Summary:

- JNJ’s current dividend yield is around the highest level in at least 10 years.

- The market’s concern over its current issues – which are all temporary in my view – is drastically overblown.

- The overreaction has created a severe mispricing for this sector leader with superb financial strength and stable growth outlook.

Dragon Claws

JNJ stock: chart of the day

I last wrote on Johnson & Johnson (NYSE:JNJ) stock back in August 2024. In an article titled “Johnson & Johnson: Don’t Bet Against Double Compounding“, I argued for a buy thesis after considering its total shareholder returns. Quote:

The gist of my analysis is to show a doubling compounding mechanism at work for JNJ – the combined effects of healthy profit growth and consistent share repurchases fueled by profit growth. Because compounding works multiplicatively, not additively, this mechanism is far more potent for total shareholder returns than each of them is separately. A typical example of 1+1>2.

Since that writing, a few new developments have materialized around the company. Unfortunately, most of these developments were in the negative direction. The top ones on my list include a series of setbacks for its pipeline drugs (an example is quoted below), ongoing restructuring efforts and thus associated expenses, and also the cash outflow due to its recent Shockwave Medical acquisition.

Seeking Alpha News: JNJ said it has discontinued a Phase 2 study of its drug TAR-200 for the treatment of muscle-invasive bladder cancer, or MIBC, due to disappointing data. The drugmaker had been testing the drug in patients with MIBC who were not receiving a radical cystectomy. The study, called SunRISe-2, was discontinued after an interim analysis of the data showed the treatment was not showing superiority over chemoradiation.

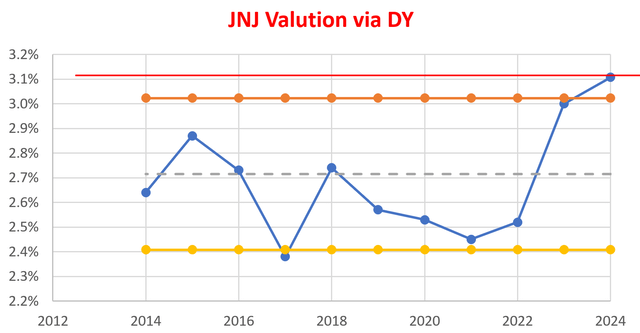

I will elaborate on the implications of these developments in the next section. Overall, they have indeed created both financial stress and earnings uncertainties for the companies. As a result, the company’s stock prices have been under pressure lately, which led me to the chart of the day. The chart below displays JNJ’s valuation in terms of its dividend yield (“DY”). As you can tell by just eyeballing the data, its current DY (shown by the solid red line) is far outside the historical range. It is not only far above the historical average (shown by the grey dashed line) but also above it by more than 1 standard deviation as seen.

As a textbook dividend champion, its DY serves as a reliable valuation indicator. When the valuation of a leader in a stable sector becomes so out of whack, we’ve learned from experiences that there are three possibilities here:

- The business fundamentals and finances of the company have deteriorated sufficiently so that a dividend cut has become imminent.

- The fundamental economics of the business have changed in a dramatic way so that earnings are likely to stagnate permanently (and subsequently, the dividend payouts too).

- The market has overacted drastically and therefore created an outsized mispricing.

In the remainder of this article, we will argue that the 3rd possibility is the most likely one in our view in this case of JNJ. We consider the current situation to represent an outsized mispricing, offering one of the most attractive entry points for JNJ in many years. This consideration leads us to upgrade our rating from the previous BUY to a STRONG BUY.

JNJ stock: dividend safety check

Let’s start with a simple reality check on its dividend payout ratios and balance sheet strength to rule out the possibility of an imminent dividend cut.

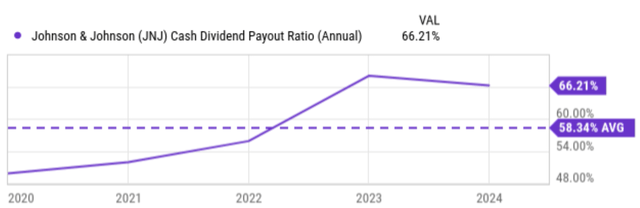

The next chart displays the cash dividend payout ratio for JNJ in the past 5 years from 2020 to 2024. As seen, the bad news is that JNJ’s dividend payout ratio has been on an upward trend overall. In 2020, it began at a relatively low point of around 50%. It increased over the following years. After reaching a peak of ~68% in 2023, it came down a bit to the current level of 66.2%. However, ~66% is still a very safe and manageable level in my view. It falls squarely into the traditional wisdom of paying out 2/3 and retaining 1/3 for mature companies.

