Summary:

- Johnson & Johnson reported solid first quarter results and is also expecting mid-single digit growth for the full year.

- The company is facing risks right now, especially from the litigations due to the talc products, and breaking the support line is also a rather bearish sign.

- But the stock seems slightly undervalued at this point, and Johnson & Johnson is probably a good investment for investors seeking stability and a bond-like investment.

JHVEPhoto

In my last article, I called Johnson & Johnson (NYSE:JNJ) (NEOE:JNJ:CA) a very cautious “Buy” but since my last article Johnson & Johnson continued to decline further and the stock lost about 9% in value during the last 10 months. Especially when comparing the performance to the S&P 500 (SPY) which increased 23% in the same timeframe, we have to see Johnson & Johnson rather as a disappointment.

Johnson & Johnson is not really declining steeply, but the stock is slowly creeping lower and has reached price levels not seen for almost 4 years. And with the stock now being almost 10% cheaper than last time, let’s look at the company and stock again to determine if it is a good investment now.

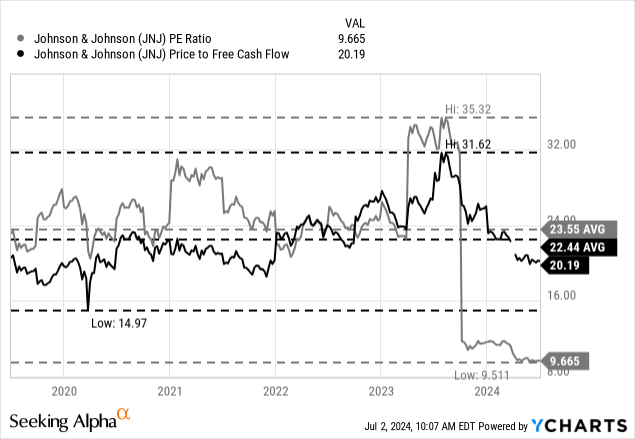

Valuation Multiples

A first hint to answer the question if Johnson & Johnson is a good investment comes from the simple valuation multiples – especially the price-earnings ratio. In the following chart I only look at data from the last five years, as triple digit valuation multiples in the meantime would completely distort the picture. Right now, Johnson & Johnson is trading for 9.7 times earnings, and this is clearly the lowest valuation multiple in the last five years. And although this is not visible in the chart, it is also the lowest valuation multiple in at least the last 35 years (I don’t have data prior to that).

When looking at the price-free-cash-flow ratio, the picture is a little different. Right now, Johnson & Johnson is trading for 20 times free cash flow – a valuation multiple that is neither cheap nor expensive. It is also slightly below the 5-year average of 22.44. So, while the P/E ratio is clearly telling us that Johnson & Johnson is undervalued, the P/FCF is not giving us such clear hints to buy the stock (rather indicating to hold at this point).

Quarterly Results

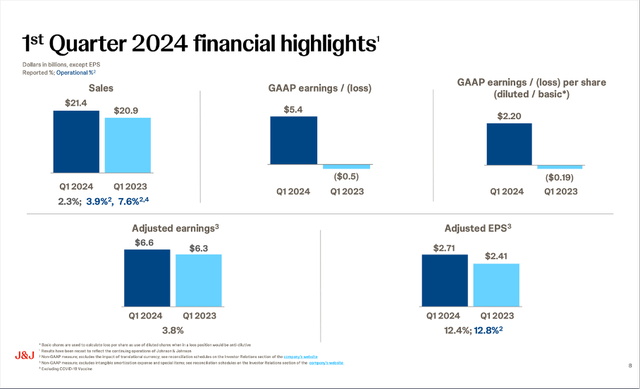

Next, let’s look at the results of Johnson & Johnson to get a better picture. On April 16, 2024, Johnson & Johnson reported first quarter results and sales increased slightly from $20,894 million in Q1/23 to $21,383 million in Q1/24 – resulting in 2.3% year-over-year growth. Diluted earnings per share switched from a loss of $0.19 in the same quarter last year to $2.20 in earnings per share this quarter. Additionally, we can also look at adjusted earnings per share, which increased 12.4% year-over-year from $2.41 in Q1/23 to $2.71 in Q1/24.

