Summary:

- Johnson & Johnson reported Q3 earnings with a 6.8% surge in sales, reaching $21.4 billion in revenue.

- The company’s innovative medicine segment showed strong growth, with key brands like DARZALEX and ERLEADA performing well.

- J&J has future growth opportunities in its MedTech segment, particularly in electrophysiology and pulse field ablation, as well as in expanding its production capacity.

Andrei Akushevich/iStock via Getty Images

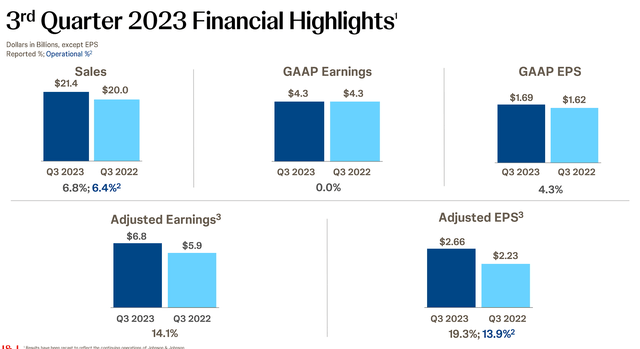

The iconic healthcare conglomerate, Johnson & Johnson (NYSE:JNJ), recently reported their Q3 earnings on the heels of an eventful period for the company, including a major strategic shift and developments in its healthcare segments. Q3 was the first earnings report after J&J’s strategic offshoot of its consumer health business into a new entity branded Kenvue (KVUE). Longstanding J&J brands like Benadryl, Band-Aid, Listerine, and Tylenol now reside under this new venture, with J&J only having a less than 10% stake in KVUE after an exchange offer transaction. As a result, it was clear that the Q3 earnings report was going to be a bit cloudy as analysts pegged the consensus EPS Estimate at $2.52, indicating a slight 1.2% year-over-year decrease. Revenue estimates stand at $21.06B, reflecting an 11.5% decline from the previous year’s figures. Personally, I was optimistic about J&J hitting the Street’s projections thanks to their impressive earnings performance over the last two years, surpassing EPS estimates 100% of the time. In addition, J&J reported a robust Q2 performance, surpassing expectations in both adjusted earnings per share and revenue. Thankfully, J&J reported a formidable 6.8% surge in sales, amassing a staggering $21.4B in revenue with a beat on EPS and revenue.

I believe J&J’s Q3 earnings unveiled the “new” JNJ and its prospects for growth. Although the company has a few notable downside risks to consider, I am still bullish on the company’s long-term outlook in biopharma and MedTech.

I intend to provide a little background on the “New” J&J and will review their Q3 earnings. Then, I will point out some potential growth drivers, as well as some downside risks to consider. Finally, I reveal my plan for managing my JNJ position while we wait for the selling pressure to subside.

Background On The “New” J&J

Johnson & Johnson stands as a paragon of innovation and excellence in the global healthcare industry. With a legacy spanning over a century operating across more than 60 countries pushing a diverse portfolio of pharmaceuticals and medical devices.

J&J’s innovative medicine portfolio consists of some heavy-hitters in biopharma including DARZALEX, STELARA, Tremfya, Erleada, CARVYKTI, Simponi, and Spravato. For the company’s MedTech segment, they offer products from Abiomed, as well as items for electrophysiology, wound closure, bio-surgery, contact lenses, surgical vision, as well as articles used in hip, knee, and trauma surgery.

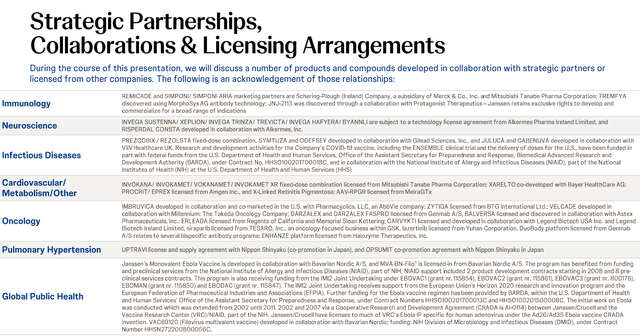

J&J also has a long list of partnerships collaborations and licensing agreements in immunology, neuroscience, infectious disease, cardiovascular, metabolic, oncology, pulmonary hypertension, and public health.

