Summary:

- Continuing poor health amongst the US population is a tailwind for Johnson & Johnson.

- Prevalent chronic conditions, for which Johnson & Johnson provides relief, show no signs of declining.

- Financials for Johnson & Johnson continue to impress.

kuppa_rock/iStock via Getty Images

Preamble

Back in January, I explored the weird phenomenon of increasing sickness amongst the US population. In the article, I advocated a position in either HCA Healthcare (HCA), or Tenet Healthcare Corporation (THC), which have increased 4.86% and 29.7% respectively. Not bad considering the S&P 500 has increased 3.89% over the same period at time of writing.

In this article, I delve deeper into strange circumstances in which we find ourselves. According to numerous data, it would appear that the level of sickness and life expectancy are moving in the wrong direction. Not only do the trends seem to be moving in the wrong direction, but the incidence of some medical conditions imply an acceleration rather than a slowdown. Under these conditions, an investment in Johnson & Johnson (NYSE:JNJ) would be advised.

Decreasing life expectancy

The United States is without doubt a high-income country and so, has one of the highest life expectancies among the countries that make up our world. However, when compared to the average life expectancy of many of the nations with similar economic development, the US lags far behind.

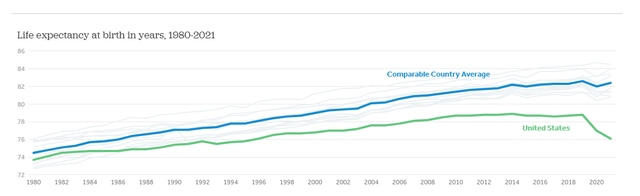

According to the World Bank, the life expectancy in the United States in 2021 was 77.2 years. This is lower than the average life expectancy of other high-income countries, which is around 81.6 years. The US ranks 38th in the world in terms of life expectancy, behind countries like Japan, Switzerland, and Australia. The graphic below, provided courtesy of Health System Tracker, gives a more dramatic illustration of data found within the World bank.

Life expectancy US v Other countries (Health System Tracker)

There are numerous explanations for the lower life expectancy in the US. These include; smoking obesity, gun related deaths, opioid overdoses, obesity and income inequality.

I doubt if there are many skeptics that would disagree with notion that the US has a higher rate of gun violence than other high-income countries. There are indeed reports that conclude that the US leads the Western world in gun related homicides. Sad to say that the US also leads the way in deaths from opioid related mortalities. In addition, the US tops the charts in lowered life expectancy resulting from obesity, more often than not resulting from an exceptionally poor diet.

In the US, it is estimated that about 60% of the diet accounts for processed foods. Processed foods are those that have been altered from their natural state through various methods such as canning, freezing, or adding preservatives, flavorings, or other additives.

While some processed foods can be part of a healthy diet, many processed foods are high in calories, sugar, sodium, and unhealthy fats. The over consumption of sugar has been linked to many conditions, including metabolic syndrome and diabetes. Also, these foods often lack important nutrients such as fiber, vitamins, and minerals. Overconsumption of processed foods has been linked to an increased risk of heart disease, and some types of cancer.

In addition to the lack of nutrients, processed foods often contain additives that can be harmful to health. For example, some food additives such as high fructose corn syrup, artificial sweeteners, and trans fats have been linked to various health problems.

Increased sickness in the US

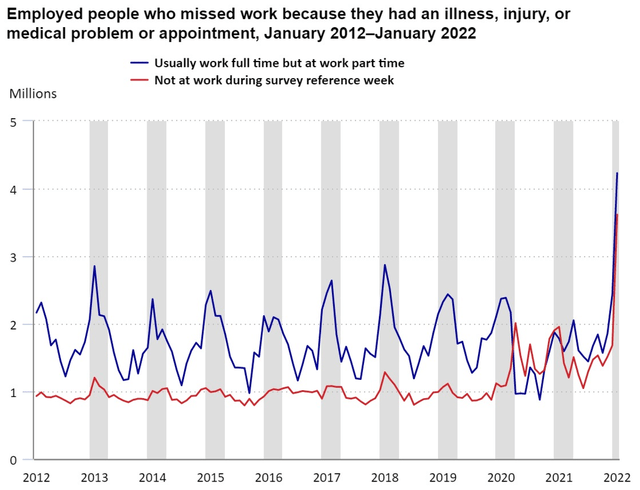

Given that life expectancy is marching ever lower, one might reasonably expect that the level of illnesses would also be rising. Confirmation of this expectation has been provided by The US Bureau of Labor Statistics, which reported an increase in sickness and absence rates among workers in January 2022. And, according to the graphic provided by the Bureau, the level of sickness is rocketing.

