Summary:

- Johnson & Johnson is a Dividend King focused on the creation and manufacturing of medical devices, vaccines, and medicines.

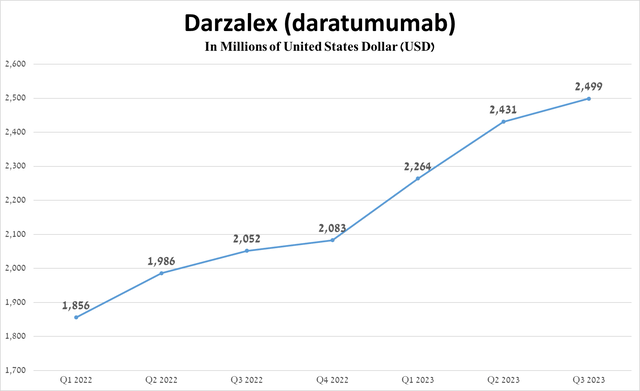

- Sales of Darzalex, an anti-CD38 monoclonal antibody, were $2.5 billion in the third quarter of 2023, up 21.8% year-over-year.

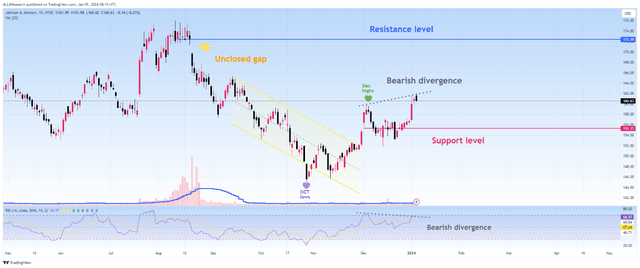

- In the short term, I expect a technical pullback of the company’s share price to $155, due to the bearish RSI divergence.

- Johnson & Johnson has faced over 50,000 lawsuits in the past three years alleging that talcum powder products caused cancer.

- I’m initiating coverage of Johnson & Johnson with a “buy” rating.

FG Trade

Johnson & Johnson (NYSE:JNJ) is an American corporation focused on the creation and manufacturing of medical devices, vaccines, and medicines designed to address a range of prevalent illnesses, such as cancer, cardiovascular diseases, and neurological disorders.

Thesis

Over the past two weeks, Johnson & Johnson’s share price has continued to trend upward despite continued pressure from thousands of talcum powder-related lawsuits, the addition of Stelara to the list of Part D drugs for which Medicare will negotiate prices as part of the Inflation Reduction Act and other risks, which will be discussed later in the article.

This emerging upward trend indicates an increase in the company’s investment attractiveness, due to continued strong sales of its oncology and immunology franchises, the expected Fed interest-rate cuts in 2024, an increase in its full-year 2023 revenue guidance, its strong balance sheet, and consistently increasing dividend payments over the past 62 years.

I’m initiating coverage of Johnson & Johnson with a “buy” rating.

Increased full-year 2023 guidance, Johnson & Johnson’s high dividend yield, and its strong balance sheet

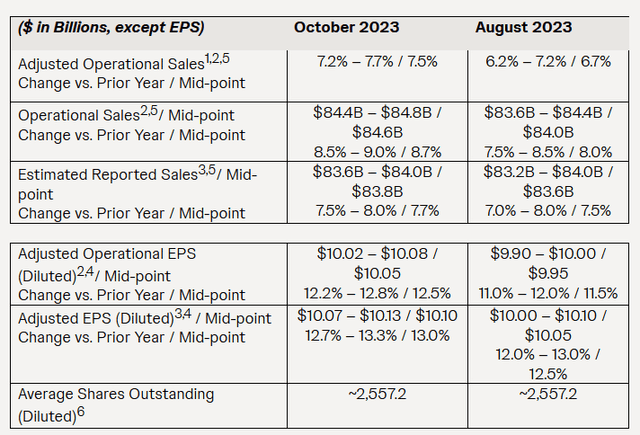

On October 17, 2023, Johnson & Johnson published results for the 3rd quarter of 2023, which not only pleasantly surprised with the continued high demand for its flagship products but also its management increased its full-year 2023 financial guidance.

