinning the litigation out into a separate company, and declaring that company bankrupt, which would effectively cap payouts at around the $8bn mark.

This maneuver, known in legal circles as the “Texas two-step,” has been rebuffed by the courts on two previous occasions, but JNJ is attempting it once again, announcing last month that its subsidiary:

Red River Talc LLC [Red River], filed a voluntary prepackaged Chapter 11 bankruptcy case today in the U.S. Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”) to fully and finally resolve all current and future claims related to ovarian cancer arising from cosmetic talc litigation against the Company and its affiliates in the United States.

JNJ adds that:

After extensive negotiations with counsel for claimants who initially opposed the Plan, Red River agreed to increase its contribution to the settlement by $1.75 billion to approximately $8 billion.

JNJ now says it has the support of 83% of current claimants, which “far exceeds the 75% approval threshold required by the U.S. Bankruptcy Code to secure confirmation of the Plan.” If successful, JNJ says its plan will resolve “99.75% of all pending talc lawsuits,” and on the earnings call, JNJ’s head of worldwide litigation, Erik Haas told analysts:

We contemplate putting forth a schedule that resolves those issues through the end of the year for a confirmation hearing sometime at the beginning of next year. So that’s the schedule we’re on.

In summary, it seems JNJ is edging closer to a settlement, which would heavily impact 2025 financial performance presumably (the company reported a $1.75bn charge related to litigation in Q3), but would be a case of “short-term pain for long-term gain.” A resolution would likely be positive for the share price, but another verdict against the company is equally likely to trigger a sharp sell-off of stock.

Concluding Thoughts — Post Q3 Earnings, Is JNJ Stock a “Buy,” “Sell” or a “Hold”

Back in April, I shared a note on JNJ suggesting the company faced a “tricky outlook” in 2024, and awarded its stock a “Hold” rating. JNJ stock subsequently slid to ~$145 per share by the end of July (at the time of my note it had traded at $153), but after two consecutive positive sets of earnings, shares now trade at $164, giving the company a market cap valuation just shy of $400bn.

A reasonably generous dividend pays $1.24 per quarter, for a current yield of 3%, adds to the attractiveness of JNJ stock. If we add in the mitigation of the Stelara LOE with rising sales of Tremfya and other assets, the multiple, multi-billion dollar pipeline prospects, and a potential end to the company’s litigation woes, my conclusion is that JNJ stock merits an upgrade to “Buy.”

I shared some revenue estimates and discounted cash flow in my last note and below share some updated figures — these are subjective, but based on management’s guidance and some painstaking research, and these also make the bull case for JNJ stock over the longer term.

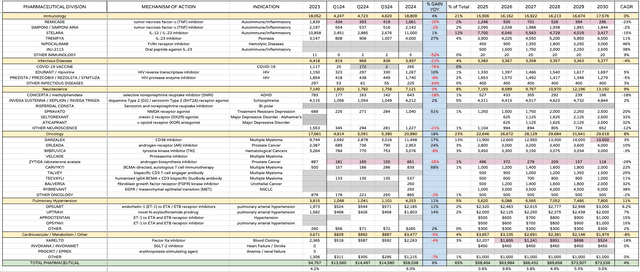

JNJ product / pipeline revenue forecasts (my table and assumptions based on guidance / research)

First, my product by product revenue guidance to 2030 for the innovative medicine division sees JNJ growing revenues >$70bn by 2030. This is challenging, but there is nothing especially unrealistic about these figures, in my view, barring one or two potential late-stage study failures.

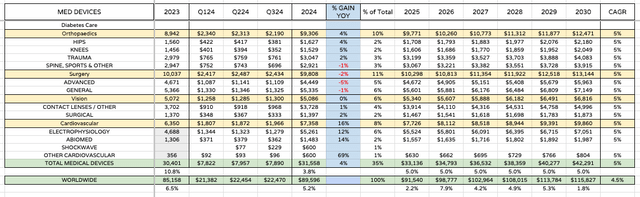

MEDICAL DEVICES PROJECTED GROWTH (my table and assumptions)

For medical devices, I have assumed a more basic 5% growth figure, in line with, or perhaps slightly lagging management’s own forecasts. The major difference I would anticipate is stronger growth within cardiovascular, with surgery perhaps underperforming / shrinking in size.

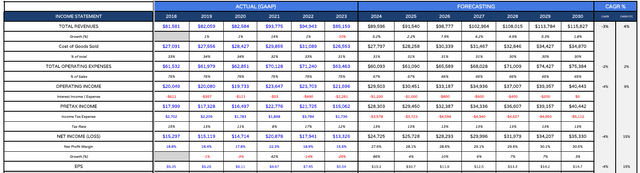

JNJ income statement forecast (my table and assumptions)

For the forward income statement, I am switching from historic GAAP EPS to forward adjusted EPS, beginning with the ~$10 figure forecast by management for 2024.

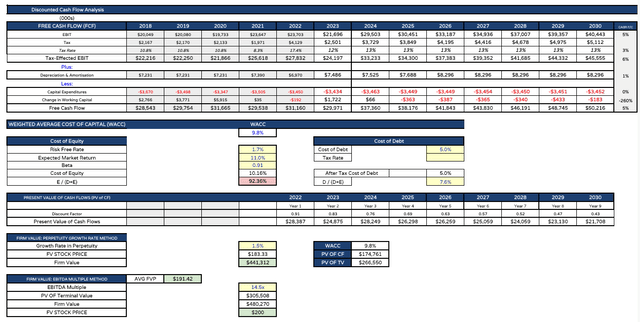

JNJ DCF analysis (my table and assumptions)

Finally, the discounted cash flow analysis itself, which as we can see suggests a present day share price value of $183 on a perpetuity growth rate method basis, and $200 on an EBITDA multiple basis, for an average value of $191.

That’s an upgrade on my last note, when my calculated present day value was $175. While such calculations are open to interpretation, these tables at least give me further comfort that JNJ stock is worth more intrinsically today than the market is paying for it at the present actual value of $164 per share.

A positive outcome for the talc litigation early next year could be the trigger for JNJ stock to challenge $190 per share. However, analysts will be watching the Stelara numbers all year long, so it may be early 2026 before we see the stock rise that high.

Either way, investors can keep collecting the dividend, and keep holding an investment that is substantially derisked by Big Pharma standards, in my view, without losing too much sleep.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ABBV, BMY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.