Summary:

- Johnson & Johnson’s talc lawsuit issues continue.

- Looming loss of exclusivity on JNJ’s top drug can drag revenues.

- A string of revenue and EBIT misses does not inspire confidence.

- Technical analysis suggests negative alpha ahead for JNJ relative to the S&P 500.

Johnson & Johnson Voluntarily Recalls Baby Powder For Asbestos Contamination Justin Sullivan/Getty Images News

Thesis

I believe Johnson & Johnson (NYSE:JNJ) will underperform the S&P 500 for 3 key reasons:

- JNJ’s talc lawsuit issues continue

- Looming loss of exclusivity on JNJ’s top drug can drag revenues

- A string of revenue and EBIT misses does not inspire confidence

JNJ’s talc lawsuit issues continue

JNJ has been subject to over 40,000 lawsuits over its talcum baby powder product over the last decade. According to Neal Katyal, the legal liabilities are estimated to be as much as $61 billion, which would eat up more than the last 3 years of the company’s free cash flows. That’s a big risk.

On October 14 2021, the company tried to minimize its legal liabilities by creating a separate subsidiary that housed the legal liabilities and filing for Chapter 11 bankruptcy protection. This strategy started to work in early 2022 until in January 2023, the courts ruled that the subsidiary JNJ created in this strategy was not eligible for bankruptcy protection.

The recent update in March 2023 is that JNJ failed to win the support of the Federal Appeals Court. Now, the company seeks to bring the case to the Supreme Court.

What does it mean for the stock?

I don’t think it’s good news. I think the chances of the Supreme Court decreeing the validity of JNJ’s bankrupt subsidiary strategy after it has been rejected till now is low. There is also some evidence to suggest the Supreme Court is influenced by the political powers. And some important sentiments are not in favor of JNJ.

A liability as large as almost 3 years of free cash flows is a very big deal. I think this is a major overhang on the stock.

Looming loss of exclusivity on JNJ’s top drug can drag revenues

Compounding the legal attacks, I think JNJ is due for some operational challenges too. Stelara – an anti-inflammation drug with a wide variety of uses including treatment of Crohn’s disease – makes up 18.1% of JNJ’s pharmaceutical revenues and 10.1% of overall revenues. This makes it the leading revenue contributor to JNJ’s pharmaceutical line. In FY22, $9.7 billion worth of revenues came from Stelara. The problem is it is due to lose its loss of exclusivity (LOE) status as patents for the drug expire in late 2023.

What impact can Stelara’s LOE have on JNJ’s business?

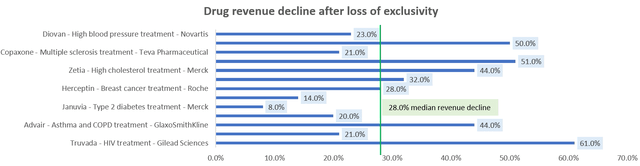

Drug Revenue Decline After Loss of Exclusivity (Company Filings, Author’s Analysis)

The data in this chart is recent; within the last 3 years.

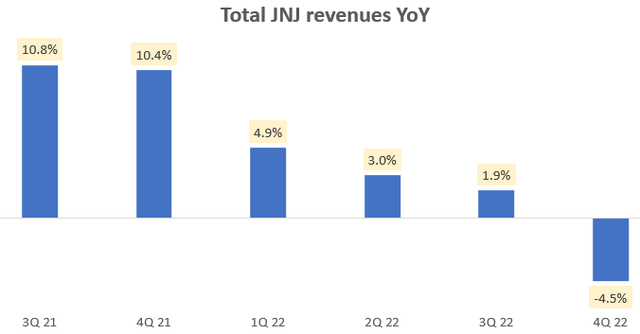

Recent history shows that median loss in revenue after a drug’s LOE is 28%. Assuming this is the impact for Stelara, this implies a 28%*10.1% = 2.8% overall fall in JNJ’s top-line, holding all other things constant. I believe this is a meaningful headwind that will put further pressure on the company’s already slowing revenue growth in recent quarters:

Total JNJ Revenues YoY (Company Filings, Author’s Analysis)

A string of revenue and EBIT misses does not inspire confidence

Management has guided for an overall 2.6% YoY revenue growth in FY23. The commentary on the pharmaceuticals segment, which makes up 55.5% of overall revenues is bullish:

We believe we will be able to achieve our market growth in 2023 for the 12th consecutive year, even in the face of the STELARA loss of exclusivity and macroeconomic challenges.

– CEO Joaquin Duato in the Q4 FY22 earnings call

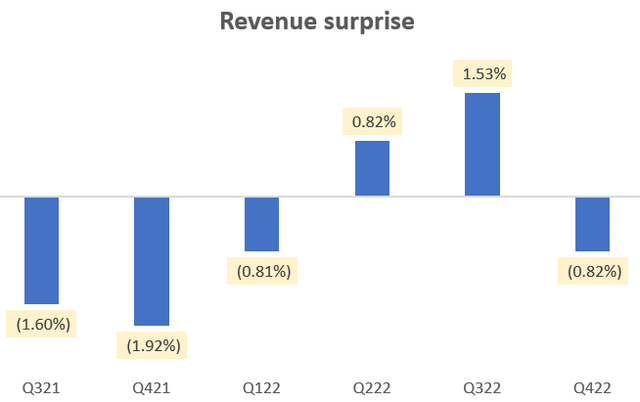

How reliable are these comments? Well, looking at the recent history of revenue surprises vs consensus estimates does not inspire much confidence:

Revenue surprise vs consensus (Capital IQ, Author’s Analysis)

Over the last 6 quarters, the company has had an average miss on revenues vs consensus estimates of 0.47% and a miss in 4 out of 6 recent quarters.

