Summary:

- Early Monday, JPMorgan and federal regulators reached a deal for JPM to acquire First Republic’s assets.

- JPMorgan stock rose 3.8% pre-market when the news was announced.

- JPMorgan will get the benefit of all earnings accruing from First Republic’s assets while sharing the impact of losses with the Deposit Insurance Corp.

- First Republic common shareholders on the other hand have been wiped out.

- In this article, I make the case that the First Republic deal is a positive for JPMorgan shareholders.

Jamie Dimon

Drew Angerer

Early Monday Morning, Bloomberg reported that JPMorgan (NYSE:JPM) would be ‘acquiring’ First Republic, in a last minute bid to save the ailing regional bank. The deal, the details of which haven’t been revealed yet, reportedly won’t include a rescue for equity holders. First Republic has already gone into receivership and JPMorgan managed to get the company’s assets for pennies on the dollar, as the Tweet below explains.

As you can see, JPM paid a mere $10.6 billion for $18 billion in net assets at market value, meaning that JPMorgan shareholders grabbed $7.4 billion in equity from the deal.

We also know from JPMorgan’s deal press release that the company will enjoy:

-

$173 billion worth of loans.

-

$30 billion worth of securities.

-

Loss sharing from the FDIC.

-

No assumption of First Republic’s corporate debt.

Frankly, a sweeter deal than this would be difficult to imagine. Not only is JPM getting a ton of interest-bearing loans, it’s also sharing the responsibility for any potential losses with a Federal agency, and avoiding FRC’s corporate debt. It’s a win-win situation for JPM shareholders, and further support for Jamie Dimon’s sterling reputation. In this article I explain why I consider the First Republic deal a positive for JPMorgan.

Details on the Deal

Because JPMorgan’s First Republic deal involves “buying” a failed entity, it helps to go over the reasons why it is a positive. Upon hearing that JPM bought a company that failed and went into receivership, your first instinct might be to think that the company is taking on loads of bad debt and deposits that are sure to flee, but that’s not really the case. JPM is not buying First Republic common stock, it is simply buying the majority of the company’s assets, leaving it in a much better position on FRC’s assets then FRC, the company, was in. So, let’s take a look at what this deal actually entails.

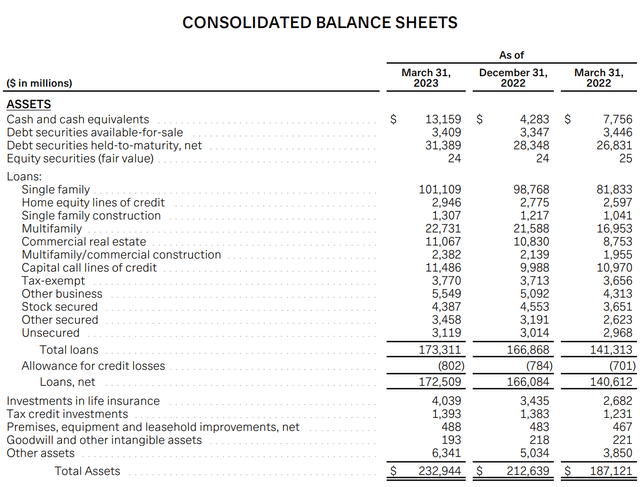

First, JPMorgan will be getting $173 billion worth of loans (assets), and $104 billion worth of deposits (liabilities). The press release does not mention cash and equivalents but they stood at $13.159 billion as of First Republic’s last release and presumably fell further after the earnings release renewed fears of an FRC bank run.

JPMorgan Balance Sheet (JPMorgan)

Let’s assume that, between the earnings release and the FDIC receivership, FRC’s cash position fell to $10 billion. It may have fallen further than that but I don’t need to assume that cash fell to $0 in order to show what JPM bears are worried about. The point is, with $32 billion in securities and $42 billion in deposits, FRC would have had $42 billion in un-committed liquidity to cover $104 billion in deposits–merely 40% coverage. Investors generally want to see this percentage over 50%. Very high percentages are quite do-able; for example, Charles Schwab (SCHW) has 94% of deposits covered by highly liquid un-committed assets.

What I’m getting at here is that JPM bought a collection of deposits and assets where the most liquid of the assets (i.e. assets that can be sold quickly) aren’t adequate to cover even half of the deposits. JPMorgan avoided taking FRC’s corporate debt, which is a good thing, but the deposits are liabilities in themselves, and they aren’t well covered by liquidity. This risk to JPMorgan’s balance sheet is what people who are criticizing the JPM/FRC deal are getting at.

