Summary:

- Johnson & Johnson reported a solid Q1 quarter beating on both the TOP and BOTTOM lines.

- All three sectors of the business experienced gains year-over-year.

- FX remains a headwind, but despite this, Johnson & Johnson management increased its 2023 guidance.

Mario Tama

Solid Q1 Results For JNJ

Johnson & Johnson (NYSE:JNJ) reported a solid Q1 quarter that saw the following:

- Revenues: $24.7 Billion

- Adj EPS: $2.68.

Analysts were expecting revenues of $23.6 billion, so a very nice beat on the top line. In terms of EPS, analysts were expecting adjusted EPS of $2.50, so a sizable beat on the bottom as well.

Total company revenues grew 5.6% year over year, while adjusted EPS grew just 0.4%. Excluding the negative impacts of foreign currency, company revenues saw growth of 9.0%.

Here is a look at how the company performed by segment:

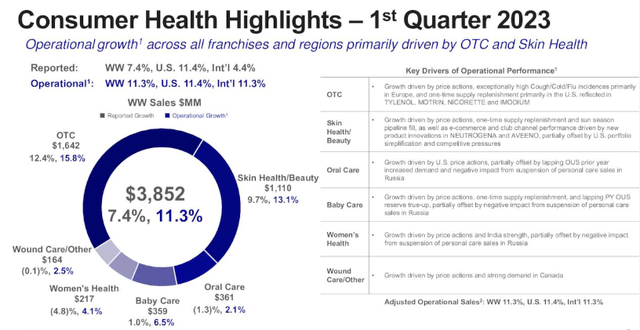

- Consumer Health

- Revenues: $3.85 Billion

- Reported Revenue Growth: 7.4%

- Adjusted Revenue Growth: 11.3%

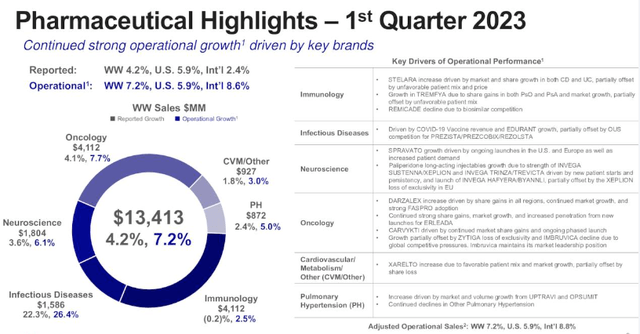

- Pharmaceutical

- Revenues: $13.41 Billion

- Reported Revenue Growth: 4.2%

- Adjusted Revenue Growth: 7.2%

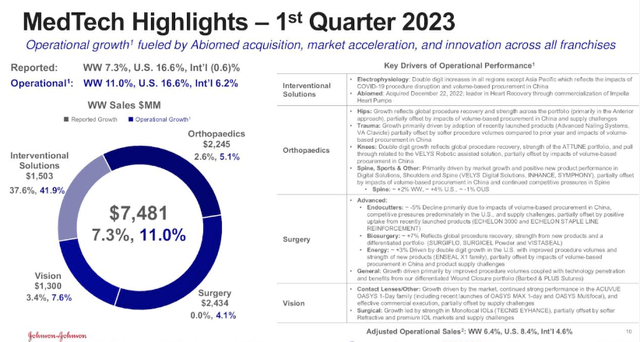

- MedTech

- Revenues: $7.48 Billion

- Reported Revenue Growth: 7.3%

- Adjusted Revenue Growth: 11.0%.

As you can see from the segment reporting from above, each Johnson & Johnson segment grew during Q1, with the consumer health segment being the fastest growing segment.

A Closer Look At Each Segment

Consumer Health

Consumer Health is going to be the segment that will be spinning off from the company into a separately traded public entity called Kenvue. This spinoff is expected to take place in Q4 2023.

The growth driver for the segment during the quarter was largely due to their over the counter products, with major contributions from Tylenol and Motrin. This comes as no surprise, as Q1 was during the winter months when many people deal with colds and flu illnesses, causing many to need these products. Early on in the year, the demand was so high for these products that stores were running low or out of products.

Within the consumer health segment, over the counter is the largest contributor, as this sector amounted to sales of $1.64 billion, making up 43% of the entire segment. Over the counter products saw an increase in sales of 12.4% year over year.

