Summary:

- In the second half of 2024, Johnson & Johnson made significant progress in developing its oncology franchise.

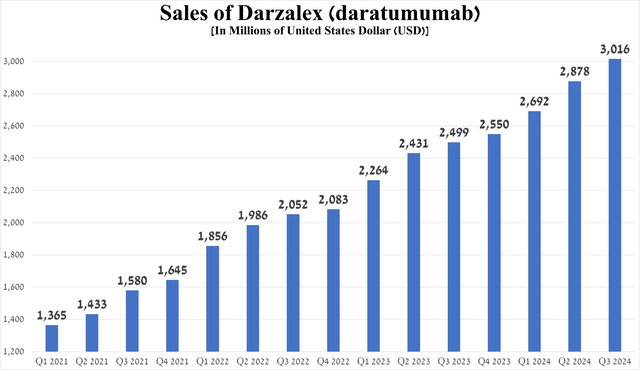

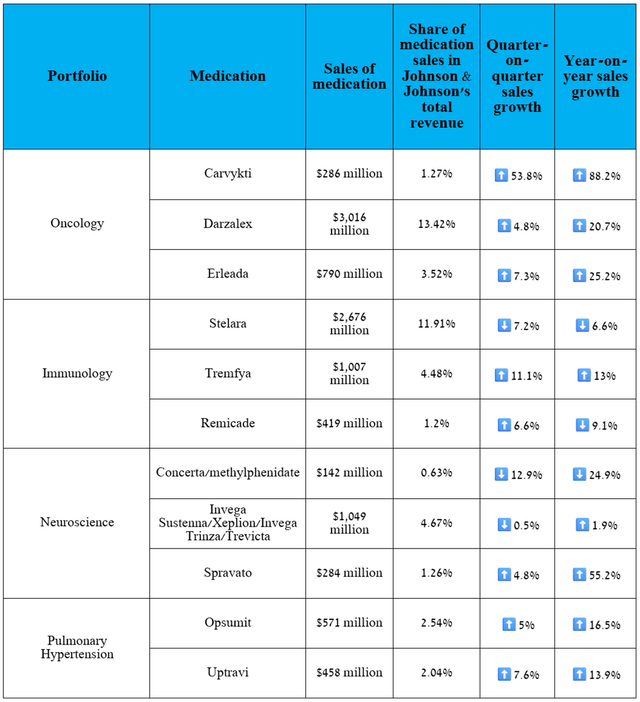

- So, Darzalex sales were $3.02 billion in the third quarter of 2024, up 20.7% year-on-year, thanks in part to its label expansions.

- Moreover, on November 8, 2024, the company announced the filing of regulatory applications to the FDA and EMA seeking approval of Darzalex Faspro for the treatment of high-risk smoldering MM.

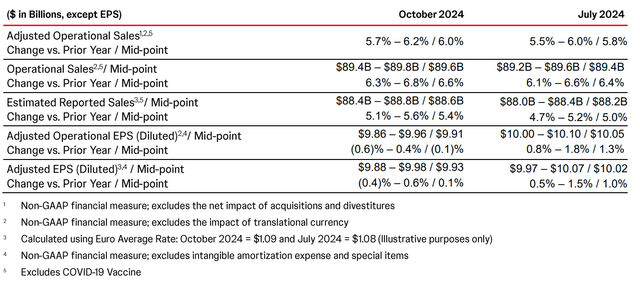

- In addition, thanks in part to growing demand for the immunology star Tremfya, it raised its full-year 2024 operational sales guidance.

- As a result, Icontinue to cover Johnson & Johnson with a ‘Buy’ rating.

Timbicus/E+ via Getty Images

On October 15, 2024, Johnson & Johnson (NYSE:JNJ) reported financial results for the third quarter of 2024 that beat Wall Street analysts’ expectations.

Equally important, the New Brunswick, New Jersey-based company, led by its CEO Joaquin Duato, was able to make significant progress in developing its oncology and immunology franchises, and it was able to move forward in settling talk-related lawsuits by allocating an additional $1.75 billion in payments to plaintiffs and covering legal expenses.