Incidence of sickness (US Bureau of Labor Statistics)

No doubt the reason behind the rise indicated is multi-faceted and a debate on the topic is beyond the scope of this article. However, undoubtedly, the rise in obesity has led to the increased prevalence of metabolic syndrome, which, in turn, causes many of the chronic conditions that plague our society.

Metabolic syndrome is a cluster of medical conditions that increase the risk of developing cardiovascular disease, stroke, and diabetes. The syndrome is diagnosed when an individual has three or more of the following conditions: abdominal obesity, high blood pressure, high blood sugar levels, low levels of HDL cholesterol, and high levels of triglycerides.

The incidence of metabolic syndrome has been on the rise in the United States over the past few decades, with an estimated 34% of adults meeting the criteria for the syndrome. This increase is largely attributed to changes in lifestyle factors, including a diet high in processed foods and sugar, sedentary behavior, and an increase in overall body weight.

Whatever the reason for this rapid rise in sickness, particularly chronic conditions resulting from obesity, Johnson & Johnson look set to provide solutions.

Johnson & Johnson

It goes without saying that Johnson & Johnson is a healthcare company that produces a wide range of products, including medical devices, pharmaceuticals, and consumer healthcare products. And we can say that the company’s financial success depends on the demand for healthcare products and services. The greater the demand, the greater the financial rewards.

If poor health in the US were to continue to climb, the result would be a rise in demand for healthcare products and services provided by Johnson & Johnson.

Products

The company operates in three segments; Consumer Health, Medical Devices, and Pharmaceuticals. In particular, the Medical Devices and Pharmaceutical divisions cater for the chronic conditions that are suffered by many of the populace.

Johnson & Johnson produces an extensive array of solutions that alleviate the symptoms of many of the conditions mentioned. For diabetes, the company produces products such as blood glucose monitoring systems and insulin pumps to help people manage their condition. Products for related conditions, such as high blood pressure and high cholesterol, are also produced.

Heart disease is another common condition found in individuals with metabolic syndrome, and Johnson & Johnson produces medications to treat and prevent cardiovascular diseases such as heart attack and stroke. Some of the company’s best-seller-cardiovascular medications include Xarelto, Zytiga, and Invokana.

Arthritis, clearly a condition exacerbated by obesity, is an affliction that affects millions of Americans, and Johnson & Johnson produces a range of products to alleviate the pain and discomfort associated with this condition. These include over-the-counter pain relievers such as Tylenol and Motrin, as well as prescription medications such as Simponi and Remicade.

The company produces many other products, too numerous to list.

Financials

The latest quarterly results were impressive given the size of the company, which were highlighted in the press release.

There was an excellent performance across a legion of fronts, indicating a powerful business model that has expertly faced the challenges of the past year with aplomb.

For investors, I would say that the most impressive aspect of the report is the company’s revenue growth. The company reported $24.7 billion in revenue, an increase of 5.6% compared to the same quarter last year. This growth was powered by strong reported sales in the pharmaceuticals and the medical devices segments, which increased by 7.2% and 11.0% respectively. We can further note that the consumer health segment reported a similar growth to the pharmaceuticals division: 7.4%.

Another item of interest in the report is the company’s dedication to innovation. The company hiked spending by 2.9% to reach $3.56 billion for research and development in the last quarter. This investment is particularly important in the healthcare industry, given that competitors are found at every turn.

On the downside, there was a net loss for the quarter, which was $68 million. As was stated in the last quarter conference call, this was due to a one-off charge related to litigation resulting from the Talc Settlement proposal.

In addition to the above, the company advised investors that the company is raising its 2023 full-year expectation for sales revenue and EPS.

Overall, Johnson & Johnson’s latest financial report is a clear-cut reflection of the company’s performance. The strong revenue growth, commitment to innovation, profitability and forward guidance are barometers of continued long-term success.

Risks

There are a few ongoing legal cases, which could impact the company quite severely. This was alluded to in the press release:

Johnson & Johnson does not provide GAAP financial measures on a forward-looking basis because the company is unable to predict with reasonable certainty the ultimate outcome of legal proceedings, unusual gains and losses, acquisition-related expenses and purchase accounting fair value adjustments without unreasonable effort.

Back in February, I advised readers of the possibility of a banking crisis, which has since come to pass. And, I developed this theme more recently in a piece I composed about SPY. If I am correct, then stocks across the board may slip to the downside, even those which have a good tailwind, such as Johnson & Johnson.

Summary

At this time, there are rising levels of sickness, the causes of which appear to be unabating. In such circumstance, an investment in JNJ stock would seem to be a wise choice, especially given that the company are maintaining a forward momentum in terms of innovation and future revenues.

As always, this does not constitute advice and investors ought to carry out their own due diligence.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.