Summary:

- JNJ stock occupies a top spot in many portfolios due to its consistent performance and low volatility. But should we really and readily accept JNJ as a SWAN stock?

- A fresh look at Johnson & Johnson is warranted, especially in light of the split-off of its Consumer Health segment (Kenvue stock) and amid the ongoing talc litigation.

- I share my view on JNJ’s two remaining segments, their future prospects, and the decline in cash flow due to the split-off of the Consumer Health segment.

- Finally, I will discuss the dividend safety of Johnson & Johnson stock against this backdrop.

BrilliantEye

Introduction

Johnson & Johnson (NYSE:JNJ) stock undoubtedly occupies a top spot in many individual stock portfolios – and portfolio managers (individual or institutional) can’t be blamed – JNJ delivers like clockwork and its long-term performance (30-year return CAGR of 11.8% vs. 10.0% for the S&P 500 (SPY), coupled with its low volatility (five-year beta of just around 0.6, 30-year max. drawdown of 33% vs. 51% for the S&P 500) is truly remarkable. I am no exception to this “rule” as JNJ stock is one of the larger positions in my portfolio.

But should we really and readily accept Johnson & Johnson as a sleep well at night (SWAN) stock today?

After all, the seemingly super-diversified healthcare giant completed the split-off of its consumer healthcare business Kenvue Inc. (KVUE) not too long ago, which I discussed in a separate article. Removing one leg from a sturdy, three-legged stool is not necessarily a good idea, one could say.

In addition, JNJ is still struggling with talc-related litigation that will likely cost the company at least $10 billion. As I explained in another article, the split-off won’t protect the parent company from talc liabilities in the U.S. and Canada (the lion’s share), but it may have nonetheless played a role in the process of managing them. In a later article, I shared my outlook amid the ongoing litigation by conservatively modeling the impact of the talc litigation on the discounted cash flow valuation of JNJ stock.

Lastly, note JNJ’s appetite for acquisitions – the most recent being that of antibody-drug conjugate (ADC) specialist Ambrx Biopharma Inc. (AMAM) for $1.9 billion (enterprise value, EV), a year after acquiring Abiomed, Inc. (ABMD) for $16.6 billion (EV). Concerning the latest acquisition, I recommend you read the (very good and detailed) review by fellow analyst Edmund Ingham. While AMAM will certainly improve JNJ’s position in the increasingly important (but also highly competitive) ADC space, it comes with execution and integration risks and consequently the risk of a poor return on investment.

In this update, I’ll take a fresh look at good old – yet brand new – Johnson & Johnson and whether it continues to deserve a top spot in a diversified equity portfolio. I will offer my opinion on JNJ’s two remaining segments, their future prospects, and the decline in cash flow due to the split-off of the Consumer Health segment, also in light of the ongoing litigation. Finally, I will address the dividend safety of Johnson & Johnson stock against this backdrop.

The Two-Legged JNJ: Cause For Concern From A Diversification Perspective?

Metaphorically speaking, removing a leg from a three-legged stool is a recipe for disaster. And while I can’t blame anyone for missing the added diversification that the Consumer Health segment brought, I think it’s worth taking a closer look to see if JNJ is actually on shaky ground now. Perhaps the third leg of the stool has not brought the supposed stability after all?

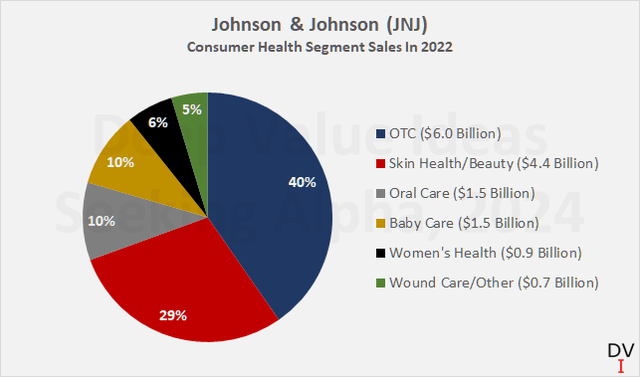

In 2022, Consumer Health generated sales of $15.0 billion, with a focus on OTC products (over-the-counter products, 40% of segment sales), but was generally quite well diversified (Figure 1). This segment includes brands such as Tylenol, Zyrtec, Nicorette, Listerine, Aveeno, Johnson’s, Neutrogena and many more.