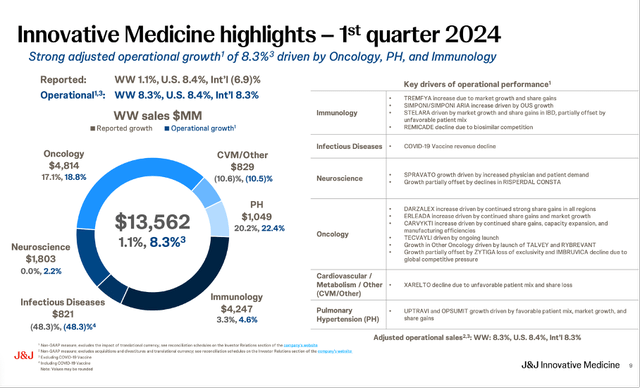

Johnson & Johnson Q1/24 Investor Presentation

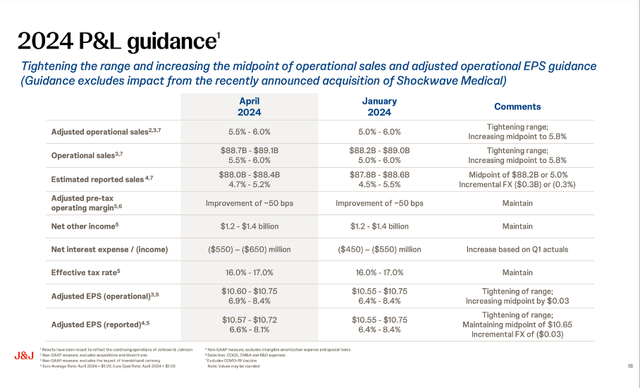

Johnson & Johnson also updated its guidance. Management is now expecting adjusted operating sales to increase between 5.5% and 6.0% and reported sales are expected to be around $88 billion (resulting in about 5% top line growth). Adjusted earnings per share are expected to be in a range between $10.57 and $10.72 – basically the same as last time only guidance was narrowed.

Johnson & Johnson Q1/24 Investor Presentation

Segment Results

When looking at the segment results, Johnson & Johnson is now reporting in two different segments (when my last article was published, the company was still reporting in three different segments).

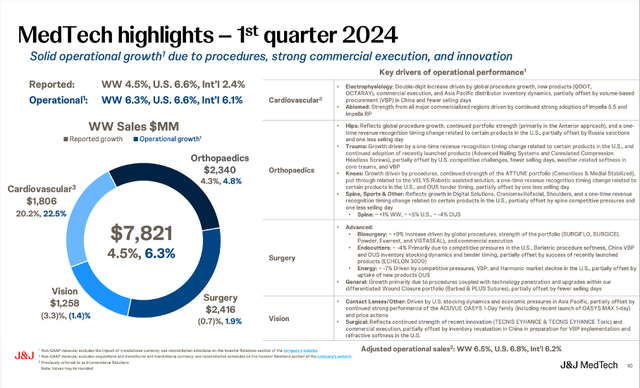

In the first quarter, MedTech reported $7,821 million in revenue, which resulted in 4.5% year-over-year growth. However, the segment was negatively impacted by approximately 80 basis points due to fewer selling days. And in cardiovascular, which was previously referred to as the Interventional Solutions segment, electrophysiology delivered double-digit growth of 25.9% in all regions.

Johnson & Johnson Q1/24 Investor Presentation

When looking at the Innovative Medicines segment, reported revenue was $13,562 million and this resulted in 1.1% year-over-year growth. However, when excluding the impact of the COVID-19 vaccine, operational sales grew 8.3% – both worldwide and outside the United States. Growth was driven both by key brands as well as recently launched products taking market shares. This includes Tremfya, which grew 26.3% year-over-year, Durant growing 15.7% year-over-year, Spravato increased 72.2% year-over-year and Erleada grew 27.0% year-over-year. But it was especially Darzalex, which increased 18.9% year-over-year to $2,692 million in quarterly revenue and is therefore one of the most important products of Johnson & Johnson.

Johnson & Johnson Q1/24 Investor Presentation

Growth: Buybacks and Acquisitions

Similar to every other company, Johnson & Johnson has several ways to grow its business. Improving margins, buying back shares, being innovative and introducing new products. In the following section, we focus on two ways – share buybacks and acquisitions.

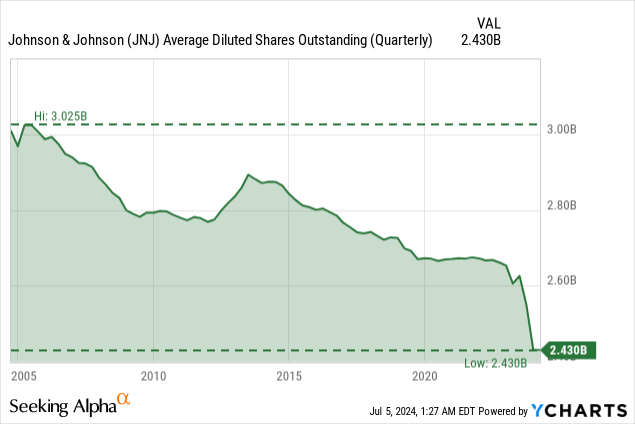

Johnson & Johnson is growing a little bit by buying back shares. And although Johnson & Johnson accelerated share buybacks in the recent past, it is still not buying back with the same aggressive pace as some other companies.

