Summary:

- Investors have been abandoning Johnson & Johnson stock in droves as mounting legal issues and a shift towards risk-on sectors have exacerbated negative sentiment surrounding the company.

- Despite growing legal uncertainties and heightened scrutiny, we believe Johnson & Johnson is well-equipped to fulfill its obligations and emerge from this challenge even stronger.

- JNJ was overvalued late last year. However, the steep selloff has eliminated the froth, and its valuation is now attractive.

- Coupled with robust price action signals, we believe the opportunity for JNJ investors to add more exposure is timely.

Justin Sullivan

Johnson & Johnson, or J&J (NYSE:JNJ), fell to lows last seen in March 2021 as investors bailed out of healthcare stocks. Healthcare stocks have been battered lately, as seen in the relative underperformance of the Health Care Select Sector SPDR ETF (XLV) against the S&P 500 (SPY) (SPX).

However, JNJ performed worse than its peers in the XLV since late December as it dealt with a further fallout from its talc liabilities after it lost its court case in late January.

Moreover, sector rotation to risk-on sectors under the hood in 2023 impacted healthcare stocks, weakening JNJ’s thesis further. In addition, the company also pulled out of the RSV vaccine race recently, even though its development was in “late-stage studies.” Analysts’ estimates suggest that the RSV vaccine could have helped “generate sales of $975 million by 2028.”

However, we don’t think it’s significant to J&J’s topline in the near- and medium-term as it’s projected to report $97.68B in revenue for FY23. Despite that, it could have added negative sentiments to the company’s recent troubles, sending more weak holders out of the door.

But, before more investors pull the Sell trigger now, we encourage investors to consider whether J&J’s recent headwinds have been priced in accordingly?

Analysts’ estimates suggest that the company is expected to post revenue growth of 2.9% for FY23, with an adjusted EPS growth of 3.6%, consistent with last year’s cadence.

It’s also expected to deliver a free cash flow or FCF margin of 25.2%, corroborating its strong free cash flow generation. It’s also considered one of the highly-coveted wide-moat companies in Morningstar’s coverage universe, suggesting that J&J possesses a highly defensible business model.

Notwithstanding, J&J’s potential liabilities over its talc case remain “unclear” and could potentially end up “paying as much as $10 billion to resolve its talc liabilities.” However, the company is expected to generate nearly $24.6B in FCF this year, suggesting that J&J is more than capable of meeting its obligations.

Hence, we don’t envisage imminent risks to J&J from its talc case, even though it likely compelled some investors to flee recently.

But, with the market taking such a pessimistic stance against J&J, has opportunistic buyers returned to help stem a further slide?

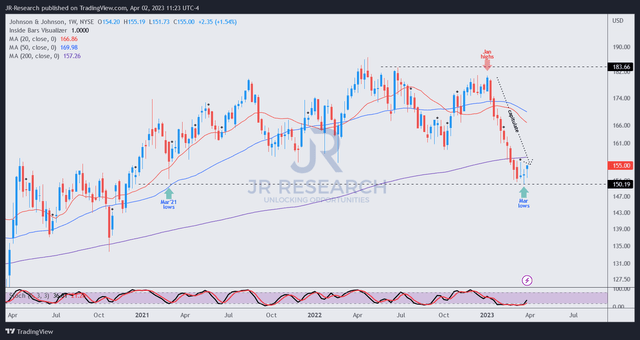

JNJ price chart (weekly) (TradingView)

Actually yes. If you look at the chart above, there’s a subtle bear trap or false downside breakdown in JNJ’s price action two weeks ago, followed by a validated bullish reversal last week.

Hence, we assessed that buyers returned emphatically to stanch a further decline in JNJ, bolstered by a steep capitulation from its January highs.

We parsed that JNJ’s price action suggests robust buying signals to long-term JNJ buyers. Moreover, it indicates investors should consider joining the ride early to capitalize on the potential mean-reversion opportunity from the steep selloff.

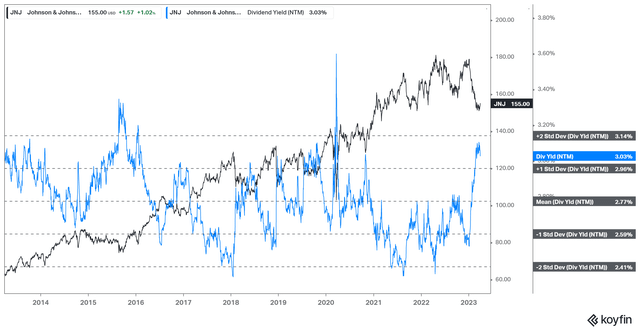

JNJ NTM dividend yield (koyfin)

Moreover, we don’t see imminent risks to JNJ’s dividends. Accordingly, the company is expected to report an adjusted EPS of $10.52, with a dividend per share projection of $4.69. As such, its payout ratio of 44.6% is well covered.

Hence, we assessed that its valuation had improved dramatically from January levels (when it was overvalued). The steep selloff sent JNJ’s NTM dividend yield of 3.03% close to the two standard deviation zone over its 10Y average.

In other words, JNJ is attractive now.

Takeaway

J&J’s fundamental thesis remains sound, and its business model generates significant FCF profitability and has a wide economic moat. While it could face higher liabilities from its talc case, J&J has the wherewithal to navigate it.

Moreover, its valuation is appealing, and JNJ’s price action has a validated bullish reversal Buy trigger, predicated against a bear trap. In other words, we believe the opportunity is timely for healthcare/J&J investors to consider adding more positions.

Rating: Strong Buy.

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have you spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment and let us know why, and help everyone to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!