Investment thesis

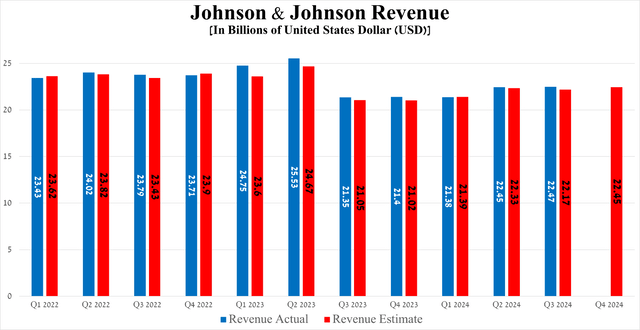

Johnson & Johnson’s revenue was about $22.47 billion for the three months ended September 29, 2024, up 5.25% year over year, beating both my and analysts’ expectations, thanks to stronger sales of Tremfya, Carvykti, Darzalex, and Erleada, which also helped offset the decline in demand for the blockbuster medication Stelara, as well as its blood cancer treatment Imbruvica.

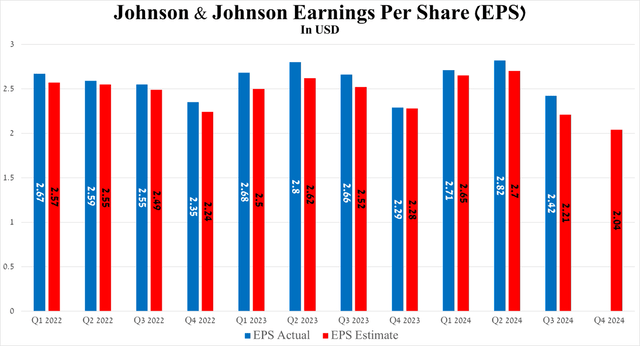

Meanwhile, the company’s non-GAAP earnings per share reached $2.42 for the third quarter of 2024, beating analysts’ consensus estimates by 21 cents but down year-over-year due to higher R&D expenses and its acquisition of medical device maker V-Wave for up to $1.7 billion.

So, right at the beginning of the article, I want to note the performance of Darzalex (daratumumab), which continues to be the cornerstone of the company’s oncology portfolio and is also becoming the ‘gold standard’ in the treatment of one of the common types of blood cancer, which is called multiple myeloma [MM].

Sales of this anti-CD38 monoclonal antibody in the third quarter of 2024 were about $3.02 billion, an increase of 20.7% year-on-year.

Source: graph was made by Author based on 10-Qs and 10-Ks

What are the reasons for the growth of Darzalex sales?

First, in late July of this year, the FDA approved a combination of bortezomib, lenalidomide, and dexamethasone with Darzalex Faspro, a subcutaneous formulation of daratumumab, for the treatment of people with NDMM who are suitable for an autologous stem cell transplant.

In addition, demand for both Darzalex Faspro and Darzalex remains high among patients in the European Union and the United States, even in the face of increasing competition from CAR-T cell therapies, including Carvykti and Bristol-Myers Squibb’s Abecma (BMY), and bispecific monoclonal antibodies such as Pfizer’s Elrexfio (PFE).

Dry figures and the cherished word for any financial market participant in the company’s press release “beat” the expectations of Wall Street analysts are undoubtedly important. However, for me, as a Seeking Alpha analyst who continues to cover Johnson & Johnson with a ‘Strong Buy’ rating, it is more critical to determine the factors that contributed to this and also those that will have a significant impact on its financial position in the future.

Johnson & Johnson’s Q3 2024 financial results and outlook beyond 2024

First, I want to point out that the company’s financial results for Q3 2024 were excellent, even given the uncertainty about whether it can overcome the difficulties of settling the tens of thousands of talcum powder lawsuits.

Under Joaquin Duato’s leadership, Johnson & Johnson is becoming an increasingly important player in the global autoimmune disease and cancer therapeutics markets, even as demand for its blockbuster medicine Stelara (ustekinumab) has fallen due to the launch of biosimilars in Europe, including by Alvotech (ALVO) in partnership with STADA, and less than satisfactory growth in sales of Tecvayli, a bispecific antibody for the treatment of people with relapsed or refractory multiple myeloma.

