Summary:

- Johnson & Johnson will release its second quarter earnings report on July 20 before the market opens.

- I share my thoughts on the upcoming earnings release, focusing on the ongoing talc litigation and the anticipated spinoff/split-off of the remaining 89.6% stake Johnson & Johnson holds in Kenvue Inc.

- I provide an updated valuation and explain why I don’t currently add to my JNJ stock position despite the quite compelling valuation.

- Since it is now generally understood that Kenvue Inc. is not Johnson & Johnson’s “bad bank,” I share whether I still intend to hold on to my prospective Kenvue position.

marketlan/iStock via Getty Images

Introduction

I first wrote about pharmaceutical, medical devices (and soon no longer) consumer health company Johnson & Johnson (NYSE:JNJ) in January 2023, when I compared it to Swiss diagnostics and pharmaceuticals giant Roche Holding AG (OTCQX:RHHBY, OTCQX:RHHBF). I own both stocks in my portfolio, but consider JNJ the better dividend stock despite its lower yield.

In light of the still unresolved talc-related litigation, I took a closer look at the matter in early March. In that article, I clarified what was then a common misconception, namely that Kenvue Inc. (NYSE:KVUE) – the recently IPO’d Consumer Health business – is not JNJ’s “bad bank.” In my last earnings preview, published in mid-April, I shared my thoughts on recent events related to the talc litigation (JNJ roughly quadrupled its offer to settle the claims) and provided an update on JNJ’s balance sheet and the litigation impact.

JNJ’s second quarter earnings report will be released on Thursday, July 20, before the market opens. Management will host an earnings call at 8:30 a.m. eastern time. In this article, I share my thoughts on the upcoming earnings release, focusing on the ongoing talc litigation and the anticipated spinoff/split-off of the remaining 89.6% stake JNJ still holds in Kenvue. I provide an updated valuation and share whether I currently consider JNJ stock a buy, hold or sell and whether I still intend to hold on to my prospective Kenvue position.

What To Expect From Johnson & Johnson’s Upcoming Earnings?

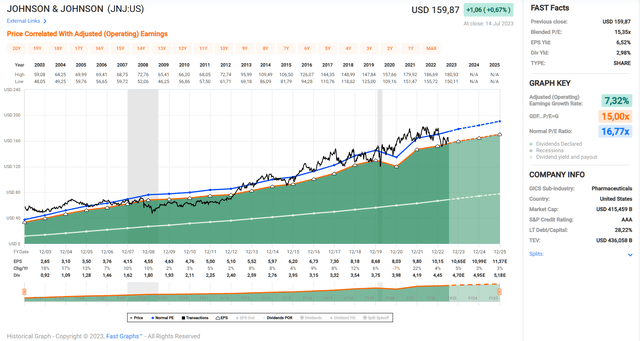

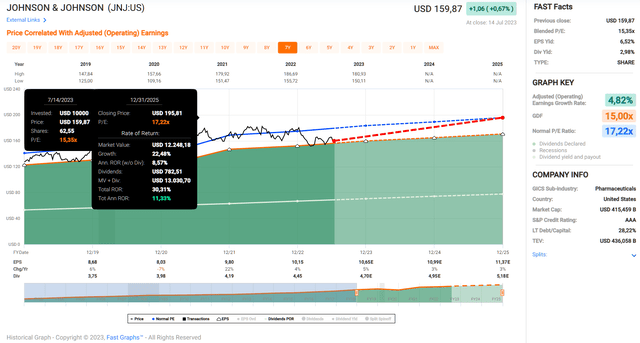

Most, if not all, JNJ investors appreciate the healthcare giant’s almost clockwork performance. On an adjusted operating earnings per share basis, JNJ has maintained a healthy long-term growth rate averaging 7.3% per year over the past 20 years, including analysts’ two-year forward estimates. The company’s strong and reliable earnings record is also reflected in Johnson & Johnson’s share price performance:

Figure 1: Johnson & Johnson (JNJ): FAST Graphs chart for the 2002 to 2025 period, based on adjusted operating earnings per share (FAST Graphs tool)

While it could be argued that it is fairly “easy” to maintain a solid track record of earnings per share (EPS) on an adjusted basis, it is worth noting that JNJ’s growth rate on a GAAP basis is fairly similar (6.7%). Likewise, free cash flow, while temporarily impacted last year by input cost pressures (91 basis point decline in gross margin) and working capital effects, continues to grow at a very healthy average long-term growth rate of 7%.