Source: Johnson & Johnson press release

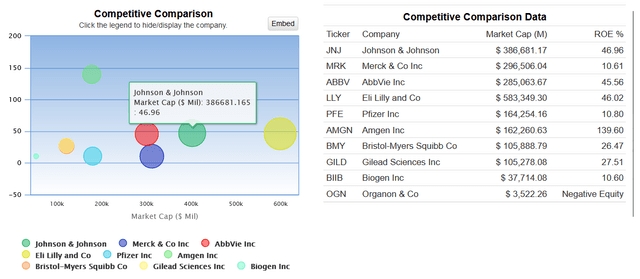

Also, Johnson & Johnson has a return on equity of about 46.96%, indicating the efficiency of managing its capital and relatively high profitability from invested funds. In addition, the company continues to outperform most of its healthcare peers on this crucial financial metric.

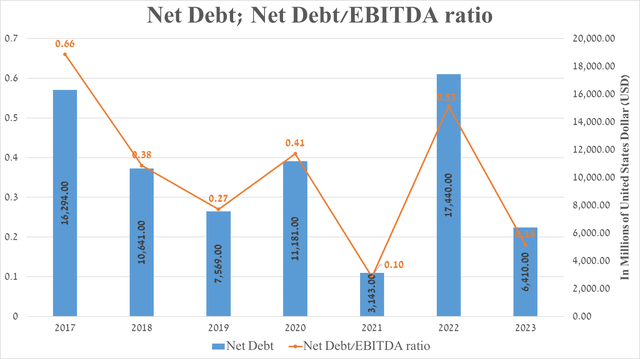

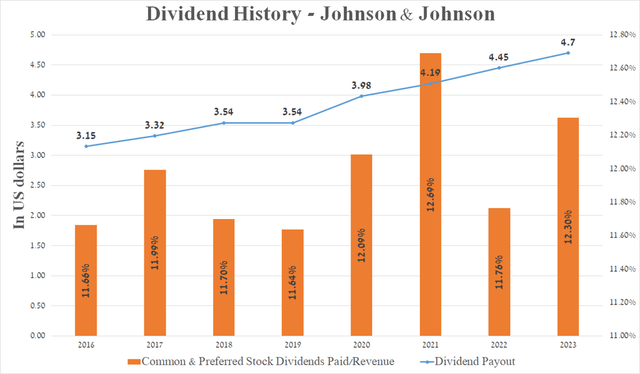

Over the past 62 years, Johnson & Johnson’s management has consistently increased its dividend payments, and I expect this trend to continue, thanks in part to the company’s growing cash flow and meager net debt/EBITDA ratio.

Source: graph was made by Author based on Seeking Alpha

Meanwhile, the company’s 5-year dividend growth rate is 5.83%, which, together with the Payout Ratio [non-GAAP] of 44.23%, indicates a reasonable ratio between its income earned and dividends paid.

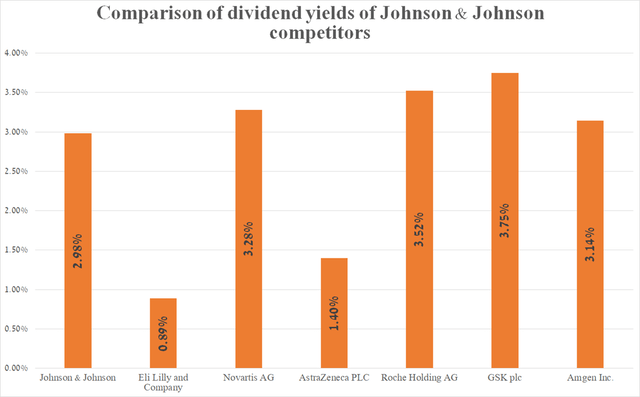

Johnson & Johnson’s dividend yield stands at 2.96%, aligning with the comparable values of its key competitors in the cancer therapeutics market.