In addition to Darzalex, whose performance I discussed earlier, I want to highlight the sales, as well as the failures and achievements in clinical development of some of the company’s key products, including those in its neuroscience, oncology, and cardiovascular portfolios.

The following medications have contributed significantly to Johnson & Johnson’s improved financial position, allowing it to accelerate the development of product candidates for atrial fibrillation [milvexian], ulcerative colitis [JNJ-2113, JNJ-4804], bladder cancer [TAR-200], next-generation surgery and vision solutions developed by its MedTech segment, and maintain a policy of increasing dividend payments for more than 60 years.

Source: graph was made by Author based on 10-Qs and 10-Ks

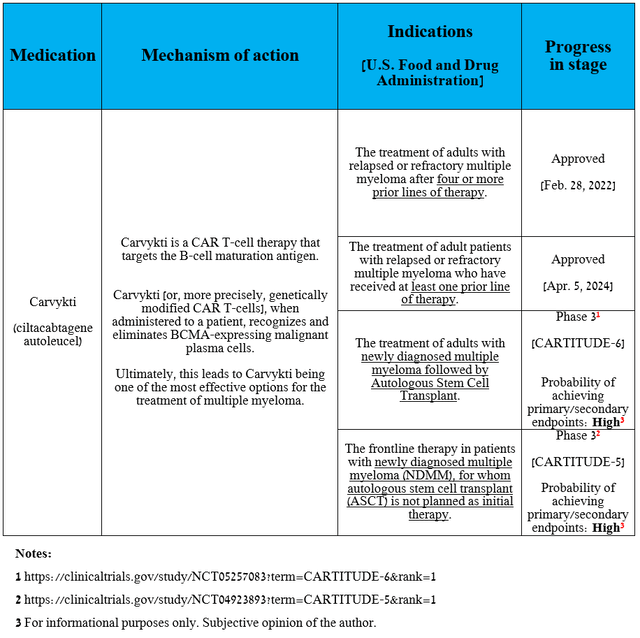

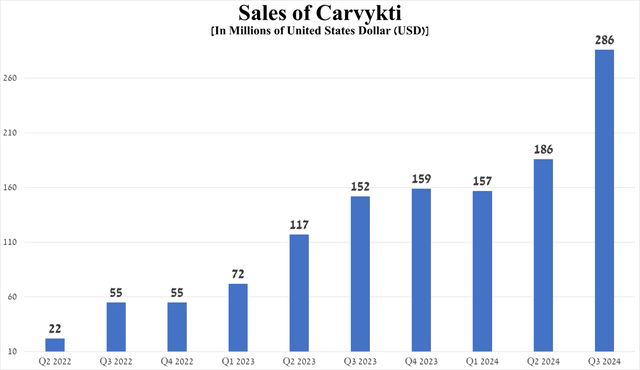

In my estimation, the second most significant drug in Johnson & Johnson’s oncology franchise is Carvykti (ciltacabtagene autoleucel). Carvykti is a CAR T-cell therapy that targets the B-cell maturation antigen, which is highly expressed on the surface of cancer cells, particularly myeloma cells.

In the table below, I have noted, in addition to Carvykti’s mechanism of action and indications for use, also the chances of its future label expansions.

Source: table was made by Author based on Johnson & Johnson press releases and ClinicalTrials.gov

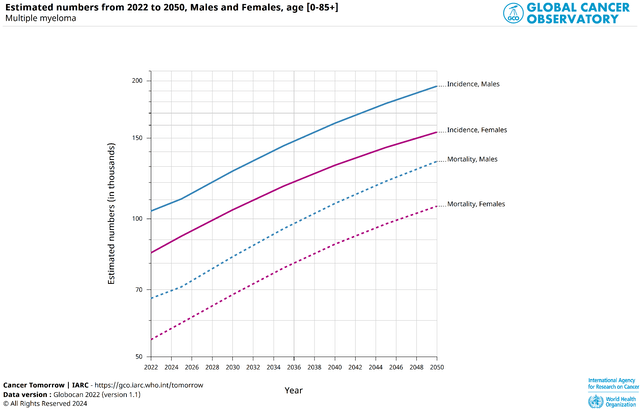

Overall, according to the Global Cancer Observatory, about 348.6 thousand new cases of multiple myeloma [194,362 in men and 154,282 in women] will be diagnosed worldwide in 2050, which is 85.5% more than in 2022.

