Summary:

- Johnson & Johnson, the pharmaceutical giant with a 3.21% dividend yield, released financial results for Q2 2024 that exceeded my expectations.

- Its oncology franchise revenue was $5.09 billion for the three months ended June 30, 2024, an increase of 15.7% year-on-year.

- For example, sales of Darzalex, an anticancer medication, were $2.88 billion in the second quarter of 2024, up 18.4% year-on-year.

- Additionally, thanks to strong sales of the immunology franchise, as well as the acquisition of Shockwave Medical, Johnson & Johnson raised its full-year 2024 operating sales guidance.

- As a result, I continue to cover Johnson & Johnson with a ‘Strong Buy’ rating.

Kohei Hara/DigitalVision via Getty Images

Since my last article, Johnson & Johnson’s stock price (NYSE:JNJ) has been trading sideways until July 10, mainly due to caution from financial market participants about the impact of the talcum-powder litigation on its financial position.

On the other hand, the company reported Q2 2024 financial results on July 17 that beat my expectations as well as Wall Street’s. It also pleased investors with the progress in developing its portfolio of FDA-approved medicines and product candidates over the past two months. As a result, given these factors, as well as other detailed analyses I will provide later in the article, I believe Johnson & Johnson is becoming an increasingly attractive stock among Big Pharma for long-term investors.

Johnson & Johnson’s Q2 2024 financial results were beyond praise

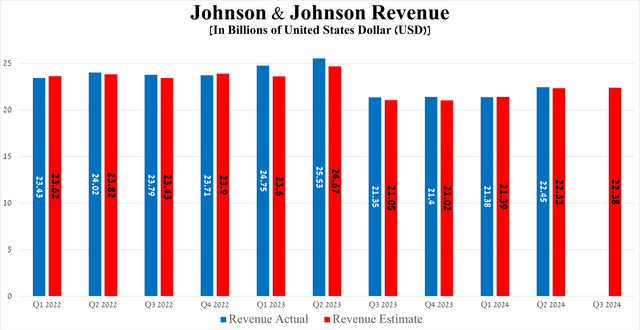

The company’s revenue was $22.45 billion in Q2 2024, up 5% quarter-on-quarter and beating the consensus estimate by $120 million.

Source: Seeking Alpha

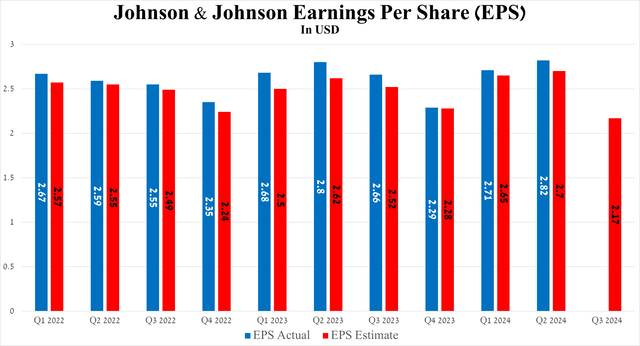

Furthermore, the results of another equally important financial metric, namely EPS, also pleased me as it amounted to $2.82 for the three months ended June 30, 2024, increasing by $0.02 year-on-year and beating analysts’ expectations.

Source: Seeking Alpha

What are the reasons for the success of the New Jersey-based healthcare giant?

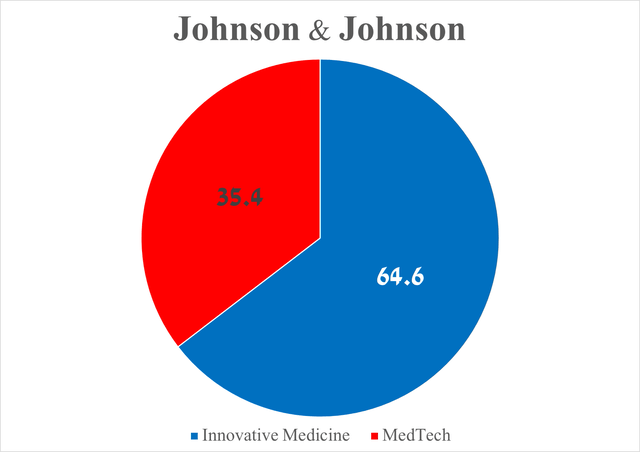

To answer this question, I want to focus your attention on Johnson & Johnson’s pharmaceutical division, called Innovative Medicine, whose total sales were $14.49 billion for the three months ended June 30, 2024, up 5.5% from the previous quarter.