It would be a fair point if JPMorgan were simply a holding company acquiring FRC in exchange for all of its assets, but that’s not the case. JPMorgan is a company with assets and liabilities of its own. In the most recent quarter, they stood at:

-

$3.7 trillion in assets.

-

$1.13 trillion in loans.

-

$25 billion in cash.

-

$520 trillion in deposits at other banks.

-

$197 billion in available for sale debt securities.

-

$413 billion in held-to-maturity securities.

-

$2.38 trillion in deposits.

-

$295 billion in debt.

If you take JPM’s cash & equivalents, available for sale and held to maturity securities together, they come to $1.155 trillion, enough to cover 48.5% of deposits. This is pretty good coverage although not as good as what Bank of America (BAC) has (about 51%).

Now, as you can see, the figures we’re working with here are much larger than those with First Republic. The figure for loans, for example, is 6.5 TIMES greater. If you add all of FRC’s assets and liabilities to JPM’s balance sheet, and subtract $10.3 billion purchase price, you do get a weakening of the liquidity position, but overall liquidity is closer to what JPM had before the deal, than to what FRC had before the deal. In the meantime, JPM is realizing a one-time post tax gain of $2.6 billion, which will add to book value.

Valuation

Having looked at the impact of FRC on JPMorgan’s balance sheet, we can now look at JPM’s valuation.

According to Seeking Alpha Quant, JPMorgan stock trades at:

-

10.25 times earnings.

-

3.2 times sales.

-

1.47 times book value.

-

16.88 times P/E divided by growth.

-

3.8 times operating cash flow.

These multiples are fairly high on a sector relative basis, resulting in JPM scoring a D+ on valuation in Seeking Alpha’s Quant system. However, you need to consider the fact that the FRC deal is going to add a lot to JPM’s balance sheet and earnings power. We know that:

-

JPM is expecting an immediate $2.3 billion gain to equity on an after-tax basis.

-

$173 billion in loans, which will yield $4.4 billion a year in gross interest income if the interest rate is 2.5%.

-

$1.7 billion in full year net income, if 2023 looks like 2022.

FRC’s impact on JPM won’t look exactly like the above, of course. Net income contribution will probably be different, because on the one hand JPM isn’t taking on FRC’s debt, but on the other hand there may be an increase in defaults. The impact will differ from what I’ve estimated, although the $2.3 billion gain in equity is from JPMorgan’s own analysts, so we can take that one as a given.

Risks and Challenges

As I’ve shown in this article, JPMorgan is a stable, relatively liquid bank that has just gained a lot of earning power from buying First Republic’s assets. It’s not a bad value today, but it’s not my favorite bank stock either, for reasons outlined below:

-

Less liquidity than some other alternatives. As I showed in the section on JPMorgan’s balance sheet, the bank has pretty good liquidity, but it’s not among the best of its peer group. Bank of America’s liquid assets cover 51% of deposits, Schwab’s cover 94%–that is the kind of liquidity investors like to see. JPMorgan’s same percentage is 48.5% and it’s going to go down as a result of assuming FRC’s deposits, securities and cash. So, JPM is not the best U.S. bank from the standpoint of liquidity. I don’t mean to say that it’s severely illiquid and at risk of a failure, but it’s not “best in class” by liquidity measures.

-

A pricier valuation than some of the alternatives. As I showed in the section on valuation, JPM trades at 10 times earnings and 1.47 times book. By contrast, Bank of America trades at 8.46 times earnings and 0.89 times book–all while having better liquidity than JPM. It looks like people have sold off BAC stock due to news reports of its “large unrealized losses on securities,” ignoring the fact that its liquidity is very good even after adjusting for the unrealized losses. JPM, on the whole, looks like a less desirable package today.

-

Continued interest rate hikes. On the day this article was written, JPMorgan stock fell 2.12% on news that the Fed had hiked 25 basis points and was not quite ready to commit to a pause. Bank stocks as a class fell when the news was announced. Overall, interest rate hikes are mixed for banks. On the one hand, banks get to charge higher interest on loans when rates go up. On the other hand, deposit interest also goes up and if banks try to avoid raising deposit interest then they face withdrawals like the one that sank Silicon Valley bank. Also, the value of their treasury securities declines, leading to the “unrealized losses chipping away at equity and liquidity” problem.

The Bottom Line

The bottom line on JPMorgan stock is that it’s a reasonably good buy today. Personally, I’m rating it a “hold,” because I see better, cheaper opportunities in financials today. However, if you buy JPM stock you’ll probably do reasonably well in the long run. You’ll collect a sizable dividend and may see your holdings increase in value if the next earnings release is good.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.