Summary:

- I reiterate a “Buy” rating for Johnson & Johnson, driven by their robust cardiovascular device portfolio and recent acquisitions, with a fair value of $195 per share.

- The acquisition of V-Wave enhances Johnson & Johnson’s MedTech business, opening new opportunities in the high-growth heart failure device market.

- Johnson & Johnson’s Q3 results exceeded expectations, with 26.5% year-over-year growth in the cardiovascular market and a 5.4% adjusted operational revenue growth.

- Despite headwinds in China, Johnson & Johnson’s decentralization strategy and ongoing acquisitions are expected to drive organic revenue growth and margin expansion.

JHVEPhoto

I assigned a “Buy” rating to Johnson & Johnson (NYSE:JNJ) stock in July 2024, highlighting their strong product pipeline and the acquisition of Shockwave Medical. Johnson & Johnson delivered a solid financial result for Q3, beating the market expectations. With the recent acquisitions, Johnson & Johnson has built a solid cardiovascular device portfolio, which is growing at double-digit. I reiterate “Buy” rating with a fair value of $195 per share.

Acquisition of V-Wave

On October 9th, Johnson & Johnson completed the acquisition of V-Wave, a private company focused on developing innovative treatment options for patients with heart failure, for $1.7 billion. I think the acquisition could benefit Johnson & Johnson in several ways:

- V-Wave could strengthen Johnson & Johnson’s MedTech business in cardiovascular disease. V-Wave’s technology could help Johnson & Johnson open new opportunities in the heart failure device market, a high-growth end-market.

- V-Wave’s device received the FDA’s breakthrough device designation in 2019 and Europe’s CE mark in 2020. As such, Johnson & Johnson could immediately utilize their global distribution channels to expand V-Wave Ventura Interatrial Shunt product worldwide.

- Johnson & Johnson has been building up their cardiovascular device portfolio recently. They acquired Abiomed for $16.6 billion in 2022, and purchased Shockwave Medical for $13.1 billion in 2024, as discussed in my previous article. With the acquisition of V-Wave, Johnson & Johnson now has a substantial portfolio in the cardiovascular device market. As communicated by the management, the cardiovascular device is a very attractive growth market with a total addressable market of $60 billion, growing at 8%+ annually.

Recent Result, Outlook, and Valuation

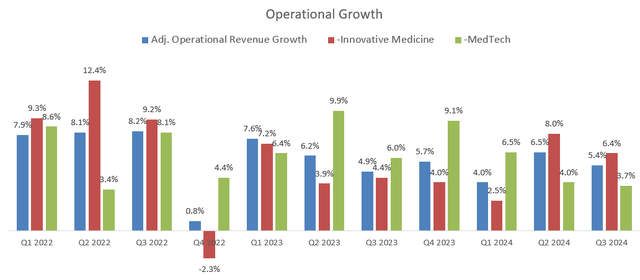

The company released their Q3 result on October 15th before the market opened, beating the market expectations. As depicted in the chart below, Johnson & Johnson delivered 5.4% adjusted operational revenue growth with strong growth in their innovative medicine segment. My key takeaway from the quarter is their business strength in the cardiovascular market, which posted a 26.5% year-over-year in operational sales.

Johnson & Johnson Quarterly Result

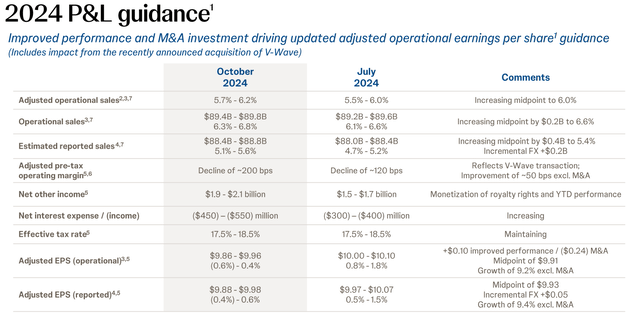

Due to the recent acquisition of V-Wave, the company adjusted their full-year guidance as follows:

Johnson & Johnson Investor Presentation

For normalized business growth, I am considering the followings:

- MedTech: I think their cardiovascular business will continue to drive Johnson & Johnson’s MedTech segment. As discussed previously, the cardiovascular device market has been growing at 8%+ driven by increasing numbers of procedures. Johnson & Johnson has consistently delivered double-digit revenue growth in the cardiovascular device business. I calculate that Johnson & Johnson’s MedTech business will grow by 7%, with 4% growth from cardiovascular, 2% from the Vision business, and 1% from other business including orthopedics and surgery.

- Innovative Medicine: As a pharmaceutical business, the revenue growth will be volatile, as the business is largely driven by new drug developments. Johnson & Johnson has built a comprehensive portfolio across oncology, neuroscience, infectious diseases and immunology. Future Market Insights predicts the global pharmaceutical market will grow at a CAGR of 6.4% from 2023 to 2033. I assume Johnson & Johnson will grow in line with the overall market.

As such, I calculate Johnson & Johnson will deliver 6.4% organic revenue growth in the near future. I continue to assume the company will allocate 5% of revenue towards M&A, contributing an additional 130bps to the topline growth.

Johnson & Johnson is in the process of decentralizing their operations, aiming to improve productivity among sales/marketing, R&D as well as global manufacturing. I think their ongoing decentralization strategy will generate margin upside over time. I continue to project 20bps annual margin expansion, driven by 10bps from new product launches and 10bps from decentralization efforts.

The WACC is calculated to be 8.9% assuming: risk-free rate 3.6%; beta 0.8; cost of debt 5%; debt balance $29 billion; equity $388 billion; tax rate 16%; equity risk premium 7%.

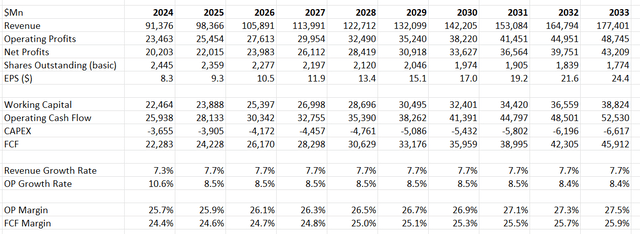

The discounted cash flow (“DCF”) summary can be found as follows:

Discounting all the future FCF, the fair value is estimated to be $195 per share, according to my DCF model.

Key Risks

China represents 5% of total Johnson & Johnson’s revenue. The management indicated that the headwinds from China are expected to persist into FY25, as China’s Volume-Based Procurement (VBP) has been impacted by the ongoing anticorruption program. The anticorruption campaign in China has impacted Johnson & Johnson’s ability to engage with physicians, creating growth hurdles for their medical device marketing activities. The management lacks any visibilities regarding the timing of a market recovery in China.

Conclusion

With the acquisition of Abiomed, Shockwave Medical and V-Wave, I think Johnson & Johnson could potentially accelerate their organic growth in the cardiovascular device market. I reiterate “Buy” rating with a fair value of $195 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.