Summary:

- Renewed uncertainty in relation to Johnson & Johnson’s talc lawsuit settlement led to a brief and temporary selloff in JNJ stock. What was Mr. Market thinking?

- It looks like a “once and for all” resolution regarding J&J’s talc lawsuits is now off the table, and the company could face time-consuming litigation on a case-by-case basis.

- I share my outlook on Johnson & Johnson’s talc lawsuits, and the potential consequences of Judge Kaplan’s recent ruling.

- I take a closer look at the case of Emory Hernandez Valadez, who was awarded $18.8 million despite (or because of?) his particular case, and discuss what this could mean for future cases.

- I model the impact of a conservative $15 billion (previously $9 billion) impact from talc lawsuits on the valuation of JNJ stock.

Justin Sullivan

Introduction

So far, 2023 has been a fairly tumultuous year for the otherwise low-volatility blue chip Johnson & Johnson (NYSE:JNJ). Renewed fears related to litigation over talc products triggered a selloff from $180 to $150 in the first quarter of the year. The stock rebounded on hopes that subsidiary LTL Management LLC’s second bankruptcy filing and related $8.9 billion value commitment would meet the necessary 75% acceptance threshold among claimants.

JNJ stock remained quite volatile in the second quarter, but rallied 10% following a solid second quarter earnings report. However, the stock fell again after LTL’s second attempt of filing for Chapter 11 was dismissed because, according to Judge Kaplan, the pending lawsuits did not place the company in immediate financial distress. Interestingly, unlike last time, the selloff proved short-lived, and the stock recovered swiftly.

In this update, I share my thoughts on the outlook for the stock as a quick resolution to settle the lawsuits based on J&J’s talc bankruptcy plans becomes increasingly unlikely. The company appears increasingly unable to insulate itself from potentially costly future lawsuits, and might now be required to handle pending lawsuits on a time-consuming case-by-case basis. Recall that JNJ will be responsible for talc-related lawsuits in the U.S. and Canada, while its soon split-off consumer healthcare business Kenvue Inc. (KVUE) will be liable for lawsuits from overseas – with the former almost certainly accounting for the lion’s share.

As an aside, I want to make it clear that my intent in writing this article is not to disparage people who have health issues and are taking action against JNJ. I only intend to evaluate litigation risk from the perspective of a JNJ (and potential prospective) KVUE shareholder.

JNJ Talc Lawsuits: What To Expect Going Forward

JNJ’s main goal in pursuing the infamous “Texas Two-Step” legal maneuver (explained in this article) is likely to be to protect itself from potentially devastating future claims and to limit current claims. With LTL Management’s second bankruptcy filing off the table (for now), it increasingly looks like the company will have to handle at least some of the cases one at a time, which, in addition to compensating plaintiffs, will entail significant internal legal costs and leave the door open for future claims.

J&J announced it would appeal the decision of U.S. Bankruptcy Judge Kaplan, who formally dismissed LTL’s second bankruptcy case on July 28, 2023. Interestingly, however, the same judge later rejected a request by some lawyers to prohibit the company from renewed bankruptcy filings for six months.

It remains to be seen whether LTL Management will file for Chapter 11 bankruptcy protection a third time, but the back-and-forth will definitely increase legal costs. According to the Reuters article linked above, J&J has neither confirmed nor rejected a third bankruptcy attempt, but the company has openly welcomed the judge’s decision to reject the six-month ban. LTL Management’s latest proposal is supported by the vast majority of claimants, suggesting that the company will maintain its current course and make only minor further concessions, also considering that an increase like last time (roughly $7 billion over the original proposal) might suggest desperation. Those lawyers who do not support the current offer are unlikely to accept a moderately higher offer, in my view. They are probably the ones who – CFO Joe Wolk said in the first quarter conference call – “don’t even want to give their claimants the right to vote.”

