Summary:

- Johnson & Johnson is regaining momentum with strong growth in its Innovative Medicine and MedTech segments, driven by new products and strategic acquisitions.

- The company’s robust financials, including a triple-A credit rating and significant cash reserves, position it well for sustained growth and reduced legal risks.

- Despite past underperformance, the company offers a reliable 3.1% dividend and a reasonable valuation, making it an attractive option for low-risk, long-term investors.

Nudphon Phuengsuwan

Introduction

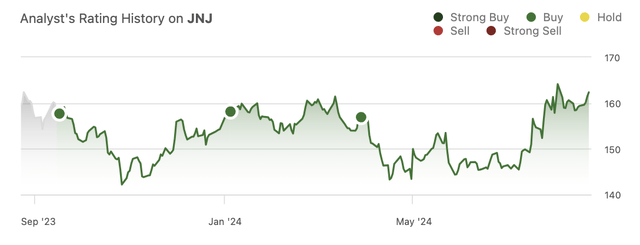

I started covering Johnson & Johnson (NYSE:JNJ) in September of last year, when the stock became interesting again, as spin-off and lawsuit headlines provided several buyable corrections.

As we can see below, I have written about this company three times. All of my calls are profitable – yet not by a lot. My most recent article was published on March 28, when I focused on its transition to high-growth healthcare markets. Since then, shares have returned 3.5%, lagging the 6% return of the S&P 500 (SP500).

In this article, I’ll update my thesis, as I believe Johnson & Johnson is slowly but steadily turning into a very attractive healthcare company again. On top of having a triple-A rated balance sheet, I see a path to higher growth with less lawsuit risk, making the company a great pick in a market with an overall lofty valuation.

So, let’s keep this intro short and get right to it!

Growth Is Back!

Some people are fed up with the J&J stock. I get that.

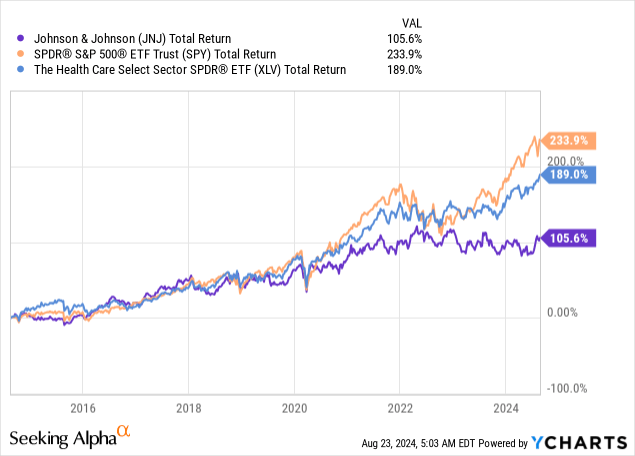

Over the past ten years, JNJ has returned just 106%. Although that’s not a horrible number (it could be a lot worse), it is bad compared to the S&P 500’s 234% return and the 189% return of The Health Care Select Sector SPDR® Fund ETF (XLV).

This includes a sideways trend since 2021 and a lot of lawsuit uncertainty.

Whenever better opportunities exist and a company enters turmoil, investors bail – and rightfully so.

The good news is that Johnson & Johnson is recovering.

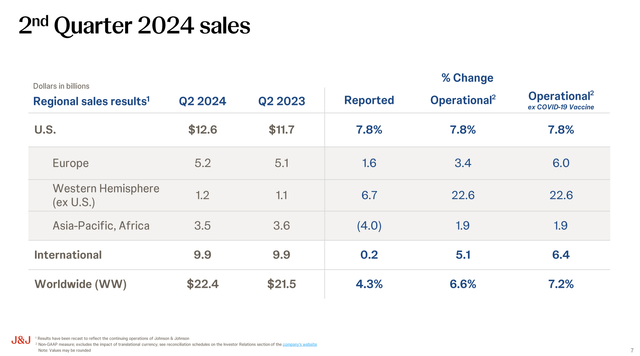

For example, in its most recent earnings call, the company noted worldwide sales of $22.4 billion. That’s a 6.6% increase compared to the prior-year quarter. According to the company, this growth was driven by a 7.8% increase in the U.S. and 5.1% growth internationally.