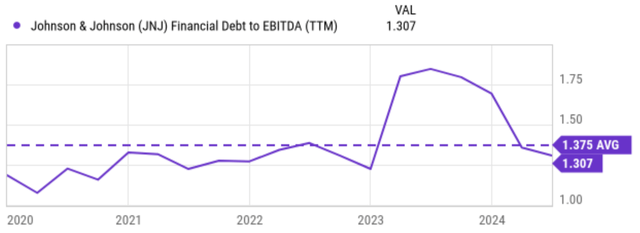

Of course, the payout ratio is only one aspect of dividend safety. Another crucial aspect is the health of the company’s balance sheet. For JNJ, there are some negatives here due to the recent development mentioned above, especially the costs associated with the Shockwave Medical acquisition. As a result, S&P Global recently affirmed JNJ’s AAA credit ratings but updated the outlook from stable to negative. More specifics of the rationale behind this update are quoted below (slightly edited by me with highlights added by me also):

S&P Global: JNJ announced it is acquiring cardiovascular device manufacturer Shockwave Medical Inc. for roughly $13.1 billion (net of cash at the target). The transaction adds a potentially significant growth platform to Johnson & Johnson’s medical device franchise’s cardiovascular portfolio. However, the acquisition utilizes almost all of the company’s financial capacity at the current ‘AAA’ rating … Therefore, we affirmed our ‘AAA’ long-term issuer credit rating… The negative outlook reflects very limited debt capacity at the current rating and the potential for further debt-financed mergers and acquisitions (M&A) amid continued uncertainty regarding talc-related liabilities.

My view is it will take a huge leap to go from the negative outlook to any material deterioration of JNJ’s credit rating, let alone triggering a dividend cut. AAA represents the highest level of financial strength and to my knowledge, JNJ is one of only 2 U.S. companies that currently receive this distinction (with the other one being Microsoft).

JNJ stock: Other risks and final thoughts

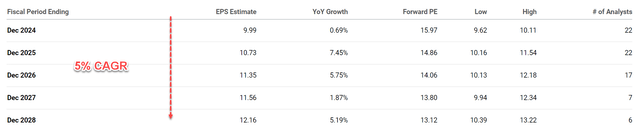

I also consider the 2nd scenario (the permanent stagnation scenario) to be extremely unlikely under current conditions. Healthcare in general might be facing some temporary headwinds (such as reimbursement policies). However, I am bullish on the secular tailwind given the aging population and the greater health consciousness as more and more people raise their living standards. Consensus estimates seem to reflect this secular tailwind too. As seen in the chart below, consensus estimates forecast a 5% growth rate in CAGR terms for JNJ in the next 5 years. Admittedly, it is not the most exciting growth rate. However, for a sector leader like JNJ with its current P/E multiples (and the high dividends), I think a 5% growth rate is already sufficient to drive outsized total shareholder returns.

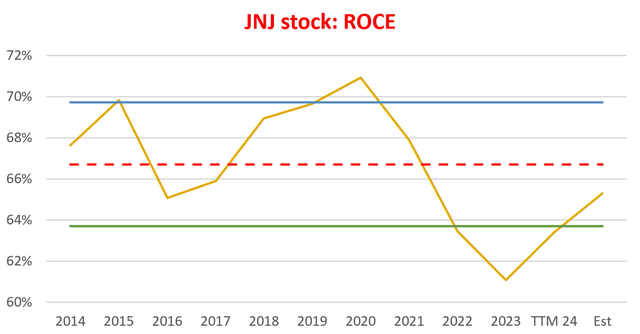

Furthermore, I also consider the above consensus estimates to be too conservative. As seen in the next figure below, JNJ has been boasting a very competitive and consistent ROCE (return on capital employed). Currently, its ROCE is around 65%, in line with its historical range as seen. Its effective reinvestment rate is more than 10% based on my estimate. A combination of 65% ROCE and a 10% reinvestment rate should lead to 6.5% annual organic growth rates. External acquisitions like those mentioned earlier should add another boost to growth.

All told, I indeed see multiple headwinds facing JNJ currently. Developments since my last writing, unfortunately, further add to these headwinds. However, my view is that the market’s concern over these issues is dramatically overblown, as reflected in both its dividend yield and P/E (only about 16x based on FY1 EPS). As such, I see a compelling opportunity to buy a sector leader with superb financial strength and robust ROCE at one of the most attractive valuation multiples in a decade.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.