You may wonder why I am focusing on it and not also on MedTech, which is focused on the development and subsequent commercialization of lenses, electrophysiology products, diagnostic equipment, and medical devices widely used to treat cardiovascular diseases, bone and joint conditions, and more. The answer is quite simple, and it lies in the fact that the total sales of the Innovative Medicine division amounted to about 65% of the company’s total revenue.

Overall, the MedTech division’s total sales were $7.96 billion for the second quarter of 2024, an increase of 2.2% quarter-on-quarter.

Source: graph was made by Author based on the Johnson & Johnson press release

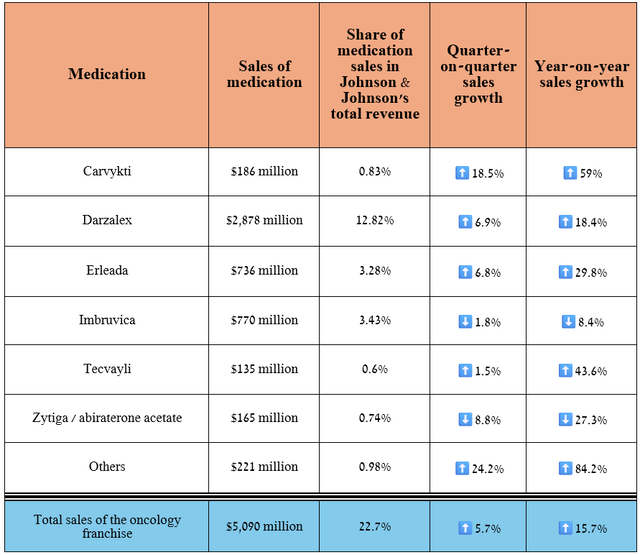

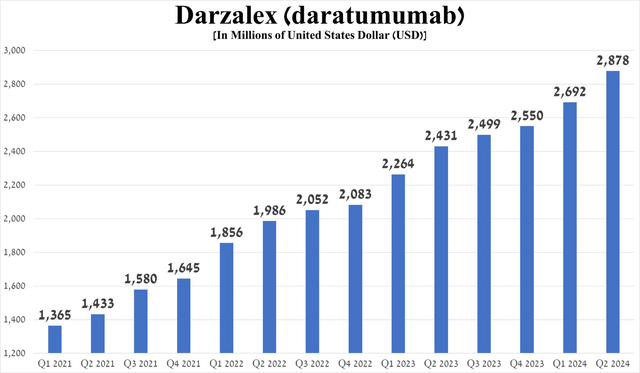

In recent quarters, the biggest contributor to Johnson & Johnson’s improving financial position has continued to be its oncology franchise, which includes Carvykti, Darzalex, Erleada, Imbruvica, and other medications noted in the table below and which are widely used to treat, among other things, lung cancer, multiple myeloma, prostate cancer, chronic lymphocytic leukemia.

Its revenue was $5.09 billion for the three months ended June 30, 2024, an increase of 15.7% year-on-year.

Source: graph was made by Author based on 10-Qs and 10-Ks

Let’s move on to discussing Johnson & Johnson’s FDA-approved drugs that have the greatest impact on its financial position.