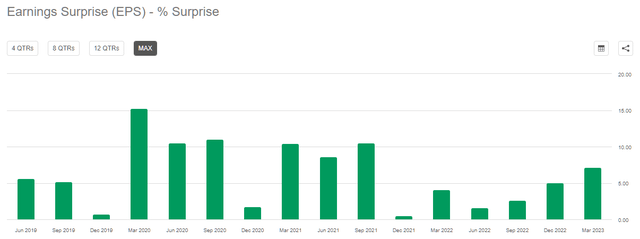

With an industry giant like JNJ, I would argue that quarterly performance doesn’t matter as much, but of course Wall Street’s focus on short-term results can have a significant, albeit brief, impact on the share price. In this context, I tend to be cautious about adding to a position just before quarterly results are announced, especially if a company has a history of missing analysts’ estimates.

Asking what analysts are expecting and whether JNJ has beat earnings expectations in previous quarters, the answer is already pretty obvious. Just like the company’s long-term performance, its quarterly performance is like clockwork (Figure 2). While it is unlikely that management will break with this “tradition” on Thursday, one could argue that Wall Street has become accustomed to this trend and would most likely “punish” the stock if earnings missed even slightly. It’s also important to remember that JNJ has missed revenue estimates on occasion. Therefore, despite the stock’s fairly good valuation (see below), I personally will not be adding to my position ahead of the earnings report.

Figure 2: Johnson & Johnson (JNJ): Earnings per share surprise over the last 16 quarters (Seeking Alpha)

JNJ stock sold off moderately in response to the first-quarter 2023 earnings report, and has since recovered slightly from the local low of $150 to $155. On the surface, the earnings report was solid, and Johnson & Johnson’s one percentage point increase in guidance (revenue and adjusted earnings) and solid dividend increase of over 5% were reassuring.

I think investors have become more cautious due to the lowered 2025 revenue target for the Pharmaceutical segment ($57 billion vs. $60 billion), although management largely attributes the lowered guidance to currency effects. While the weakening U.S. dollar in recent months should somewhat benefit JNJ’s quarterly results, the long-term guidance is still a sign of lower confidence in the drug pipeline. Because of this, and the impending loss of exclusivity (LOE) for Stelara (ustekinumab) at the end of 2023, I expect investors to remain nervous and sell the stock at the slightest sign of earnings weakness.

While the LOE of Stelara is not news to those who read JNJ’s annual reports, I would argue that the increasing market availability of several Humira biosimilars – e.g., adalimumab from AbbVie (ABBV) – and the association with Stelara (a biologic with similar indications) contribute to the uncertainty. Although Stelara is not as significant to JNJ’s revenue as Humira is to AbbVie’s, it is still a significant contributor to Johnson & Johnson’s revenue, accounting for 18.5% of the Pharmaceutical segment’s 2022 sales, or 10.2% of consolidated sales.

On the litigation front, I am quite confident that LTL Management’s renewed filing for Chapter 11 bankruptcy protection and increased offer of approximately $9 billion in present value (previously $2.4 billion) will be accepted, especially given CFO Joe Wolk’s remarks during the first quarter earnings conference call:

[…] we have the support of 60,000 to 70,000 claimants that would vote for the proposal as it’s currently presented. But curiously, we’ve got a small number of plaintiff’s attorneys who don’t even want to give their claimants, the right to vote. So we’re simply asking that they get the right to vote.

Now from my chair as CFO, it is unfortunate that we’ve got to put dollars towards, quite frankly, baseless scientific claims. However, litigation is inherently costly when it’s protracted and it’s also inherently uncertain. And when court (ph) proposal really aims to bring certainty in a very efficient manner for all really involved, something that would otherwise take probably decades to resolve.

While I do not expect the company to announce a decision on the updated reorganization plan (which it likely filed with the court in mid-to-late May), I am nonetheless eager to hear management’s updated remarks during the conference call, also given the recent $750 million trust fund established with insurers, which was negotiated with an attorney representing “many plaintiffs’ law firms” supporting LTL Management’s updated offer. Similarly, it will be interesting to learn if there is any news on the recently filed motion related to the alleged fraudulent transfer of liabilities to LTL Management.

Those interested in a deeper dive into JNJ’s talc litigation process, as well as the role I believe consumer healthcare IPO and spinoff/split-off Kenvue played in that process, should read my article published in March and review the additional remarks in my first quarter earnings preview from mid-April (links in the Introduction).