Johnson & Johnson Partnerships and Collaborations (Johnson & Johnson)

Q3 Performance Highlights

J&J recently reported their Q3 earnings, where worldwide sales of $21.4B, representing an impressive 6.8% surge year-over-year. The operational sales growth, a metric excluding currency fluctuations, demonstrated noteworthy growth at 6.4%. Particularly, the U.S. market experienced a remarkable 11.1% growth, while international sales demonstrated commendable growth at 1.6%.

Johnson & Johnson Q3 Earnings (Johnson & Johnson)

As a result, J&J revised their full-year 2023 guidance with revenues to be in the range of $83.6B-$84B, up from the previous guidance of $83.2B-$84B. In addition, they upgraded their adjusted EPS to be in the range of $10.07-$10.13, up from $10.00-$10.10.

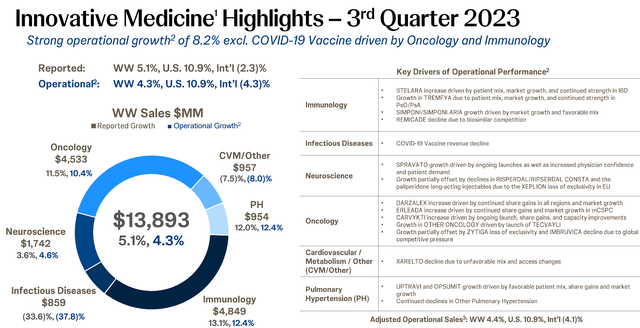

Stalwart Innovative Medicine Segment

The innovative medicine segment emerged as a stalwart, reporting worldwide sales of $13.9B, up 5.1% year-over-year. I will note that the company reported their innovative medicine segment sales in the U.S. experienced an extraordinary 10.9% growth. Although international sales faced a slight dip of 2.3%, it is noteworthy that, excluding COVID-19 vaccine sales, operational sales growth surged to an impressive 8.2%.

Johnson & Johnson Innovative Medicines Q3 Performance (Johnson & Johnson)

Key brands such as DARZALEX and ERLEADA showcased substantial growth, with increases of 20.7% and 27% respectively, driven by market expansion and a favorable patient mix. In the immunology sector, both STELARA and TREMFYA exhibited impressive growth rates of 15.8% and 21.5% respectively, predominantly propelled by a favorable patient demographic and market expansion.

Freshly launched products like SPRAVATO and CARVYKTI demonstrated encouraging early success. Additionally, the expansion of the oncology segment through products like TALVEY and TECVAYLI is poised to be a significant driver of future growth, with TECVAYLI’s sales set to be disclosed in Q1 of next year.

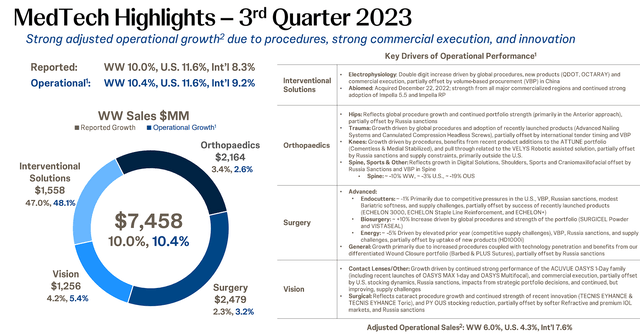

Defiant MedTech Segment

In their MedTech segment, J&J reported global sales coming in at $7.5B, showcasing an impressive 10% growth. The U.S. market excelled with an 11.6% increase, while Ex-U.S. sales also saw a commendable 8.3% uptick. The company also experienced a 10.4% growth in operational sales thanks to contributions from Abiomed with their Interventional Solutions franchise bringing in $311M attributable to the implementation of their Impella 5.5 technology.