Figure 1: Johnson & Johnson (JNJ): 2022 sales of the Consumer Health segment, which was split-off in August 2023 (own work, based on company filings)

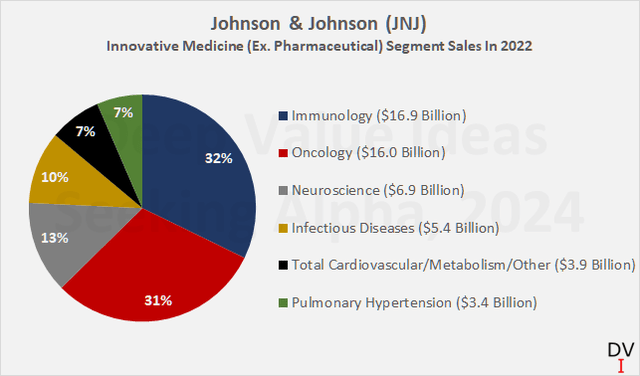

JNJ’s Innovative Medicine and MedTech segments are similarly well diversified. In its former Pharmaceutical segment (Figure 2), the company focused on immunology (primarily Stelara and Tremfya, $9.7 billion and $2.7 billion, +7% and 25% year-over-year respectively) and oncology drugs (primarily Darzalex, $8.0 billion, +32% year-over-year).

Figure 2: Johnson & Johnson (JNJ): 2022 sales of the Innovative Medicine segment, the former Pharmaceutical segment (own work, based on company filings)

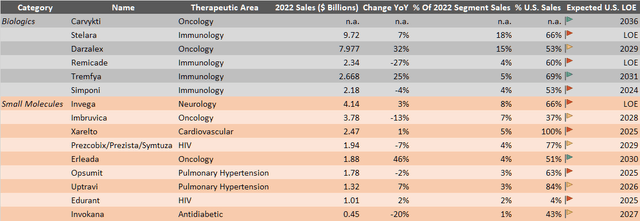

Table 1 gives an overview of JNJ’s most important current treatments, their 2022 sales, year-over-year change, U.S. patent status (expected loss-of-exclusivity, LOE), and percentage of U.S. sales (i.e., potential impact from inflation-mitigating efforts such as the Inflation Reduction Act).

Table 1: Johnson & Johnson (JNJ): Innovative Medicine segment – main sales drivers, U.S. exposure, expected loss-of-exclusivity (own work, based on company filings)

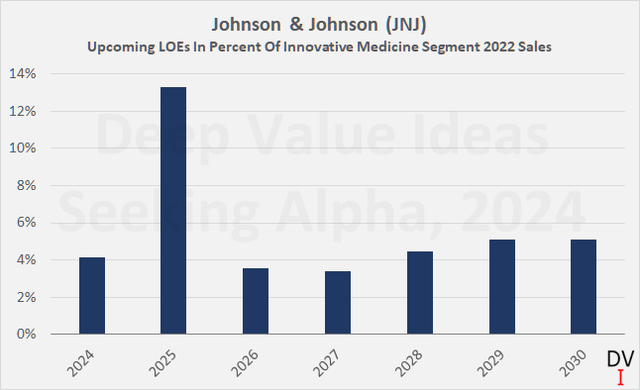

Figure 3 shows that the LOEs of Xarelto, Opsumit and Edurant could lead to significant sales losses in 2025. Xarelto deserves special mention, as JNJ only markets this highly successful anticoagulant in the U.S. (it was developed jointly with Bayer HealthCare AG, which holds international marketing rights).

Figure 3: Johnson & Johnson (JNJ): Upcoming losses-of-exclusivity in percent of Innovative Medicine segment sales (own work, based on company filings)

JNJ’s drug pipeline is presented in detail on the company’s website. Currently, 34 out of a total of 94 indications are in Phase 3 trials. JNJ is working to gain approval for Stelara and Darzalex for several new indications and its pipeline includes promising candidates such as amivantamab/lazertinib (Phase 3, non-small cell lung cancer) and of course, Milvexian, which is currently in Phase 3 trials for atrial fibrillation, acute coronary syndrome and secondary stroke prevention.

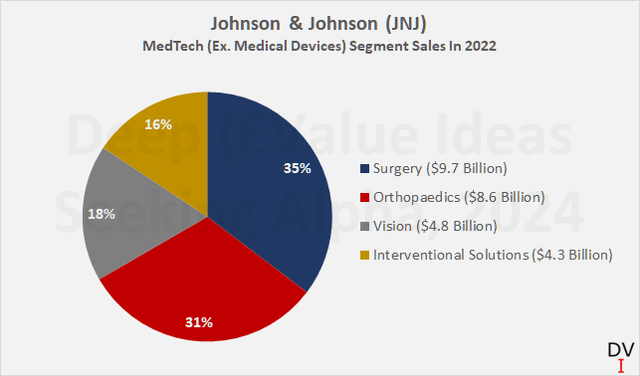

The well-diversified MedTech segment (Figure 3) focuses on surgical devices and orthopaedics (e.g., artificial hips and knees) and grew inorganically through the acquisition of Abiomed, Inc. at the end of 2022. The $16.6 billion acquisition is consolidated in the MedTech Interventional Solutions subsegment, as Abiomed is a leader in the treatment of coronary artery disease and heart failure.