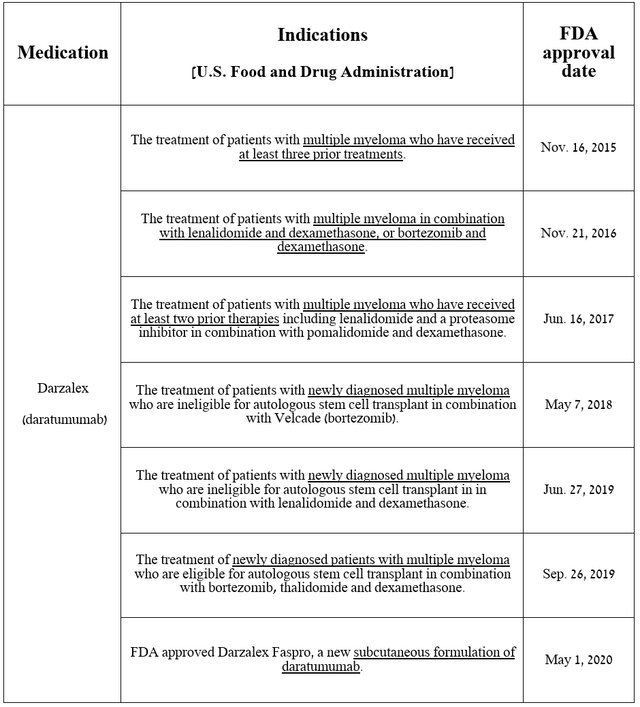

First on my list is Darzalex (daratumumab), which is the first FDA-approved anti-CD38 monoclonal antibody used to treat patients with multiple myeloma, either as monotherapy or in combination with other medications.

Source: table was made by Author based on Johnson & Johnson press releases

Its sales were approximately $2.88 billion for the three months ended June 30, 2024, an increase of 18.4% year-on-year. I would also like to point out that despite increased competition in the multiple myeloma therapeutics market, particularly from CAR-T cell therapies, its sales growth accelerated quarter-on-quarter due to strong demand for Darzalex Faspro, a subcutaneous formulation of daratumumab, and the release of additional clinical data at the 2024 ASCO Annual Meeting.

Source: graph was made by Author based on 10-Qs and 10-Ks

J&J is not resting on its laurels and is seeking to expand the indications for Darzalex, conducting several pivotal clinical trials aimed at determining its efficacy in the fight against smoldering multiple myeloma, as well as transplant-ineligible multiple myeloma.

Source: Johnson & Johnson

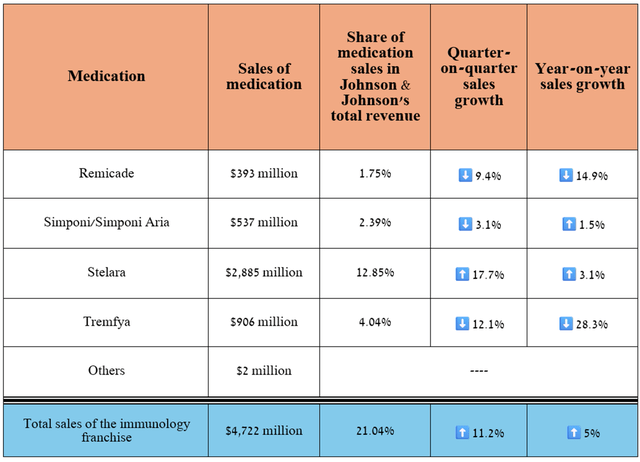

Let’s move on to discussing the company’s immunology franchise, which, along with the oncology franchise, will play an important role in increasing the growth rate of Johnson & Johnson’s revenue and earnings per share after the spin-off of Kenvue (KVUE) in 2023.

So, its total revenue was $4.72 billion in the second quarter of 2024, an increase of 11.2% quarter-on-quarter.