Source: graph was made by Author based on Seeking Alpha

Johnson & Johnson’s immunology franchise demonstrates considerable potential

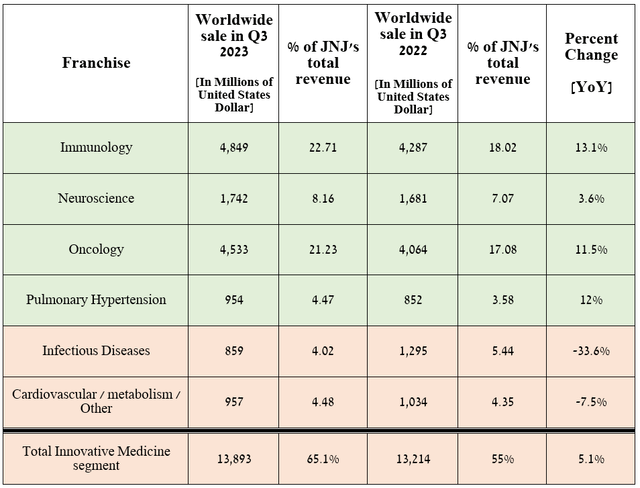

Johnson & Johnson’s portfolio of immunology products consists of Remicade, Simponi/Simponi Aria, Stelara, and Tremfya, whose combined worldwide sales were approximately $4.85 billion in the third quarter of 2023, an increase of 13.1% year-over-year.

Stelara is a leader in the autoimmune disease therapeutics market

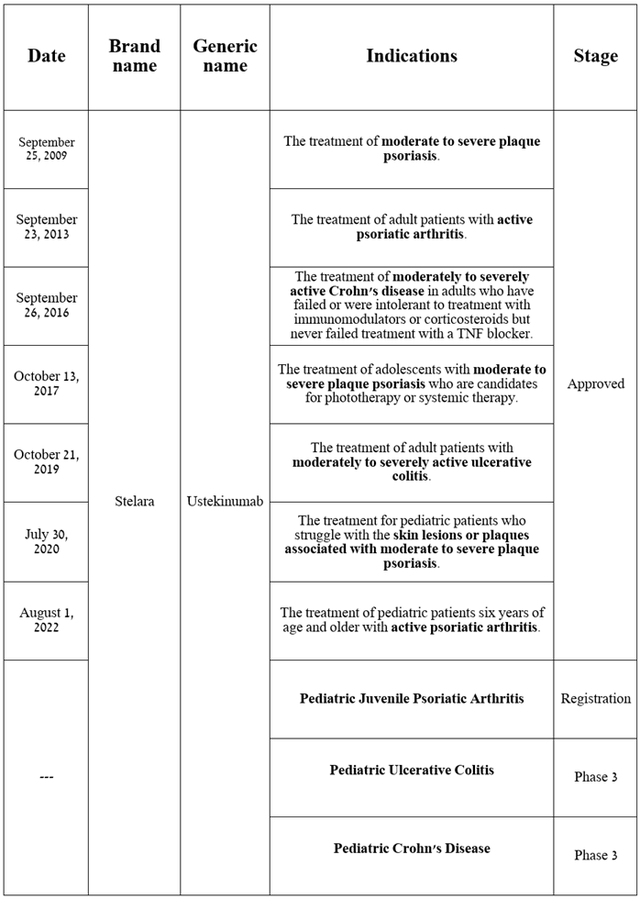

Stelara (ustekinumab) is a medication that binds to interleukin-12 and interleukin-23 and then inhibits IL-12- and IL-23-mediated cell signaling and the release of chemokines. IL-23 and IL-12 are cytokines that trigger immune and inflammatory responses within the body, and their elevated levels are directly linked to the development of various immune-mediated inflammatory diseases.