Figure 4: Johnson & Johnson (JNJ): 2022 sales of the MedTech segment (own work, based on company filings)

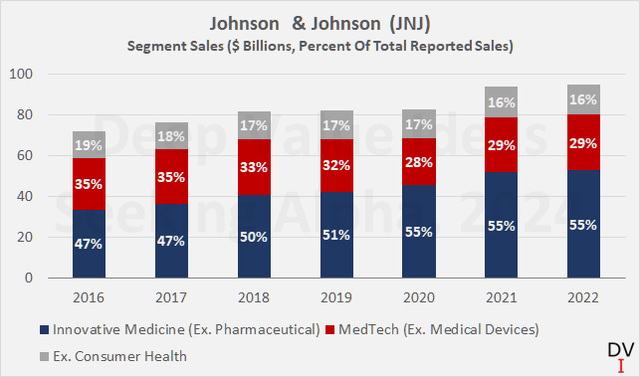

A look at the relative share of Consumer Health shows that the segment has made a relatively small contribution to JNJ’s consolidated sales for at least the last seven years (Figure 5). Since 2016, the segment’s contribution to the company’s sales has fallen from 19% to 16%, which is mainly due to the strong growth in the former Pharmaceutical (7.8% CAGR) segment, but also due to the disappointing long-term growth of Consumer Health (2.0% CAGR since 2016) and especially in the years 2016 to 2020 (1.1% CAGR).

Figure 5: Johnson & Johnson (JNJ): Segment sales in percent of total sales (own work, based on company filings)

The MedTech segment also performed rather poorly in this period (1.5% CAGR). While the weak growth could be attributed to the mandated lockdown measures in 2020 (associated decline in elective surgeries), it should be noted that the segment experienced a strong upswing in 2021 and 2022 due to pent-up demand. It remains to be seen whether the acquisition of Abiomed will significantly benefit the segment’s sales in the future – in 2023, Abiomed’s contribution so far amounted to only $966 million (p. 25, 2023 10-Q3), but the long-term demand expectation looks promising. Although MedTech’s current performance is underwhelming, I can overlook this as the company is very solidly positioned against the backdrop of an ageing population.

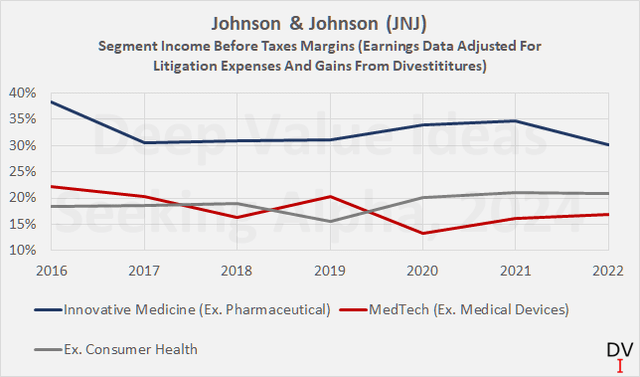

While it is not too surprising that the Innovative Medicine segment is also the clear leader in terms of profitability (profit before tax segment margins, Figure 6), I think it is worth noting that Consumer Health’s profit margin has improved over the years – slowly but surely.

Figure 6: Johnson & Johnson (JNJ): Segment earnings before taxes margins; data adjusted for litigation expenses and gains from divestitures. (own work, based on company filings)

All in all, it’s fair to say that JNJ has indeed been – and continues to be – a healthcare giant, with much of its growth coming from its former Pharmaceutical segment. While the segment faces some challenges in relation to upcoming LOEs, one should keep in mind the company’s world-class balance sheet and the resulting flexibility for acquisitions. Innovative Medicine is the segment with the highest margins and therefore contributes the lion’s share of the company’s profit and free cash flow.

Now let’s see if JNJ can continue its unblemished dividend history after the split-off and amidst the ongoing talc litigation.

Can JNJ Continue Its Flawless Dividend Track Record Despite The Split-Off And Ongoing Talc Litigation?