This allowed the company to grow its adjusted EPS by 10.2%.

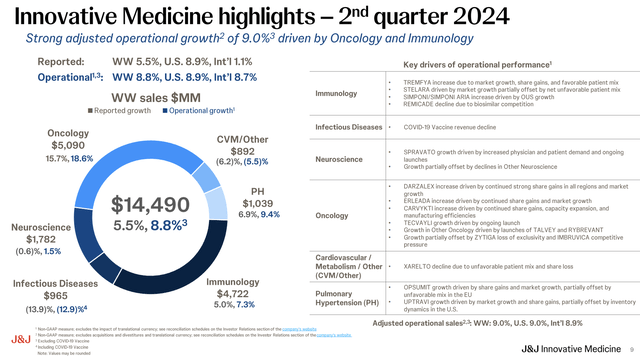

Based on this context, let’s dig a bit deeper, as underlying revenue growth trends tell us a lot about how J&J is positioning itself for future growth. This includes its innovative Medicine segment, which saw $14.5 billion in sales, a 7.8% increase.

As we can see below, this growth was fueled by leading products like DARZALEX, which saw a 21.3% growth rate due to market share gains and increased adoption in various therapy lines. DARZALEX is not a chemotherapy, but a drug used for “targeted therapy” or immunotherapy. It is designed to work with a patient’s immune system.

On that note, the company’s oncology portfolio also saw strong growth, with CARVYKTI sales surging by 59.9% and roughly 44% growth in TECVAYLI.

Additionally, the company’s investments in fast-growing areas like neuroscience and immunology are paying off.

SPRAVATO, which is used for treatment-resistant depression, saw 61% growth. TREMFYA, which is an immunology drug, saw 31% growth.

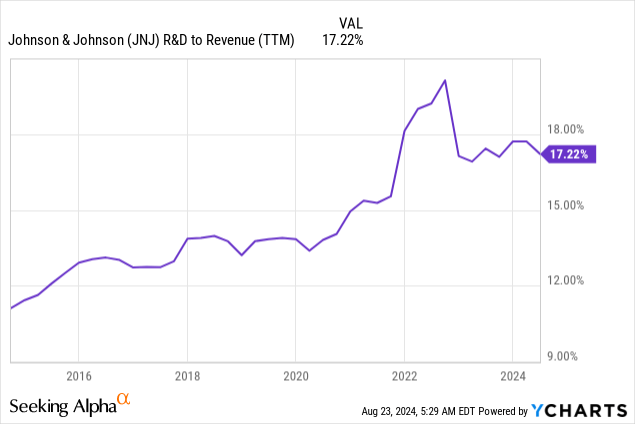

In general, the company is massively investing in R&D (research and development). In the second quarter alone, the company invested $3.4 billion in R&D. That’s 15% of its sales! Over the past four quarters, $0.17 of every revenue dollar went to R&D.