Johnson & Johnson MedTech Q3 Performance (Johnson & Johnson)

Future Growth Opportunities

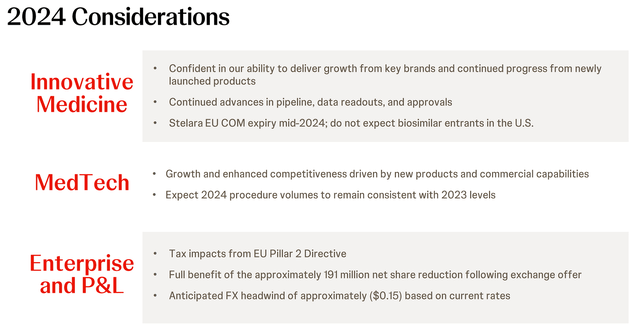

Looking ahead to 2024, Johnson & Johnson appears to be poised to build upon their 2023 success thanks to their robust pipeline and key brands. I would point to their MedTech segment with improvements in electrophysiology and pulse field ablation to be significant growth drivers.

Johnson & Johnson 2024 Outlook (Johnson & Johnson)

In addition, J&J has been making significant strides in expanding its production capacity, especially in Europe. Notably, they have been focusing on perfecting their lentivirus component technology, a critical component in certain cell therapies. Their development of this technology, coupled with the expansion of their factory in Switzerland, is poised to address a historically rate-limiting aspect of their treatments.

The company also expressed tremendous enthusiasm regarding their progress with, CARVYKTI, their CAR-T therapy for multiple myeloma (MM). Clinical data showed exceptional results, with a remarkable 99% ORR and an 86% CR rate. Importantly, the therapy revealed high durability with nominal adverse effects. As a result, the company believes CARVYKTI is now situated to be a preferred second-line therapy for MM, and they may explore its potential as an alternative to stem cell transplants.

The recent nomination of TALVEY in the multiple myeloma space and the launch of TECVAYLI have exceeded J&J’s expectations. The company announced that about 2K healthcare professionals in the U.S. have already received certification to administer these therapies, which should lead to sales growth starting next year.

Long-term, I am looking at their Ottava robotic-assisted surgery platform that could be an industry disruptor. Ottava holds promise to introduce a matchless construction, coupling cutting-edge software and hardware with their renowned instruments. The company anticipates that Ottava will significantly impact the rapidly growing field of robotic surgery, offering less invasive options.

New and Lingering Risks

Although the orthopedic segment showed growth, a restructuring approach is in place to ensure long-term profitability. It appears as if J&J’s orthopedic results are indicating a perceived softness in performance. Although the orthopedics segment reported a 2.6% growth, it was partially attributed to seasonality. Clearly, J&J appears to be committed to becoming a top competitor in each segment of orthopedics, however, they are restructuring by withdrawing from less lucrative markets and orthopedic product lines. While this may lead to some revenue disturbance, it is expected to drive future growth and profitability. Still, any perceived softness or decline tends to have a negative impact on the share price… even if it is anticipated and is a consequence of a strategic move.

Another risk to consider is the fact that J&J is still actively managing TALC litigation. The company is employing a multi-pronged strategy that comprises pursuing an appeal to the Supreme Court and working towards a resolution including bankruptcy. Obviously, litigation at this level is serious and will maintain a dark cloud over the ticker until everything is settled.

The company also acknowledged headwinds in China due to Value-Based Pricing (VBP), which is anticipated to affect specific MedTech platforms, including trauma, spine, endocutters, and electrophysiology.