The next largest area of the segment is skin health/beauty which has products like Neutrogena and Aveeno. These products reported revenue growth of 9.7% during the quarter generating sales of $1.1 billion.

Pharmaceutical

The Pharmaceutical is the company’s largest segment and often one of the faster growing. However, in Q1 they were the slowest growing of the three segments.

Within the Pharmaceutical segment, Immunology and Oncology are the largest, as they EACH generated revenues of $4.11 billion during the quarter. The largest revenue generating products include Stelara and Darzalex, which generated revenues of $2.44 billion and $2.26 billion, respectively. Darzalex was a standout performer as it saw revenues grow 22% during the quarter. This drug is used to treat multiple myeloma.

MedTech

Finally MedTech, which is a segment that continues to grow after general hospital procedures were shut down during the pandemic. Surgery is the largest sub sector within MedTech, accounting for $2.4 billion in revenues during Q1, which was exactly flat year over year.

The second largest sub sector of MedTech is Orthopedics, which generated revenues of $2.24 billion during Q1, which was a 2.6% increase year over year.

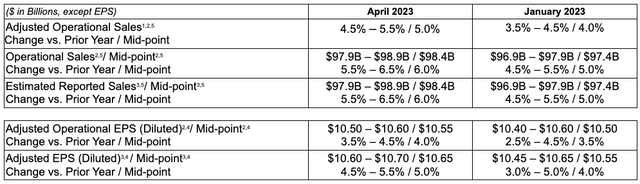

Management Increases 2023 Guidance

In addition to reporting solid Q1 results, management also increased its 2023 guidance.

Revenues increased 100 basis points, as management expects 5.0% revenue growth for the year compared to only 4.0% in the prior guidance given. Adjusted EPS also increased slightly from $10.55 per share to now having a midpoint of $10.65 per share.

During pre-market, JNJ was trading in the green, but quickly moved into negative territory as investors digested the Q1 earnings call. During that call, management made several comments regarding the potential impacts foreign currency could have on forecasts, which may have sent shares falling after the open.

A Dividend King Worth Owning

Johnson & Johnson has long been a stable company for dividend investors, as the company has a rare AAA credit rating, essentially making them “safer” than U.S. Government T-Bills.

However, JNJ has had its share of hiccups over the past year in regards to their talc baby powder. JNJ was in the news recently as they have reportedly made progress on a settlement, gaining support of 70,000 to 80,000 claimant, enough to meet the 75% voting threshold required for a bankruptcy court to approve the settlement, according to Reuters. The proposed settlement is for $8.9 billion.

After news of the potential settlement came out, JNJ shares shot up, but after today’s pullback, they have lost nearly all of those gains.

If the company is able to come to terms and get this behind them, this would be huge for not only the company, but investors. The settlement would be a near-term blow to cash flow, but the dividend should remain safe. After all, the company showed confidence in that by increasing the dividend 5.3% today. JNJ has increased their dividend for 61 consecutive years and counting, making them a dividend king.

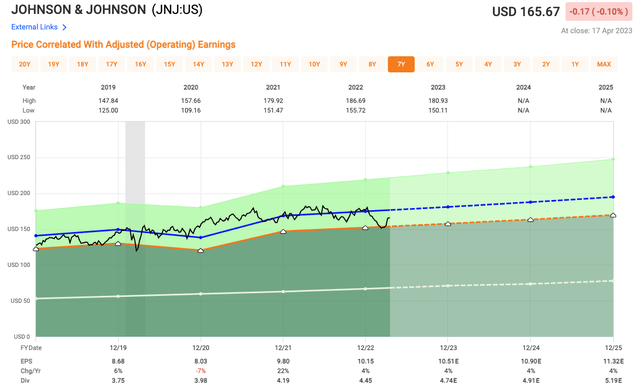

In terms of valuation, shares of JNJ look rather intriguing here. Using the midpoint of managements adjusted EPS guidance of $10.65, shares of JNJ have a 2023 earnings multiple of 15.1x after today’s pullback. Over the past five years, shares have traded at an average multiple of 17.2x and 17.3x over the past decade.

This is a stable, well-run company, and a dividend king worth owning.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.