Summary:

- JPMorgan’s Q3 earnings surpassed expectations, with significant beats in key metrics such as net revenue, net interest income, and EPS, driving a 4.44% stock price increase.

- Year-over-year, NII growth was modest at 3%, and net income decreased by -1%. Yet, the bank saw great momentum in non-interest revenue, growing 12%.

- Although the CEO thinks the stock multiple is inflated, I believe it is fairly valued, and given the bank’s strong positioning, it is worth providing it with a buy rating.

subman

The Q3 earning season started, and as usual, banks reported first. On this occasion, I will analyze the Q3 results of JPMorgan (NYSE:JPM), which, together with Wells Fargo (WFC), custody Bank of New York Mellon (BK), and asset manager BlackRock (BLK), reported earnings on Friday morning.

Even though I have never rated JPMorgan’s stock on Seeking Alpha before, I have cited it numerous times, and the conclusion always relies on it being the bank with the strongest metrics in almost all aspects compared to other money center banks. Therefore, in this analysis, I will research JPM’s stock based on Q3 earnings, outlook, risks, and valuation to conclude the buy rating it deserves.

JPM Q3 Earnings: Better Than Anticipated

First, the stock of JPMorgan opened Friday’s trading session with a positive gap of 1.33%, which expanded considerably throughout the trading session, ending 4.44% higher, as investors reflected on the favorable earnings reported.

On this occasion, JPM exceeded market expectations on almost every key line item.

- Managed net revenue $42.65B > EST $41.38B

- Net interest income $23.53B > EST $22.80B

- GAAP EPS $3.11 > EST $2.94

- Total deposits $2.43T > EST $2.40T

- Net yield on interest-earning assets 2.58% > EST 2.57%

- ROE 16.0% > EST 14.5%

- Standard CET1 15.3% > EST 15.1%

- Overhead Ratio 52.0% < EST 54.7%

Yet, the provision for credit losses was approximately 5.78% higher than expected, at $3.11 billion, compared to the estimate of $2.94 billion.

From here, on a firmwide basis, management raised guidance and now expects an increase in FY ’24 net interest income at ~$92.5 billion ($91 billion before) and lower adjusted non-interest expenses at ~$91.5 billion ($92 billion before). Last, guidance for card services net charge-offs was left intact at an expected ~3.4%.

Mixed YoY Growth per Segment

When digging into the growth of each operating segment, the trajectory is diverse among the three main segments.

For example, the largest segment, Consumer & Community Banking (CCB), saw in Q3 a net income drop of -31% from a year ago, primarily due to two things. First, credit quality declined as provisions almost doubled on an absolute basis due to continued credit normalization. Second, net interest income dropped in the Banking & Wealth Management unit due to NIM contraction and lower deposit balances. All of these, coupled with a rise in non-interest expenses of $481 million, driven by higher employee compensation and investments in marketing.

Conversely, Commercial & Investment Bank (CIB) saw an important YoY net income growth of 13%, with both Banking & Payments and Markets & Securities Services increasing revenues by 8% and combined reducing expenses by -1%. Here, the main drivers were Investment Banking fees, which saw a whopping rise of 31% compared to a year ago, and Equity Markets trading, which jumped 27% YoY.

Finally, Asset & Wealth Management (AWM) exhibited a net income drop of -5% despite a rise in net revenues by 9% and an increase in assets under management of 23%, driven by higher market levels and net inflows. On this one, the rise in non-interest expense by 16% removed all gains from the fees and the AUM rise.

Overall, the company obtained a modest NII growth of 3% throughout the year, which was erased due to increased provisions by 125%. Nonetheless, non-interest income came in fantastic at a yearly growth of 12%, with particular strength in Investment Banking fees. Simultaneously, key metrics such as the managed overhead ratio declined to 2 points from a year ago and sat at 53%.

Highlights of the Q3 Conference Call

From the conference call, an important question was asked on whether the 50 bps rate cut has shown an early sign of loan growth pickup and realization of investment banking deals, as it is expected. To this, the answer was a solid “no,” and below is the full answer from CFO Jeremy Burnum:

“I would say, Matt, generally no, frankly, with a couple of minor exceptions. So I think it’s probably fair to say that the outperformance late in the quarter in Investment Banking fees was to a meaningful degree, as I mentioned, driven by DCM as well as, to some degree, driven by the acceleration of the closing of some M&A transactions. And I do think that some of that DCM outperformance is in the types of deals that are opportunistic deals that aren’t in our pipeline. And those are often driven by treasurers and CFOs sort of seeing improvement in market levels and jumping on those. So it’s possible that, that’s a little of a consequence of the cuts.

