Johnson & Johnson: Sleep Well At Night With The Only AAA-Rated Dividend Aristocrat

Summary:

- As a Dividend King with six decades of dividend growth to its credit and a AAA credit rating from S&P, Johnson & Johnson stands in a league of its own.

- The healthcare behemoth reported solid sales and earnings growth in the third quarter.

- JNJ maintains a rock-solid balance sheet, which operationally shields it from the higher for longer rate narrative.

- The stock is currently valued at a 17% discount to fair value.

- JNJ could almost 2X the S&P 500 through 2025 and match it for the next 10 years.

A senior couple relaxing on a bench.

Tim Robberts

As a younger investor, I have a higher risk tolerance than most investors. This is reflected by the fact that aside from my emergency fund, I am 100% weighted toward stocks.

I will qualify this statement with a caveat, however. I am particular about the types of businesses that I buy for my portfolio. Accounting for 0.7% of my individual stock portfolio, Johnson & Johnson (NYSE:JNJ) is neither a huge holding in my portfolio nor an insignificant one.

What I will say after several years of not doing an earnings update on J&J here on my Seeking Alpha profile is that I certainly like the stock. Please allow me to dig into J&J’s fundamentals and valuation to elaborate.

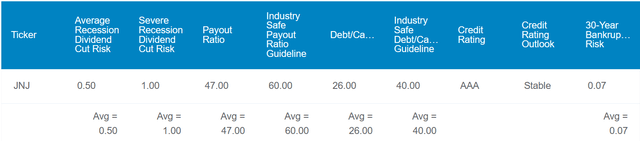

DK Zen Research Terminal

JNJ’s 3.2% dividend yield clocks in at double the 1.5% yield of the S&P 500 (SP500). The company’s 47% EPS payout ratio comes in meaningfully below the 60% EPS payout ratio that is considered viable by credit rating agencies.

Another attribute that I like about JNJ is its AAA credit rating from S&P on a stable outlook. As many companies were tempted to leverage up and sacrifice their perfect credit ratings over the decade of largely zero-interest rate policy leading up to Spring 2022, JNJ held firm. Thus, the 26% debt-to-capital ratio versus the 40% that rating agencies view as safe. This flawless credit rating makes JNJ the only publicly traded company in the world that also carries the distinction of being a Dividend Aristocrat let alone a Dividend King per Dividend Kings.

Thus, Dividend Kings gauges the risk of the company cutting its dividend in an average recession at just 0.5%. Even in the next bad recession, the probability of JNJ’s 60-year dividend growth streak ending is just 1% per Dividend Kings.

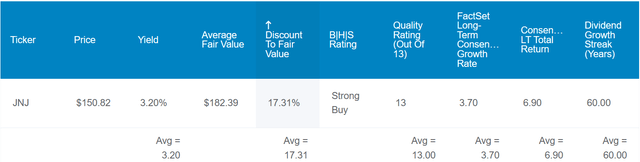

DK Zen Research Terminal

Besides its safe payout and stellar financial position, JNJ currently shines in the valuation arena as well. Factoring in its historical P/E ratio and dividend yield, Dividend Kings pegs the stock’s fair value per share at $182. That would represent a 17% discount versus the current $152 share price (as of November 29, 2023).

If JNJ grows as expected and returns to what markets have decided it is worth long-term, here are the total returns that it could produce for investors in the next 10 years:

- 3.2% yield + 3.7% annual FactSet Research growth consensus + 1.9% annual valuation multiple expansion = 8.8% annual total return potential or a 132% cumulative 10-year total return versus the 9% annual total return potential of the S&P 500 or a 137% cumulative 10-year total return

A Solid Third Quarter

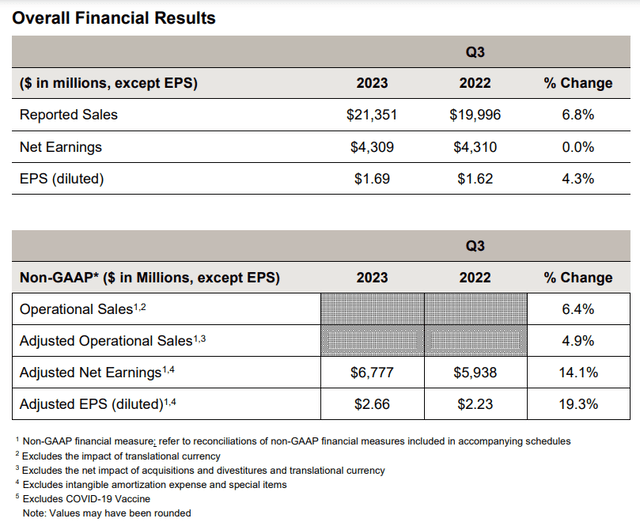

JNJ Q3 2023 Earnings Press Release

As I have come to expect from the company, JNJ delivered good results in the third quarter reported in October. The healthcare juggernaut grew sales by 6.8% year-over-year to $21.4 billion during the quarter, which topped the average analyst estimate by $300 million.