This monoclonal antibody received its first FDA approval in September 2009 for the treatment of patients suffering from moderate to severe psoriasis.

Source: table was made by Author based on Johnson & Johnson press releases and its pipeline

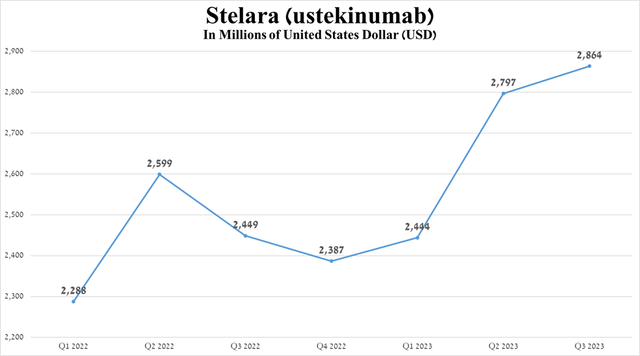

Sales of Stelara were about $2.86 billion for the three months ended October 1, 2023, up 17% from the prior year, driven by gains in its share in the autoimmune disease therapeutics market, rise in demand for the treatment of patients with psoriasis and arthritis, and an increase in its price.

Source: graph was made by Author based on 10-Qs and 10-Ks

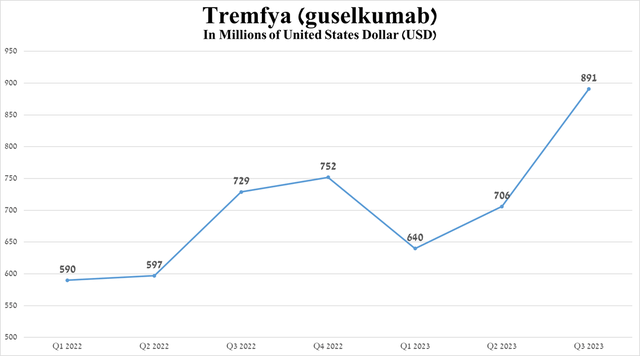

Nevertheless, Stelara’s U.S. composition of matter patent expires in 2023, which, given the settlement terms with Teva Pharmaceutical (TEVA) and Amgen (AMGN), will lead to the launch of ustekinumab biosimilars in the first half of 2025. However, in my estimation, Tremfya, being the first selective p19 interleukin-23 antagonist, will be able to offset the sharp drop in demand for Johnson & Johnson’s flagship product. Tremfya sales were $891 million in the third quarter of 2023, up 26.2% quarter-over-quarter, thanks to its superior efficacy relative to blockbusters such as Novartis’ Cosentyx (NVS), Johnson & Johnson’s Stelara and AbbVie’s Humira (ABBV).

Source: graph was made by Author based on 10-Qs and 10-Ks

Johnson & Johnson’s financial results and outlook

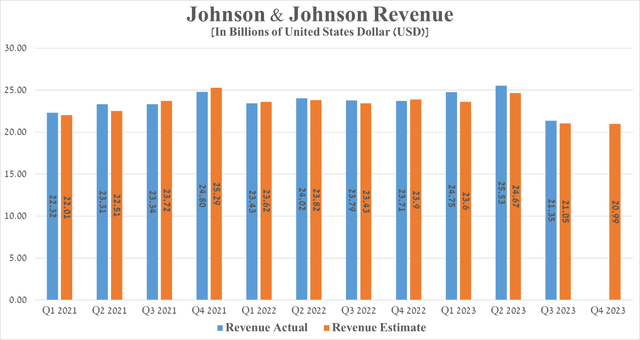

Johnson & Johnson’s revenue for the three months ended October 1, 2023, reached about $21.35 billion, down 11.4% from the previous year but beating analysts’ expectations by $300 million.