Source: table was made by Author based on 10-Qs and 10-Ks

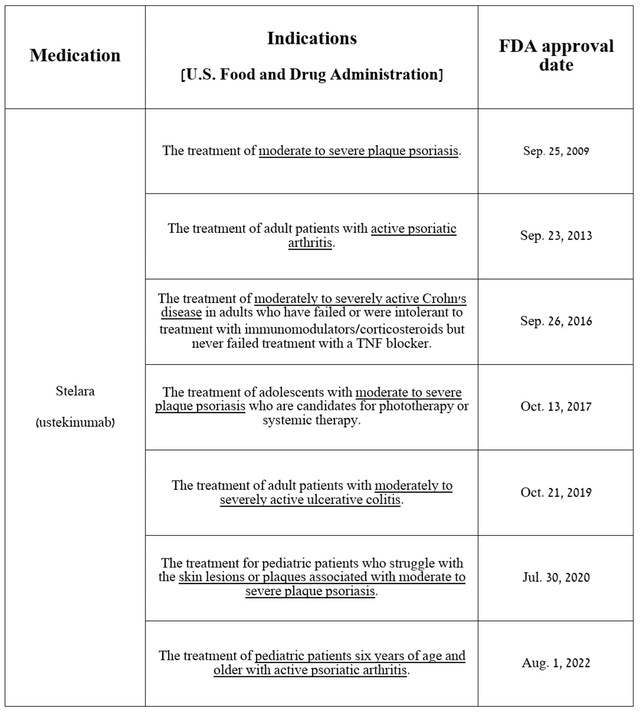

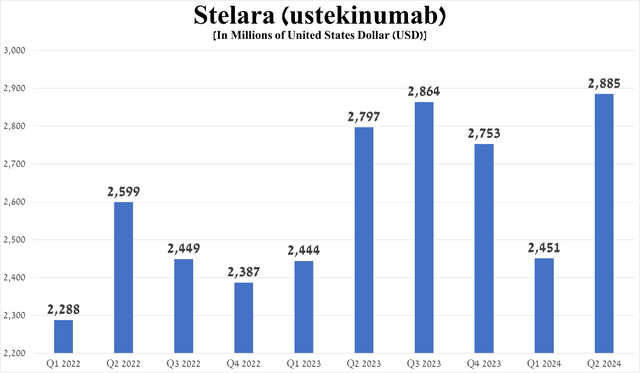

Stelara (ustekinumab), an anti-IL-12/23 p40 monoclonal antibody, continues to be one of the company’s flagship medications, as its sales account for more than 10% of Johnson & Johnson’s total revenue. It is approved for the treatment of a broad range of immune-mediated inflammatory diseases.

Source: table was made by Author based on Johnson & Johnson press releases

Stelara sales were about $2.89 billion for the three quarters ended June 30, up sharply from the first quarter of 2024, driven by the expansion of the autoimmune disease treatment market, as well as continued strong demand from patients suffering from psoriatic arthritis and Crohn’s disease.

Source: graph was made by Author based on 10-Qs and 10-Ks

On the other hand, for those Seeking Alpha readers who missed my previous article, “Johnson & Johnson’s Bullish Outlook: Surprising Strength You Shouldn’t Overlook,” I want to point out that the launch of ustekinumab biosimilars in the U.S. is scheduled for the first half of 2025. Meanwhile, on the quarterly earnings call, Jessica Moore, the company’s vice president, noted the following regarding the launch of its biosimilars in Europe.

We continue to anticipate biosimilar entry in Europe later this month, while in the U.S., we expect continued volume growth largely offset by price declines as we move towards biosimilar entry in 2025.