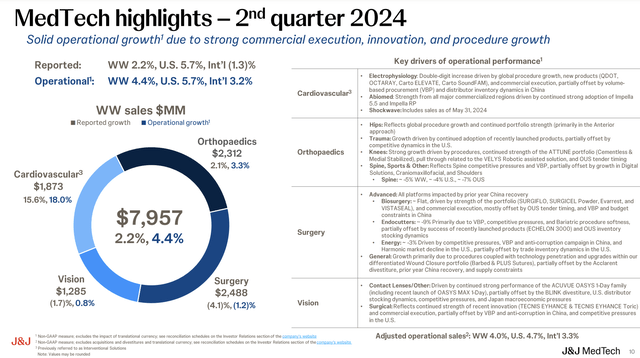

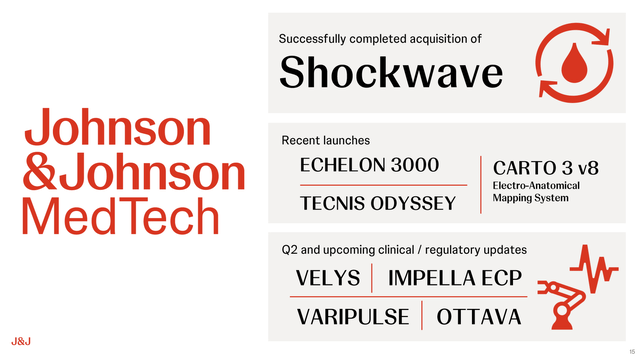

One area that enjoys a lot of R&D spending is MedTech, a segment that generated $8 billion in revenue in 2Q24. A brief look at the overview below reveals that this is 4.4% more than one year ago, led by 5.7% growth in the United States of America.

This was driven by strong growth in cardiovascular and orthopedics. These segments saw 18% and 3% higher revenues, respectively.

In the next part of this article, I’ll tell you what this means for shareholders going forward.

There’s A Lot Of Value In J&J

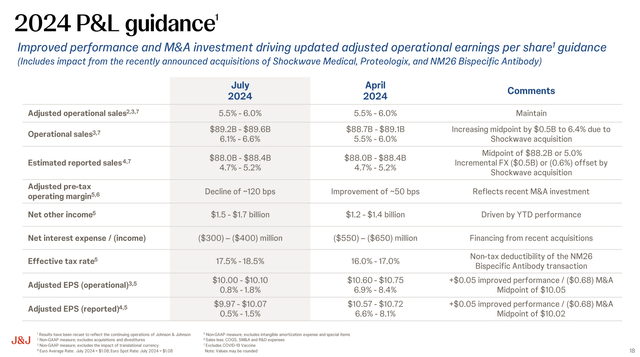

As part of a strong performance, the company raised its guidance.

It now expects between 6.1% and 6.6% in revenue growth, with a midpoint of $89.4 billion. Additionally, the company sees at least $10.00 in EPS, with the midpoint of its EPS range indicating 8.2% growth.

Looking beyond these numbers, I believe J&J has figured out how to position itself for sustained growth.

For example, in its Innovative Medicine segment, the company has achieved its 13th consecutive year of above-market growth.

Our Innovative Medicine business is on track for a 13th consecutive year of above-market growth. Our success is driven by a portfolio of innovative best and first-in-class medicines, many of which have the potential to change the practice of medicine. Across the board, oncology, immunology, neuroscience, we are reinventing treatment paradigms and transforming lives. – JNJ 2Q24 Earnings Call.

Meanwhile, in its MedTech segment, the company is moving into higher-growth markets through acquisitions and new product launches.

According to the company, the acquisition of Shockwave Medical and the launch of advanced technologies like the VARIPULSE platform and the TECNIS Odyssey are expected to drive growth in cardiovascular and surgical segments.