It is worth remembering that while the talc-related litigation has historically been allocated to Consumer Health, the liabilities were not spun off last August – with the exception of those associated with claims outside the U.S. or Canada (see my article linked in the Introduction).

Clearly, the parent company’s operating results and free cash flow will be impacted by litigation-related payments for years and decades to come. As I discussed in my last article on JNJ, I expect the ongoing litigation to impact JNJ’s cash flow by $400 million to $600 million annually before taxes. While that sounds hefty, I think it’s manageable, and it’s also worth keeping in mind the time value of money, as the settlement – after it’s finally reached – will likely be paid out over more than two decades.

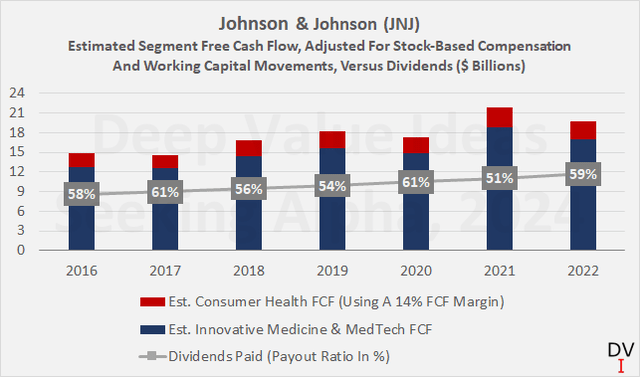

This raises the question of whether JNJ can remain the SWAN dividend king that investors have become accustomed to over the years also after the split-off and amidst ongoing litigation. In my view, one can assume that the pharma/medtech company’s free cash flow will be about 14% lower than before the transaction, as Consumer Health’s average operating margin was about 12.5% and taking into account comparatively low depreciation and amortization. An annualized contribution of approximately $2.7 billion is a reasonable estimate for Kenvue’s free cash flow, also from the perspective of the 10-Q filing for the third quarter of 2023, according to which the company generated $1.9bn in free cash flow between January and December 2023.

Figure 7 shows my estimate of the amount of cash flow “lost” as a result of the split-off (red) and the annual dividends paid to shareholders. What at first glance looks a little worrying, especially when you consider the additional cost of litigation, should be looked at more closely. The dividend payout takes into account the shares outstanding each year, but since Johnson & Johnson split-off the Consumer Health segment (instead of spinning it off), existing shareholders had to decide whether they wanted to stay with the parent company or exchange their JNJ shares for KVUE shares.

Figure 7: Johnson & Johnson (JNJ): Estimated free cash flow contribution from the Consumer Health segment and the RemainCo (own work, based on company filings)

As a result of the exchange offer (and thanks to $4.8 billion in share repurchases between January and September 2023), JNJ had 2.41 billion shares outstanding as of October 23, 2023 (just prior to the release of its 2023 10-Q3), down 7.6% from 2.60 billion at the end of 2022. In addition, the transaction (IPO in May 2023 and completion of the exchange offer in August), which is detailed in Note 12 on p. 39 in JNJ’s most recent 10-Q filing, resulted in $3.1 billion of cash received, net of cash transferred to Kenvue in the separation. Of note, JNJ retains a 9.5% interest in Kenvue, which entitles the company to dividend payments currently totaling approximately $150 million annually. Finally, JNJ recorded a cash inflow of $8.0 billion related to debt transferred to Kenvue.

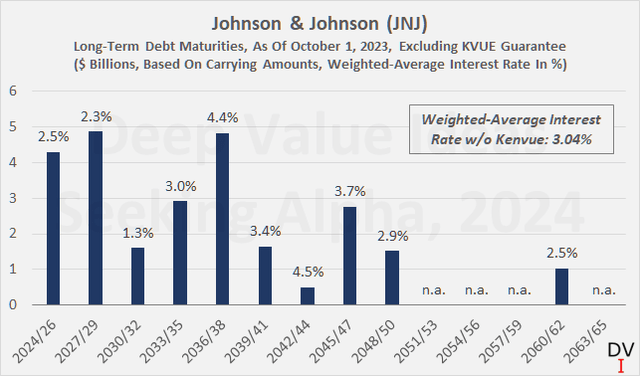

Consequently, JNJ’s balance sheet is – I’m inclined to say, as always – in excellent shape. At the end of the third quarter of 2023, JNJ had $19.7 billion in cash and cash equivalents, $3.8 billion in marketable securities and $30 billion in debt (almost 90% long-term). This equates to $6.4 billion in net debt, which means that the company could pay off all of its net debt in a little over a year, even after the split-off and without having to suspend its dividend. Of course, I’m not suggesting that JNJ will suddenly pay off all of its debt, and I think its balanced maturity profile in Figure 8 clearly shows why: the company benefits from an extremely favorable weighted-average interest rate, making it a beneficiary of the current interest rate environment on a net basis thanks to its strong cash position.