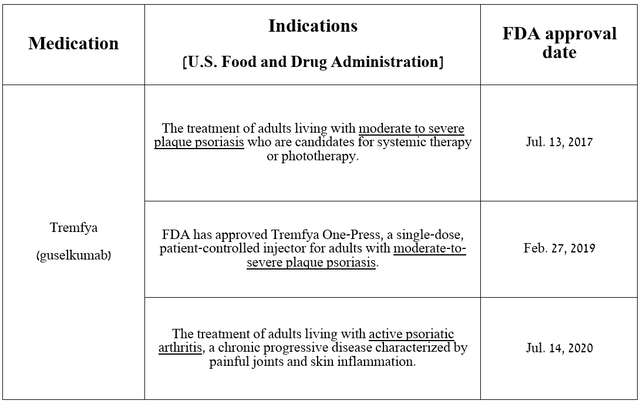

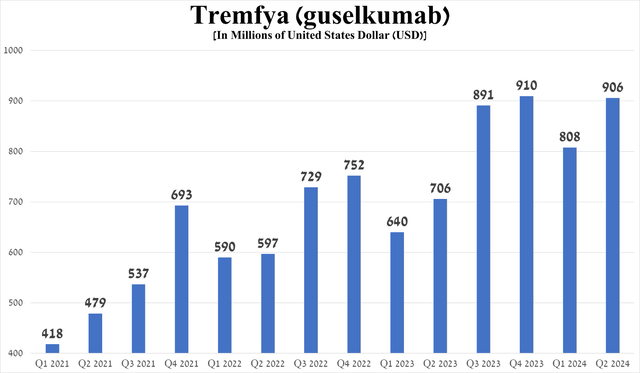

Currently, the second most important medication in the company’s immunology portfolio is Tremfya (guselkumab), which should eventually replace Stelara from Olympus.

As I noted in my last article, “Johnson & Johnson: Buy This Bargain Before It’s Gone,” it is a dual-acting monoclonal antibody that selectively blocks interleukin-23 [IL-23]. The FDA has approved it for the treatment of widespread diseases such as moderate to severe plaque psoriasis and psoriatic arthritis.

Source: table was made by Author based on Johnson & Johnson press releases

Tremfya’s total sales were $906 million in the second quarter of 2024, up 28.3% year over year, driven primarily by growth in demand for the treatment of people with plaque psoriasis and psoriatic arthritis in the U.S., switching patients from Stelara, and competitive advantages relative to AbbVie’s Humira (ABBV), Bristol-Myers Squibb’s Sotyktu (BMY), Amgen’s Otezla (AMGN), and Novartis’ Cosentyx (NVS).

Source: graph was made by Author based on 10-Qs and 10-Ks

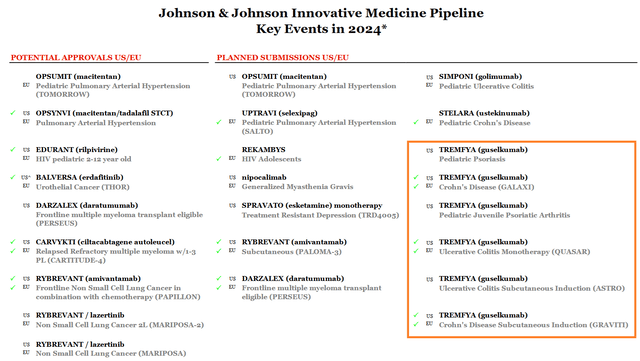

Additionally, I expect its sales growth rate to accelerate next year, driven by its potential approval for the treatment of people with ulcerative colitis in the first quarter of 2025 and moderately to severely active Crohn’s disease in the second quarter of 2025.

Source: Johnson & Johnson

Joseph Wolk, Johnson & Johnson’s CFO, was also satisfied with the progress in the development of Tremfya, stating the following on the earnings call.

Turning to immunology, we achieved key milestones for TREMFYA in inflammatory bowel disease, including the presentation and filing of Phase III studies in ulcerative colitis and Crohn’s disease, as well as the filing of our subcutaneous formulation, which would make TREMFYA the only IL-23 inhibitor with a fully subcutaneous regimen.

And before I move on to discussing the risks that I think Seeking Alpha readers should consider, as well as Johnson & Johnson’s earnings-per-share growth rates and other metrics, I also want to note the progress made in developing its neuroscience franchise.