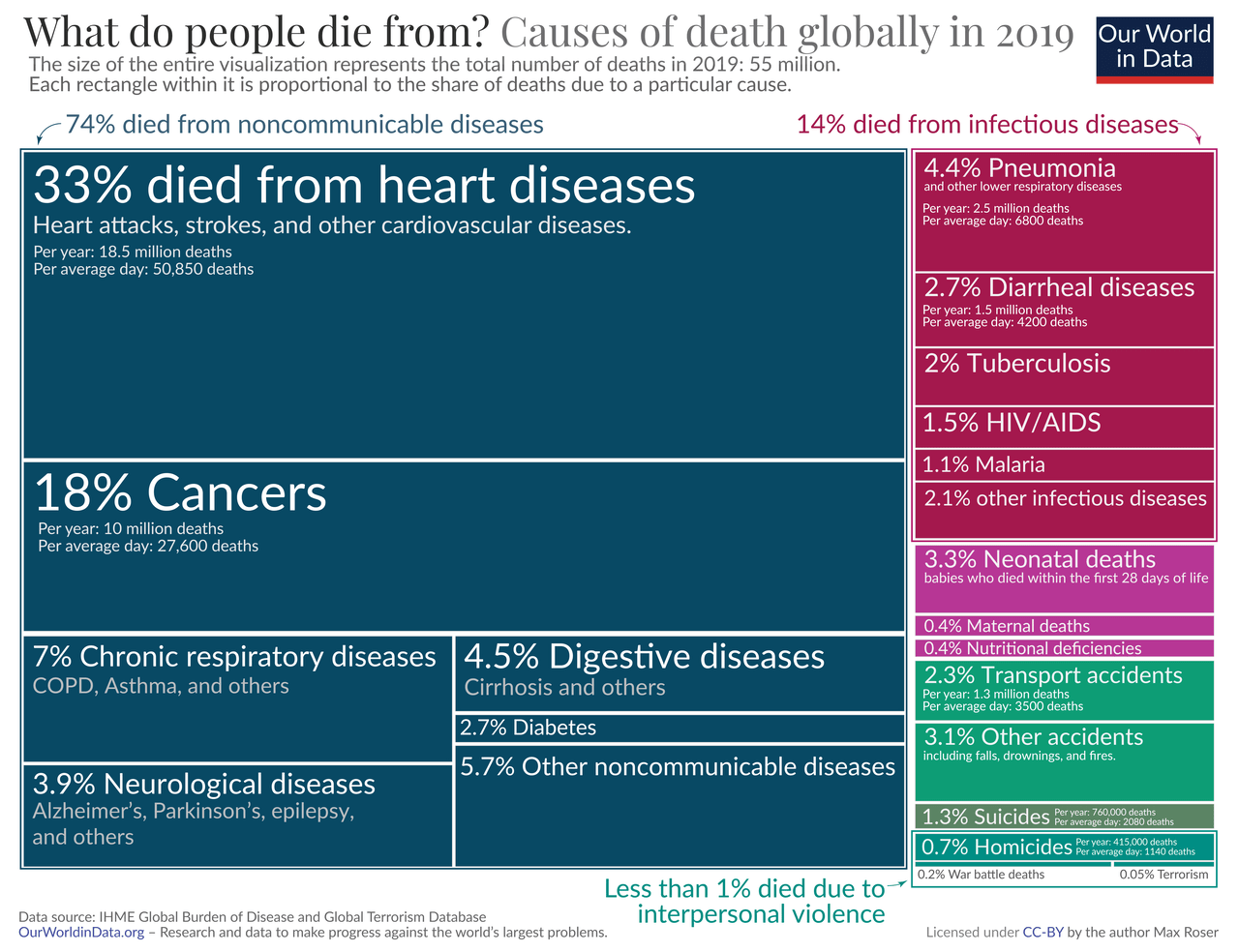

As I have written in prior articles, cardiovascular health is one of my favorite areas, as it is such an important area. In 2019, a third of all deaths were caused by heart disease. That’s almost twice as many deaths as cancer. Although I am not a medical professional, I believe many of these deaths could have been prevented – or at least delayed, as death isn’t preventable.

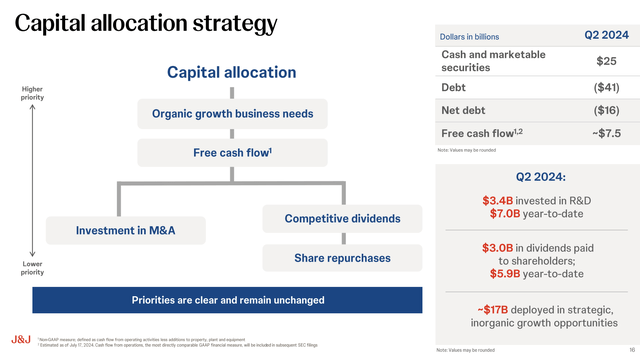

With that said, the company is using M&A to grow its footprint in fast-growing areas. In the first half of this year, the company has spent $17 billion on “inorganic” growth, including the takeover of Shockwave, Proteologix, and the NM26 bispecific antibody transaction.

The company has a lot of room to engage in major deals, as it has one of the best balance sheets in the world. It has a triple-A rating, which is better than the rating of many developed nations (although it’s difficult to compare a company to a country). It also has $25 billion in cash and cash equivalents and is close to significantly de-risking the talc powder lawsuit, as reported by Reuters.