These results were even more impressive than they initially appeared. That is because they include the 90%+ decline in COVID-19 vaccine revenue to just $41 million for the quarter stemming from fading demand for COVID-19 products overall. Factoring this and foreign currency translation out of the company’s results, operational sales growth was 9%.

JNJ’s third quarter was driven by organic growth from the MedTech segment and the acquisition of temporary and implantable oxygenation device maker Abiomed. The latter contributed to nearly half of the segment’s 10.4% operational sales growth in the third quarter.

The remainder of JNJ’s growth was fueled by 8.2% operational sales growth within the Innovative Medicine (e.g., pharmaceuticals) segment during the third quarter. Double-digit operational sales growth rates in immunology drugs Stelara, Tremfya, and Simponi, as well as oncology medicines Darzalex and Erleada made these results possible. These were just five of the 11 drugs in total that delivered double-digit topline growth for the quarter, according to VP of Investor Relations Jessica Moore’s opening remarks in the recent earnings call.

JNJ also has a well-balanced pipeline that should sustain growth throughout the years to come. As of the most recent update to its pipeline page, the company had 19 indications in phase 1 clinical trials, 22 indications in phase 2 clinical trials, and 39 indications in phase 3 clinical trials. Even as biosimilars for Stelara soon hit the market, JNJ should have the firepower to continue growing.

Better yet, the company also has the financial prowess to execute bolt-on acquisitions to juice its growth prospects. In a time when many companies are struggling to service their debt, JNJ is getting paid interest. The company had a net interest income of $182 million in the third quarter.

Ample Free Cash Flow

JNJ also can generate sufficient free cash flow to maintain an enviable balance sheet. Even with a slight downtick in operating cash flow and an uptick in capital expenditures, the company has generated $12 billion in free cash flow in the first nine months of 2023. Compared to the $8.9 billion that it has sent to shareholders so far this year, that’s a manageable free cash flow payout ratio (page 13 of 78 of JNJ 10-Q filing). This is why I am confident that JNJ can keep handing out dividend increases year after year.

Risks To Consider

JNJ is an excellent company, but it faces plenty of risks that investors must be comfortable with before buying.

Pharmaceutical-oriented businesses like JNJ are no strangers to patent expirations. When mega-blockbuster drugs like Stelara face competition from biosimilar drugs, this causes a drop-off in sales for a while. This often results in lumpy sales from year to year, but JNJ has been very consistent in growing over the years. That is why patience is always required for those who intend to invest in the pharmaceutical industry.

Another risk that is specific to the healthcare sector overall is regulatory. Global governments could enact new regulations at any time, which could require JNJ to spend more on compliance and impact reimbursement for its products as well.

Summary: Compelling Total Return Potential Through 2025

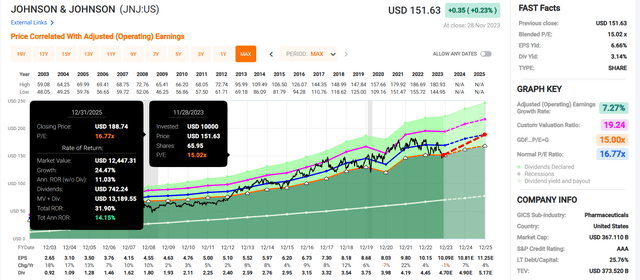

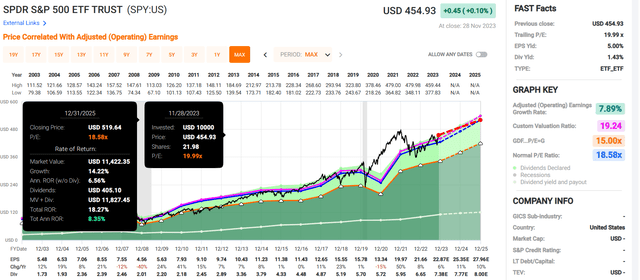

FAST Graphs, FactSet

FAST Graphs, FactSet

JNJ has all of the characteristics that I believe make it a fit for my portfolio. Slow but steady growth? Yes. An unbelievable balance sheet? You bet. A market-beating and growing dividend? Indeed.

Even better, JNJ’s blended P/E ratio is currently 15. For context, that is less than its historical P/E ratio of 16.8 per FAST Graphs. Assuming a reversion to a P/E ratio of 16.8 and JNJ grows as anticipated, it could generate 32% total returns between now and 2025. That’s about nearly twice what the SPDR S&P 500 ETF Trust (SPY) is expected to return over that time.

Superior total return potential in the next two years from one of the most well-established businesses on the planet makes JNJ a buy from my perspective.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.