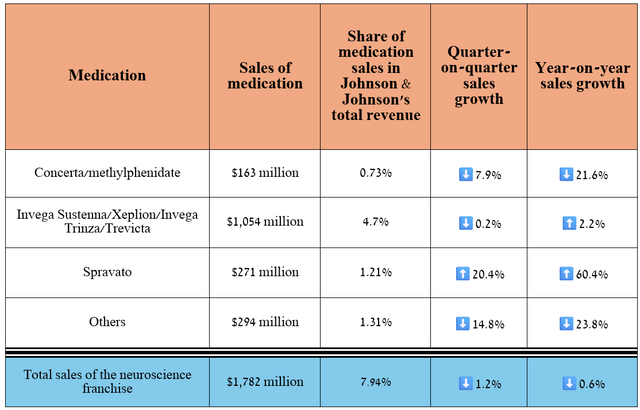

Its total revenue was about $1.78 billion in the second quarter of 2024, down 0.6% year-on-year due to declining sales of Concerta, which faced rising competition from its generic versions, as well as Takeda Pharmaceutical’s Vyvanse (TAK).

Source: table was made by Author based on 10-Qs and 10-Ks

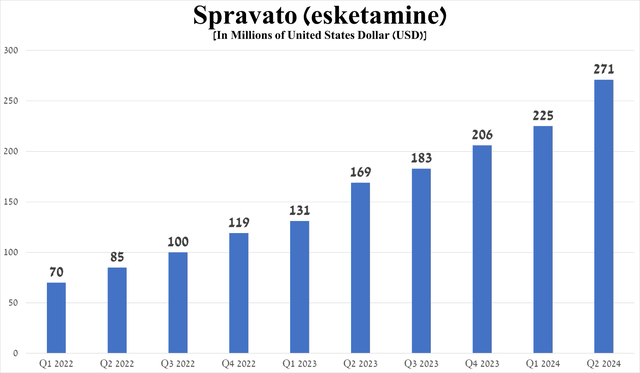

But in reality, while I believe Johnson & Johnson’s neuroscience portfolio is not as strong as AbbVie, Biogen (BIIB), and Pfizer (PFE), it does have Spravato (esketamine), which will help its revenue grow in the long term.

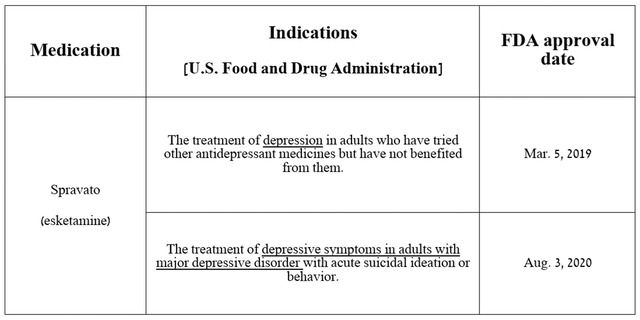

It is the first NMDA receptor antagonist approved by regulatory agencies for the treatment of treatment-resistant depression, as well as depressive symptoms in certain patients with major depressive disorder.

Source: table was made by Author based on Johnson & Johnson press releases

Spravato sales totaled $271 million in the second quarter of 2024, up 60.4% year-on-year, mainly due to its strong efficacy in treating the mental disorders noted in the table above, ultimately driving increased demand from patients and physicians in the United States.

Source: graph was made by Author based on 10-Qs and 10-Ks

In an effort to increase sales of Spravato, the company is conducting clinical trials to determine its efficacy and safety profile in treating people with treatment-resistant depression, as well as major depressive disorder having suicidal ideation in the pediatric population.