But I think I mentioned we did see, for example, a pickup in mortgage applications, tiny bit of pickup in refi and our multi-family lending business, there might be some hints of more activity there. But these cuts were very heavily priced, right? The curve has been inverted for a long time. So to a large degree, this is expected. So I’m not — it’s not obvious to me that you should expect immediate dramatic reactions, and that’s not really what we’re seeing.”

Another question regarding the expected deposit behavior in the future was asked, to which Burnum commented that the yield-seeking behavior has probably peaked, and that’s no longer a headwind for deposits. Also, they expect that with rate cuts, the CD mix would decrease with high deposit betas, benefiting the funding mix. Below is the complete answer:

“It feels to us like right now, as I mentioned in my prepared remarks for consumer, we’re pretty much in the trough right now as we speak. When you look at yield seeking behavior, that has come down quite a bit. So that’s no longer as much of a headwind all else being equal. And then if you look at checking account balances, those have been pretty stable for some time, which we see as an indication that consumers are kind of done spending another cash buffers. So that’s kind of supportive for consumer deposit balances.

And in that context, the other relevant point is the CD mix, where with the rate cuts coming, we expect CD balances to price down with pretty high betas and probably the CD mix actually peaking around now. And then as you move to wholesale, we’ve actually already been seeing a little bit of growth there. And when you combine that with the sort of increasing view that many people in the market have that it’s likely that the end of Q2 will be announced sometime soon, that’s also a little bit supportive for deposit balances”.

Stock Valuation of JPM Morgan

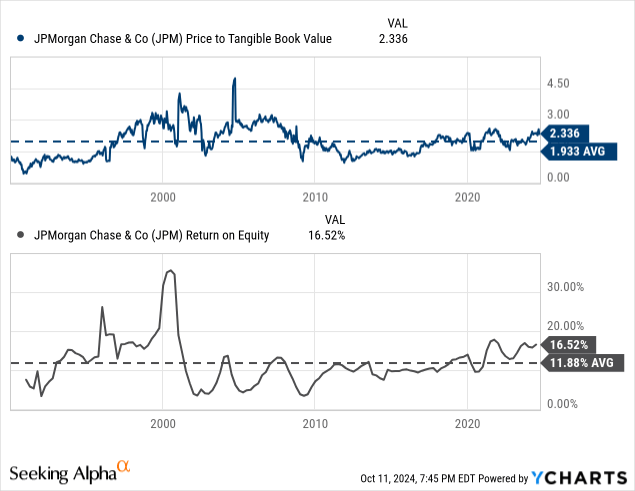

Q3 results registered a tangible book value per share of $96.42, which, when factored in with the $222.29 share price, results in a price-to-TBV of 2.3x.

In May, the valuation was exactly the same, and CEO Jamie Dimon commented on share buybacks not being currently attractive, which caused the stock price to dip during the trading session following his comments.

“Repurchasing shares at a 2.3 times tangible book value valuation is a mistake. We aren’t going to do it.”

But what’s true is that in Q3, JPM repurchased 30.3 million shares at an average price of $209.61, totaling roughly $6.4 billion. This is the most significant quarterly figure registered since the bank started sequentially repurchasing shares in 1Q of 2023.

Even though JPM increased the volume of share repurchases, Dimon still considers the stock price level slightly inflated and the current buyback pace to be modest, as mentioned in the Q3 press release.

“On share repurchases, given that market levels are at least slightly inflated, we maintain our modest pace of buybacks, although we reserve the right to adjust this at any time.”

Nonetheless, that level of share buyback above 30 million hasn’t been seen since three years ago, when the company bought 33.4 million shares in Q3 of 2021. Yet, this repurchase was, in part, reflected by the deployment of the proceeds from the sale of Visa shares, which was initiated in Q2, and it’s relatively low compared to the nearly $30 billion of excess capital that JPM has, which is helping drive up the capital ratios.