I think the majority of plaintiffs are still seeking a timely resolution, so an out-of-court settlement, based on the $8.9 billion offered in connection with LTL’s bankruptcy, is the most likely outcome. Other cases would have to be tried in court on a case-by-case basis, a time-consuming process with an uncertain outcome that is not necessarily in the interest of each individual plaintiff – clearly a “high-risk, high-reward” approach.

In this context, the case of Emory Hernandez Valadez (EHV) is of particular interest. While the approximately 38,000 lawsuits already filed against JNJ have been put on hold due to pending bankruptcy proceedings, EHV’s case was allowed to be litigated due to the plaintiff’s short remaining life expectancy.

EHV, who is only 24 years old, says he has developed mesothelioma “in the tissue around his heart,” so most likely primary pericardial mesothelioma (PPM), due to exposure to JNJ’s talc products. However, and I caution that I am not a physician, there are two things to keep in mind. First, pericardial tumors in general and PPM in particular are rare. Second, the causal relationship between asbestos exposure and the development of PPM is debatable. Research on PPM, published in 2009, says the following:

However, in primary pericardial mesotheliomas the evidence for asbestos as an etiologic factor seems to be less convincing (3 exposed among 14 cases).

In another – quite dated – article from 1994, 4 of 28 patients were found to have been exposed to asbestos. The patient studied in this research paper from 2013 categorically denied previous exposure to asbestos.

In the context of EHV’s case, a lawyer for JNJ said that the development of this form of cancer “more likely related to a family history of heart disease and cancer.” In contrast, a lawyer for EHV stated that “mesothelioma is a signature disease of asbestos.” While there is indeed sufficient evidence that asbestos causes mesothelioma (see, e.g., this article), I think it is important to distinguish the development of mesothelioma in the lung lining and chest wall (the most commonly affected area) from the development of PPM.

In any case, the jury in an Oakland, California courtroom found that EHV was entitled to $18.8 million in compensation, even though, according to J&J attorney Brown, there is no evidence linking his cancer to JNJ’s talc products and the tissue samples apparently did not even contain asbestos.

While it would be overly conservative to extrapolate EHV’s compensation by the number of cases that are unlikely to participate in a mass settlement, it does tell us that the financial risk of JNJ talc lawsuits may have increased significantly. However, the probability-weighted risk remains uncertain and impossible to determine.

In addition to a – probably rather small – number of plaintiffs seeking a settlement outside of bankruptcy court and thus potentially receiving higher individual compensation, future claims represent the greatest risk. Extensive media coverage could lead to increased litigation efforts – including abroad. However, under the terms of the KVUE/JNJ separation (see my detailed analysis), the parent company is not liable for claims outside the U.S. and Canada, so Kenvue investors should keep an eye on proceedings related to J&J lawsuit settlement. Granted, future lawsuits from the U.S. and Canada will most likely account for the lion’s share, as is currently the case, but as the example of 3M Company (MMM) in Belgium shows (see my articles here and here), the issue should not be lightly explained away.

From a JNJ shareholder’s perspective, it’s looking more and more like there won’t be a “once and for all” settlement, but I think the company is nonetheless quite well positioned given the strong support for the offer in conjunction with LTL’s second bankruptcy filing. I wouldn’t underestimate the power of the anchoring effect. $9 billion is a number that has been floating around for some time, and a significant number of claimants have likely received an estimate from their lawyers of what they can expect on an individual basis. I think it is unlikely that claimants who previously supported the $9 billion LTL offer would suddenly apply for individual compensation and risk receiving nothing. Time is also likely to be a factor, as most claimants probably prefer a timely settlement.

With that in mind, I believe that the $9 billion is still a realistic baseline expectation for the settlement of most claims, but a small number of claims that will be litigated, as well as future claims, are obviously not included in that number.