Another concern to keep an eye on is STELARA’s impending biosimilar opposition in 2025. STELARA is a vital product in J&J’s immunology portfolio, so the loss of exclusivity (LOE) will impact the company’s ability to maintain its position in massive markets, including psoriasis and psoriatic arthritis.

Despite these risks and concerns, JNJ still has a conviction rating of 5 out of 5 in the Compounding Healthcare “Healthy Dividend” Portfolio.

Our Takeaway

J&J’s Q3 2023 results reveal that the company is entering a transformative phase after a successful separation with Kenvue while also achieving a staggering $21.4B in revenue for Q3. Although J&J has plenty of concerns weighing on the share price, the company appears to be well-prepared for sustained growth and leadership in numerous healthcare segments thanks to a focused strategy, backed by innovative products, and a robust financial foundation.

My Plan

Despite some lingering concerns and the Kenvue split, I am sticking to my current Buy Targets and Sell Targets to manage my JNJ position.

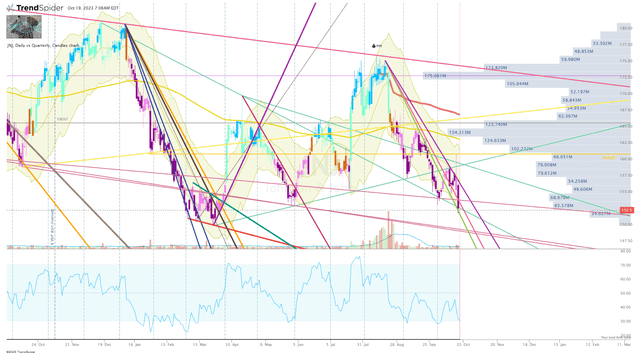

At the moment, JNJ is trading around $152 per share, which is below my Buy Threshold of $163. However, I am not looking to pull the trigger on a buy just yet. The Daily Chart shows that the ticker has dropped outside its wedge formation and was rejected after failing to recapture. Moreover, the ticker has a very bearish rating on the Go-No-Go Indicator along with a weak RSI. In addition, the share price failed to break the downtrend ray from the August-high following the earnings release. So, it appears the algorithms are still applying the selling pressure for the time being.

I do see a potential double-bottom set-up forming after a bounce off the bottom of the Daily Keltner Channel, but I would have to see a strong break of the downtrend with volume before I consider clicking the buy button. At the moment, JNJ’s technical analysis looks very bearish.

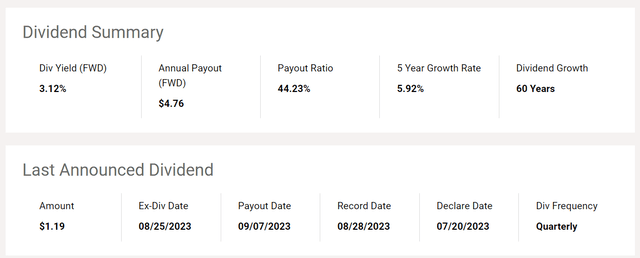

That being said, I am still bullish on JNJ’s fundamentals and long-term outlook. Therefore, I am going to remain vigilant and will keep an eye on the ticker. If JNJ’s share price continues to deteriorate and falls below my Buy Target 1, I would have to consider clicking the buy button based on the valuation along with JNJ’s healthy dividend.

JNJ Dividend Summary (Seeking Alpha)

Long term, JNJ is basically cemented into the Compounding Healthcare Healthy Dividend Portfolio, thanks to the ticker’s ability to weather uncertain markets, continuously cultivate growth, and maintain an impressive track record of providing a safe dividend.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ, KVUE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Want to capitalize on the next big medical breakthrough?

Tired of missing out on some of the healthcare sector’s multi-baggers?

Join Compounding Healthcare where we employ data analytics in combination with technical analysis and clinical data breakdown in order to manage a position in numerous potential multi-bagger investments that can grow into a comprehensive healthcare portfolio.