Summary:

- Johnson & Johnson has one of the strongest balance sheets in the industry, and it’s using that to drive shareholder returns with a strong dividend.

- The company has an incredibly strong and diversified portfolio of assets, and perhaps the strongest moat of any company in the industry. It’s continued to invest annually.

- The company is facing substantial lawsuit risks, but we expect it can comfortably handle that, especially with any costs paid off over years. That’ll only impact free cash flow by 1-2%.

Justin Sullivan

Johnson & Johnson (NYSE:JNJ) suffered in the press after the company’s last attempt to handle risks that its baby powder, and asbestos found within, could cause cancer. The company has tried the same strategy again with almost $9 billion, but it remains to be seen whether the strategy works out. Despite our views on the strategy, we expect the company will prevail.

Johnson & Johnson Lawsuits

Let’s first discuss the lawsuits and get that out of the way. The company’s latest offering was several times its last bankruptcy attempt, indicating the scope of the trial and the company’s attempts. The company says that it has more than 60 thousand plaintiffs agreeing to the latest process, however, 10 thousand had their lawyers disagreeing.

The total price of the offering is $9 billion, which, divided by the number of plaintiffs, is roughly $130 thousand / plaintiff. That’s much smaller than the verdicts offered in other similar trials, where a California jury recently awarded $200 million / person. The company has recently settled other lawsuits with claimants for roughly $100k / person.

The exact number is tough to entertain, and our view is that Johnson & Johnson’s bankruptcy attempt is morally fishy, but makes sense. We don’t expect the company would have entered in another offer that it expects to fail, and expect the final number to be anywhere from $9-15 billion over a number of years. That’s a number Johnson & Johnson can comfortably afford.

It has other lawsuits going on, such as hip replacements, etc., in an era of large awards for company malpractice, that we expect to cost the company several $ billion. The company has announced a plan to split its consumer products division going forward. Over 25 years, the costs amount to several hundred $ million / year, versus its $410 billion market cap.

Johnson & Johnson 2022 Results

Johnson & Johnson had strong 2022 results, highlighting the performance of its portfolio.

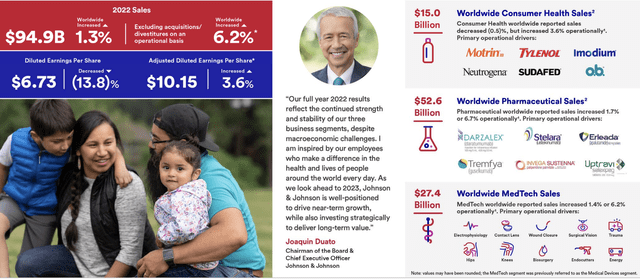

Johnson & Johnson Investor Presentation

The company had almost $95 billion in sales, up 1.3% YoY. Excluding the company’s acquisitions and divestitures, its worldwide revenue increased more than 6% YoY. The company’s specific diluted earnings per share was just under $7 / share, while its diluted earnings per share was more than $10 / share, giving the company an adjusted P/E of 16.

The company’s sales are led by its pharmaceutical division. MedTech sales are next, and Consumer Health, despite having most of the company’s most well-known brands, is in last. The company’s sales are well distributed across a number of businesses here that provides the company with a massive moat and protected businesses.

Johnson & Johnson Business Breakdown

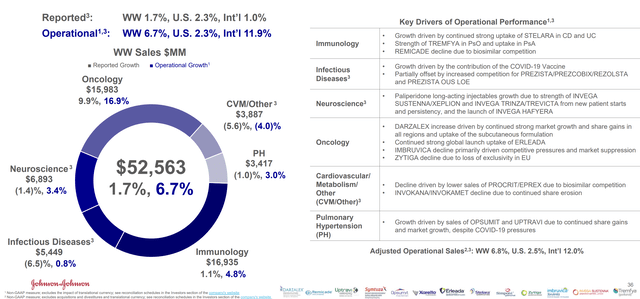

The company’s core division is its pharmaceutical division that earns more than $50 billion in annualized revenue.

Johnson & Johnson Investor Presentation

The company earned more than $50 billion in revenue from this core division. The most successful division of its operations was oncology, which saw worldwide sales grow by 9.9% and almost 17% in operational growth. Some drugs like Imbruvica have seen their sales suffer, but the company has other drugs with exciting future such as Erleada.

More exciting to us is the company’s faster international growth. The U.S. is known for some of the highest drug prices in the world, and it’s a major issue. Some provisions in recent bills, such as the federal government being required to negotiate drug prices, have been passed and have saved money. We expect U.S. drug prices to go down as a result.

As a result, the company’s faster-growing international diversification can help it to diversify its overall portfolio.