Source: Global Cancer Observatory | International Agency for Research on Cancer

Its sales were $286 million in the third quarter of 2024, up 88.2% year-on-year and 53.8% quarter-on-quarter, driven in part by its expansion of manufacturing capacity and its approval on April 5, 2024, in the United States and April 22, 2024, in Europe for the treatment of relapsed/refractory multiple myeloma [RRMM] who have received ≥1 prior therapies.

Source: graph was made by Author based on 10-Qs and 10-Ks

So, one of the latest good news published by Johnson & Johnson on September 27, 2024, was the data from the Phase 3 CARTITUDE-4 clinical trial.

With a median follow-up of 34 months, taking Carvykti by patients with lenalidomide-refractory multiple myeloma led to a 45% decrease in the risk of death [hazard ratio (HR), 0.55] relative to the group of patients taking standard therapies, which is a statistically significant result.

As a result, these data strengthen my belief that this CAR-T therapy, developed jointly with Legend Biotech (LEGN), remains one of the most effective drugs on the multiple myeloma market and will receive the coveted “blockbuster” status next year.

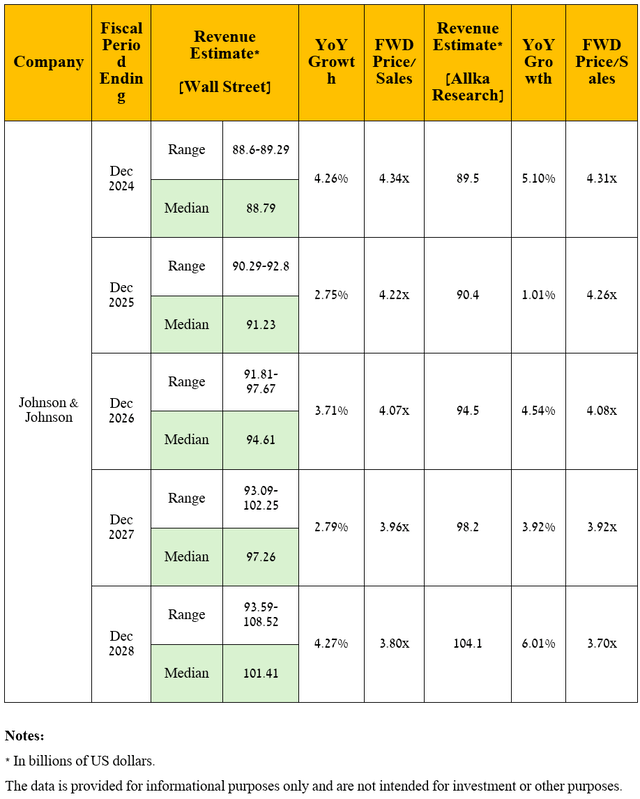

Seeking Alpha offers financial data, as well as Wall Street analysts’ forecasts for Johnson & Johnson’s revenue and earnings per share through 2028 and beyond.

So, Wall Street analysts expect Johnson & Johnson’s revenue for the fourth quarter of 2024 to be between $22.29 billion and $22.75 billion, which implies its growth of 5% year-on-year.

Meanwhile, its price/sales [FWD] ratio is 4.2x, which is not only 7.7% lower than the 5-year average but also lower than many of its competitors in the pharmaceutical industry, including AbbVie [P/S ratio is 5.5x] (ABBV), Novartis [P/S ratio is 4.18x] (NVS), and Amgen [P/S ratio is 5.21x] (AMGN), thus being the first of the factors that, in my opinion, indicate that the New Brunswick-based company continues to trade at a discount at the moment.