However, I would not overstate the tail risk entailed by such cases, as JNJ is likely to pursue legal action against researchers who publish new articles linking the company’s talc products to mesothelioma and other cancers. This is not to say that the company will take action to “hide the truth” – rather, I believe that J&J’s legal and research departments will closely scrutinize new scientific publications and take legal action against authors of factually incorrect or unsupportable conclusions.

The Impact Of Johnson & Johnson Lawsuits On Stock Valuation

The association of exposure to J&J’s talc products with the development of even rare forms of mesothelioma is not clear in my view, but the EHV case has confirmed that substantial compensation can nevertheless be awarded.

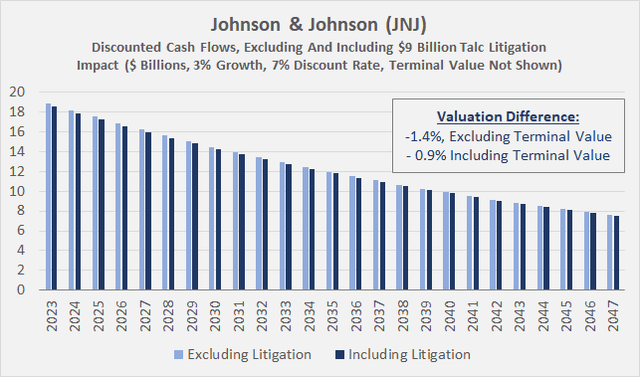

Based on LTL Management’s last commitment of $9 billion, I have shown that JNJ’s stock price should be insignificantly affected assuming a settlement over the next 25 years. Figure 1 shows the discounted cash flow profile based on the $9 billion litigation impact. For clarity, the terminal value of JNJ’s cash flows ($182 billion) is not shown in the graph, but even if it is excluded, artificially increasing the impact of litigation on valuation, JNJ stock should be penalized by only 1.4%. Also, keep in mind that including the litigation costs directly in a discounted cash flow analysis does not consider taxes, so the impact is more conservative than is actually the case.

Figure 1: Johnson & Johnson (JNJ): Discounted cash flow profile, excluding and including $9 billion talc litigation impact (own work, based on company filings, own estimates and calculations)

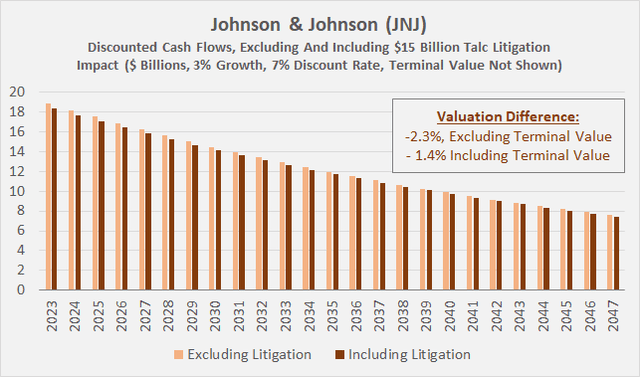

Now that it is increasingly likely that JNJ will face at least moderately higher talc litigation expenses, it seems reasonable to adjust the model accordingly. An increase in gross after-tax litigation expenses to $15 billion may sound overly conservative, but I believe it represents a reasonable margin of safety given that probability-weighted risk is uncertain and impossible to determine. The case of 3M Company shows how quickly previously underestimated litigation costs can increase. However, I have chosen not to shorten the settlement period – which would increase the impact due to the time value of money – simply because the now increasingly likely approach of litigating several cases individually will take considerable time. Even Johnson & Johnson’s CFO noted in the Q1 2023 earnings Q&A that the process would “take probably decades to resolve.”

Figure 2 shows the impact of the increase in litigation expenses to $15 billion. However, even if we again conservatively ignore the terminal value of discounted free cash flows, Johnson & Johnson stock should be penalized by only 2.3%.