Can We Expect News On The (Expected) Distribution Of Kenvue Shares On Thursday?

In my previous articles, I suspected that KVUE stock might experience a significant sell-off upon its initial public offering (IPO), as it was incorrectly viewed by some as JNJ’s “bad bank.” Because of this, and the expectation that JNJ will (most likely) distribute its majority stake in KVUE, I have expressed my intention to hold on to my prospective KVUE position until the dust settles.

Suffice it to say that by the time the IPO closed in May, most if not all investors realized that Kenvue’s litigation risk was quite limited. And while it would be presumptuous to claim that my article published in March alerted a significant percentage of JNJ investors to this widespread misconception, I would not underestimate the impact of the Reuters article titled “J&J to retain all talc-related liabilities from litigation in US, Canada,” published just a week before the Kenvue IPO, on April 27.

I am a proponent of the transaction, even considering that JNJ has retained about 90% of the total outstanding Kenvue shares, currently valued at about $43 billion. While the original S-1 document filed with the SEC in early January indicated that the parent company expected to distribute its majority stake in a tax-free transaction, there is of course no guarantee that this will happen. JNJ’s recently released Q&A on the Consumer Health separation provides no further insight, but suggests that JNJ could seek either a spin-off (a pro rata distribution / JNJ stock dividend as indicated in the S-1), a split-off (an exchange of all, some, or none of the shareholder’s JNJ shares for KVUE shares), or a combination of both. Despite this uncertainty, I still believe that the company will split off its Consumer Health business entirely. After all, it was openly stated in the Q1 earnings results remarks that the company remains “on track to complete the separation of this business in 2023.“

Nonetheless, I would not expect news regarding distribution or exchange to be announced in the upcoming earnings release on Thursday. JNJ is restricted in its ability to trade or exchange Kenvue stock until early November, so we will likely have to wait at least until after the Q3 earnings call in mid-October.

My Updated Take On Kenvue Stock

Given the stock’s performance since the IPO, most, if not all, investors by now understood that KVUE would be spared the lion’s share of the talc lawsuits. Now that I expect the stock to continue to trade at a normal to high valuation, I have been entertaining the idea of selling my shares upon receipt.

However, while I know that JNJ’s Consumer Health business has been a rather weak performer in recent years, I have not changed my decision to hold on to the prospective position. Kenvue’s brands (e.g., Aveeno, Neutrogena, Tylenol, Zyrtec, Listerine, Band Aid, Nicorette) are widely recognized and will not suffer from the separation. If anything, the fact that JNJ is no longer associated with these consumer products could be a tailwind due to the no longer obvious connection with the talc issue. Because of its size, Kenvue benefits from an attractive cost structure and also has pricing power, as evidenced by its first-quarter 2023 results. There is definitely room for margin improvement, but the foundation is strong.

Because of this, and increasing external visibility and investor attention (the rather weak segment is no longer “carried” by the Pharmaceutical and MedTech divisions), I think Kenvue can return to meaningful growth and deliver good shareholder returns. My decision to hold on to my prospective Kenvue position has not changed (but the reasons for doing so obviously have).

Is Johnson & Johnson A Good Stock To Buy Now – And A Word On GLP-1 Receptor Agonists

Mainly due to the – in my view most likely resolved – uncertainties related to the talc litigation and the somewhat weak drug pipeline, the stock does not seem to find sustainable interest among investors. Johnson & Johnson’s stock has been more or less treading water since early 2021.

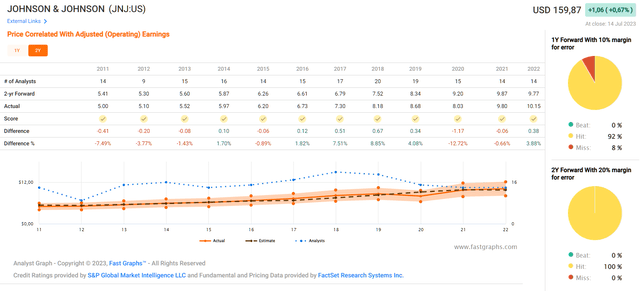

However, as a long-term investor, I embrace periods like this as the stock gets cheaper over time. Granted, as interest rates have risen sharply since early 2022, so have opportunity costs, but I still think JNJ stock is an increasingly attractive opportunity. Given the high earnings reliability (see two-year forward analyst scorecard in Figure 3), it’s understandable that JNJ rarely suffers from sharp price declines, which can be used to increase one’s long-term position opportunistically.