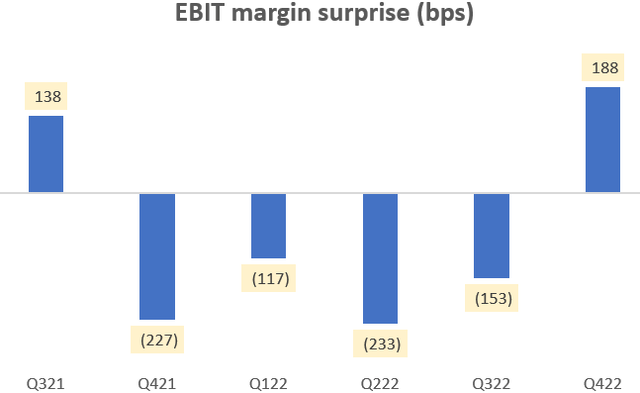

The EBIT margin surprises paint a similar picture with an average miss on margins vs consensus estimates of 67bps, with a similar miss in 4 out of 6 recent quarters:

EBIT Margin Surprise vs Consensus (Capital IQ, Author’s Analysis)

These disappointments have been due to increased competitive pressures particularly in Europe, a slowing down of COVID vaccine sales and LOEs. Hence, I remain unconvinced about the company’s operating momentum taking a turn for the better.

Technical Analysis

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do, utilizing principles of Flow, Location and Trap.

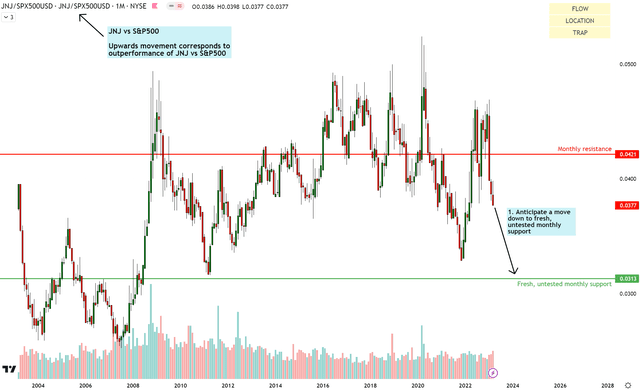

Relative Read of JNJ vs SPX 500

JNJ vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

On the relative chart of JNJ / S&P 500 (SPX) (SPY), I see sharp moves being made by the sellers. I anticipate the ratio price to fall toward the fresh, untested monthly support. This implies negative alpha ahead for the JNJ stock.

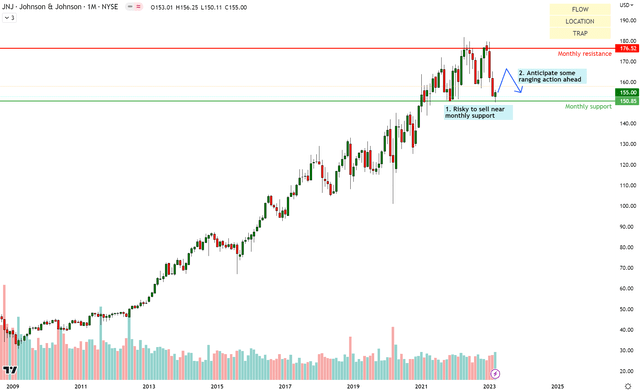

Standalone Read of JNJ

JNJ Technical Analysis (TradingView, Author’s Analysis)

On the standalone chart of JNJ, it looks a little better. Prices are near the monthly support zone and I anticipate a small rebound and some ranging action ahead.

Overall, whilst the technicals give me a clear and confident read of negative alpha vs S&P 500, but not necessarily a negative absolute return expectation for the JNJ stock.

Takeaway

I think JNJ is under many headwinds currently. The company has had no relief in the courts in curbing its legal liabilities from the talc product lawsuits. It is potentially facing a dear hit equal to 3 years of free cash flows here. Operationally, the loss of patent protection on its top drug is expected to have an incremental impact of a 2.8% hit on the company’s annual revenues. JNJ can offset this with other drugs in their portfolio, however a history of recent top-line and EBIT margin misses vs consensus estimates fails to inspire sufficient confidence in the offsetting effects.

Taking into account the read of the technicals, I am confident that JNJ will underperform the S&P 500 over the next few months and quarters. But I do not have the same level of confidence in having a negative total shareholder return expectation on the stock. Hence, I rate JNJ stock neutral/hold, albeit with a bearish slant. If I were a shareholder, I would exit and put the proceeds in the S&P 500 through a cheap ETF product by Vanguard (VOO).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.