Figure 2: Johnson & Johnson (JNJ): Discounted cash flow profile, excluding and including $15 billion talc litigation impact (own work, based on company filings, own estimates and calculations)

In my view, and ignoring the brief and temporary dip in share price, the market was right not to punish JNJ stock after the negative headline that LTL’s bankruptcy maneuver was again rejected. And it should be noted, by the way, that bond investors have not suddenly become more cautious either. The company’s long-term bonds, such as the 4.500% notes due 2043, continue to trade in line with the long-term risk-free rate, plus a very modest corporate bond premium of about 40 basis points – despite the fact that JNJ is still rated Aaa by Moody’s, while the U.S. government was recently downgraded to AA+ by Fitch Ratings. While Moody’s noted that the recent litigation setback increases uncertainty and is credit negative, the agency saw no reason to change the rating or stable outlook. Finally, JNJ’s 5-year credit default swap (CDS) rate continues to fluctuate around 30 basis points. By comparison, it briefly rose to 40 basis points in the midst of the COVID-19 pandemic, while it peaked at around 80 basis points in late 2008.

Summary And Key Takeaways

Following a solid second-quarter earnings report, JNJ shares briefly fell in response to negative headlines that LTL Management’s second attempt to file for Chapter 11 bankruptcy protection was rejected. However, the market’s reaction was only temporary, and the stock is trading as if the company is still on track to settle all current and future talc-related claims in the U.S. and Canada through the infamous “Texas Two-Step” maneuver.

The verdict in the Emory Hernandez Valadez case suggests that cases tried on an individual basis could potentially result in significantly higher compensation than a mass settlement, even though the link between exposure to J&J’s talc products and the development of certain tumors remains a matter of debate. This could represent an incentive for certain plaintiffs to pursue the individual lawsuit route in court.

However, it is very likely that the vast majority of plaintiffs who have already agreed to the $9 billion settlement offer will continue to seek a quick resolution rather than engage in risky and time-consuming individual litigation – and they are also likely to be advised to do so by their lawyers. There is a minority that is likely to continue to seek higher compensation through individual litigation, but I think it is unrealistic for lawyers to take a “whatever it takes” attitude. After all, the vast majority of defendants are likely to be solely seeking compensation and not necessarily acting out of pure principle.

However, the vote on LTL’s renewed bankruptcy filing, scheduled for August 22, 2023, will most likely not take place, and the matter will drag on considerably longer than originally anticipated.

A modest upward revision to the previous $9 billion estimate is warranted, but the greatest uncertainty lies in the potential future claims. Extensive media coverage of successful multi-million dollar judgments could lead to a sustained run on JNJ, which is known for its top-notch credit rating and balance sheet. This is also relevant for Kenvue shareholders, as the soon-to-be split-off consumer health business will be responsible for claims outside the U.S. and Canada.

However, given the – in my opinion – inconclusive scientific evidence, I would not overstate the risk of future cases and expect JNJ’s lawyers to closely scrutinize new scientific publications linking cosmetic talc to the development of various cancers. In addition, I would not underestimate the potential for intimidation with respect to future cases resulting from the undeniable support of the $9 billion offer by nearly 75% of current claimants.

All in all, we can only guess about the final financial impact, but even if we conservatively assume total costs of $15 billion, the impact on the fair value of JNJ stock is negligible (-1.4% and -2.3% of discounted cash flows, inclusive and exclusive of terminal value, respectively).

In conclusion, I think the renewed uncertainty and expected higher litigation expenses will continue to weigh on the price of J&J stock. I don’t expect significant selling pressure, but at the same time I don’t expect good performance either. However, as a long-term investor, I don’t mind. JNJ stock may not be a super bargain today, but it is getting cheaper every day as the company’s profits continue to increase. In other words, while the stock price may continue to bob along, the company continues to compound internally. Buying shares of this blue-chip company at increasingly attractive valuations – for example through reinvestment of dividends – and holding them for decades can lead to above-average long-term returns.

As always, please consider this article only as a first step in your own due diligence. Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.