In the last 20 years, the company reduced the number of outstanding shares from around 3 billion to 2.43 billion right now. This is resulting in a CAGR of 1.05% during the last 20 years. However, in the last five years, share buybacks were accelerated and Johnson & Johnson’s share buybacks contributed about 2% annually to the bottom line.

Another way to grow is by acquisitions. With $25.1 billion in long-term debt (as well as $8.6 billion in short-term notes and loans), Johnson & Johnson has some debt on its balance sheet. But at the same time, the company has $25.5 billion in cash and cash equivalents on the balance sheet and $745 million in marketable securities. And although the balance sheet is not perfect, it is enabling Johnson & Johnson to make some acquisitions. However, we must take into account that Johnson & Johnson used $13.1 billion for the acquisition of Shockwave Medical in the meantime (we will get to this).

Recently, Johnson & Johnson acquired the dermatology-focused biotech company Proteologix for $850 million. The acquisition closed in Mid-June, but the acquisition of such a small business won’t have any measurable impact on Johnson & Johnson top and bottom line right now. The company mostly has early-stage drugs in its portfolio, and it probably will take a while before these pharmaceuticals can contribute to revenue (and earnings per share).

Additionally, Johnson & Johnson acquired Shockwave Medical, and the acquisition was completed at the end of May 2024. The business was acquired for $13.1 billion and will extend the position of Johnson & Johnson in cardiovascular intervention (one of the fastest growing medtech markets).

During the last earnings call, CFO Joseph J. Wolk commented on the Shockwave Medical acquisition:

Earlier this month, we announced a definitive agreement to acquire Shockwave Medical. Johnson & Johnson has a long history of addressing cardiovascular disease through both our Innovative Medicine and MedTech businesses. The acquisition of Shockwave with its leading intravascular lithotripsy or IVL technology will provide us with a unique opportunity to impact coronary artery and peripheral artery disease, two of the highest growth innovation oriented segments within cardiovascular intervention. This addition is not only adjacent to our other cardiovascular businesses but also consistent with our strategy of becoming a best-in-class MedTech company. During the first quarter, we also expanded our Innovative Medicine portfolio with the completion of the Ambrx acquisition. With its promising pipeline and ADC platform, Ambrx will further strengthen our oncology portfolio and ability to deliver enhanced precision biologics that treat cancer.

However, there are two aspects we should take into account. At first, we must subtract $13.1 billion from the cash reserves that Johnson & Johnson used in the meantime for the Shockwave Medical acquisition. Additionally, as mentioned during the last earnings call, Johnson & Johnson is building some reserves in cash it might need for a resolution of the talc litigation – one of the major problems and risks Johnson & Johnson is facing right now.

Risk I: Litigation

Lawsuits are always a risk for a business and for its investors, as we are dealing with several unknowns and factors hard to anticipate. Not only do we not know if and how much a company must pay. Additionally, these lawsuits can take several years, and it is difficult to know beforehand when the problems might be resolved.

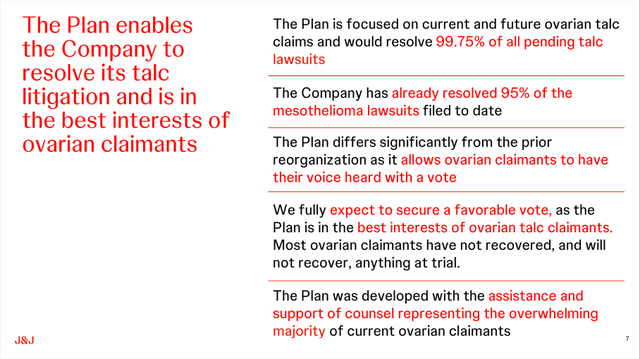

Johnson & Johnson is facing tens of thousands of lawsuits in the United States due to its talc products – more than 50,000 claims have been filed against the company, mostly on behalf of women who developed ovarian cancer. Recently, the company offered to pay $6.5 billion to settle allegations that its talc products caused cancer. The proposal would settle 99.75% of the pending talc lawsuits in the United States.

Johnson & Johnson Cancer Talc Claims Presentation

In some cases, the company has already reached a settlement of $700 million in a nationwide settlement resolving allegations that it misled customers about the safety of its talcum-based powder products in its marketing. The settlement is still pending judicial approval, but in case it is approved, Johnson & Johnson will make four payments and the company will also permanently stop the manufacturing, promotion and sale of its baby powder and other body and cosmetics products that contain talcum powder.

Additionally, Johnson & Johnson has already set aside reserves for the lawsuits and settlements. Right now, Johnson & Johnson is reporting a total nominal value of reserves of $13.7 billion. But Johnson & Johnson would not be the first company seeming close to a settlement but still taking several years until the issue is finally resolved. And although we have reasons to be optimistic about Johnson & Johnson, there are also reasons to remain cautious about how the settlement will finally turn out.