Moreover, a big part of its capital allocation is to pay a competitive dividend.

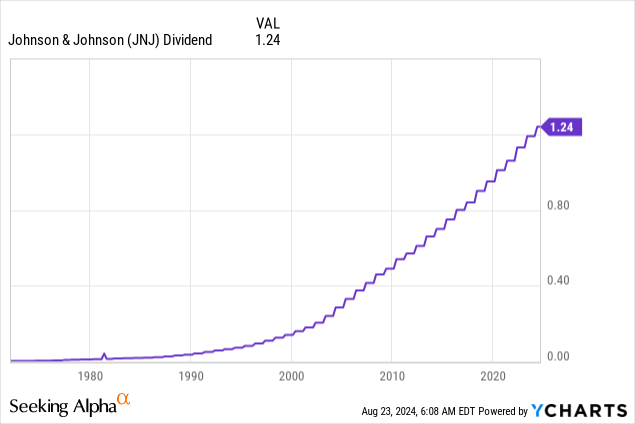

The JNJ dividend is one of the most reliable dividends in the world. Currently yielding 3.1%, Johnson & Johnson has hiked its dividend for 61 consecutive years. It has a payout ratio of 46% and a five-year CAGR of 5.7%.

It also has a valuation that benefits from a clear path to higher growth.

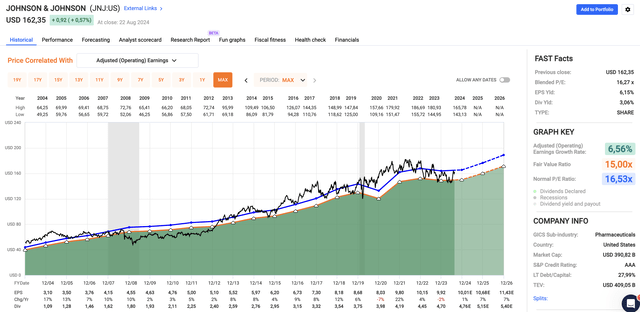

Currently trading at a blended P/E ratio of 16.3x, the company trades slightly below its long-term average (the blue line). This year, analysts expect 1% EPS growth (that’s unadjusted). In 2025 and 2026, EPS growth is expected to be 7%. This would mark the longest expected growth streak since the company ran until issues in 2020.

Beyond 2026, I expect EPS growth to remain elevated. When adding its 3% yield to 7-8% annual EPS growth, we get a total return outlook of 10-11% per year.

I believe that is highly reasonable, making JNJ a good buy for investors seeking low-risk dividend growth in healthcare.

Takeaway

Johnson & Johnson is steadily reclaiming its place as a standout in the healthcare sector.

Despite poor returns over the past decade, the company’s recent performance, fueled by strong growth in its Innovative Medicine and MedTech segments, is a strong indicator of its future potential.

Moreover, with a healthy balance sheet, strategic acquisitions, and increased R&D investment, I believe J&J is positioning itself for sustained growth.

When adding a reliable dividend and an attractive valuation, I believe JNJ is an appealing pick for investors seeking growth and income in an anti-cyclical market.

Pros & Cons

Pros:

- Strong Growth Potential: J&J is making impressive progress in high-growth areas like oncology and MedTech, with a solid pipeline of innovative products.

- Robust Financials: With a triple-A-rated balance sheet and significant cash reserves, J&J is in a great spot to fund growth and deal with challenges.

- Reliable Dividend: The company’s 3.1% yield, backed by 61 consecutive years of dividend hikes, makes it a dependable income source.

Cons (unchanged compared to my prior article):

- Lawsuit Overhang: While recent developments are favorable, the company is still prone to lawsuit risks if plaintiffs can prove that its talc powder caused cancer.

- Performance Concerns: JNJ’s stock has lagged the S&P 500 over the past two decades. It needs to execute well to change that.

- Competition: Competition in healthcare, especially the medtech industry, could pressure growth.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.