The decline in this metric was attributed to the finalization of the spin-off of Kenvue (KVUE), the world’s largest consumer health company, and was not linked to a decrease in demand for products in Johnson & Johnson’s two segments, namely Innovative Medicine and MedTech. Excluding sales of consumer products, the company’s revenue for the third quarter of 2023 increased by 6.8% year-on-year due in part to sustained strong demand for its products in the immunology, neuroscience, and oncology franchises.

Source: graph was made by Author on 10-Qs and 10-Ks

For example, sales of Darzalex (daratumumab), an anti-CD38 monoclonal antibody, were $2.5 billion in the third quarter of 2023, up 21.8% year-over-year, reflecting strong patient demand, increasing its share in the multiple myeloma therapeutics market, and raising its prices.

Source: graph was made by Author on 10-Qs and 10-Ks

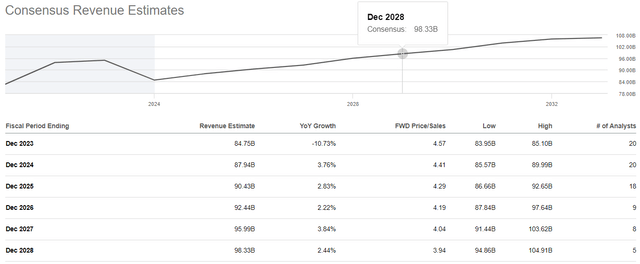

Seeking Alpha offers financial data on Wall Street analysts’ expectations for the coming quarters. So, Johnson & Johnson’s revenue for the fourth quarter of 2023 is expected to range from $20.19 billion to $21.34 billion, which is almost the same level relative to the third quarter of 2023.

On the other hand, the company’s price/sales [FWD] is 4.54x, indicating that it is trading at a premium to most of its peers in the healthcare sector, including Bristol-Myers Squibb (BMY), Pfizer (PFE), and Sanofi (SNY).

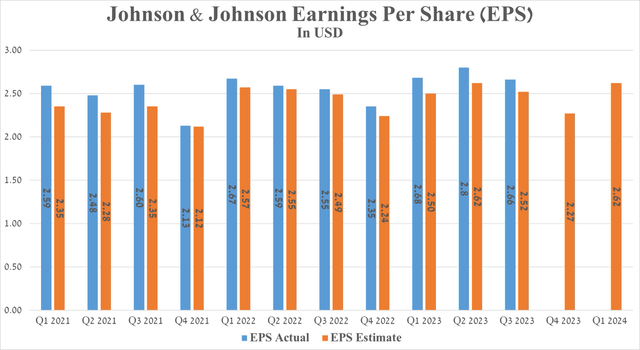

Johnson & Johnson’s Q3 Non-GAAP EPS was $2.66, beating analysts’ consensus estimates by $0.14. However, its EPS is anticipated to be in the range of $2.25 to $2.3 in the fourth quarter of 2023, which is 3.2% less than the fourth quarter of 2022.

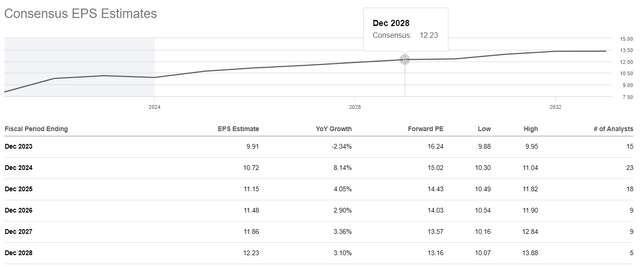

On a more global level, Johnson & Johnson’s EPS is expected to grow through 2028. The increase in this financial metric is accompanied by an anticipated decrease in the Non-GAAP P/E ratio from the current 15.35x to 13.16x. Thus, I believe that some market participants are cautious about Johnson & Johnson’s business outlook due in part to the risks outlined later in the article, notwithstanding favorable trends in its financial results.

It is important to discuss Johnson & Johnson’s debt, which, in my assessment, is not a risk to its financial position. So, its net debt amounted to about $6.41 billion at the beginning of October 2023, and its net debt/EBITDA ratio has decreased in recent quarters, reaching 0.18x, reflecting the continuing improvement of the company’s financial strength.