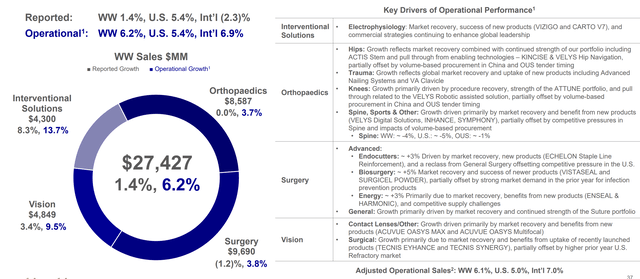

Johnson & Johnson Investor Presentation

We’ll discuss the company’s medtech division next, and ignore its consumer health division, given the volatility caused by COVID-19 last year and its effects in the future. The company’s medtech sales were more than $27 billion, and were up strongly YoY, even when including the company’s divestments.

The company does have some lawsuits here, especially in its orthopedics division, but its other divisions have continued to perform well. We expect continued growth in the company’s medtech divisions.

Johnson & Johnson Capital Allocation

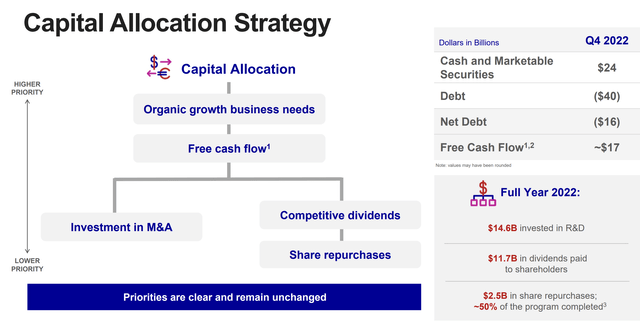

Johnson & Johnson has a long history of shareholder returns, and we expect that to continue.

Johnson & Johnson Investor Presentation

The company is focused on growing its organic businesses to generate substantial free cash flow, or FCF. Out of every single company in the world, the company has one of the strongest balance sheets around. The company has $16 billion in net debt, and $24 billion in cash and securities. The company’s annualized FCF is $17 billion, or a 4% FCF yield.

The company is continuing to invest in its core business with $14.6 billion in 2022 R&D. We expect that, along with the company’s brands, will enable the company to maintain strong shareholder returns. The company paid $11.7 billion in dividends, and it has an almost 3% yield with an incredibly strong history of paying those dividends.

We expect the company to continue both its dividends and share repurchases / returns.

Johnson & Johnson 2023 Guidance

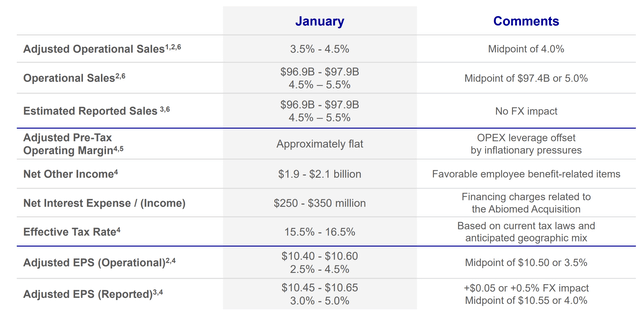

The company’s 2023 guidance is for continued modest growth and shareholder returns.

Johnson & Johnson Investor Presentation

The company is looking to increased operational sales by 4% and is guiding for a midpoint of $97.4 billion in sales. Its expecting no substantial FX impact to its business. The company expects incredibly modest interest expenditures of $300 million and adjusted EPS of roughly $10.5. That gives the company a P/E ratio of roughly 16, highlighting its relatively low earnings.

We expect the company to continue modestly increasing its dividend and using share repurchases to drive other returns. The company has decreased its outstanding shares by roughly 10% over the past several years, showing its ability to drive shareholder returns.

Thesis Risk

The largest risk to our thesis is two-fold. The first is valuation. Johnson & Johnson trades at almost 25x earnings, which means a yield of roughly 4.5%. That’s a great yield for a company that’s growing and a terrible yield for a company that isn’t growing. The company needs continued long-term growth to justify its valuation.

The second is the company’s lawsuits. The company seems to be doing a good job of keeping those lawsuits in the $10-15 billion range, but it’s easy to convince a sympathetic jury to punish a company, especially when malfeasance is shown. The company has significant room here to see its expenses go up.

Conclusion

Johnson & Johnson continues to regularly be in the news for its lawsuits. The company has recently upped its lawsuit amounts to $9 billion, which shows the strength of the lawsuits it’s fighting, tripling that amount from the last potential bankruptcy. The majority of plaintiffs are supporting the verdict, and we expect a deal will come out in the upcoming years.

Johnson & Johnson generates an almost 3% dividend, one that it can easily afford with its balance sheet, that it’ll continue to increase. The company has also continued to buy back shares. Its FCF is more than 4% which is relatively low, but the company is expecting 5% sales growth. We expect Johnson & Johnson to continue generating substantial shareholder returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.