Summary:

- Johnson & Johnson’s stock has seen modest gains in recent months, supported by approvals for treatments like Tremfya, Darzalex Faspro, and Rybrevant.

- Despite positive developments, litigation issues and the V-Wave acquisition cast a shadow over EPS forecasts, which, along with the recent price rise, suggest limited upside for the stock.

- There could be upside going by the growth potential from recent approvals, but the extent is unknown. For this reason, I am downgrading JNJ stock to Hold.

Sundry Photography

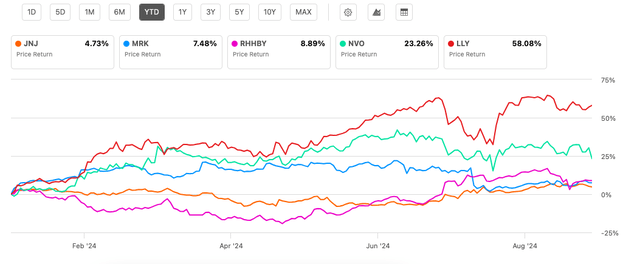

When I last wrote about the pharmaceuticals company Johnson & Johnson (NYSE:JNJ) in July, it was the only one among the five biggest stocks in the segment by market capitalization to witness a price decline year-to-date [YTD]. That has changed, with its price gains in the interim. It has still seen the smallest increase among peers in 2024 so far (see chart below). But even this is an improvement over the earlier trend.

Price Returns, Big 5 Pharmaceutical Stocks (By MCap) (Source: Seeking Alpha)

A quick look back

At the time, there was already a case for some price uptick. This was based on improved revenue growth, particularly due to the gains for its psoriasis treatment Tremfya, which could pick up the slack from Stelara over time, that’s seeing weak growth due to patent expiration.

The adjusted earnings per share [EPS] was expected to see a bit of growth in 2024 too, resulting in a lower forward non-GAAP price-to-earnings (P/E) ratio compared to the five-year average. Additionally, the dividend yield wasn’t bad compared to peers and dividend longevity went in JNJ’s favour as well.

Spate of approvals

The expected price increase for JNJ has played out in the past couple of months. It’s forward non-GAAP P/E at 16.4x is almost at the five-year average of 16.5x now. This leaves the question – can the stock continue to rise? There are certainly multiple positive developments for it, mostly in terms of approvals. These are as follows:

#1. Tremfya for ulcerative colitis

The company’s fast-growing treatment Tremfya has now been approved for treatment of moderate to severely active ulcerative colitis, a disease in which the lining of the colon becomes inflamed. It was earlier approved for plaque psoriasis and psoriatic arthritis. Additionally, the company’s also seeking approval for Tremfya for Crohn’s disease, which is another manifestation of inflammatory bowel disease, much like ulcerative colitis, from the FDA and the European Medical Agency.

While the treatment’s revenues are still small, at just 4% of the company’s sales in the first half of 2024 (H1 2024), it holds much promise. Besides the multiple myeloma treatment Darzalex and prostate cancer treatment Erleada, it’s the only treatment with over USD 1 billion of revenues in H1 2024 to see over 20% growth during the time, of 29.2% year-on-year (YoY) in operational, which is to say, constant currency terms.

Further, with over 100% contribution to immunology’s total revenue increase in H1 2024 (due to a contraction in some other treatments) it could be the next big treatment for the segment, with Stelara seeing just 3.1% YoY rise in operational terms during this time.

#2. Cancer treatment Darzalex Faspro

Further, Darzalex Faspro, the injectable version of Darzalex, which is otherwise administered intravenously, also received the FDA’s approval for treatment of multiple myeloma, in combination with other treatments. This is particularly positive since Darzalex is the single biggest revenue generator for Johnson & Johnson, accounting for 28.4% of the company’s sales in H1 2024. Its robust 21.2% YoY operational growth is also notable.

#3. Tagrisso challenger, Rybrevant approved

Finally, Rybrevant was approved by the FDA for treatment of metastatic non-small cell lung cancer, in combination with chemotherapy. The treatment, which would be a competitor to AstraZeneca’s (AZN) Tagrisso, could hold a promising future, considering that Tagrisso is AstraZeneca’s second-biggest revenue generating treatment after its diabetes medication Farxiga.

The litigation drag

But the big thorn in Johnson & Johnson’s side remains litigation, even with some recent progress on the front. For instance, litigation claiming that the company’s talcum power caused cancer is close to being settled. Last month, the majority of claimants approved of a USD 6.5 billion payout by the company. However, the matter didn’t eventually get settled, and the company is now ready to USD 8 billion towards the same. For perspective, this is 60% of its last year’s net income.

The company intends to make these payments through a subsidiary, Red River Talc LLC, which could distance the settlement from Johnson & Johnson. But so far, it has been unsuccessful, with the courts denying the route twice, but the company is trying yet again.

Further, the company now has to pay over USD 1 billion in settlement of a lawsuit related to its acquisition of surgical robot development company Auris Health. It made a USD 3.4 million cash payment, and further payouts were agreed on based on milestone achievement. However, it has been alleged that Johnson & Johnson didn’t support the meeting of these milestones, and the company has been asked to pay up. Along with the proposed settlement for talcum power litigations, this payout brings up the total expected payout figure to ~68% of the company’s EPS in 2023.

V-Wave acquisition’s earnings impact

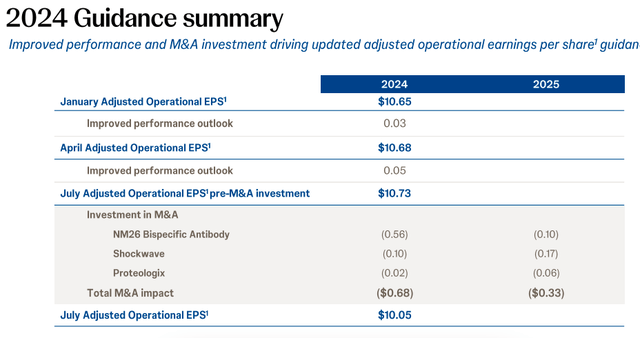

Further, the company’s acquisition of heart failure treatments company V-Wave holds promise for its MedTech segment, but for now, it represents an earnings drag. The deal, which includes an upfront payment of USD 600 million and milestone-based payments of up to USD 1.1 billion, will reduce the adjusted EPS for 2024 by USD 0.24. In July, the company forecast an adjusted EPS of USD 10.05 for 2024 (see table below). After the latest acquisition, the number would come to USD 9.81, which leads to a forward P/E of 16.6x. This is slightly higher than the stock’s five-year average.

What next?

The key point from the discussion is that at least for now, despite all the advancements for the company in the past couple of months, it looks fairly priced. Its earlier acquisitions had already reduced the EPS forecast and with the V-Wave buyout, the number is low enough to indicate little upside anymore. Additionally, the litigation related payouts are expected to be bigger than earlier anticipated, which could make the stock even more unattractive.

That said, the recent approvals look really good, since they are in high growth and potentially high-growth segments. How fast their growth comes in remains to be seen, though. As such, it’s hard to determine right now how at least the remainder of 2024 will play out for JNJ. For this reason, I’m erring on the side of caution and downgrading it to Hold. This rating is open to change as more clarity emerges.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

—