On a more global level, I expect Johnson & Johnson’s revenue to continue to grow in the coming years, including due to increased demand for MedTech’s cardiovascular solutions, increased sales of Carvykti, Darzalex, the immunology franchise, Spravato, both through label expansions and improved uptake of these drugs into clinical practice due to their encouraging results demonstrated in phase 2/3 clinical studies, and potential approvals of its product candidates including nipocalimab, JNJ-4804, and TAR-200.

In predicting the company’s revenue and net income, I took into account the launch of biosimilars of Stelara [sales reached $2.68 billion in Q3 2024 or 11.9% of Johnson & Johnson’s total revenue] in the U.S. in early 2025, as well as continued declining sales of Imbruvica due to increased competition from more effective BTK inhibitors, including AstraZeneca’s Calquence (AZN), BeiGene’s Brukinsa (BGNE), and Eli Lilly’s Jaypirca (LLY).

On the whole, I anticipate its revenue to be $104.1 billion in 2028, which firstly implies its average annual growth over the next five years by single-digit percentages, and secondly, it is in line with the expectations of 8 analysts [$93.59-$108.52 billion]. Accordingly, Johnson & Johnson’s P/S ratio will decline from 4.26x over the past 12 months to below 3.75x by 2028.

Source: graph was made by the Author

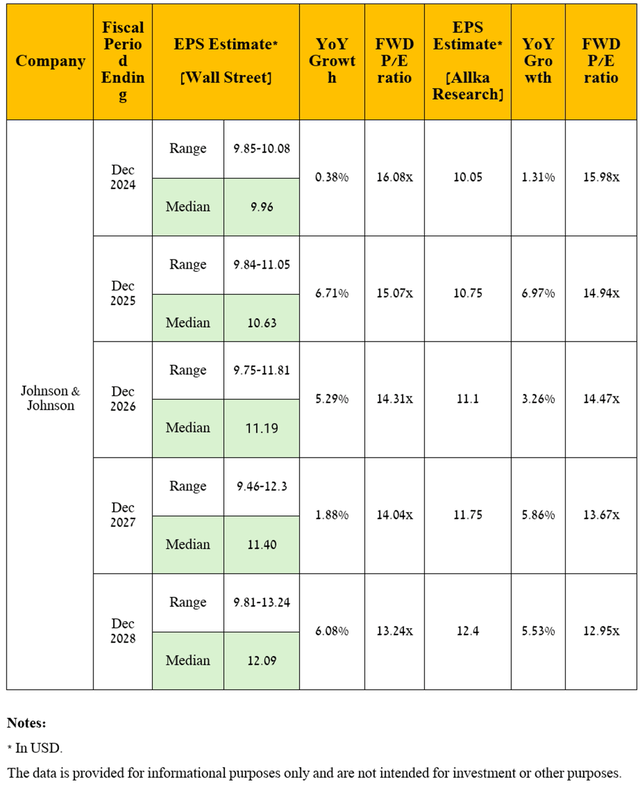

Dear Seeking Alpha readers, as I have noted in previous articles, let’s move on to a discussion of an equally important financial indicator, namely non-GAAP earnings per share [non-GAAP EPS].

Why?

This needs to be done because it more accurately and comprehensively determines how effective the business strategies implemented under the leadership of Joaquin Duato are.

So, Johnson & Johnson’s non-GAAP EPS is expected to be in the range of $1.93 to $2.43 in the fourth quarter of 2024, implying a decline of 11% year over year.

Moving to a longer time frame, I expect Johnson & Johnson’s operating income to grow steadily year-on-year from the second half of 2025, driven primarily by an expansion of its portfolio of drugs and vaccines, as well as optimization of administrative and R&D expenses as the company seeks to focus on the most promising therapeutic areas, including neurology, immunology, and oncology, and reduce investments in the development of solutions for the treatment of infectious diseases.