Figure 3: Johnson & Johnson (JNJ): FAST Graphs two-year forward analyst scorecard (FAST Graphs tool)

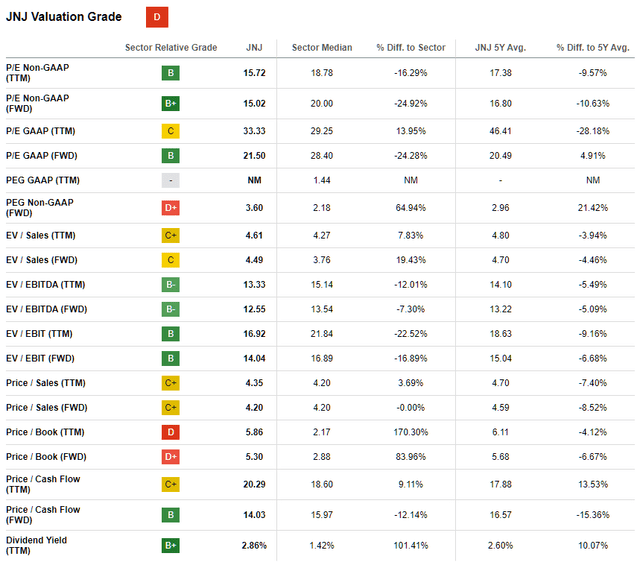

At a current price of $160, JNJ stock trades at a blended price-to-earnings ratio of 15.4, a free cash flow yield of 4.9% (average 2020 to 2022, adjusted for stock-based compensation and working capital movements), and an EV/EBITDA multiple of 13.3 (TTM basis) to 12.6 (forward basis). Johnson & Johnson’s dividend of currently $1.19 per share and quarter represents an annualized dividend yield of 2.95%, which is quite attractive by historical standards. Taking into account the current yield on 10-year Treasuries of 3.83%, investors will have to wait until 2028 before breaking even in terms of yield. However, unlike long-term government bonds, I would argue that JNJ stock is currently a pretty good inflation hedge due to its reliable dividend growth and very manageable payout ratio of 50% to 60% of normalized free cash flow. If JNJ maintains a 5% dividend growth rate (the current five-year CAGR is 5.7%), the yield-on-cost will exceed the current yield on 10-year Treasuries by 2028.

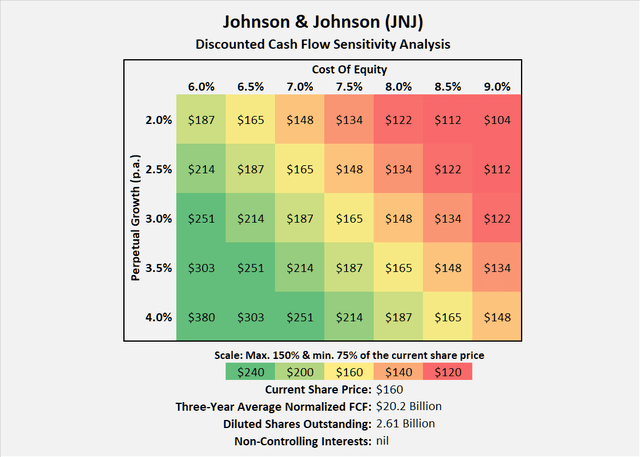

While this is arguably not a particularly cheap valuation, it compares quite favorably to the historical average (Table 1). The long-term FAST Graphs chart in Figure 1 (above), the chart based on earnings for 2018 to 2022 and estimates for 2023 to 2025 (Figure 4), and the discounted cash flow sensitivity analysis in Figure 5 also suggest a fair valuation or a slight undervaluation.

Table 1: Johnson & Johnson (JNJ): Valuation metrics and comparison with the sector median and five-year average valuations (Seeking Alpha) Figure 4: Johnson & Johnson (JNJ): FAST Graphs chart for the 2018 to 2025 period, based on adjusted operating earnings per share (FAST Graphs tool) Figure 5: Johnson & Johnson (JNJ): Discounted cash flow sensitivity analysis, suggesting fair valuation at a cost of equity of 7.5% and a perpetual growth rate of 3.0% (own work, based on company filings and own calculations)

A total annualized rate of return of around 11% according to FAST Graphs sounds very solid for such a high-quality blue-chip company, but I would argue that the market will not grant JNJ stock its normally observed slight premium valuation of around 17 times earnings until litigation is settled and pipeline uncertainties are resolved. Another factor negatively impacting JNJ stock sentiment is the upcoming drug pricing negotiations, even though the company is one of the better diversified in terms of geography and assets (see my first article linked in the Introduction). The upcoming negotiations could have a material impact on Invega (4.4% of 2022 consolidated sales) and Darzalex FASPRO (daratumumab and hyaluronidase, together with daratumumab a sales contribution of 8.4%).