Figure 8: Johnson & Johnson (JNJ): Long-term debt maturity profile and weighted-average interest rates, as of October 1, 2023 (own work, based on company filings)

No wonder rating agency Moody’s saw no reason to downgrade Johnson & Johnson’s long-term credit rating from Aaa (or set the outlook to negative). Similarly, I found it very reassuring to see that JNJ’s five-year credit default swap premium (an “insurance” against default) has fallen to just 20 basis points – 15 basis points less than last October’s local peak. To put the insurance premium in perspective, it peaked at around 85 basis points during the Great Recession and briefly rose to 40 basis points during the pandemic in March 2020 – generally very low levels.

Taken together, and given that the company’s quarterly dividend was increased by 5.3% last April (the 61st consecutive increase), Johnson & Johnson is likely to pay out $11.5 billion in dividends to its shareholders on an annualized basis. This represents a payout ratio of approximately 55% of the average free cash flow for 2021 to 2022, adjusted for the contribution from the Consumer Health segment, or 58% if talc litigation expenses (conservatively estimated at $600 million annually) are also taken into account. In this context, it is worth noting that the company will most likely attempt a third time to settle the claims in bankruptcy court and that a 2019 judgment in favor of four plaintiffs ($224 million, Bard, Etheridge, McNeill-George and Ronning) was dismissed by a New Jersey court in late 2023.

In my view, the safety of the parent company’s dividend has not changed with the separation of the Consumer Health business and in the midst of the ongoing talc litigation for the reasons mentioned above. Admittedly, the company is now somewhat more exposed to patent cliff risks in its Innovative Medicine segment, but as this segment has always been the strongest in terms of revenue and also the largest contributor to profit and cash flow due to its strong margins, I do not consider the increase in risk to be significant.

Concluding Remarks – Is The JNJ Dividend Safe?

Johnson & Johnson completed the split-off of its Consumer Health segment in August 2023. As a result, consolidated sales in Q3 2023 decreased by more than 10% compared to the previous year. This is significantly less than the segment’s most recent annual sales contribution of around 16% and is largely attributable to growth in the Innovative Medicine (formerly Pharmaceutical) and MedTech business segments. The transaction led to a significant decrease in shares outstanding, partly due to the treatment as a split-off and the repurchase of shares in 2023 (approx. $4.8 billion). As a result, earnings per share (EPS) and other per share metrics will not decrease due to the now lower earnings and cash flows. On the contrary, in its Q3 earnings release, JNJ raised its adjusted operating sales guidance to a midpoint of 7.5%, an increase of 80 basis points from the prior quarter’s guidance. I estimate Kenvue’s (former Consumer Health segment) contribution to free cash flow to be in the high $2 billion range, and factoring in the split-off, share repurchases, and the U.S. and Canada talc liabilities remaining with the parent company, I expect JNJ’s dividend payout to remain in the high 50% range, same as before the transaction.

In my view, the safety of the parent company’s dividend has not changed with the separation of the Consumer Health business and in the midst of the ongoing talc process for the reasons mentioned above. Admittedly, the company is now somewhat more exposed to patent cliff risks in its Innovative Medicine segment, but as this has always been the strongest segment in terms of sales and also the largest contributor to profit and cash flow due to its strong margins, I do not consider the increase in risk to be material.

In this context, one should also keep in mind Johnson & Johnson’s rock-solid balance sheet, which gives the company enormous flexibility in terms of acquisitions. I think it is worth remembering that the company acquired Abiomed for almost $17 billion at the end of 2022 and that the transaction is not really recognizable from a debt perspective just nine months later. The company’s Aaa credit rating and its balanced maturity profile are further aspects to consider when comparing Johnson & Johnson’s excellent position to other companies in the healthcare space.

In conclusion, I am confident that Johnson & Johnson remains a classic SWAN stock – although I must admit that I am not a fan of this classification because it can convey a false sense of security. As an investor in individual stocks, I simply feel obliged to revisit my holdings from time to time and check whether my investment thesis is still valid and the fundamentals remain intact. Of course, JNJ stock is one of those that comes pretty close to being a SWAN stock because it requires relatively little recurring due diligence. However, given the significance of the Consumer Health split-off completed in 2023, I believe a more in-depth discussion was warranted.

Thank you very much for reading my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.