Summary:

- Johnson & Johnson is a safe and stable business with an AAA rating and a 60+ year history of dividend increases.

- JNJ has a strong balance sheet, generating significant free cash flow and having the resources for investments and shareholder rewards.

- The stock trades at an attractive valuation with potential for dividend growth and EPS growth.

- The company reported solid Q3 earnings with 6.8% YoY sales growth, driven by strong performance in both its Medtech and Innovative Medicine segments.

Mario Tama

Dear readers,

Johnson & Johnson (NYSE:JNJ) is arguably one of the safest businesses in the world, as it is one of only two companies that have an AAA rating which is higher than the AA+ rating of the U.S. government.

It is also a dividend king with a 60+ year history of dividend increases and a defensive stock which I believe is suitable for most portfolios. I argued in a recent article on Procter & Gamble (PG) why I like to allocate a portion of my capital to Staples. JNJ shares a lot of the same characteristics as PG and could, in my opinion, be positioned to outperform the S&P 500 (SPX) over the next few years with much lower volatility. Today I present my outlook for the stock and why I think it deserves a BUY rating here at $160 per share.

Why JNJ is a great business

Warren Buffet is famous, among many other things, for saying that he would much rather buy a great business at a fair price than an OK business at a great price. And JNJ is no question a great business.

Here’s why.

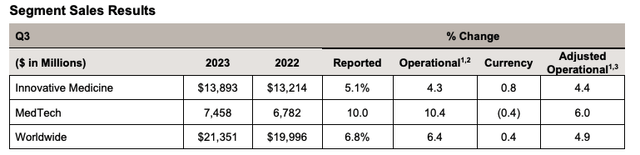

The company reported solid Q3 earnings with 6.8% YoY sales growth which beat consensus estimates by $300 Million, despite a 90% drop in Covid vaccine revenue. In terms of location, growth came primarily from the U.S. (11.1%) with International markets lagging at 1.6%.

Notably, both segments in which JNJ operates performed well. Medtech which accounts for about 35% of sales saw YoY revenue growth of 10% driven, in large part, by the acquisition of Abiomed which added almost half of the year-over-year growth. Innovative Medicine which accounts for the remaining part of revenues saw similar growth in the U.S. (10.9% YoY), but sluggish performance in international markets resulted in overall sales growth of just 5.1% YoY.

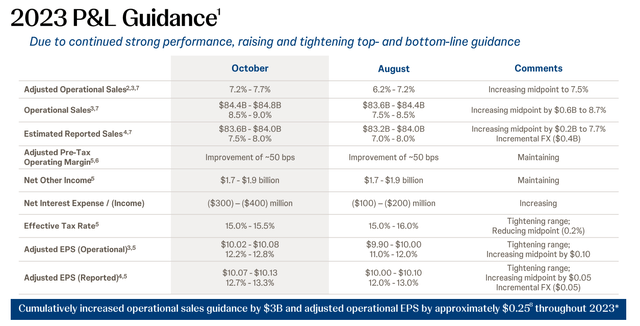

As a result of the Q3 beat in earnings, management raised their full-year 2023 guidance slightly from EPS of $10-$10.1 to $10.07-$10.13 driven by full-year sales YoY growth of 7.2-7.7%.

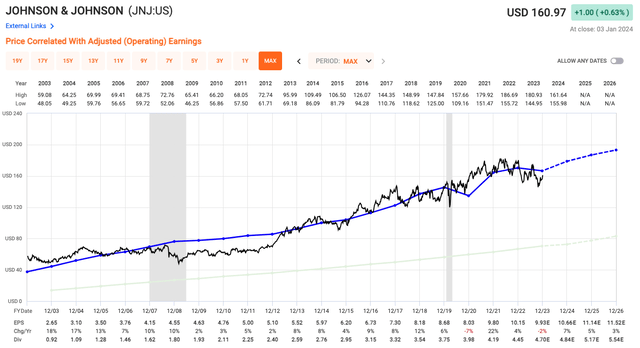

Pharmaceutical companies rarely grow their revenues in a straight line. One of the biggest risks is the expiring patents of best-seller drugs and potential competition from other products. JNJ has one of the best track records of consistently growing their EPS with a 15-year growth CAGR of 5.5%.

Going forward consensus calls for 8% growth in 2024 and 4% in 2025. With a 2-year forward analyst hit rate of 100%, therefore I’m fairly confident that JNJ will be able to deliver on these targets and reach EPS of $11.15 by 2025.

JNJ’s balance sheet is second to none as highlighted by the AAA rating. The company has $30 Billion in debt but also holds $24 Billion in cash. As a result, rather than paying interest expense, it has made $277 Million year-to-date in net interest income. That’s right, they made more money on their cash than they paid in interest on their debt.

The company also generates a ton of free cash flow, $12 Billion year-to-date to be exact. That means that JNJ could pay off all of its net debt (of $6 Billion) in just 6 months. It also means that they have the resources necessary to (1) invest in M&A to grow the business and (2) reward shareholders by dividends and share repurchases. Which they have done extensively, over the first 9 months of 2023, as they paid out $8.9 Billion in dividends and completed 100% of their share repurchase program, returning a further $2.5 Billion.

Why JNJ trades at a fair price

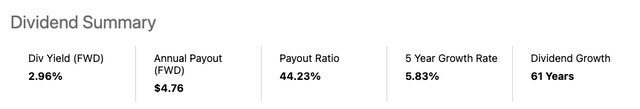

JNJ pays a dividend that yields nearly 3% and has a 61-year history of dividend increases with a 5-year dividend CAGR of 5.8%. With a payout ratio of just 45% and expected EPS growth at 4-8% over the next two years, it’s very likely that JNJ will continue its dividend growth streak.

On top of the dividend, the stock also trades at an attractive valuation of 16.2x earnings, which is below its lifetime average of 16.8x and its 10-year average of 17.3x.

JNJ’s price and multiple have been extraordinarily stable over the years, including the Covid drop, which is barely visible in the chart below. I don’t see much potential for sharp multiple expansion for JNJ, but I’d argue that it’s not needed to make it a worthwhile investment.

Even if the multiple stays at 16.2x, over the next two years, investors are very likely to make 6% in dividends and 12% in EPS growth, for total annual growth of around 9%.

For the S&P 500 to return as much, it would need to reach 5,175 in 2024 and 5,600 in 2025. While possible, I’d argue that JNJ is more likely to deliver this sort of return and given its historical track record and exceptional AAA rating, it might even be able to achieve it with lower volatility.

As a result, I rate JNJ a BUY here at $160 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to access my entire Portfolio and all my current Top Picks, feel free to join ‘High Yield Landlord’ for a 2-week free trial.

We are the largest and best-rated community of real estate investors on Seeking Alpha with 2,500+ members on board and a 4.9/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.