Ultimately, due to the anticipated resorting of its management to the share buyback program in the coming years, as well as the increase in its revenue under my forecast, which was stated earlier, I expect the company’s EPS to be $12.4 in 2028, which is firstly near the upper end of the analysts’ range [$9.81-$13.24] due to my more optimistic expectations for Darzalex and Tremfya sales, and secondly implies a drop in its price-to-earnings ratio from 16.74x to 12.95x in less than the next five years.

Source: graph was made by the Author

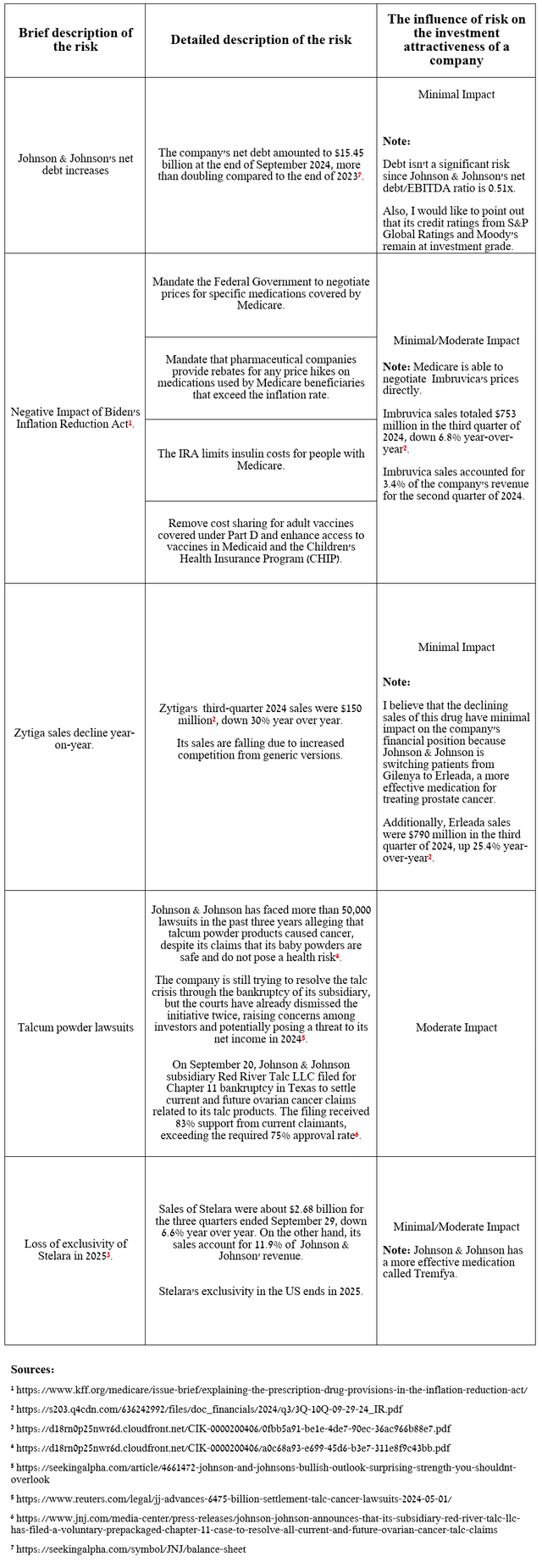

Risks

Beyond the decline in Stelara sales from Q3 2024, I’ve highlighted several risks in the table below, including the latest progress in settling the talc lawsuits, that long-term Johnson & Johnson investors should consider to minimize potential losses.

Source: table was made by Author

Takeaway

Johnson & Johnson’s pharmaceutical and medical device businesses have continued to thrive in recent quarters, even as management tries to finally settle tens of thousands of talc lawsuits.

Stronger sales of its oncology franchise, particularly Darzalex and Carvykti, have helped the New Brunswick-based company raise its full-year 2024 guidance again.

Given this, as well as the approval of Edurant for the treatment of HIV-1 infection on October 28, 2024, by the European Commission and Darzalex SC a week earlier for the treatment of newly diagnosed multiple myeloma who eligible for ASCT, as well as the ongoing trend of publishing promising results from Phase 2/3 studies involving some of its key blockbusters, including Tremfya and Erleada, I continue to cover Johnson & Johnson with a ‘Buy’ rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.