Source: Johnson & Johnson

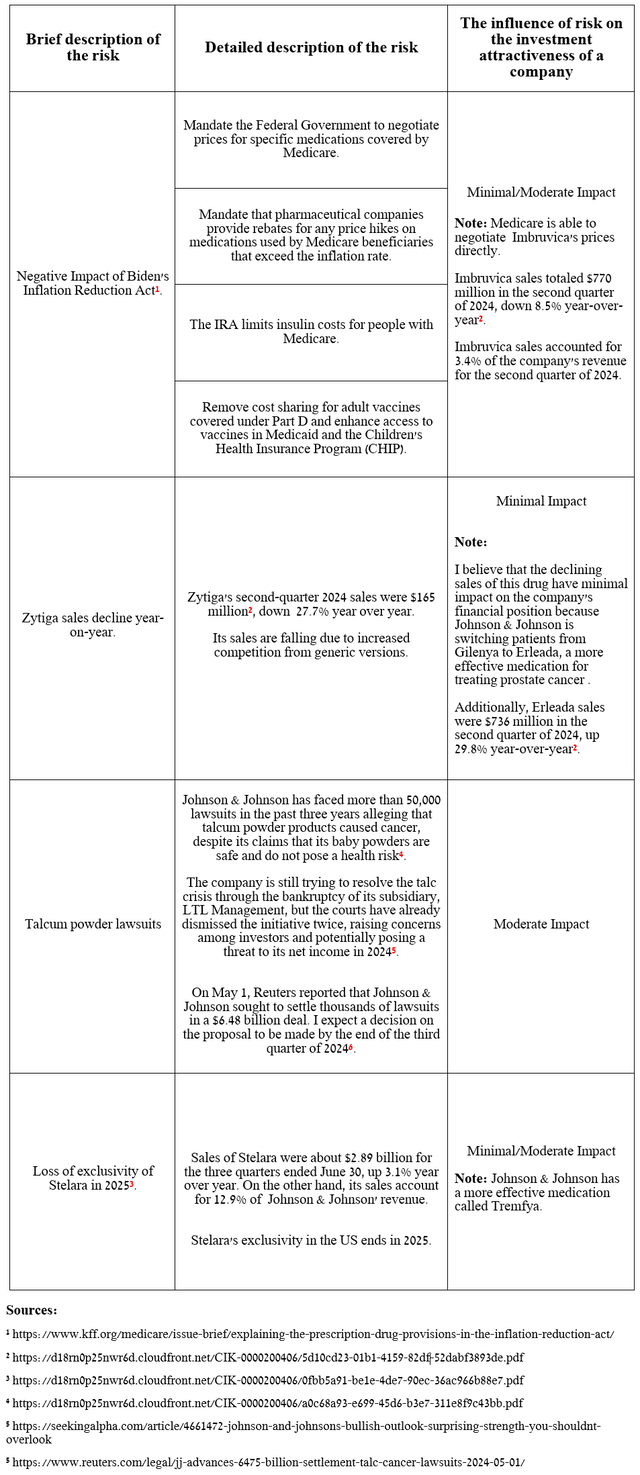

Risks

I would like to note the following risks that may negatively affect Johnson & Johnson’s investment attractiveness in the medium and long term.

Source: table was made by Author

Takeaway

This article provided an analysis of the company’s results for the second quarter of 2024, as well as the successes and failures of its oncology, neuroscience, and immunology franchises, which, in my opinion, will continue to play a fundamental role in improving Johnson & Johnson’s financial position in the long term.

In recent months, many retail and institutional investors have remained skeptical about the company’s business prospects due to uncertainty surrounding its $6.48 billion settlement to resolve thousands of talc-related lawsuits.

However, I believe that the impact of this long-running legal saga will have a negative impact on Johnson & Johnson’s investment attractiveness only for a short time, including due to the expansion of its already rich portfolio of product candidates, many of which have the potential to become “gold standards” in the treatment of immune-mediated diseases and cancer, and the acceleration of sales growth of its key medications, including Carvykti, Darzalex, Tremfya, Spravato, and Erleada.

So, one of the company’s latest achievements was the publication of data from the Phase 3 CARTITUDE-4 study in early July 2024, which demonstrated that taking Carvykti, developed jointly with Legend Biotech (LEGN), significantly improves the overall survival of patients with relapsed or lenalidomide-refractory multiple myeloma compared to standard therapies.

Consequently, I continue to cover Johnson & Johnson with a ‘Strong Buy’ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.