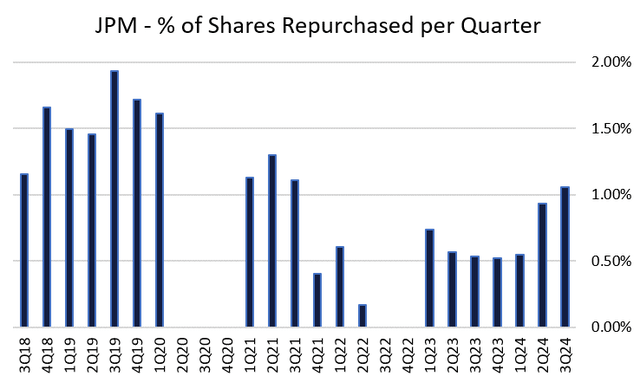

Author’s Compilations | JPM Supplemental Information Q3 ’24-’18

The previous statement could be further justified when comparing total shares of common stock repurchased and dividing it by the weighted-average diluted shares outstanding per quarter. As illustrated, the most recent figure of 1.06% is above the average percentage of the past six years.

Furthermore, during the Q3 earnings call, Jamie Dimon reemphasized their actions of being patient on capital allocations and cited Warren Buffett’s cash pile.

“If you look at it roughly, we have about a minimum $30 billion of excess capital. And for me, it’s not burning a hole in my pocket. I look at it as you own the whole company and you can’t properly deploy it now is perfectly reasonable to wait. And I’ve been quite clear that I think things the future could be quite turbulent and asset prices in my view and you in life, you’ve got to take a view sometimes, are inflated. I don’t know if they’re extremely inflated or a little bit, but I prefer to wait. We will be able to deploy it. Our shareholders will be very well-served by just waiting.

And one last thing. Cash is a very valuable asset sometimes in a turbulent world. And you see my friend Warren Buffett stockpiling cash right now. I mean, people should be a little more thoughtful about how we’re trying to navigate in this world and grow for the long-term for our company.”

Unfortunately, for JPM, the justified price-to-book value formula can’t be used since the elevated ROE and retention ratio make the sustainable growth rate higher than the cost of equity. Nevertheless, the ROE achieved in Q3 was 16.0%, 2.1x higher than the 7.6% cost of equity calculated through CAPM.

Yet, if considering that a bank trading at book value should have an ROE equal to its equity cost, then JPM is slightly overvalued based on its fundamentals but very close to falling within a fair value bandwidth of +-5%.

Disclosure: Return on Tangible Common Equity isn’t available on YCharts. Therefore, I selected ROE, a highly correlated metric, for illustrative purposes.

Last, Dimon is right that the stock is trading at a high price-to-TBV multiple compared to its historical average of the past five years, which has been approximately 1.9x (vs. 2.3x now). But, again, it could be justified by the return on equity (as a proxy for ROTBV), which is at one of its highest levels.

Therefore, considering all these valuation aspects, I wouldn’t conclude that the stock is overvalued. For me, it is fairly valued, the multiple is justified, and probably the CEO is waiting for the stock price to go undervalued to buy back shares more aggressively.

Risks on the Investment

An actual negative aspect of JPM Q3, and perhaps would be similar to most banks like it happened with Wells Fargo, is that the net yield on interest-earning assets and interest rate spread continued to drop, and it’s the third consecutive month where this happened. In Q3, the net yield on interest-earning assets sat at 2.58%, which is 23 bps lower than three quarters ago. It is the same with the interest spread, which is now at 1.87% when Q4 used to be at 2.33. The trend hasn’t been reported for now, and perhaps what the CFO said about the deposit betas could help drive these metrics up in the next quarter.

Another risk is the competition of direct lending, which could take out considerable market share for traditional banks in the coming decades, as these private credit asset managers are not heavily regulated compared to a bank. Recently, competitor Citigroup (C) partnered with Apollo (APO) to release a direct lending private credit program initially worth $25 billion and likely to expand.

Citing this agreement, analyst Glenn Schorr from Evercore ISI asked Jamie Dimon if they are considering such an agreement to avoid being left out of the private debt party. The CEO responded that in the past, they have allocated $10 billion in direct loans and that they will not partner exclusively with a single asset manager as multiple co-lenders end up with more flexibility and deal sizes.

Takeaway

The conclusion here is obviously a buy rating for a well-positioned bank with strong fundamentals and capitalization ratios that, in Q3, beat almost every line item. Although the growth in Consumer Banking hasn’t arrived yet, the alluring performance of Investment Banking is countering those losses. Furthermore, as credit conditions normalize and the funding mix becomes cheaper, JPM is well-positioned to increase net interest income and make more substantial bottom-line profits. With a valuation that I do consider decent, this is a no-brainer for me, and I am rating the stock of JPMorgan as a buy following their Q3 earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.