And while I admit that I’m not buying any more shares until I take a close look at the second quarter results, I definitely prefer such a stock to quite hyped competitors like Eli Lilly and Company (LLY), which recently surpassed JNJ as the world’s most valuable pharmaceutical company, largely due to high expectations for its glucagon-like peptide-1 (GLP-1) receptor agonist tirzepatide (Mounjaro), which was recently approved for type 2 diabetes (T2D) and likely soon for obesity. By comparison, LLY stock currently trades at a price-to-sales ratio of over 14, a blended price-to-earnings ratio of 54, and a free cash flow yield of 1.3%. In other words, Eli Lilly is three to four times more expensive than Johnson & Johnson.

Granted, GLP-1 receptor agonists represent a significant breakthrough in the treatment of type 2 diabetes and obesity. However, I would argue that it is likely to be a classic case of ROIC mean reversion, given the success of Novo Nordisk’s (NVO) semaglutide, which was approved for T2D and obesity in 2017 and 2021 under the brand names Ozempic and Wegovy, respectively. Here is a link to an interesting comparative study of the two drugs that suggests the superiority of tirzepatide. Also, the emerging competition from Amgen Inc. (AMGN) and Pfizer Inc. (PFE, despite a recent setback) should not be hastily dismissed. JNJ has also been active in GLP-1 receptor agonist research. JNJ-54728518 was tested in a phase I study in 2016, but there are no current studies registered at clinicaltrials.gov. JNJ-64565111 showed somewhat promising results in a phase 2 trial (link to other registered studies). However, JNJ does not currently list any GLP-1 receptor agonists as being in development as of April 18, 2023.

Concluding Remarks

Johnson & Johnson will report its second-quarter results on Thursday, July 20, before the stock market opens. The company hasn’t missed earnings per share estimates in at least 16 quarters – an earnings beat on Thursday is likely. JNJ stock dropped after the company released first-quarter results, despite beating earnings per share and raising guidance. With Wall Street likely expecting another earnings beat, and given the uncertainties surrounding talc litigation and drug pipeline, I’m not adding to my Johnson & Johnson position despite the fairly compelling valuation for such a high-quality blue-chip company.

It is reasonable to expect an update on the resolution of the talc litigation, as JNJ likely submitted the updated reorganization plan to court in mid-to-late May. Things look quite good, in my view, and the expected litigation expense is very manageable in light of the company’s strong free cash flow, low debt, and expected distribution of the payment over 25 years.

Previously, I had concluded that I would hold on to my (prospective) Kenvue position until the dust settled, as the prevailing view at that time was that KVUE was JNJ’s “bad bank.” Given the stock’s performance since the IPO, I think most if not all investors have understood that KVUE will be spared the lion’s share of the talc lawsuits. Because I now expect the stock to continue to trade at a normal to high valuation, I have been entertaining the idea of selling my shares upon receipt. However, given the strong brands, solid operating foundation, increasing external visibility, and also the no longer obvious association of the products with the probably somewhat tainted JNJ brand name, I think Kenvue can return to meaningful growth and generate good shareholder returns.

Nonetheless, I would not expect news regarding distribution or exchange to be announced in the upcoming earnings release on Thursday. JNJ is restricted in its ability to trade or exchange Kenvue stock until early November, so we will likely have to wait at least until after the Q3 earnings call in mid-October.

Moreover, I wouldn’t expect management to suddenly start discussing GLP-1 receptor agonists (the AI analogy buzzword in pharma these days), even though JNJ’s efforts in this area date back to 2016.

From a valuation perspective, I think JNJ stock, which has more or less treaded water since early 2021, is increasingly attractive, despite currently higher opportunity costs. The company continues to grow, but the market is not acknowledging that due to the ongoing uncertainties. Investors need to remain patient, but in retrospect, I believe that disciplined purchases of shares in such a high-quality company will pay off.

As always, please consider this article only as a first step in your own due diligence. Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ, ABBV, AMGN, PFE, RHHBY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.