Key risks to consider

In addition to the expected launch of biosimilars of Stelara in 2025, I highlight two main risks that financial market participants need to consider to make informed investment decisions and formulate effective risk management strategies in anticipation of the entry into force of new provisions of the Inflation Reduction Act.

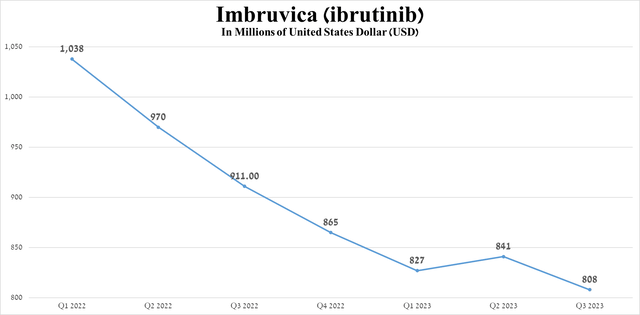

A decline in sales of Imbruvica due to increased competition in Bruton’s tyrosine kinase BTK inhibitors market

In my previous article about AbbVie, I discussed the decline in sales of Imbruvica, which was developed jointly with Johnson & Johnson. Imbruvica is a first-generation Bruton’s tyrosine kinase inhibitor whose sales were $808 million in the third quarter of 2023, down 11.3% from the prior year. Simultaneously, its share is about 5.8% of the revenue of the Innovative Medicine segment.

Source: graph was made by Author based on 10-Qs and 10-Ks

The first reason for the decline in demand for Imbruvica is AbbVie’s withdrawal of accelerated approval for treating certain patients with mantle cell lymphoma in May 2023. The second reason why its sales will continue to decline in the coming years is increased competition with Bruton’s second-generation tyrosine kinase inhibitors, such as AstraZeneca’s Calquence (AZN), BeiGene’s Brukinsa (BGNE) and Eli Lilly’s Jaypirca (LLY). These medicines have higher efficacy and selectivity compared to Imbruvica.

The talc lawsuits continue to affect Johnson & Johnson’s investment attractiveness negatively

Johnson & Johnson has faced more than 50,000 lawsuits in the past three years alleging that talcum powder products caused cancer, despite its claims that its baby powders are safe and do not pose a health risk.

The company is still trying to resolve the talc crisis through the bankruptcy of its subsidiary, LTL Management, but the courts have already dismissed the initiative twice, raising concerns among investors and potentially posing a threat to its net income in 2024.

Moreover, on December 8, 2023, Bloomberg published an article reporting a proposal from James Conlan, a former law firm partner who previously defended the company against baby powder lawsuits. His proposal would raise the amount Johnson & Johnson would have to pay to settle tens of thousands of baby powder suits to $19 billion, nearly $10 billion more than the company had previously offered.

However, the company rejected the proposal because it believed that a third Chapter 11 filing by its subsidiary would be the best solution, despite court rulings that Johnson & Johnson lacked the financial burden to compensate affected customers.

Takeaway

Johnson & Johnson is a Dividend King focused on the development and production of medical equipment used for diagnostic purposes, life-saving operations, the treatment of orthopedic trauma, and solving various medical problems. In addition, its portfolio consists of vaccines and medicines aimed at combating cancer, cardiovascular, immune-mediated inflammatory, neurological, infectious diseases, viruses, and more.

Despite the financial risks, the company has a low net debt/EBITDA ratio, a high return on equity, multiple best-in-class medications, and a rich pipeline of product candidates, many of which are in pivotal clinical trials or awaiting regulatory approval.

In the short term, I expect a technical pullback of the company’s share price to $155, including due to the bearish RSI divergence. Reaching this support level provides a perfect entry point for long-term investors.

I’m initiating coverage of Johnson & Johnson with a “buy” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.