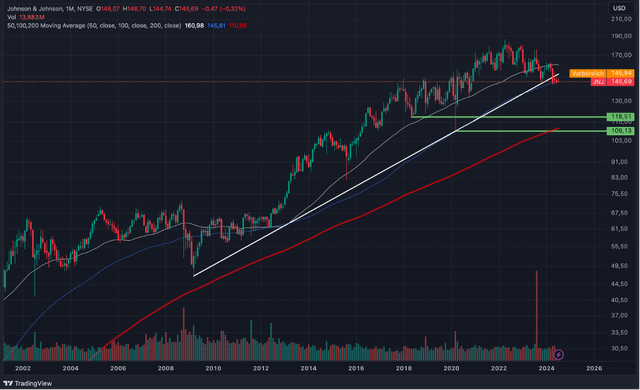

Risk II: The Chart

A second reason to remain cautious about an investment in Johnson & Johnson is the chart. In the last few quarters, the stock constantly moved lower and recently, the stock broke a supporting trendline which was connecting the lows of the Great Financial Crisis and the COVID-19 lows. And although it is just one line in a chart, it is indicating that lower stock prices might be possible.

JNJ Monthly Chart (Author’s work created with TradingView)

It also seems possible that a bigger correction of the last upward wave, which started in 2009, is beginning and such a correction probably would take the stock lower. The range between $110 and $120 seems like a first potential target in such a scenario. Here we find previous lows of the chart (the lows from the COVID-19 crash in early 2020) and the 200-month simple moving average. Although this is rather speculation at this point, lower stock prices seem possible in the coming months.

Intrinsic Value Calculation

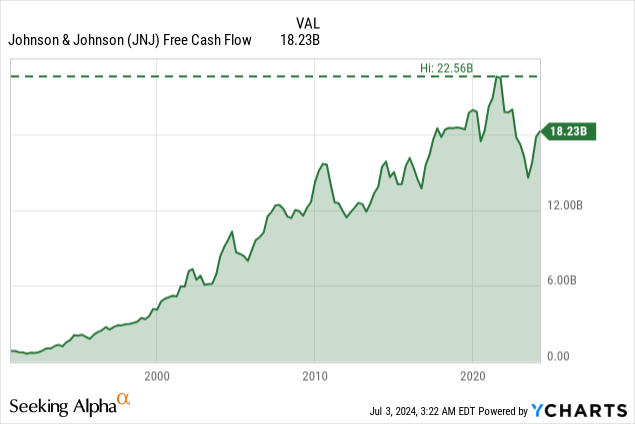

In the end, it comes down to an intrinsic value calculation to determine if Johnson & Johnson is a good investment. As a basis, we can take the free cash flow of the last four quarters, which was $18.23 billion and seems like a reasonable amount. Free cash flow already declined a little bit from its previous peak of $22.56 billion. We are also calculating with 2,430 million outstanding shares and a 10% discount rate.

In my last article, I calculated 6% growth till perpetuity. In the last ten years, Johnson & Johnson actually grew with a CAGR of 11.05% but such a high growth rate is extremely unrealistic for such a mature business. Operating income, on the other hand, grew only at a CAGR of 2.13%. And when looking at analysts’ estimates for the years to come, I would also argue that 6% growth is certainly an ambitious target for Johnson & Johnson, but a target that is realistic and achievable.

When calculating with these assumptions we get an intrinsic value of $187.55 for Johnson & Johnson and considering that the stock is currently trading for $146 at the time of writing we can call the stock undervalued. Even when being a little more cautious and calculate only with 5% growth for the years to come, the stock would still be slightly undervalued, and we can argue that a margin of safety is also included in our calculation at this point.

Upcoming earnings

In less than two weeks, Johnson & Johnson will report second quarter results. And the picture among analysts seems to be mixed. For the next quarter, we see more up revisions than down revisions for revenue, but more down revisions for earnings per share than up revisions.

And overall, we see estimates being lowered slightly over time, which is also not a good sign. When earnings and revenue estimates constantly are lowered, it is not a good sign for the business and also speaking for a rather bearish sentiment.

Conclusion

Johnson & Johnson remains a “Buy” at this point. We certainly should not expect fireworks at this point, and also not in the years to come. But over the long run, Johnson & Johnson will continue to pay a dividend to its shareholders and the stock will move higher. However, in the short-to-mid-term, the risk of lower stock prices remains, and one could also try to wait for lower stock prices.

In my opinion, Johnson & Johnson is an investment that offers stability and consistency, but not necessary have the potential for extremely high returns. Johnson & Johnson is rather one of the companies that can be seen as a bond-like investment, generating returns not only via a coupon (dividend payments) but also by an increasing stock price.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.