Summary:

- J&J’s stock fell steeply following its share exchange offer for Kenvue stock, but dip buyers have since returned, auguring well for a further recovery.

- JNJ’s best-in-class “A+” profitability grade provides robust support in a high-interest rate environment. Its renewed focus on its pharma and medtech business provides further valuation support.

- Management remains open to accretive M&A opportunities, bolstered by a robust balance sheet, which could lift its growth drivers further.

- I argue why J&J Bulls, who missed buying its previous steep pullbacks, shouldn’t miss loading up at the current levels. JNJ looks well-primed to regain control of its uptrend bias.

yuelan

I last updated investors in Johnson & Johnson, or J&J (NYSE:JNJ), in early April, urging them to capitalize on its capitulation to add more shares. That thesis has worked out well, as JNJ dip buyers held its March lows ($150 level), lifting buying sentiments.

Following its remarkable surge into its early August highs ($176 level), optimism in JNJ has since waned. Accordingly, sellers took profit following the deadline of the exchange offer for Kenvue (KVUE) stock on August 18. Accordingly, JNJ fell steeply and lost more than 10% (in price-performance terms) toward its early September lows.

That said, I assessed robust dip-buying support in September, bolstering investors’ sentiments in JNJ, suggesting buyers were keen to defend its March lows. Therefore, it could potentially help JNJ chart a more sustainable recovery from here.

Management provided revised guidance in late August, corroborating the strength of its underlying business. Accordingly, the updated adjusted EPS outlook of between $10 and $10.10 suggests a midpoint growth of about 12.5%. Analysts’ estimates are also optimistic, with an average projection of $10.07, auguring well for the company’s execution in the second half.

In addition, management provided confident commentary in a mid-September conference about its renewed focus on its pharmaceutical and medical technology business. CEO Joaquin Duato highlighted that J&J’s pharma business is trending well, with average analysts’ estimates moving closer to the company’s FY25 outlook of $57B. Therefore, it should reassure the investors concerned about the growth in its pharma business, which is expected to be a key growth driver over the next couple of years.

The company delved into the growth of its new products category and provided visibility into its pipeline, adding more clarity on its revenue trajectory. As such, management accentuated that “there’s increased investor confidence” in J&J meeting its FY25 guidance.

With that in mind, we should observe improved buying sentiments as investors anticipate J&J’s strong execution in meeting its growth cadence moving forward, bolstering its valuation. Why? Because JNJ isn’t priced at a discount against its peers.

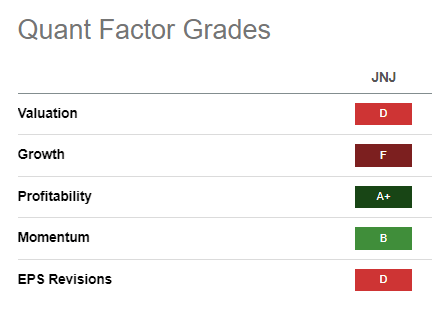

JNJ Quant Grades (Seeking Alpha)

As seen above, JNJ is assigned a “D” valuation grade by Seeking Alpha Quant, indicating relative overvaluation compared to peers. I also gleaned that JNJ last traded at a forward EBITDA multiple of 12.8x. While it’s broadly in line with its 10Y average of 12.4x, it’s markedly higher than its pharma peers’ median multiple of 10.1x (according to S&P Cap IQ data).

However, with an “F” growth grade (the worst possible), JNJ could be viewed by some investors as relatively overvalued compared to more attractive growth or value opportunities in the sector.

Despite that, J&J’s best-in-class “A+” profitability should provide robust support in a high-interest rate market environment, underpinned by its robust balance sheet. Analysts’ estimates suggest an adjusted EBITDA leverage ratio of just 0.3x for FY23. As such, the company’s robust earnings and free cash flow conversion should corroborate its ability to drive M&A or business development opportunities. Management maintained that J&J remains “open to value-creating opportunities.”

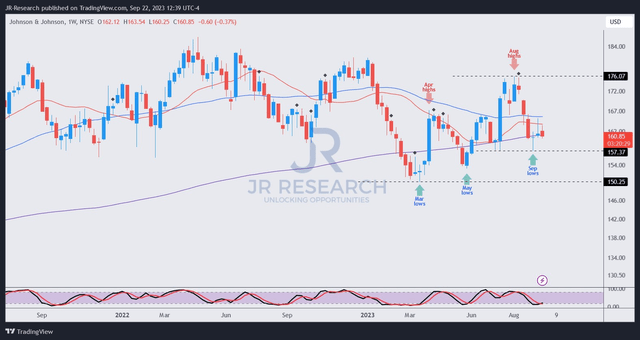

JNJ price chart (weekly) (TradingView)

As seen above, I gleaned robust dip-buying sentiments in March, May, and September. In addition, JNJ has recovered above its critical 200-week moving average or MA (purple line), a pivotal move to retake its 50-week MA (blue line) subsequently. A decisive recovery above its 50-week MA would likely improve buying sentiments further.

Moreover, an astute bear trap (false downside breakdown) in September was observed, proffering my conviction that dip-buyers have been holding up the current levels well. As such, it suggests buyers remain confident about management’s execution at its current valuation, notwithstanding JNJ’s relative overvaluation.

Therefore, I urge JNJ holders who have been waiting patiently for the August surge to be digested, first consider loading up at the current levels.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!